-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:Projected Rate Cuts Retreat Post NFP

- MNI US: Senator Murphy: Border Security Bill Out "This Weekend"

- MNI GLOBAL POLTICAL RISK: CMA CGM Suspends Transit Of Red Sea

- MNI GERMANY: Bundestag Passes '24 Budget, But '25 Negotiations Loom Large

- MNI RUSSIA: 'Anti-War' Candidate Could Be Blocked From Appearing On Ballot-RTRS

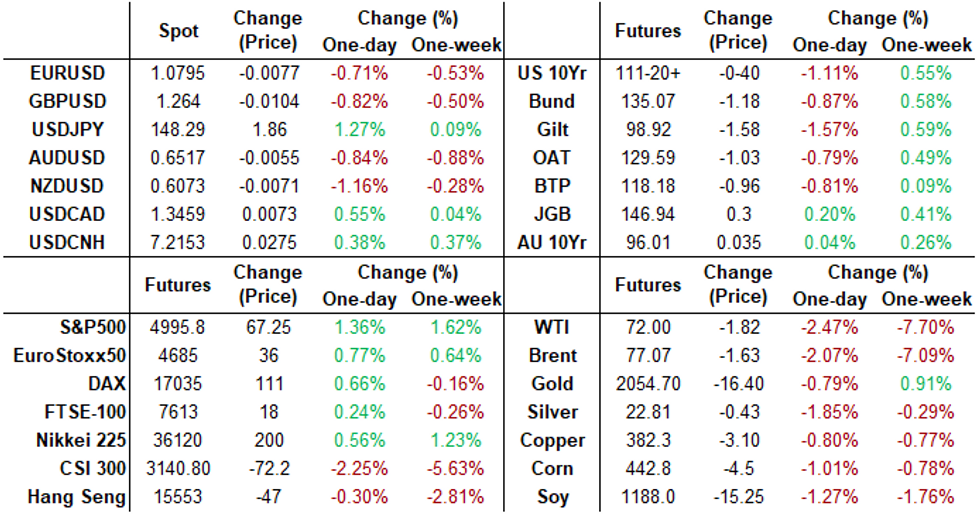

US TSYS January Jobs Surge Weighs on Projected Rate Cut pricing

Tsy futures gapped lower after broadly higher than expected Change in Nonfarm Payrolls of +353k vs 185k est (prior up-revised to 333k from 216k), Private Payrolls surge to +317k vs. 170k est. Unemployment Rate 3.7% vs. 3.8% est while Labor Force Participation Rate near steady at 62.5% vs. 62.6% est.

- Futures continued to extend lows after little initial react to UofM and Factory/Durables Order data

- U. of Mich. Sentiment (79.0 vs 78.9 est)

- U. of Mich. Current Conditions (81.9 vs. 83.5 est)

- U. of Mich. Expectations (77.1 vs. 76.0 est)

- U. of Mich. 1 Yr Inflation (2.9% vs. 2.9% est), 5-10 Yr (2.9% vs. 2.8% est)

- Mar'24 10Y futures currently trading -1-06.5 at 111-22. Technical support at 111-16/110-26 Low Feb 2 / Low Jan 19 and bear trigger. Curves remain flatter but well off lows: 2s10s -2.206 at -34.839 (-40.198 low), while 10Y yield remained above 4% at 4.0237% (+.1435) after starting the day around 3.8648%.

- Factory Orders in-line w/ 0.2% vs. est, Ex Trans (0.4% vs. 0.2% vs. est)

- Durable Goods Orders in line w/ 0.0% vs. est, ex Trans (0.5% vs. 0.6% vs. est)

- SOFR futures gapped lower (SFRH4-SFRZ4 -0.080-0.210) while projected rate cut chances retreated: March 2024 chance of 25bp rate cut currently -22.2% vs. -38.7% pre-data w/ cumulative of -5.6bp at 5.263%, May 2024 at -70.6% vs. -90.8% w/ cumulative -23.2bp at 5.087%, while June 2024 at retreated to -87.9% vs. 105% w/ cumulative -45.2bp at 4.867%. Fed terminal at 5.3175% in Feb'24.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00141 to 5.32211 (-0.01436/wk)

- 3M +0.01788 to 5.29046 (-0.02697/wk)

- 6M +0.01227 to 5.0961 (-0.06130/wk)

- 12M -0.00974 to 4.69280 (-0.10618/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.897T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $703B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $689B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $81B

- Daily Overnight Bank Funding Rate: 5.3-% (-0.01), volume: $254B

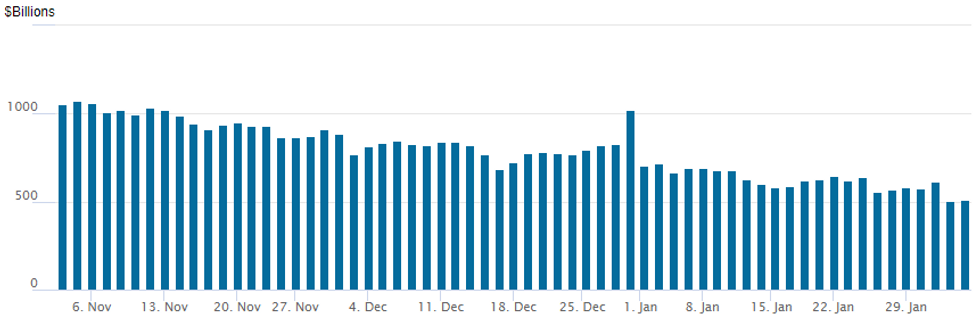

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $513.422B vs. $503.548B yesterday, the lowest level since mid-2021. Compares to prior low of $557.687B on Thursday, January 25.

- Meanwhile, the number of counterparties back up to 80 from 74 Thursday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option remained mixed on heavy volume Friday, accounts adjusting positions after an unexpected surge in January jobs: +353k vs 185k est (prior up-revised to 333k from 216k), Private Payrolls surge to +317k vs. 170k est. SOFR futures gapped lower (SFRH4-SFRZ4 -0.080-0.210) while projected rate cut chances retreated: March 2024 chance of 25bp rate cut currently -22.2% vs. -38.7% pre-data w/ cumulative of -5.6bp at 5.263%, May 2024 at -70.6% vs. -90.8% w/ cumulative -23.2bp at 5.087%, while June 2024 at retreated to -87.9% vs. 105% w/ cumulative -45.2bp at 4.867%. Fed terminal at 5.3175% in Feb'24.

- SOFR Options:

- Block, 20,000 SFRU4 95.31/95.43 call spds, 6.5 ref 95.59

- Block, 10,000 SFRU4 94.93/95.37/95.43/95.68 broken put condors, 1.0 net - belly over

- Block, 10,000 SFRM4 95.31/95.43/95.56/95.68 call condors, 1.25

- Block, 5,000 SFRH4 95.50 calls, 1.25 ref 94.795/0.09%

- Block, 5,000 SFRM4 95.37/96.00 call spds, 8.0 ref 95.20

- Block, 5,000 SFRH4 95.00/95.06/95.12 call flys, 0.25 ref 94.795

- +9,000 SFRH4 95.00 calls, 2.5 ref 94.81/0.10%

- Block, 20,000 SFRH4 94.87/95.00/95.12/95.25 call condors, 0.75

- Block, 5,000 SFRJ4 95.18/95.37/95.62/95.81 call condors, 3.5 vs. 95.195/0.12%

- Block, 5,000 SFRM4 94.87/95.00/95.12 put flys, 1.5 ref 95.33

- over 4,200 SFRH4 94.81 puts, 2.75 last

- 3,500 SFRJ4 95.43 calls, 15 last

- 2,000 SFRH4 94.68/94.75 2x1 put spds ref 94.87

- 4,000 SFRH4 95.00/95.25 call spds ref 94.87

- 2,000 SFRU4 95.81/95.93 call spds vs. SFRU4 95.18/95.31 put spds

- Treasury Options:

- +10,000 FVH4 106 puts, 2.5

- 10,000 TYH4 111.5 puts, 43.0, total volume on nay over 98k

- Block, 10,500 TYM4 111 puts, 105 vs. 111-19/0.16%

- 8,400 TYH4 112.5/113.5 1x2 call spds, 2 ref 111-20.5

- -2,900 TYM4 112 straddles, 318 ref 112-08.5

- 6,000 FVH4/wk2 FV 108.5 straddle spds

- 1,800 FVH4 106.75/107.5/108.25 2x3x1 put flys ref 107-31.5

- 2,300 TYH4 109.5/110.5/111.5 put flys, 10 ref 111-27.5

- 5,750 TYM4 111 puts, 47

- Block, 8,000 TYH4 109.5/110.75 2x1 put spds, 4 ref 112-23.5/0.06%

- 30,000 TYH4 110.5/111.5 put spds, 12 ref 112-23.5/0.14%

- 2,000 wk2 TY 110.5/111.25 put spds ref 112-23

- 3,700 FVH4 110.25 calls ref 108-17.25

- 10,000 TYH4 111/112.5 2x1 put spds

- 4,800 TYH4 109.5/111/112.5 put flys ref 112-23

- 4,000 wk2 FV 106.75/107/107.25 put trees, expire Feb 9

FOREX USD Surges Higher Following Bumper Payrolls Data, JPY & NZD Pressured

- A much higher-than-expected increase in nonfarm payrolls, a dip in the unemployment rate and a boost for average hourly earnings contributed to a sharp move higher for both US yields and the greenback on Friday. An initial gap higher for the USD index (+0.85%) extended into late session trade, and looks set to close around 104.00, the highest level since mid-December.

- Continued sensitivity to core rates leaves the Japanese yen as the joint poorest performer in G10 on Friday, alongside the New Zealand dollar. USDJPY’s impressive 150-pip jump in the aftermath of the US data was briefly capped around the 148.00 figure, however, the pullback remained very shallow, and the pair then extended gains above the figure in mid0afternoon trade.

- Price action sees USDJPY rise 1.28% on the session, narrowing the gap with the January highs which reside at 148.80, closely followed by 149.16, a Fibonacci retracement. The trend outlook is unchanged and remains bullish, moving average studies have recently crossed and are now in a bull-mode set-up. This reinforces the current trend condition and highlights positive market sentiment. For reference, notable levels further out include 149.75 and 150.78, the November 22 and 17 highs respectively.

- For Kiwi, bearish price action across January was re-established with the 20 and 50-day EMA acting as solid resistance overall in NZDUSD. The pair made a new low on the year by 3 pips, reaching the 100-day SMA in late trade.

- Overall, the greenback had some volatile swings this week. Initial weak US data and regional bank concerns weighed before being trumped by a moderately hawkish Fed, who appeared to set a high bar to a March cut, and then by the much firmer-than-expected employment data.

- China Caixin Services PMI headlines the APAC docket on Monday before the focus turns to US Services PMI data, scheduled later in the session.

Late Equities Roundup: Eminis Climb to New Contract Highs, Near 5000

- Stocks have shrugged off this morning's post-jobs data weakness, to making new contract highs the second half. While higher than expected employment figures is positive for the economy, stocks (as well as Tsys) had initially reacted negatively as projected rate cut chances declined (May 2024 at -74.9% vs. -90.8% pre-data). Currently, the DJIA is up 235.89 points (0.61%) at 38755.63, S&P E-Minis up 64.25 points (1.3%) at 4992.75, Nasdaq up 290 points (1.9%) at 15651.79.

- Communication Services sector continued to lead gainers late Friday - but it was primarily due to one stock: Meta +21.59% after announcing positive earnings, forward guidance and a $50B share buyback late Thursday. Others in the sector not so lucky: Charter Communications -16.29% after missing earning ests, Alphabet, Comcast -3.25%, and Warner Brothers -2.2%.

- Similarly, the Consumer Discretionary sector was buoyed by one broadline retailer: Amazon +8.17% after beating earnings late Thursday, while Etsy gained 5.26%.

- Laggers: Real Estate and Utility sectors underperformed in late trade, office and health care investment trusts weighing on the former: Boston Properties -2.83%, Alexandria Real Estate -1.84%, Healthpeak Properties -2.66%. Independent power and multi-utility shares weighed on the later sector: NiSource -2.58%, Southern Co -2.6%, WEC Energy -2.27%.

- Looking ahead: corporate earnings expected next Monday: Estee Lauder, McDonalds, Tyso Foods, ON Semiconductor, Caterpillar, Rambus and Vertex Pharmaceuticals.

E-MINI S&P TECHS: (H4) Fresh Cycle High

- RES 4: 5100.00 Round number resistance

- RES 3: 5050.14 1.764 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5012.80 1.618 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 5000.00 Psychological round number

- PRICE: 4992.00 @ 18:53 GMT Feb 02

- SUP 1: 4866.000/4764.36 Low Jan 31 / 50-day EMA values

- SUP 2: 4702.00 Low Jan 5

- SUP 3: 4594.00 Low Nov 30

- SUP 4: 4550.75 Low Nov 16

A broader uptrend in S&P E-Minis remains intact and today’s rally has reinforced this condition. The contract has traded to fresh cycle highs, confirming a resumption of the uptrend. Recent corrections have been shallow - this also highlights a strong uptrend. The focus is on the psychological 5000.00 handle. On the downside, initial key short-term support has been defined at 4866.00, the Jan 31 low.

COMMODITIES Crude Set For Heavy Losses On The Week, Gold Swings But Ultimately Higher

- Crude markets are down more than 7% on the week, with further losses today amid pressure from a rising US dollar following strong US payrolls data. Slower global demand growth and rising non-OPEC output continues to weigh against Middle East conflict concerns for supply.

- CBS News sources reported the US has a series of strikes planned in the coming days in response to the drone attack on a Jordanian outpost that killed three US service personnel last weekend.

- US oil and gas rig count fell by 2 on the week to 619 rigs, according to Baker Hughes, the lowest since Jan. 12 and down 16.7% on the year. Oil Rigs: 499 (=), Gas Rigs: 117 (-2), Miscellaneous: 3 (=)

- OPEC oil production fell by 490kbpd in January to 26.5mbpd, according to a Bloomberg survey but remains above its output target.

- WTI is -2.4% at $72.07 with the sharp reversal undermining the recent bullish theme. Support is seen at $70.62 (Jan 17 low).

- Brent is -2.0% at $77.16, with support seen at $76.13 (Jan 17 low).

- Gold is -0.8% at $2037.7, coming under firm pressure as the USD soared after a strong payrolls report. Gold hangs onto gains for the week, buoyed by US retaliatory strike plans, and having seen a large boost amidst a then weaker USD with a high of $2065.48. Support is seen at $2033.0 (20-day EMA).

- Weekly moves: WTI -7.6%, Brent -7.7%, Gold +0.9%, US HH nat gas -23%, EU TTF nat gas +4.4%

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/02/2024 | 0030/1130 | ** |  | AU | Trade Balance |

| 05/02/2024 | 0700/0800 | ** |  | DE | Trade Balance |

| 05/02/2024 | 0700/0200 | * |  | TR | Turkey CPI |

| 05/02/2024 | 1000/1100 | ** |  | EU | PPI |

| 05/02/2024 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/02/2024 | 1530/1030 |  | CA | BOC quarterly Market Participants Survey | |

| 05/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 05/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/02/2024 | 1900/1400 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.