-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rates Bounce, Focus on Eco Summit

- MNI MIDEAST: MBS Meets Iranian Foreign Min In Likely Precursor To Raisi Visit

- MNI ARGENTINA: IMF Meets With Presidential Frontrunner MileiZ

- MNI AUSTRIA: Kurz Charged In Corruption Case; Trial Could Stretch Into Election Year

- MNI US-JAPAN-ROK: JAPAN-ROK: NSA Sullivan - Summit Marks New Era Of Trilateral Cooperation

US TSYS Markets Roundup: Rates Off Week Lows, Focus on Eco-Summit Next Week

- US Rates are holding moderately firmer levels after the bell late Friday, inside a relatively narrow range following Thursday's sell-off to new contract lows. A quiet end to the week with no economic data Friday, or next Monday for that matter, or Fed speakers until next week.

- Chicago Fed President Goolsbee returns with opening remarks at a Fed listens event on youth employment at 1430ET Tuesday, followed by a fireside chat with Gov Bowman at 1530ET Tuesday.

- Markets eager for details on next week's KC Fed Economic Policy Symposium in Jackson Hole: ‘Structural Shifts in the Global Economy,’ from August 24 to August 26 (schedule/attendees list likely announced the evening of the 24th).

- Treasury futures bounced off early session lows to new session highs in midmorning trade, shy of overnight highs with obvious headline or block/cross driver. Cross-market/asset: Bunds inched higher after the cash open in stocks, Gilts off session lows; West Texas crude climbed .88 to 81.27 while Gold recede -1.45 to 1887.99..

- USD index held marginal negative territory. The Japanese Yen is the strongest performer in G10, with USDJPY slowly gravitating back towards session lows and the important pivotal support around 145.10.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00029 to 5.31427 (+.00377/k)

- 3M +0.00341 to 5.38317 (+0.01860/wk)

- 6M +0.00342 to 5.44454 (+0.02946/wk)

- 12M +0.00693 to 5.38338 (+0.07756/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $98B

- Daily Overnight Bank Funding Rate: 5.32% volume: $259B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.343T

- Broad General Collateral Rate (BGCR): 5.28%, $564B

- Tri-Party General Collateral Rate (TGCR): 5.27%, $548B

- (rate, volume levels reflect prior session)

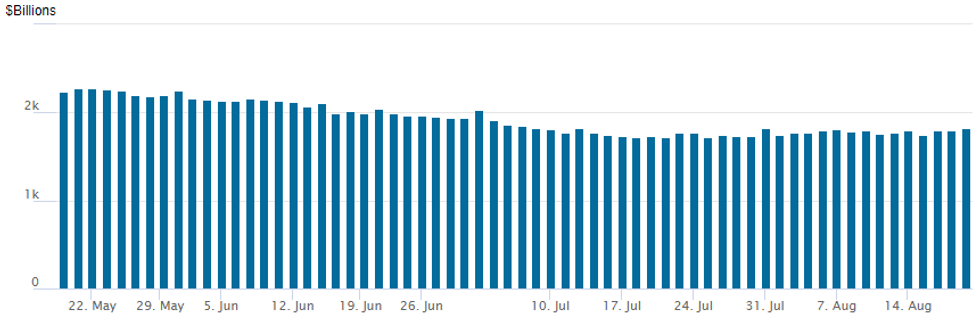

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation climbs to $1,819.201B w/98 counterparties, compared to $1,794.120B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Light option trade Friday rotated around better upside 5Y, 10Y and 30Y Treasury calls as underlying futures bounced off Thursday's lows (TYU3 marked 109-28.5 high, yield 4.2133% low). Meanwhile, rate hike projections through year end receded slightly, Sep 20 FOMC is 10% w/ implied rate change of +2.5bp to 5.354%. November cumulative of +9.1bp at 5.42, December cumulative of 6bp at 5.389%. Fed terminal slips to 5.415% in Nov'23.

- Treasury Options:

- 4,000 TYV3 114.5 calls, 7 ref 110-06.5

- over 7,400 TYV3 112 calls, 24 ref 110-00.5

- 2,000 TYU3 111.75 calls, 3 ref 109-19.5

- 2,000 USU3 123.5 calls, 4 ref 119-02

- over 6,500 FVV3 108 calls, 14.5-15 ref 106-14.25 to -12

- over 10,300 3MQ3 110 calls, 6-8 ref 109-27.5 to -25 (expire today)

- 4,000 TYU3 111 calls, 7 ref 109-24

- 2,000 TUU3 101.75 calls, 1.5 ref 101-13.38

- over 7,000 FVU3 105.5 puts, 8 last, ref 106-00.5

- 4,000 TYU3 109.5 puts, 26 ref 109-21

- SOFR Option trade remained light

- Block, 20,000 SFRF4 95.12/95.62 call spds vs. SFRM5 96.75/97.25 call spds, 9.5 net SFRM5 over

- Block, 5,000 0QZ3 97.12 calls, 6.0 vs. 95.795/0.10%

- over 5,000 SFRV3 94.31/94.43/94.50/94.62 put condors ref 94.625 to -.63

- 2,000 SFRX3 94.93 puts ref 94.63

EGBs-GILTS: UK Yields Sharply Higher On Week, But Bunds Steady

Gilts continued to underperform Bunds Friday despite soft UK retail sales data.

- After gapping stronger at the open, Gilt futures faded somewhat over the course of the session. Bunds continued higher for the most part, with some early morning strength after a Corriere report that the ECB would rebuke the Italian government for its windfall bank tax.

- The UK curve leaned bull steeper, with Germany's bull flattening.

- There were no major catalysts (final July Eurozone CPI was unrevised, no other data / speakers of note), with cross-market moves of greater note, particularly for European equities which hit multi-month lows.

- Despite the risk-off move and the move lower in Bund yields, periphery EGB spreads largely held their ground.

- Looking back on the week, price action reflected the market focus on mostly inflationary UK data (including CPI and wage growth): UK 2Y yields rose 17bp vs flat for Schatz; UK 10Y yields were up 15bp vs unch for Bund.

- Next week starts off with a relatively quiet schedule, picking up on Wednesday with flash PMIs, with the Fed's Jackson Hole symposium starting on Thursday and German IFO on Friday.

Friday Cash Yield Levels:

- Germany: The 2-Yr yield is down 5.9bps at 3.048%, 5-Yr is down 8.1bps at 2.623%, 10-Yr is down 9.4bps at 2.615%, and 30-Yr is down 7.8bps at 2.714%.

- UK: The 2-Yr yield is down 7.9bps at 5.197%, 5-Yr is down 6.6bps at 4.689%, 10-Yr is down 6.7bps at 4.679%, and 30-Yr is down 5.9bps at 4.873%.

- Italian BTP spread up 0.3bps at 170.8bps / Spanish up 0.5bps at 105.6bps

EGB Options Unwinding Positions Into The Weekend

Friday's Europe rates / bond options flow included:

- RXX3 123.00/120.50 put spread bought for 10 in 4k. Note this was also bought yesterday for 14.5 in 6k

- ERV3 96.125/96.25/96.375/96.50 call condor sold at 3.5 in 5k

- SFIU3 94.35/94.45 call spread, sold at 4 in 2.5k, hearing this is unwinding upside

- SFIZ3 94.80/95.00 call spread bought for 1 in 8k (v 94.06)

- SFIZ3 94.10/94.25/94.35/94.50 call condor bought for 3.5 in 2k

- SFIZ3 94.35/94.50/94.60/94.75 call condor, bought for 2.5 in 2.5k

- SFIX3 94.00/93.85 put spread vs 94.60/94.75 call spread, buys the put spread for 5 in 2k

FOREX USDJPY Gravitates Back To Prior Breakout Level Around 145.00

- Greenback strength over the European session was reversed during US trade on Friday, leaving the USD index in marginal negative territory. The Japanese Yen is the strongest performer in G10, with USDJPY slowly gravitating back towards session lows and the important pivotal support around 145.10. Overall, sentiment remains unchanged and the uptrend in USDJPY remains intact, with short-term pullbacks considered corrective at this juncture. Initial firm support is 143.74, the 20-day EMA.

- On the other end of the spectrum the Swiss Franc is the weakest on the board. EURCHF was unable to match the July lows of 0.9522 and has since edged higher to levels close to unchanged on the week.

- Despite briefly trading below 1.2700 on the back of weaker UK retail sales, GBPUSD has bounced around 40 pips and remains only moderately lower on the session with the week’s earlier wage data maintaining hawkish bets on the Bank of England’s policy path ahead.

- Overall, the USD index has risen around half a percent this week, mainly reflecting the concerns over the Chinese economy and the associated higher yields and lower equity benchmarks.

- Focus turns swiftly to next week where markets will receive the latest European Flash PMIs to indicate the health of Eurozone economies. The main event will be the Jackson Hole Symposium where Fed Chair Powell and ECB’s Lagarde are already slated to speak.

Late Equity Roundup: Inching Off Lows

- Stock indexes continue to inch off first half lows in late trade, Energy sector shares outperforming. DJIA shares are up 22.8 points (0.07%) at 34498, S&P E-Mini futures up 0.75 points (0.02%) at 4385.5, Nasdaq down 6.3 points (0%) at 13311.69.

- Leading gainers: Energy sector shares outperformed for the third day running with crude gaining in the second half (WTI +.72 at 81.11). Oil and gas shares outpaced equipment and services shares in the first half: Devon Energy +1.65%, Marathon Oil +1.38, Exxon Mobil +1.28%.

- Consumer Staples and Utility sectors followed, distribution/retail stores buoyed the former: Dollar General +1.6%, Walmart +1.36%, Kimberly-Clark +1.35%. Water and multi-energy utilities supported the latter: Ameren Corp +1.5%, Consolidated Edison +1.25%, Pinnacle West +1.2, American Water Works +0.60%.

- Laggers: Communication Services, Consumer Discretionary and Financial sectors underperformed in the second half (IT shares gained rebounded in the second half). Interactive media weighed on Communication Services with Google -1.75%, Meta -1.55%, Charter Comm -1.0%. Meanwhile, auto maker Tesla weighed on Consumer Discretionary with Tesla -2.1% while parts maker/distributor Aptiv slipped -.14%.

- Meanwhile, Banks and financial services shares underperformed insurance names in the second half: Citizens Financial -1.75%, Comerica -1.35%, Fidelity National -1.15%.

E-MINI S&P TECHS: (U3) Heading South

- RES 4: 4634.50 High Jul 27 and the bull trigger

- RES 3: 4593.50/4634.50 High Aug 2 / Jul 27

- RES 2: 4560.75 High Aug 4

- RES 1: 4459.03/4494.76 20- and 50-day EMA

- PRICE: 4385.75 @ 14:50 ET Aug 18

- SUP 1: 4344.28 38.2% retracement of the Mar 13 - Jul 27 bull cycle

- SUP 2: 4305.75 Low Jun 8

- SUP 3: 4254.62 50.0% retracement of the Mar 13 - Jul 27 bull cycle

- SUP 4: 42116.00 Low May 31

A bearish theme in the E-mini S&P contract remains intact and today’s sell-off reinforces this theme. This week’s bearish price action has resulted in a break of the 50-day EMA and the contract has breached channel support drawn from the Mar 13 low. 4368.50, the Jun 26 low, has been breached today and attention turns to 4344.28, a Fibonacci retracement. Initial firm resistance to watch is at the 50-day EMA - at 4459.03.

COMMODITIES Crude Limits Weekly Decline Whilst Gold Suffers With USD Strength

- Crude is finishing the session pushing higher into the settle but it’s not enough to claw back a weekly decline after seven weekly increases. The decline comes following poor economic data in China and with concern that the US rate tightening cycle may not be at an end which has also spilled into a significant lifting of longer dated Treasury yields.

- Several major banks have revised up their crude price forecasts for this year and 2024, amid lower OPEC+ supply, lower inventories, and an upward revision in oil demand but forecasts remain below $100/bbl, at least not for a sustained period, given uncertainties about Chinese oil demand, higher non-OPEC crude supplies and economic slowdowns in the US and Europe.

- Asian refiners are looking for sour crudes to replace Kuwaiti supply as the Gulf state cuts exports by almost 20%, whilst in non-OPEC supply, the Baker Hughes US rig count fell a further 5 to 520 for its lowest since the start of Russia’s invasion of Ukraine.

- WTI is +1.1% at $81.30 but doesn’t test resistance at $84.89 (Aug 10 high), whilst support remains at $78.69.

- Brent is +0.8% at $84.84, off support at $82.36 (Aug 3 low) but not testing resistance at $88.10 (Aug 10 high).

- Gold is -0.1% at $1887.88 as it caps off a torid week for the yellow metal against trend USD appreciation fuelled by higher US yields and EM-related frailties. It sits off yesterday’s low of $1885.1 but has breached key support at $1893.1 (Jun 29 low) which signals scope for $1865.8 (76.4% retrace of Feb 28 – May 4 bull leg).

- Weekly moves: WTI -2.3%, Brent -2.3%, Gold -1.4%, US nat gas -8.2%, EU TTF nat gas +3.1%.

MONDAY-WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/08/2023 | 0600/0800 | ** |  | DE | PPI |

| 22/08/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 22/08/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 22/08/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 22/08/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 22/08/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/08/2023 | - | * |  | FR | Retail Sales |

| 22/08/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/08/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/08/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 22/08/2023 | 1830/1430 |  | US | Chicago Fed's Austan Goolsbee | |

| 23/08/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.