-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rates Hold Narrow Range Ahead CPI

- MNI US-ISRAEL: Biden Expected To Meet Netanyahu At UNGA In New York

- MNI US: Trump To Propose "Aggressive New Tax Cuts" For Second Term, WaPo

- MNI SECURITY: Putin-Kim Meeting May Take Place As Soon As Tomorrow

- MNI WHEAT: Erdogan: West Must Do Their Part To Revive Grain Deal

cropfilter_vintageloyaltyshopping_cartdelete

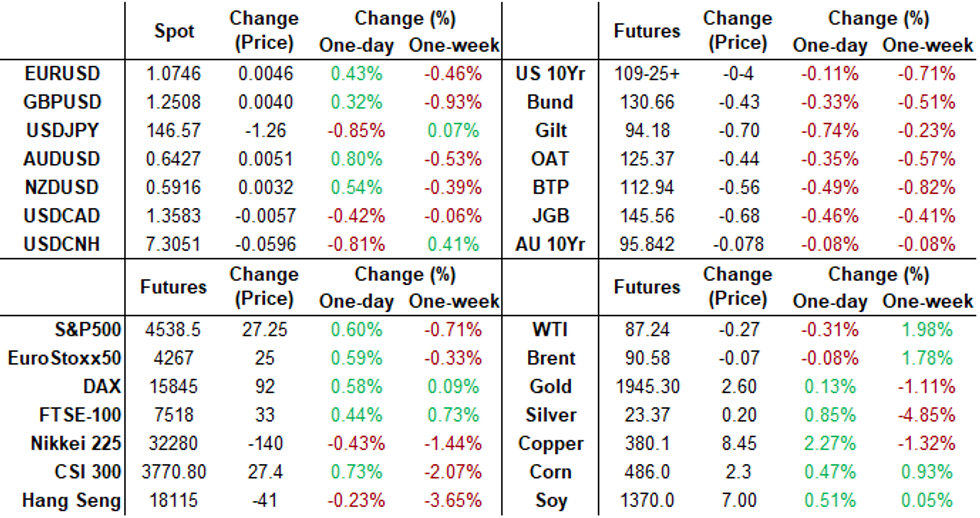

US TSYS Weaker Tsy Inside Narrow Range, Focus on Wednesday's CPI

- Still weaker after the bell, Treasury futures are paring losses after the bell, Dec'23 10Y at 109-27 (-2.5) upper half of narrow 9bp range.

- Little in the way of data today, rates drifted near the middle of the session range following the NY Fed 1Y Inflation Expectations release: 3.63% vs. 3.55% prior. Three-year-ahead inflation expectations declined a tenth to 2.8%. Median home price growth expectations increased by 0.3pp to 3.1%, its highest reading since July 2022. Year-ahead commodity price expectations rose across the board in August.

- Treasury futures dipped after $44B 3Y note auction (91282CHY0) tails: 4.660% high yield vs. 4.647% WI - the first tail since February 7 (4.073% vs. 4.035% WI).

- Curves steeper but off early highs: 3M10Y +2.584 at -118.395, 2Y10Y +2.684 at -70.391. Moving average studies continue to highlight a medium-term downtrend. An extension lower would signal scope for 109-09+, Aug 22 low and a bear trigger. A break of this level would strengthen a bearish theme.

- Another slow day ahead, data doesn't pick up until Wednesday with the release of August CPI.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00113 to 5.32833 (+.00059 total last wk)

- 3M -0.00522 to 5.40525 (+0.00817 total last wk)

- 6M -0.00912 to 5.46285 (+0.01873 total last wk)

- 12M -0.02033 to 5.40359 (+0.06318 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $104B

- Daily Overnight Bank Funding Rate: 5.32% volume: $267B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.420T

- Broad General Collateral Rate (BGCR): 5.30%, $572B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $561B

- (rate, volume levels reflect prior session)

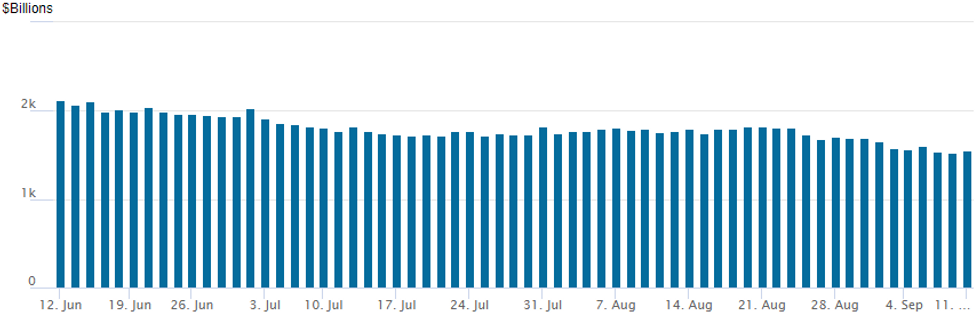

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation bounces to $1,549.111B w/94 counterparties, compared to $1,525.403B (lowest since early March 2022) in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option continued to rotate around better low delta covered puts and spreads Monday as year-end rate hike projections gained traction: Sep 20 FOMC steady at 6.8% w/ implied rate change of +1.7bp to 5.347%. November cumulative of +11bp at 5.441, while December cumulative of climbed to 12.6bp at 5.457%. Meanwhile, the Fed terminal rate from a flat 5.44% in Nov'23-Jan'24 to 5.455% in Dec'23-Jan'24.

- SOFR Options:

- 2,000 0QZ3 96.68 calls, 6.5

- 1,600 SFRV3 94.50/94.56/94.62/94.68 put condors

- 8,000 SFRX3 94.31/94.43/94.50 broken put trees ref 94.555

- Block, 2,500 SFRZ3 93.87 puts, .75 vs. 95.54/0.05%

- Block 4,500 SFRF4 94.18/94.37 3x2 put spds, 3.5 ref 94.695 to -.70

- Treasury Options:

- 3,000 FVV3 106.75 calls, 12 ref 106-05.75

- Block, 18,000 wk3 TY 110.25/111.25 call spds, 10 vs. 109-23/0.21%

- 1,600 TYX3 108 puts, 29-28 vs. 109-23 to -23.5

- 12,000 TYX3 108/109.5 3x2 put spds, 38-39 ref 109-21.5 to -22.5

- over 11,000 TYV3 109 puts, 18-19 ref 109-23

- -5,000 USX3 116/121 call over risk reversals, 9 net vs. 118-28

- over 4,700 TYV3 111.5 calls, 6 last

- over 5,200 TYV3 109 puts, 20 last

- over 4,300 TYV3 108.5 puts, 11 last

- over 3,500 wk3 TY 109 puts, 9 last ref 109-23.5

- 4,400 TYV3 111.5 calls, 6 ref 109-22

- over 3,600 USX3 118 puts, 136 last

- 2,000 FVV3 104.5/105.5 put spds

EGBs-GILTS CASH CLOSE: Cheaper To Start A Busy Week

Gilts underperformed Bunds Monday for the first time in 4 sessions, with both the UK and German curves bear steepening to start the week.

- With a limited set of macro data on the European schedule, core FI cheapened alongside global counterparts following hawkish tones overnight from BoJ's Ueda.

- Overall though the ECB decision and US inflation data loomed over a fairly cautious session, with supply pressures also weighing including Dutch and German supply up Tuesday (EU today also announced 7Y supply).

- BoE's Mann burnished her hawkish credentials, saying that the BoE should err toward overtightening.

- Periphery EGB spreads widened - GGBs modestly outperformed on the back of DBRS’ upgrading Greece to investment grade on Friday.

- Attention turns to UK labour market data which is out first thing Tuesday morning in which evidence of further wage persistence will be eyed - MNI's preview is here.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.6bps at 3.097%, 5-Yr is up 1.8bps at 2.633%, 10-Yr is up 2.5bps at 2.635%, and 30-Yr is up 3.3bps at 2.768%.

- UK: The 2-Yr yield is up 1.6bps at 5.085%, 5-Yr is up 3.4bps at 4.697%, 10-Yr is up 4.4bps at 4.467%, and 30-Yr is up 6.5bps at 4.769%

- Italian BTP spread up 1.8bps at 175.7bps / Greek up 0.5bps at 135.9bps

EGB Options: Call Selling Across Rate Structures Monday

Monday's Europe rates / bond options flow included:

- DUX3 105.104.50ps, bought for 11.5 in 3k

- OEZ3 118.75/119.50cs, sold at 11 down to 10.5 in 18k

- ERU3 96.25c sold at 0.75 in 10k

- ERX3 96.125/96.00/95.875 put ladder paper paid 3.75 on 4.4K

- SFIZ3 94.15/94.30/94.40/94.55c condor sold at 3.5 and 3.25 in 6k

- SFIZ3 93.80/94.10/94.20c fly sold at 18 in 3k

FOREX USDJPY Consolidates Overnight Decline, EMFX Surges

- A confluence of factors led to the greenback falling out of favour on Monday, which has prompted the USD index to retrace roughly 0.55% lower to start the week.

- First of all, stronger than expected August credit data in China has provided risk sentiment with a firmer backdrop, boosting global indices, benefitting more risk sensitive currencies and weighing on the dollar. Additionally, hawkish commentary from Bank of Japan’s Ueda has prompted a substantial correction lower for USDJPY and taking the shine off the USD index as a whole. Furthermore, after the impressive string of winning sessions for the index, the close proximity to the US CPI data and next weed’s Fed decision, market participants may be taking an opportunity to lock in some profits.

- Although the daily G10 ranges have not altered much throughout US hours, there was some notable movement for USDJPY (-0.90%) which after bouncing over 100 pips from the 145.91 lows, then resumed its intra-day downtrend before settling around 146.50 as we approach the APAC crossover.

- Overall, trend conditions remain bullish for USDJPY and on the downside, 144.45 represents the key short-term support, the Sep 1 low.

- The more positive mood across markets has seen the likes of CNH and AUD consolidate gains of around 0.8% on the session, however, the emerging market fx basket has really outperformed across the US timezone.

- This has been most noticeable in USDMXN, declining 1.7% to trade back to 17.30 with some better-than-expected industrial output figures providing an additional MXN tailwind. On the downside for USDMXN, support to watch lies at the 50-day EMA which intersects at 17.1243. In similar vein, the South African Rand has risen 1.4% amid a noticeable uptick in the metals complex.

- UK unemployment and German ZEW sentiment data will highlight the economic calendar on Tuesday, however, the focus will quickly turn to US August inflation data which is due on Wednesday.

FX Expiries for Sep12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650-65(E1.8bln), $1.0700(E1.2bln), $1.0720-25(E1.3bln), $1.0770-75(E920mln), $1.0800-20(E1.2bln), $1.0830-35(E531mln), $1.1000(E1.2bln)

- USD/JPY: Y140.00($1.1bln), Y146.50-65($725mln), Y146.85-00($540mln)

- GBP/USD: $1.2350-55(Gbp968mln)

- EUR/GBP: Gbp0.8600-20(E644mln), Gbp0.8880-00(E603mln)

- AUD/USD: $0.6250(A$936mln)

- NZD/USD: $0.5835(N$605mln), $0.5950-65(N$837mln)

- USD/CAD: C$1.3700($512mln)

- USD/CNY: Cny7.3000($982mln)

Late Equity Roundup: Tesla Gains Over 10%

- Stocks gaining in late trade - back near early session highs, led by automaker Tesla and a weaker US$. Currently, S&P E-Mini futures are up S&P E-Mini Future up 27.75 points (0.62%) at 4539, Nasdaq up 159.1 points (1.2%) at 13920.52, DJIA up 99.14 points (0.29%) at 34675.13.

- Leaders: Consumer Discretionary, communication Services and Consumer Staples are outperforming. Discretionary sector led by autos, in particular Tesla +10.05% after Morgan Stanley upgrade earlier, while component maker BorgWarner gained 1.1%.

- Telecom shares buoyed Communication Services with T-Mobile +2.1%, Verizon +1.3%, ATT +0.9%. Household and personal care shares outpaced food, beverage and tobacco names in the second half: Kenvue +3.9%, Proctor & Gamble +1.4%while Colgate Palmolive gained 1.2%.

- Laggers: Energy, Industrials and Real Estate sectors underperformed. Oil and Gas names saw better selling on profit taking after last week's gains: Devon Energy and Marathon -3.95%, APA -3.15 and Diamondback Energy -2.45%. Aerospace and Defense contractors weighed on Industrials: RTX Corp -7.55%, Axon Enterprises -1.2%, while Lockheed Martin slipped 0.85%.

- Technicals: Despite today's soft rally, SPX bear cycle remains in play. Key resistance has been defined at 4597.50, Sep 1 high. A break is required to reinstate the recent bullish theme. A resumption of weakness would signal scope for a move towards the key support and bear trigger at 4397.75, the Aug 18 low. A break of this support would highlight a short-term reversal. For bulls, clearance of 4597.50 would open 4685.25, Jul 27 high.

E-MINI S&P TECHS: (Z3) Bear Threat Remains Present

- RES 4: 4685.25 High Jul 27 and key resistance

- RES 3: 4617.40 61.8% retracement of the Jul 27 - Aug 18 sell-off

- RES 2: 4597.50 High Sep 1 and a near-term bull trigger

- RES 1: 4553.25 High Sep 6

- PRICE: 4536.75 @ 14:21 BST Sep 11

- SUP 1: 4482.00 Low Aug 29

- SUP 2: 4397.75 Low Aug 18 and a bear trigger

- SUP 3: 4378.75 Low Jun 9

- SUP 4: 4352.50 Low Jun 8

The E-mini S&P contract traded lower last week and a bear cycle remains in play. Key resistance has been defined at 4597.50, Sep 1 high. A break is required to reinstate the recent bullish theme. A resumption of weakness would signal scope for a move towards the key support and bear trigger at 4397.75, the Aug 18 low. A break of this support would highlight a short-term reversal. For bulls, clearance of 4597.50 would open 4685.25, Jul 27 high.

COMMODITIES Crude Futures and Gold Pull Back After Clearing Recent Resistance Levels

- Crude futures have edged out small declines after some limited two-way trade today, ultimately consolidating Friday’s gains. Tight supplies and low stocks continue to support crude markets whilst a weaker US dollar is adding to the price support.

- The near-term crude option put skews are holding steady today but longer term spreads continue to turn more bearish amid ongoing concern for future oil demand growth and uncertainty over OPEC+ supply targets into next year.

- Crude managed money net long positions rose to a six month high with WTI positioning the most bullish since June 2022 according to CFTC data released on Friday. The combined net long positions for Brent and WTI increased by +101k to 452k.

- The Libyan oil ports - Es Sider, Ras Lanuf, Brega and Zueitina – remain shut until at least Tuesday after a severe rainstorm hit the country's eastern region over the weekend, leading to flooding, according to shipping agents.

- WTI is -0.3% at $87.22 off a high of $88.15 to clear $88.08 (Sep 6 high) and re-open the round $90.00.

- Brent is -0.1% at $90.56 off a high of $91.45 to clear $91.15 (Sep 5 high) and open $92.91 (Nov 17, 2022 high, cont).

- Gold is +0.15% at $1921.97 with only limited gains considering a sizeable -0.5% decline in the USD index, sliding back after quickly reversing a clearance of technical resistance at $1930.5 (50-day EMA). A more concerted push is required to open a key resistance at $1953.0 (Sep 4 high).

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/09/2023 | 2300/0000 |  | UK | BOE's Mann to Speak in Canada | |

| 12/09/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 12/09/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 12/09/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/09/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 12/09/2023 | 0905/1105 | *** |  | DE | ZEW Current Conditions Index |

| 12/09/2023 | 0905/1105 | *** |  | DE | ZEW Current Expectations Index |

| 12/09/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/09/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/09/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/09/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.