-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Retail Sales Spurs Rate Cut Pricing

- Strong risk-on reaction as Retail Sales miss (and down-revisions to prior) stole spotlight from largely in-line CPI.

- 10Y Tsy yield fell to lowest level since prior to April's "hot" CPI, S&P Eminis back at levels not seen since April 1.

- Projected rate cuts gained momentum post data, currently pricing two 25bp moves by year end, all things equal.

US TSYS Retail Sales Miss, April Down-Revisions Outshines In-Line CPI

- Treasuries remain well bid after the bell, not far off this morning's post-Retail Sales (and down-revisions to prior release) and CPI data highs. While 10Y Tsy yield fell to 4.3361% this morning - the lowest level since of prior to the "hot" CPI on April 10, S&P Eminis are back at levels not seen since April 1 this morning.

- Supercore CPI at a still hot but broadly as expected 0.42% M/M (and with its large 0.19pp contribution from vehicle insurance that isn’t reflected in PCE).

- US retail sales had their poorest performance in 3 months in April, with weakness evident across the board, partially reversing March's strong gains. Overall retail sales were flat (+0.4% expected), pulling back from +0.6% in March, while ex-auto/gas sales were -0.1% (+0.2% expected) vs +0.7% in March. Each represented the poorest outturn in 3 months.

- In-turn, short end rate cut pricing now projects two 25bp rate cuts by year end (Sep & Dec).

- Trying to keep things in perspective, Minneapolis Fed President Neel Kashkari said the Federal Reserve should keep monetary policy on hold for now given uncertainty about how tight policy actually is and against a backdrop of inflation that has fallen from its peaks but is still too high.

- Look ahead to Thursday's data calendar: Weekly Claims, Build Permits and more Fed Speak.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00091 to 5.32055 (+0.00068/wk)

- 3M +0.00263 to 5.32933 (+0.00735/wk)

- 6M +0.00218 to 5.29573 (+0.01142/wk)

- 12M -0.00182 to 5.15640 (+0.01747/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.838T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $736B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $713B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $76B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $265B

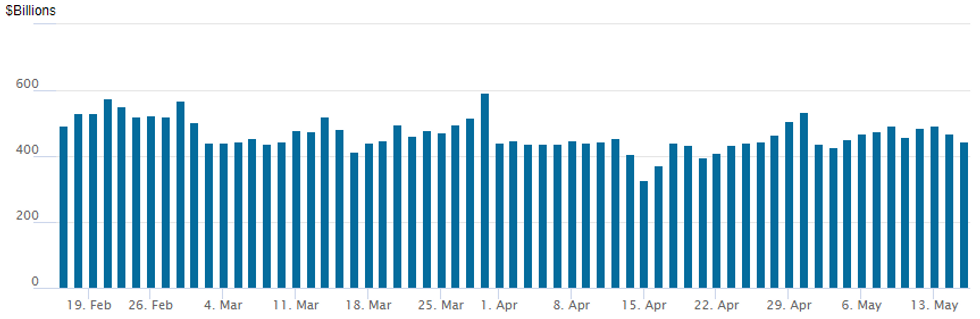

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage falls to $443.779B from $468.344B prior; number of counterparties 74. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Heavy volumes reported in SOFR and Treasury options Wednesday, mixed flow on net as accounts shifted strategies in reaction to the CPI, Retail Sales Data. Option accounts have been well positioned for higher yields since April's "hot" CPI read. Heavy upside call buying in the last few sessions anticipated the reaction to this morning's in-line CPI and Retail Sales miss as underlying futures surged. First half trade favored put unwinds and vol sales as rate cut pricing projected two 25bp by year end (Sep and Dec). By midday, trade shifted to buying downside puts again as option accounts looked to fade initial reaction.- SOFR Options:

- Block, 8,874 94.68/94.75/94.81/94.88 put condor 2.0

- -8,000 SFRM4 94.68/94.75/94.81 put flys 1.0 ref 94.70

- -5,000 SFRM5 95.00 puts, 19.0 vs. 95.695/0.24%

- +5,000 SFRQ4 94.43/94.68 put spds, 1.0 vs. 94.90/0.10%

- -10,000 SFRN4 94.93/95.06 2x1 put spds 0.5, ref 94.90

- -10,000 SFRU4 94.93/95.06 2x1 put spds 3.5 ref 94.915

- -5,000 0QU4 96.62 calls, 8.5 vs. 95.89/0.16%

- Block, total 40,000 SFRZ4 94.37/94.62/94.87 put flys, 5.75/spilts

- Block, +15,000 SFRH6 93.75/94.25/94.75 put flys, 4.0

- Block, 10,000 SFRH6 93.75/94.25/94.75 put flys, 3.75/splits

- Block, 5,000 SFRU4 94.81/94.93/95.06 call flys, 3.0

- -10,000 SFRU4 94.56/94.62 put spds, 0.25 ref 94.92

- +7,000 0QM4 95.37 puts, 8.0 vs. 95.61/0.38%

- +10,000 SFRV4 94.12/94.62/94.75 put trees w/ SFRZ4 93.41/94.50/94.62 put tree, 1.75 total

- -10,000 SFRU4 94.56/94.62 put spds, 0.25 ref 94.92

- +7,000 0QM4 95.37 puts, 8.0 vs. 95.61/0.38%

- +10,000 SFRV4 94.12/94.62/94.75 put trees w/ SFRZ4 93.41/94.50/94.62 put tree, 1.75 total

- 25,750 SFRZ4 95.06/95.12/95.18/95.25 call condors 0.625-0.7 synth ref 95.125

- Block/total 20,000 SFRZ4 94.37/94.62/94.87 put flys, 6.0 ref 95.135

- 2,000 2QM4 96.31/96.43/96.50/96.62 call condors ref 96.08

- Block, 4,000 SFRM5 94.00/94.50 put spds, 5.5 ref 95.615

- Block/screen, 6,500 SFRZ4 94.75/94.87 put spds, 5.0 ref 95.13

- Block, 5,000 0QM4 95.87/96.12/96.25 broken call flys, 3.0 vs. 95.575/0.10%

- 2,000 0QM4 95.87/96.00 call spds vs. 3QM4 96.50/96.62 call spds

- 4,000 SFRN4 94.68/94.75/94.81/94.87 put condors ref 94.885

- Treasury Options:

- -20,000 TYN4 108.5/111.5 strangles 38 ref 110-00 (TYU4)

- Block, 2,000 TUM4 101.87/102.12 call spds vs. 101.25/101.37 put spd, 4 net iron condor

- 5,000 FVM4 106.75/107 call spds, 3.5 ref 106-04

- 5,000 FVM4 106.5/107 call spds vs. wk3 5Y 106.25/106.75 call spds, .5 net Jun over

- 5,000 FVM4 106/107 call spds 19.5 ref 106-08.25.

- Block, 34,950 wk3 FV 108/108.5 put spds 5 ref 109-09.5

- 4,000 TYM4 109.25 puts, 31 ref 109-10

- 4,500 FVM4 106.5/107 call spds 5 ref 105-29.5

- 2,000 TYQ4 109.5/111.5 1x2 call spds ref 109-15.5

- 1,700 FVM4 109 calls ref 106-09.25

- 1,500 FVM4 104.5/105 put spds ref 105-28.5

- 5,000 TYM 109/109.5 call spds, 16 ref 109-06

- 2,500 TYM4 108.25/110.25 strangles, 23 ref 109-06.5

- 2,500 TYM4 110/110.5 call spds, 6 ref 109-05.5

- 1,500 TYM4 109.5/110.5 call spds, 15 ref 109-05.5

EGBs-GILTS CASH CLOSE: Bull Flattening Rally On US CPI Relief

EGBs and Gilts joined Treasuries in a broad-based bull flattening rally Wednesday as US data came in on the soft side of expectations.

- Core European instruments had already gotten off to a strong start, attributed to overnight reports that China could enact significant stimulus via government purchases of unsold homes. Eurozone prelim Q1 GDP data was as expected and had little impact.

- US core CPI was in line with median consensus but on the low side on an unrounded basis with unworrying details; the US retail sales report was the weakest in 3 months.

- Central bank easing expectations increased, with implied 2024 ECB cuts up 7bp on the day to 74bp, and BoE 5bp to 61bp.

- But the main impact was further down the curve, with yields from 5-year through 30-year down double digits in both the UK and Germany.

- Periphery EGB spreads tightened, led by BTPs, as risk appetite picked up on the US data miss.

- Thursday's highlights include BoE's Greene and a slew of ECB speakers (de Cos, Nagel, Villeroy, Centeno, Panetta, and Guindos presenting the semi-annual ECB Financial Stability Review).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 9.2bps at 2.895%, 5-Yr is down 12.1bps at 2.457%, 10-Yr is down 12.6bps at 2.422%, and 30-Yr is down 10.8bps at 2.572%.

- UK: The 2-Yr yield is down 7.8bps at 4.244%, 5-Yr is down 9.9bps at 3.95%, 10-Yr is down 10.7bps at 4.066%, and 30-Yr is down 10.9bps at 4.543%.

- Italian BTP spread down 2.9bps at 131.3bps / Spanish down 1.3bps at 77.2bps

EGB Options: Wednesday Trade Leans Toward Euro Rates Upside

Wednesday's Europe rates/bond options flow included:

- RXM4 131.50c, bought for 26 in 2.75k

- ERU4 96.62/96.87cs bought for 2.75 in 2.5k

- ERU4 96.62/96.87cs 1x1.5, bought the 1 for ~1.75 in 10k

- ERZ4 97.00/97.25/97.50c ladder, bought for 0.25 in 2k

- ERZ4/ERH5 97.50/97.75cs strip, bought for 4.5 in 8k

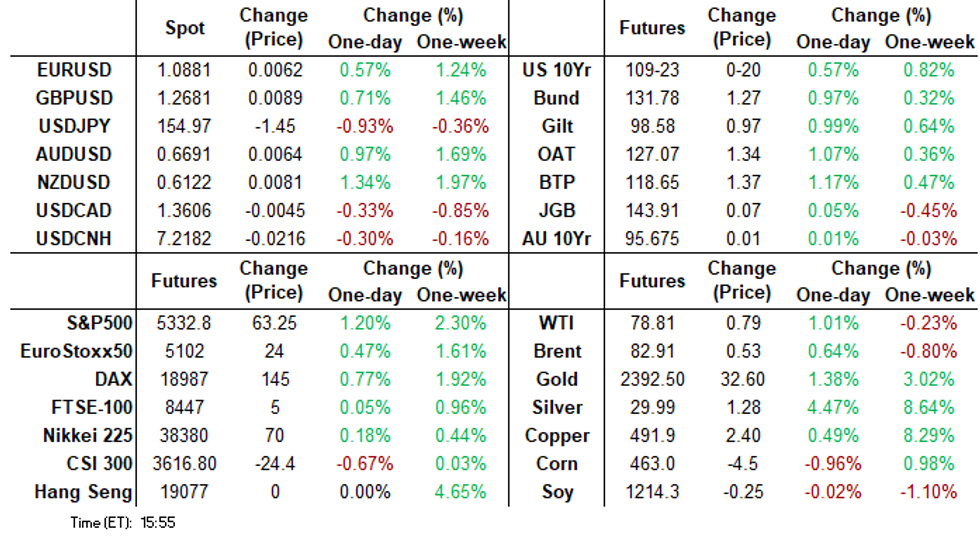

FOREX Broad Greenback Weakness Prevails Post US CPI, NZD Surges 1.25%

- The greenback traded in a volatile manner on Wednesday as markets digested the latest inflation data from the US and the USD index has maintained a downward bias throughout the session. Softer-than-expected data sees the DXY down 0.65%, lower for a third consecutive session and at the lowest level since the prior inflation print on April 10. The index has also breached below the 50-dma, intersecting today at 104.77, weighed by US yields 10bp lower on the day and major equity indices surging.

- This risk on tone of the session has been underpinned by China easing rhetoric picking up, with risk proxy currencies being the main beneficiary. This has particularly benefited the New Zealand dollar, which alongside Scandinavian FX, stands as the best performer in G10, rising around 1.25% against the greenback.

- USDJPY is also 1% lower on Wednesday, helped back below the 155.00 mark by lower core yields. Today’s selloff should snap a three-day winning streak for the pair and leave 156.74, the May 14 high and 157.00, a Fibonacci retracement as the key short-term levels on the topside as markets continue to weigh the MoF’s potential intervention plans versus the underlying drivers of central bank policy and yield differentials.

- The preliminary reading of first quarter growth data in Japan is due overnight, which precedes Australian. In the US, jobless claims, Philly Fed and industrial production will cross Thursday, however, markets will likely be more concerned with comments from Fed officials following the latest inflation report.

FX Expiries for May16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0635-45(E2.9bln), $1.0750-55(E2.9bln), $1.0790-05(E1.6bln), $1.0820-25(E907mln), $1.0845-50(E1.1bln), $1.0875(E823mln), $1.0915-20(E1.2bln)

- USD/JPY: Y155.00-05($1.5bln), Y159.30-50($2.5bln)

- GBP/USD: $1.2600-15(Gbp1.2bln)

- AUD/USD: $0.6425(A$1.3bln)

- USD/CNY: Cny7.2000($1.1bln), Cny7.2500($1.0bln)

Late Equities Roundup: Chip Stocks Carry Rally For Second Day Running

- Stocks trade near late session highs with some modest profit taking doing little to dent the risk-on tone following this morning's in-line CPI and Retail Sales beat. S&P Eminis are back at levels not seen since April 1, currently up 55.25 points (1.05%) at 5324.75, DJIA up 277.96 points (0.7%) at 39835.38, Nasdaq up 219.3 points (1.3%) at 16730.

- Eminis continue to extend the bull cycle from Apr 19, nearing key resistance and bull trigger at 5333.50, the Apr 1 high. Clearance of this hurdle would confirm a resumption of the medium-term uptrend.

- Information Technology and Real Estate sectors led gainers for the second consecutive session, chip stocks continue to buoy the former: Advanced Micro Devices and Teradyne both +3.88%, Nvidia +3.65% and Broadcom +3.6%. Estate management and Investment trusts buoyed the latter: American Tower +3.31%, CBR Group +2.92%, Public Storage +2.58%.

- Laggers: Consumer Discretionary and Materials sectors underperformed in early trade, autos and parts makers weighed on the former: Tesla -1.63%, Ford -1.72%, Aptiv -1.12%. Meanwhile, chemical makers weighed on the Materials sector late: Albemarle -5.94%, FMC Corp -3.56%, LyondellBasell Ind -1.48%.

- Late cycle earnings releases still expected this week: CIsco, B Riley, Walmart, Deere & Co, Applied Materials and Take Two Entertainment.

E-MINI S&P TECHS: (M4) Continues To Appreciate

- RES 4: 5400.00 Round number resistance

- RES 3: 5372.73 1.76 proj of the Apr 19 - 29 - May 2 price swing

- RES 2: 5333.50 High Apr 1 and the bull trigger

- RES 1: 5330.25 Intraday High May 15

- PRICE: 5324.50 @ 1455 ET May 15

- SUP 1: 5181.19/5153.63 20- and 50-day EMA values

- SUP 2: 5036.25/4963.50 Low May 2 / Low Apr 19 and bear trigger

- SUP 3: 4907.57 38.2% retracement of the Oct 27 ‘23 - Apr 1 bull leg

- SUP 4: 4863.75 Low Jan 19

S&P E-Minis traded higher yesterday and the contract remains firm today as it again extends the bull cycle from Apr 19. This highlights scope for a continuation higher and attention is on the key resistance and bull trigger at 5333.50, the Apr 1 high. Clearance of this hurdle would confirm a resumption of the medium-term uptrend. Initial resistance is 5308.50, the Apr 4 high. Initial firm support lies at 5153.63, the 50-day EMA.

COMMODITIES: Spot Gold Rises To Three Week High, WTI Crude Finds Gains

- Spot gold is up 1.2% at $2,387/oz Wednesday, aided by the weaker dollar, bringing it above last week’s highs to print the best level since mid-April.

- The medium-term trend structure in gold remains bullish and a push higher would refocus attention on $2,431.50, the Apr 12 high. On the downside, the 50-day EMA, at $2,273.83, represents a key support.

- Meanwhile, silver is outperforming and is up by 3.5% on the day at $29.6/oz, bringing the gold-silver cross to its lowest since end-November.

- Copper is currently up by 1.0% at $494.2/lb, having hit a new record high of $512.8 earlier in the session.

- Copper futures remain in a clear uptrend despite today’s volatile price action. The contract has pierced a key resistance at $503.95, the Mar 2022 high. A resumption of gains would open $516.58, a Fibonacci projection. Initial key support lies at $460.06, the 20-day EMA.

- WTI has climbed to a new intraday high as US close nears. Support comes from EIA data showing an above expectation draw in US crude stocks, coupled with US macro data which could support Fed rate cuts this year.

- WTI Jun 24 is up 0.9% at $78.8/bbl.

- A bearish theme in WTI futures remains intact and scope is seen for a move to $76.07, the Mar 11 low. Initial firm resistance is at $84.46, the Apr 26 high.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2024 | 2350/0850 | *** |  | JP | Japan GDP 1st Estimate |

| 16/05/2024 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 16/05/2024 | 0430/1330 | ** |  | JP | Industrial Production |

| 16/05/2024 | 0600/0800 | ** |  | NO | Norway GDP |

| 16/05/2024 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/05/2024 | 1100/1200 |  | UK | BOE's Greene Speech at Make UK on Labour Market | |

| 16/05/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 16/05/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/05/2024 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 16/05/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 16/05/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/05/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 16/05/2024 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 16/05/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 16/05/2024 | 1430/1030 |  | US | Philadelphia Fed's Pat Harker | |

| 16/05/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/05/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 16/05/2024 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 16/05/2024 | 1950/1550 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.