-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

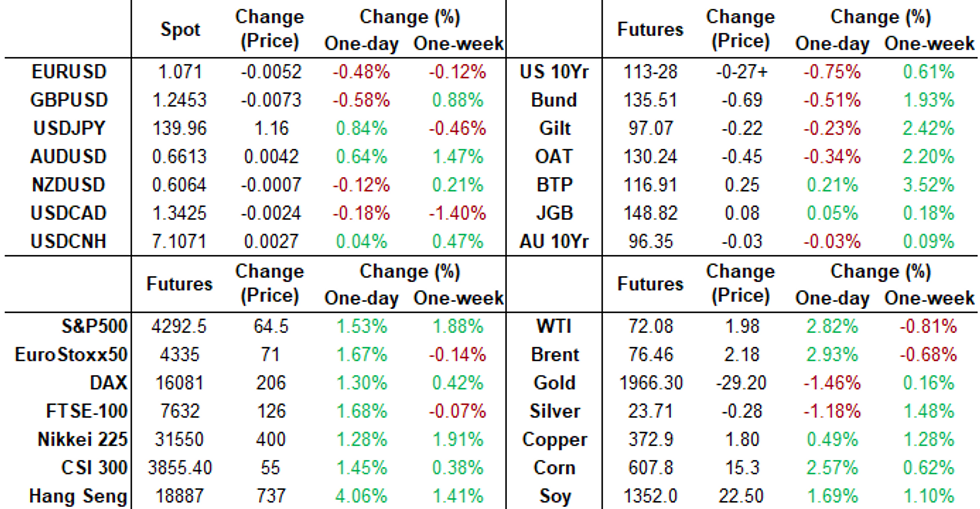

Free AccessMNI ASIA MARKETS ANALYSIS: Risk On Into Fed Blackout

- MNI: FED CHAIR POWELL TO TESTIFY BEFORE SENATE BANKING JUNE 22

- U.S. ‘AAA’ RATING REMAINS ON NEGATIVE WATCH DESPITE DEBT LIMIT AGREEMENT - FITCH RATINGS

- OPEC+ WANTS TO MAINTAIN STABILITY IN OIL MARKET: IRAQ MINISTER .. OPEC+ OIL POLICY HAS WORKED: IRAQ MINISTER, Bbg

Key Links: MNI INTERVIEW: US Dollar Leadership Eroding-Ex-IMF adviser / US Treasury Auction Calendar / US$ Corporate Supply Pipeline / MNI GLOBAL WEEK AHEAD: RBA & BOC Rates Decisions Coming Up

Tsys Breach Support, Near Lows After Mixed Jobs/Unemployment Data

- Treasury futures remain under pressure, drifting near late session lows after this mornings mixed employment data: strong May jobs gains and up-revisions for prior two data sets, vs. a higher unemployment level - employment gains in Household were the weakest since April 2022, and the "beat" of Establishment employment (+339k) vs Household (-310k) of 649k was the widest since April 2020.

- Front month 10Y futures broke support on it's way to session low of 113-25 (-30.5), yield climbing to 3.6984% high, key support and the bear trigger is 112-29+, the May 26 / 30 low.

- In the short end, FOMC-dated OIS implied rates have faded from post-payrolls highs and haven’t meaningfully changed odds of a 25bp hike on Jun 14, whilst the July terminal doesn’t quite fully price in another hike with +22bps.

- It holds sizeable increases for subsequent meetings though, with 31bp of cuts from terminal to a year-end rate of 5.00% for an effective that is just 9bp lower than current levels - see table for full run.

- There haven’t been any Fed pop-up appearances since the data ahead of the start of the media blackout tonight, leaving markets continuing to weigh up Jefferson and Harker’s skip narrative after an inconclusive payrolls report whilst ultimately waiting on CPI on day one of the Jun 13-14 meeting. In WSJ Timiraos’ words: “A difficult one for the Fed, with many officials saying this report would be very important, because it has a "choose your narrative" element to it."

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.03357 to 5.14067 (-.01277/wk)

- 3M -0.04604 to 5.23034 (-.03340/wk)

- 6M -0.03981 to 5.24547 (-.05289/wk)

- 12M -0.03573 to 5.02697 (-.13117/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 to 5.06557%

- 1M +0.02557 to 5.18857%

- 3M -0.00228 to 5.49629 */**

- 6M -0.02400 to 5.62343%

- 12M -0.06814 to 5.65729%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.51671% on 5/31/23

- Daily Effective Fed Funds Rate: 5.08% volume: $131B

- Daily Overnight Bank Funding Rate: 5.06% volume: $283B

- Secured Overnight Financing Rate (SOFR): 5.08%, $1.627T

- Broad General Collateral Rate (BGCR): 5.05%, $610B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $599B

- (rate, volume levels reflect prior session)

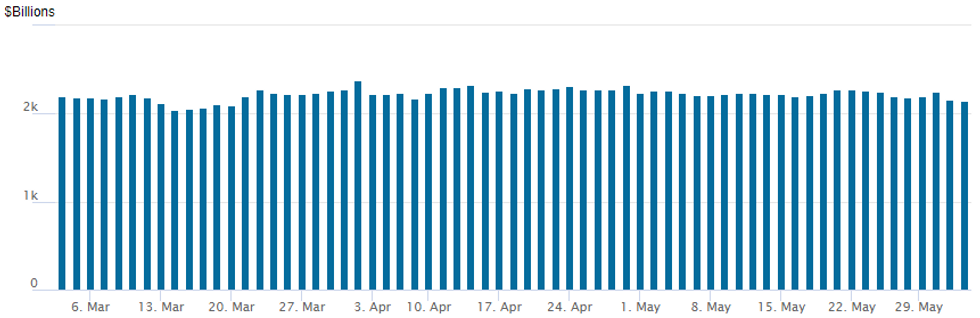

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,142.102B w/ 104 counterparties, compares to prior $2,160.055B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTIONS SUMMARY

Mixed, two-way trade on decent volumes reported Friday. SOFR and Treasury option trade leaned toward better call interest (mix of outright and position adjusting) as underlying futures came under heavy knee-jerk pressure following the higher than expected May employment data.- SOFR Options:

- 5,000 SFRM3 94.62/94.68/94.75 put flys, 0.25

- Block, 5,500 2QN3 97.00/97.25 put spds 12.5 over 97.25/97.50 call spd ref 96.915

- Block, 20,000 SFRZ3 96.25/97.25 call spds, 9.0 vs. 95.13/0.08%

- Block, 2,500 OQU3 96.62/97.37 2x3 call spds, 28.0 net ref 96.41

- -20,000 SFRZ3 96.50/97.75 call spds, 7.5-7.75 ref 95.15

- Block, 5,000 SFRM3 94.75/94.87/95.00 put flys, 3.5 ref 94.7325

- Block, 5,000 SFRQ3 94.87/95.06/95.31 broken call flys 1.5

- Block, 6,500/screen SFRM3 94.56/94.62/94.68/94.75 put condors, 1.25

- Block/screen, 32,000 SFRM3 94.87/94.93 call spds, 0.5 ref 94.74 to -.7425

- 5,250 SFRH4 95.75/96.50 call spds vs. OQH4 97.50/98.25 call spds,

- 3,000 SFRH4 96.00/OQH4 97.25 call spds

- 1,500 SFRM3 94.62/94.75 put spds ref 94.865

- 3,000 SFRM3 94.75/94.81/97.87/94.94 put condors ref 94.7325

- Treasury Options:

- Block, 8,000 TYN3 112.5 puts, 18 vs. 114-00.5/0.25%

- Ratio 10Y package Blocked at 1134:34ET

- 11,000 TYN3 118.5/119.5 call strip 4 w/

- 22,000 TYN3 112 puts, 12

- Vol sale followed on screen:

- -16,000 TYN3 112/118.5 strangles at 15 ref 114-03.5

- more recently, 8,500 TYQ3 111/117.5 strangles, 35 ref 114-01.5

- +10,000 TYN3 117 calls, 9 ref 114-12.5

- 1,800 TYN3 111.25 puts ref 114-20.5

- 2,200 FVU3 110/112 call spds ref 109-08

EGBs-GILTS CASH CLOSE: Bear Flatter In An Otherwise Bull Flattening Week

The German and UK curves bear flattened Friday to take the shine off an otherwise stronger week, with an above-expected headline US job gain accelerating yield rises in the afternoon.

- In an otherwise quiet session for headlines and data, ECB and BoE hike pricing finished marginally higher on the day, in a partial reversal of the recent pullback.

- Indeed, Friday's bear flattening came in the broader context of a soft-Eurozone CPI induced bull flattening this week. UK 2Y yields closed down 14bp on the week despite a 7bp rise today; 10Y Gilts finished the week down nearly 18bp, offset by a 4bp rise Friday.

- Similarly in Germany, Schatz rose by 9bp today but were down 14bp on the week; a 6bp yield rise in 10Y Bund today meant a weekly drop of "only" 23bp.

- A risk-on atmosphere following the US Congress's passage of a debt limit deal helped periphery EGB spreads tighten, with BTPs and GGBs outperforming.

- Friday's UK and France sovereign ratings reviews by Fitch and S&P respectively will garner attention after hours, though a 1.5bp drop in the 10Y OAT/Bund spread suggested little evident market concern for France.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 8.4bps at 2.802%, 5-Yr is up 9.2bps at 2.337%, 10-Yr is up 6.3bps at 2.312%, and 30-Yr is up 3.3bps at 2.489%.

- UK: The 2-Yr yield is up 7.2bps at 4.363%, 5-Yr is up 5.2bps at 4.102%, 10-Yr is up 4bps at 4.156%, and 30-Yr is up 2.1bps at 4.48%.

- Italian BTP spread down 8.1bps at 175.8bps / Greek down 10.4bps at 137.5bps

EGB Options: Light Rates Trade To Close The Week

Friday's Europe rates / bond options flow included:

- ERU3 95.50/95.60/9650/97.00 iron condor, bought for 7.5 in 1.6k

- ERU3 96.50/97.00cs, bought for 3.5 in 1k

FOREX: Higher US Yields Prompts Renewed JPY Weakness, Greenback Firms

- While the mixed headlines within the US employment report prompted some initial two-way trade for the greenback, the higher-than-expected payrolls figures have kept the US dollar on the front foot on Friday with the USD index rising around 0.5% as we approach the week’s close.

- While the significant pressure on the front-end of the Treasury’s curve has underpinned the greenback strength, the more notable move in G10 currency markets has been the renewed JPY weakness which sees USDJPY breaking back above 140.00 in late session trade.

- With the bounce, bullish technical conditions remain intact and attention is re-focused on the top of a bull channel, drawn from the Jan 16 low which intersects at 140.96 and represents a key resistance. A clear break of it would reinforce trend conditions and open 141.61, the Nov 23, 2022 high.

- The clear outperformer on the day remains the Australian dollar, rising 0.5%. Despite paring around half the overnight gains following the US data, the powerful overnight rally cements AUD as one of the best performing majors on Friday. Price action remains underpinned by chances of another rate hike at the RBA's June 6 meeting having risen following a sharp jump in the country's minimum- and award-wage system and a persistently high monthly inflation print earlier in the week.

- The greenback strength was enough to unwind the initial USDCNH weakness following reports that China is weighing a property market support package as a means to boost the economy. The Chinese Yuan trades closed to unchanged for Friday’s close as of typing, having bounced off the 7.0670 lows.

- Monday sees Swiss CPI and final European services PMI readings before the release of US ISM Services PMI data for May. The RBA and BOC decisions highlight the central bank calendar.

FX: Expiries for Jun05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-85(E1.0bln), $1.0690-00(E535mln), $1.0820(E959mln)

- USD/JPY: Y138.20($1.6bln), Y139.50-60($557mln)

- AUD/USD: $0.6625(A$548mln)

- USD/CAD: C$1.3430($865mln)

Equities Roundup: SPX Rally Revisits August 2022 Levels

- Stocks extend rally, SPX Eminis back to Aug 22 levels amid delayed short covering following debt bill passing senate last night. Post-data bid as June hike remains uncertain. From a practical standpoint, Materials, Energy and Consumer Discretionary sectors leading the move: metals and mining stocks supporting the former, while a rally in crude (WTI +1.94) helping Energy stocks

- At the moment S&P E-Mini futures are up 64.75 points (1.53%) at 4292.75; Nasdaq up 141.3 points (1.1%) at 13242.08; DJIA up 716.17 points (2.17%) at 33777.25.

- For a technical perspective, S&P E-minis trend conditions remain bullish and the contract is trading higher today. Resistance at 4244.00, the Feb 2 high and a medium-term bull trigger, has been cleared.

- The break reinforces bullish conditions and confirms a resumption of the uptrend that started in October 2022. This opens up next resistance at 4327.50 High Aug 16 2022 (cont).

- On the flipside, the 50-day EMA, at 4138.48 remains a key support. A break of this average is required to signal a reversal.

E-MINI S&P TECHS: (M3) Clears Key Resistance

- RES 4: 4690.25 High Mar 29 2022

- RES 3: 4327.50 High Aug 16 2022 (cont)

- RES 2: 4300.00 Round number resistance

- RES 1: 4297.00 Intraday high

- PRICE: 4290.50 @ 1530 ET Jun 2

- SUP 1: 4173.34/4114.00 20-day EMA / Low May 24

- SUP 2: 4062.25 Low May 4 and key support

- SUP 3: 4052.50 Low Mar 30

- SUP 4: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

S&P E-minis trend conditions remain bullish and the contract is trading higher today. Resistance at 4244.00, the Feb 2 high and a medium-term bull trigger, has been cleared. The break reinforces bullish conditions and confirms a resumption of the uptrend that started in October 2022. This opens key resistance 4327.50 High Aug 16 2022 (cont). The 50-day EMA, at 4138.48 remains a key support. A break of this average is required to signal a reversal.

COMMODITIES: Crude Oil Sees Second Day Of Solid Gains Ahead Of OPEC+, Gold Slides Post Payrolls

- Crude oil have steadily ground out decent-sized gains today, a second day of gains to mostly unwind what at times this week were heavy declines.

- Gains are attributed to Congress passing debt ceiling legislation, the potential for new measures to support the economy in China and with uncertainty over the outcome of the OPEC+ meeting this weekend.

- Bloomberg reports: OPEC+ gathered in Vienna to decide whether to give their existing production cuts more time to take effect, or take further preemptive action to boost prices. Ministers gave little indication of which path they would choose as they arrived in the Austrian capital, and market watchers weren’t ruling anything out.

- WTI is +2.3% at $71.71, moving closer to resistance at $73.68 (50-day EMA).

- Brent is +2.5% at $76.11 having cleared resistance at $75.92 (20-day EMA) to open $77.58 (50-day EMA).

- Gold is -1.4% at $1950.92 on resurgent dollar strength and higher yields on the nuanced payrolls report. The yellow metal more than unwinds yesterday’s large gains and closes the week only slightly higher, but doesn’t yet test support at $1932.2 (May 31 low).

- Weekly moves: WTI -0.2%, Brent -1.1%, Gold +0.2%, US nat gas -5.5%, EU NNT nat gas -3.4%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/06/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/06/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/06/2023 | 0130/1130 |  | AU | Business Indicators | |

| 05/06/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/06/2023 | 0600/0800 | ** |  | DE | Trade Balance |

| 05/06/2023 | 0630/0830 | *** |  | CH | CPI |

| 05/06/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/06/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/06/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/06/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/06/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/06/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/06/2023 | 0900/1100 | ** |  | EU | PPI |

| 05/06/2023 | 1300/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 05/06/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/06/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/06/2023 | 1400/1000 | ** |  | US | Factory New Orders |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.