-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Risk On Sparked By JOLTS Miss

- Weaker than expected JOLTS and Conference Board data see Treasuries and stocks rally.

- The upshot was broad US dollar weakness, with a notable reversal for USDJPY from an earlier clearance of 147.

- Australia CPI will highlight the overnight data docket on Wednesday, before Eurozone inflation readings come thick and fast - see below for the MNI Preview, followed by ADP employment and 2nd readings for Q2 GDP in the US.

US TSYS: Short-Lived Modest Paring Of Post-Data Gains

- Treasuries have seen a short-lived partial paring of post-data gains, more so at the wings with 5Y through 10Y tenors marginally slower after the strong 7Y auction earlier stopped through by 2bps.

- It still sees large rallies on the day though, with 2YY -11bps and 10YY -8bps, the latter driven in real terms after surprisingly low job openings, quits rate back at pre-pandemic averages and softer than expected consumer confidence including important labor market indicators.

- TYZ3 volumes have overtaken those of TYU3, with the contract trading 22 ticks higher at 110-26+, off earlier highs of 110-29+ but maintaining clearance of the 20-day EMA at 110-20.

- The Fed’s VC for Supervision Barr is still to come on Banking Services at 1500ET but there is otherwise a dearth of scheduled Fedspeak post-Jackson Hole, with Bostic up next on Thu.

- ADP is likely in additional focus tomorrow after today’s soft JOLTS report, along with the second reading of Q2 GDP considering Q3 trackers are willing wild in the case of the Atlanta Fed tracker.

US STIR: Fed Terminal Sees 5bp Hit From JOLTS & Conf. Board

- Fed Funds implied rates have held the initial hit seen after soft JOLTS and Conference Board data, with cumulative hikes reduced to +3.5bp for Sep and +12.5bp for Nov to see a terminal of 5.46%.

- It’s a sizeable reversal for terminal pricing, which had more notably cleared 5.50% before the data for fresh highs since Mar 7-9 just before SVB disruption, and in doing so priced in significiantly greater than 50% probability of another hike.

- Cut expectations have seen sizeable increases on the day but remain at the low end of recent ranges, with 47bp from terminal to Jun’24 (37bp pre-data) and 118bp from terminal to Dec’24 (107bp pre-data).

EGBs-GILTS CASH CLOSE: Rally On Weak Data; Euro Inflation Awaits

European yields reversed lower in afternoon trade Tuesday after weak US data (job openings and consumer confidence) boosted Treasuries, pulling Bunds and Gilts with them.

- European core FI curves moved in a bull steepening direction after the data with the short-end/bellies of the UK and German curves outperforming.

- Bunds started the European session on the front foot, though gains were capped by Germany holding a 30-year syndication and Bobl auction.

- Yields drifted higher most of the session until the US data switched the tone completely, with a sharp rally in both Bunds and GIlts.

- Periphery spreads closed tighter as the US data miss buoyed risk appetite alongside falling Fed hiking prospects.

- Attention is firmly on eurozone August flash inflation data which kicks off Wednesday with Spanish and German readings. MNI's preview went out today.

- On Thursday we get UK DMO investor consultations - our latest UK Issuance Deep Dive also went out today.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.3bps at 3.043%, 5-Yr is down 5.4bps at 2.541%, 10-Yr is down 5.4bps at 2.51%, and 30-Yr is down 4.7bps at 2.624%.

- UK: The 2-Yr yield is down 3.4bps at 5.246%, 5-Yr is down 2.9bps at 4.758%, 10-Yr is down 1.9bps at 4.422%, and 30-Yr is unchanged at 4.639%.

- Italian BTP spread down 2bps at 164.1bps / Spanish down 0.7bps at 101.5bps

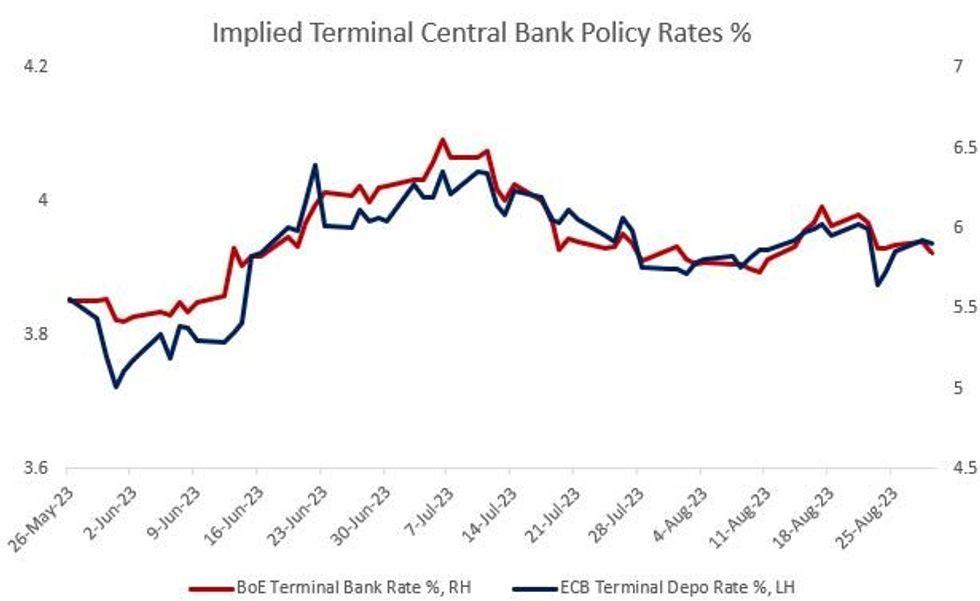

EU STIR: Soft US Data Spurs Pullback In ECB And BoE Hike Pricing

- BoE terminal Bank Rate pricing -6.7bp to 5.85% (60bp of further hikes left in the cycle to Feb 2023): BoE hike pricing pulled back to the lowest since Aug 11, with a 6bp drop from session highs after the weak US data. There's still a 25bp hike fully priced for the September MPC, with 45bp through the next two meetings cumulatively.

- ECB terminal depo Rate pricing -0.2bp to 3.94% (19bp of further hikes left in the cycle to Dec 2023): ECB hike pricing has remained relatively steady today but notably September pricing went from about 50% implied probability of a hike to around 40% after the soft US data emerged. Of course, Euro area inflation data Weds and Thurs could well dictate whether the ECB hikes another 25bp in September or opts to pause. 16bp of hikes are cumulatively priced through the next 2 meetings.

EU FI OPTIONS: Flow Tuesday Includes Sonia Upside Profit Taking

Tuesday's Europe rates / bond options flow included:

- OEZ3 118.75/119.50cs, bought for 18.5 in 16k

- SFIU3 94.2/94.494.6c fly sold at 11.5 in 1.5k (profit taking).

- SFIU3 94.35/94.55 1x2 call spread sold at 6.5 in 3k

EUROZONE INFLATION: Services Play Key Role In Above-Consensus HICP Outlooks

The following analysts are above consensus on the 5.3% Y/Y core Eurozone August HICP measure (and the 5.1% headline):

- HSBC: Core 5.5% Y/Y, Headline 5.4% Y/Y: Inflation is evolving over the summer as we had expected with room for volatility due to clothing sales. Energy base effects and industrial goods disinflation to depress headline HICP, but momentum looks to be continuing to pick up in services, especially in tourism-related ones.

- Deutsche: Core 5.4% Y/Y, Headline 5.5% Y/Y

- SocGen: Core 5.4% Y/Y, Headline 5.3% Y/Y. M/M headline 0.6% vs -0.1% prior: Weaker goods inflation to drag down core, while services are boosted by technical factors. The basket reweighting that has amplified travel inflation is likely to only add 0.05pp to core in Aug, vs 0.3pp in July. On headline, higher oil / refinery margins will add 0.5pp to headline, with French electric prices adding 0.06pp -together offsetting negative energy base effects and declining utility prices elsewhere and a 5th consecutive decline in food inflation.

- SEB: Core 5.4% Y/Y; Headline 5.2% Y/Y: Core numbers have come down with abating price pressure in goods being more evident. For services, strong demand but also seasonality, add volatility making it difficult to set the underlying trend completely. Looking ahead: Core will move roughly sideways before turning markedly lower starting in September. We see abating monthly price movements, but the y/y numbers are also affected by strong base effects.

Soft Food Prices, "Noisy Factors" Eyed In Below-Consensus HICP

The following analysts are below-consensus on August HICP:

- RBC: Core 5.2% Y/Y, Headline 5.2% Y/Y: Main downward contributions to come from food and manufactured goods inflation. Less encouragingly, services inflation is likely to prove more sticky, and may even reach a new record high. A 10% increase in French regulated electricity prices may also support energy inflation this month, although base effects will weigh on electricity and gas inflation elsewhere in the euro area. Looking ahead: Aug likely to prove to be the peak for services inflation which we expect to begin to moderate from September.

- TD: Core 5.2% Y/Y, Headline 5.2% Y/Y: While continued soft momentum in food and core goods inflation should put further downside pressure, the recent surge in oil prices will keep headline inflation from falling much. Services inflation is still key for the ECB though, and here we see another strong m/m print, though base effects should push the y/y rate down a touch.

- JPM: Core 5.1% Y/Y, Headline 5.2% Y/Y. ECB SA HICP 0.6% M/M; core 0.4% M/M JPM notes risks to their core forecast “are perhaps skewed a bit to the upside”. Note three noisy factors: upward base effect from German transport tickets, the weights distortion which is still upward (though likely limited impact in August and turning to a drag in Sept), and package holiday inflation being affected in annual terms by a structural break in the German series. “a new methodology is being used this year to collect prices, which causes noise in the annual comparison. This was a drag in July on the annual rate and we assume that this persisted in August.”

- BofA: Core 5.1% Y/Y, Headline 5.2% Y/Y. Equates to CPI M/M of 0.5% (no core estimate)

FOREX: Weaker US Data Prompts Broad Greenback Weakness

- Weaker-than-expected US JOLTS and confidence data prompted some sharp greenback weakness on Tuesday, quickly erasing the early gains for the US dollar and prompting eventual 0.5% losses for the USD index on the session.

- Lower core yields have bolstered the Japanese Yen, with USDJPY extending a powerful reversal from earlier cycle highs of 147.37 to 145.77 lows just ahead of the APAC crossover. The pair is now down 0.50% on the session and the first support to watch lies at 144.77, the 20-day EMA.

- EURUSD is moving in lockstep with the broader USD index, also rising a half a percent and approaching last Thursday’s highs around 1.0875 and initial firm resistance at 1.0900, the 20-day EMA.

- Outperforming on the session are the antipodeans with both AUD (+0.67%) and NZD (+0.81%) benefitting from buoyant global equity benchmarks. JPMorgan noted that “this looks to be very much the benign sort of labor market cooling that Fed is targeting”, potentially underpinning the more optimistic price action for stocks on Tuesday.

- Despite Hungary's central bank cutting the overnight deposit rate again by 100bps, the Forint is the best performer on Tuesday, rising 1.2% against the dollar, amid the broader optimism for risk sentiment.

- Australia CPI will highlight the overnight data docket on Wednesday, before Eurozone inflation readings come thick and fast. The greenback and broader currency markets will remain focused on the key data releases due later this week - NFP, Core PCE and ISM.

FX OPTIONS: Expiries for Aug29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0725-35(E1.0bln), $1.0800(E1.9bln), $1.0825-30(E560mln), $1.0855-65(E550mln), $1.0950-55(E1.4bln)

- USD/JPY: Y145.00($699mln), Y147.00-10($1.4bln)

- GBP/USD: $1.2700-20(Gbp646mln)

- AUD/USD: $0.6400(A$1.3bln)

US STOCKS: Holding Push Towards Resistance, Nasdaq Outperforming

- The S&P e-mini extended gains to a new high of 4502.50 before nudging back below 4500 in another step towards resistance at 4510.13 (former bull channel base drawn from Mar 13).

- SPX sits +1.3%, with gains led by communication services (+2.0%), IT (+2.0%) and consumer discretionary (+1.8%). Apple (+2.0%) and Nvidia (+4.5%) lead the contribution, whilst Tesla sees largest outright increases with +6.4%. Consumer staples (+0.2%) and utilities (+0.3%) lag.

- The performance attributions are consistent with Nasdaq’s outperformance (+1.9%), whilst Dow Jones lags (+0.7%).

- The broader markets backdrop helps, with VIX holding its push through 15 and at lows since Aug 1 whilst 10Y real yields are down 7bps on the day after softer than expected US labor data.

COMMODITIES: Recovery In Crude & Gold Aided By USD Tailwind

- A volatile session for crude but one that is ending with ~1% gains, aided by a tailwind from USD depreciation after weaker than expected US data.

- There are however continued concerns around energy demand in major markets like US and China, whilst signs of lower global oil inventories weigh against increasing supplies from Russia and Iran (the latter including Russian crude shipments at the highest in two months in the week to Aug 27).

- Chinese refiners have a weaker outlook for the recovery in Chinese demand, with Sinopec (China’s biggest refiner) saying Monday that the country’s product demand in the second half would expand at a slower pace than in the first.

- Shell is not shutting any of its offshore production due to Hurricane Idalia, a spokesperson for the company said.

- WTI is +1.1% at $80.95, ultimately taking a step closer to resistance at $81.75 (Aug 21 high).

- Brent is +1.0% at $85.24, moving closer to resistance at $85.68 (Aug 21 high) after which lies the bull trigger at $88.10 (Aug 10 high).

- Gold is +0.8% at $1936.02, directly benefiting from the slide in the USD. It has cleared the 50-day EMA ($1930.4) and next opens $1946.8 (Aug 4 high).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/08/2023 | 0130/1130 | *** |  | AU | Quarterly construction work done |

| 30/08/2023 | 0130/1130 | * |  | AU | Building Approvals |

| 30/08/2023 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 30/08/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 30/08/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Survey |

| 30/08/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/08/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/08/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/08/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 30/08/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 30/08/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/08/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 30/08/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/08/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/08/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/08/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 30/08/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/08/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 30/08/2023 | 1230/0830 | *** |  | US | GDP |

| 30/08/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 30/08/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 30/08/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.