-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA MARKETS ANALYSIS: Safe Haven Bid Cools Late

HIGHLIGHTS

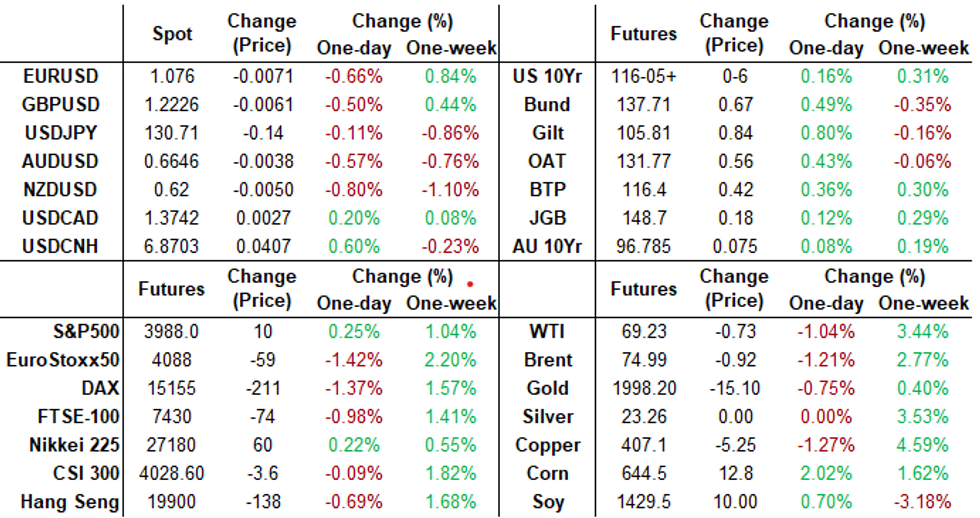

- MNI FED Bullard: I would put 80% probability on the case where financial stress abates.

- BULLARD: INFLATION REMAINS TOO HIGH, U.S. MACRO DATA "STRONGER THAN EXPECTED"

- ST. LOUIS FED'S BULLARD: U.S. RESPONSE TO BANK STRESS "SWIFT AND APPROPRIATE," ALLOWING MONETARY POLICY TO FOCUS ON INFLATION, Rtrs

- JPMORGAN ANALYSTS ON DEUTSCHE BANK: WE ARE NOT CONCERNED TODAY ABOUT COUNTERPARTY, LIQUIDITY ISSUES. JPMORGAN ANALYSTS ON DEUTSCHE BANK: RECENT CDS WIDENING IS IN OUR VIEW RELATED TO ONE WAY TRADES OF DE-RISKING ACROSS ALL MARKET PARTICIPANTS, RTRS

US TSYS: Bank-Tied Safe Haven Rate Bid Recedes in Late Trade

- Decent gains held by Treasury futures after the bell were well off first half highs, 30Y futures trading in a narrow range since late morning were trading 132-12 +19 after the bell.

- Treasury futures opened broadly higher after another retreat in European banks overnight (Deutsche Bank -12%, Commerzbank -9%), global rates rallied amid persistent worries over bank funding and surge in Foreign and International Monetary Authority repo facility take up to $60B from zero the week prior.

- Treasury 2Y yields fell to the lowest levels since September 2022: 3.5594% just two days after marking a one week high of 4.2480% early Wednesday, while yield curves bull steepened to the least inverted levels since October (2s10s taps -26.706).

- In line with the overnight bank sell-off and safe haven bid projected rate CUTS gained momentum. Fed funds implied hike for May'23 receded to around 6bp, followed by projected rate cuts through year end in early trade: Jun'23 cumulative -15.6bp to 4.631%, Jul'23 -49.3bp to 4.295% while Dec'23 cumulative neared -100.0.

- Safe haven short end support moderated through the second half as stocks recovered (SPX eminis +15 in late trade), however: Sep'23 SOFR futures traded around 95.80 late (+0.040) vs. 96.11 early session high, while Dec'23 cumulative receded to -87.7 at 3.926%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00172 to 4.90886% (+0.24800/wk)

- 1M -0.01472 to 4.83057% (+0.00457/wk)

- 3M -0.03228 to 5.10143% (+0.10300/wk)*/**

- 6M -0.15542 to 4.98729% (-0.06500/wk)

- 12M -0.29800 to 4.80886% (-0.22528/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.83% volume: $92B

- Daily Overnight Bank Funding Rate: 4.82% volume: $276B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.355T

- Broad General Collateral Rate (BGCR): 4.77%, $526B

- Tri-Party General Collateral Rate (TGCR): 4.77%, $510B

- (rate, volume levels reflect prior session)

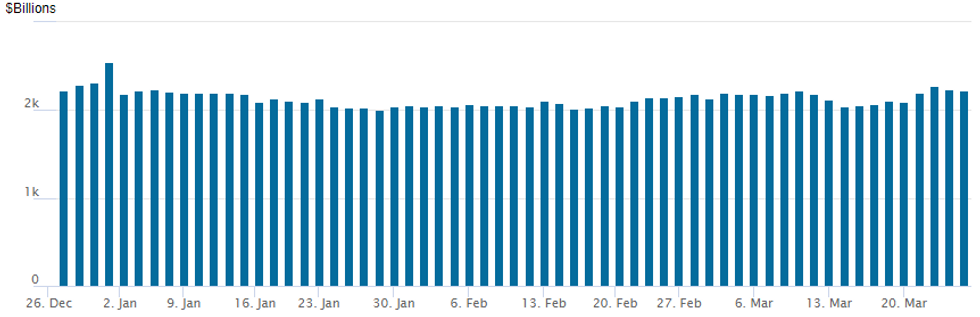

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,218.458B w/ 100 counterparties vs. the prior session''s $2,.233.956B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Downside put buying gained momentum in the second half (note the 40k Jun'23 SOFR put fly) as accounts faded the bank-panic driven safe haven support well before underlying futures pared first half gains: SFRU3 at 95.78 in late trade are +0.020 vs. 96.11 early session high! Better interest in calls overnight, particularly in SOFR options noted in early Friday trade as underlying futures surged with projected rate cuts climbing through year end (near 100bp in December) after the open.- SOFR Options:

- over 40,000 (pit/screen) SFRM3 94.37/94.56/94.75 put flys, ref 95.41

- Block, 5,000 SFRU3 94.12/94.62 put spds, 6.0 ref 95.85

- Block, 20,000 SFRU3 95.00/95.50 put spds, 20.5 vs. 96.005/0.15%

- Block, 10,000 SFRK3 95.00/95.25 put spds, 10.0 ref 95.595

- Block, 2,500 OQM3 94.50 puts, 1.0 ref 97.045

- over 14,800 SFRZ3 96.25/96.75 call spds ref 96.38 -.375

- over 11,300 SFRK3 94.62/95.00/95.25 broken put flys ref 95.575

- 9,900 SFRM4 98.25/98.50 call spds ref 97.045

- 5,000 SFRJ3 94.87/95.12/95.38 call flys, ref 95.605

- 2,000 OQJ3 96.87/97.25 2x3 call spds ref 97.045

- 2,000 SFRZ3 97.50/98.00 call spds ref 96.225

- Treasury Options:

- Block, -7,500 TYK3 118/119 call spd w/ 118.5/119.5 call spd, collects 27 on the double sale

- Block, 10,000 FVK3 114 calls, 24.5 ref 111-00

- +11,000 TYK 114 puts 27 vs. 116-30

- 2,000 TYM3 109/111 put spds 8 ref 116-30.5

- over 9,500 FVK 114 calls partly tied to FVK 112.5 calls on 2x3 ratio

- over 9,900 FVJ3 puts, 12 ref 111-00.5

- 3,100 TYK3 116.75 puts, 14 ref 116-29

- 5,000 TYM3 120/125 call spds, 41 ref 116-27.5 to 117-00

- over 24,900 TYK3 113.5 puts, 18-20 ref 116-28 to -31.5

- over 7,500 TYK3 115 puts, 40-42 ref 116-25 to -29

EGBs-GILTS CASH CLOSE: Bull Steepening Again On Bank Fears

European curves bull steepened strongly for the 2nd consecutive session Friday, as central bank hike expectations pulled back yet again.

- The session's fixed income price action was driven by a banking share price rout, with stalwart Deutsche Bank down over 10% at one point amid fears around the financial sector outlook and going into the weekend.

- 10Y BTP spreads widened as much as 7bp as Bunds rallied sharply and stocks weakened.

- However, the drop in core yields pulled back from extremes in the afternoon as equities stabilised.

- ECB peak rate expectations dipped as much as 25bp before closing 9bp lower; BoE rate pricing closed 7bp lower, but had fallen as much as 30bp intraday.

- Stronger-than-expected Eurozone / weaker-than-expected UK PMIs didn't move the needle much, with market participants much more focused on bank risks.

- For the session, 2Y German yields dropped 13.5bp with 10Y off 6.9bp; the UK short-end rally was less pronounced, with 2Y yields down 8.1bp and the belly outperforming (5Y down 8.4bp), vs 10Y Gilt down 7.9bp.

- Banking-related headlines will be watched for over the weekend, with the highlights of Monday's schedule including German IFO data and multiple ECB speakers (including Schnabel) and BOE's Bailey making an appearance.

EGB Options: Large Schatz And Euribor Call Spreads Feature Friday

Friday's Europe rates / bond options flow included:

- DUK3 106.20/106.30cs, bought for 5.5 in 16k

- DUK3 106.20/106.30cs, trades 4.5 in 16.1k

- OEK3 117/115ps 1x2, sold at 17.5 in 1k.

- RXK3 137/135/133p fly, bought for 27.5 in 7k

- RXM3 135/129/128/122p condor, bought for 94.5 in 8k

- ERH4 99.25/100cs 1x2, bought the 1 for -0.25 (receive) and flat in 30k

- ERM3 96.50/96.25/96.00p fly 1x1.7x0.7 sold at 5 in 10k

FOREX: Euro Weakness Persists Amid European Banking Sector Concerns

- Pressure on banking stocks was present again early Friday, weighing on the likes of the Euro and prompting an early surge for the US dollar and the Japanese Yen. Names such as Deutsche Bank were knocked by worries that regulators and central banks have not yet contained the current crisis, placing particular pressure on EURJPY which fell as much as 1.9% during European trade.

- PMI data from across the Eurozone saw mixed results, with composite indices beating expectations thanks to a healthier services sector, although disappointing manufacturing reads added to the bearish sentiment for the single currency.

- Despite a recovery for risk sentiment during US hours, the Euro is showing losses of around 0.7% against both the dollar and then yen as we approach the close.

- The slightly more optimistic backdrop approaching the week’s close weighed on the Yen with USDJPY set to close around 130.70 despite an early slide to 129.64 on Friday. The turnaround across higher Beta FX was also noticeable in LatAm where USDMXN fell from early highs of 18.80 to around 18.45 approaching the close.

- Overall, the USD index (+0.58%) has stabilised after a consistent grind lower both before and in the immediate aftermath of the Fed decision this week. Despite dipping briefly below 102 on Thursday, the DXY looks set to close the week on a surer footing and back above the 103 mark. The broad greenback strength on Friday was enough to depress the likes of AUD (-0.55%) and NZD (-0.80%).

- European clocks adjust for daylight saving this weekend and German IFO data will kick off the docket on Monday. Australian and Eurozone CPI prints highlight next week’s calendar.

FX Expiries for Mar27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0785(E700mln), $1.0800(E1.0bln)

- USD/JPY: Y130.00-10($606mln), Y130.50-60($1.1bln)

- GBP/USD: $1.2300(Gbp636mln)

- USD/CAD: C$1.3660($500mln)

Late Equity Roundup: Off Lows, Banks Paring Losses Ahead Weekend

- US Stocks continue to drift off first half lows, SPX Eminis at 3990.0 and the Dow at 32,175 are making modest gains, while Nasdaq shares remain mildly weaker at 11,775 in late trade.

- Utilities (+2.34%), Real Estate (+1.51%) and Consumer Staples (+1.44%) sectors continue to underpin Eminis while bank shares are gradually shrugging off early carry-over weakness following a sell-off in European banks overnight (Deutsche Bank -12%, Commerzbank -9%).

- From a technical perspective, focus remains on the 50-day EMA as Eminis failed to hold above the support level after Wednesday's sell-off. The move down means that price has - so far - failed to hold above pivot resistance around the 50-day EMA - a bearish development.

- The EMA intersects at 4021.50 and a clear break is required to strengthen bullish conditions. Support at 3966.25, Wednesday’s low, has been breached. This signals scope for 3897.25 next, the Mar 20 low. Key short-term resistance is at 4073.75, the Mar 22 high.

E-MINI S&P (M3): Remains Below The 50-Day EMA

- RES 4: 4148.48 76.4% retracement of the Feb 2 - Mar 13 downleg

- RES 3: 4119.50 High Mar 6

- RES 2: 4089.39 61.8% retracement of the Feb 2 - Mar 13 downleg

- RES 1: 4021.50/4073.75 50-day EMA / High Mar 22

- PRICE: 3990.00 @ 1445ET Mar 24

- SUP 1: 3897.25 Low Mar 20

- SUP 2: 3839.25 Low Mar 13

- SUP 3: 3822.00 Low Dec 22 and a key support

- SUP 4: 3778.00 Low Nov 3

S&P E-Minis reversed sharply lower Wednesday. The move down means that price has - so far - failed to hold above pivot resistance around the 50-day EMA - a bearish development. The EMA intersects at 4021.50 and a clear break is required to strengthen bullish conditions. Support at 3966.25, Wednesday’s low, has been breached. This signals scope for 3897.25 next, the Mar 20 low. Key short-term resistance is at 4073.75, the Mar 22 high.

COMMODITIES: Oil Holds Onto Weekly Gains Despite Banking Concerns

- An intraday recovery in risk sentiment isn’t enough to stop crude oil prices falling for a second session after first sliding with a stronger USD as European bank stocks tumbled on the open.

- Prices nevertheless hold for gains on the week after increasing strongly early in the week. Central bank and financial developments have played a key theme for the week as whole but there have also been idiosyncratic drivers such as Russia’s Novak on Tuesday saying it was looking at extending its production cuts to the end of June.

- WTI is -1.1% at $69.17 having climbed off a low of $66.84 that briefly cleared $66.90 (Mar 21 low) after which lies the bear trigger at $64.36 (Mar 20 low).

- Brent is -1.3% at $74.90, off a brief low of $72.70 that cleared $72.82 (Mar 21 low) to open the bear trigger at $70.12.

- Gold is -0.7% at $1979.53, fading with USD strength, after a volatile week that has seen a particularly wide range of 1934.3-2009.7.

- Weekly moves: WTI +3.7%, Brent +2.7%, Gold -0.5%, US nat gas -6.1%, EU TTF nat gas -4.1%.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/03/2023 | 1400/1600 |  | EU | ECB Schnabel in Discussion at Chicago Booth Conference | |

| 27/03/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 27/03/2023 | 0800/1000 | ** |  | EU | M3 |

| 27/03/2023 | 0845/0945 |  | UK | BOE Treasury Select Committee Hearing on Silicon Valley Bank | |

| 27/03/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/03/2023 | 1340/1540 |  | EU | ECB Elderson Speech at Foreign Bankers' Association | |

| 27/03/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 27/03/2023 | 1500/1700 |  | EU | ECB Schnabel in Conversation at Columbia University | |

| 27/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 27/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 27/03/2023 | 1700/1800 |  | UK | BOE Bailey Speech at LSE | |

| 27/03/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 27/03/2023 | 2100/1700 |  | US | Fed Governor Philip Jefferson |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.