-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Sep CPI Firms, Rate Hike Chances Up

- MNI SECURITY: Kirby On Iran Funds: "Regime Was Never Going Receive Money"

- MNI US-IRAN - CBS: US And Qatar Reach "Quiet Understanding" On Iran Funds

- MNI US President Biden on 60 minutes Sunday

- US GIVES FIRST IRON DOME INTERCEPTORS TO ISRAEL, PENTAGON SAYS, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Core CPI Gained, 30Y Bond Reopen Tailed

- Tsys have fallen back to early Monday levels Thursday, curves bear steepening in the minutes following a poorly received 30Y Bond auction re-open that tailed 3.5bp.

- Heavy volumes after the bell (TYZ3 near 2M), Dec'23 10Y futures at 107-10 (-20) still well above initial technical support of 106-14 (2.0% Lower Bollinger Band), 10Y Yield 4.6928% (+.1345) after tapping 4.7261% high after the Bond sale.

- Busy early session as Tsys gapped higher in the seconds PRIOR to the data release (TYZ3 108-16 high) just as quickly reversed/extended lows after U.S. CPI rose 0.396% in September and 3.7% from a year ago, the Bureau of Labor Statistics reported Thursday, a tenth higher than markets expected.

- Meanwhile core CPI added 0.323% and 4.1% over the month and year, respectively, in line with expectations. The three-month annualized rate for core CPI rose to 3.1% in September from 2.4% the previous month.

- Curves reversed flatter profiles - gapped steeper immediately after the $20B 30Y bond auction tailed 3.5bp (4.837% high yield vs. 4.802% WI). 3M10Y currently +12.906 at -82.121 vs. -99.763 low; 2Y10Y +5.635 at 37.134 vs. -48.359; 5Y10Y +3.154 at -37.811 vs. -45.133 low.

- Friday Data Calendar: Import/Export Prices, UofM Sentiment, Philly Fed Harker will present his 2023 economic outlook (text, Q&A) at 0900ET.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00212 to 5.33450 (-0.00657/wk)

- 3M +0.00010 to 5.39387 (-0.01287/wk)

- 6M +0.00530 to 5.43994 (-0.01452/wk)

- 12M +0.01319 to 5.36920 (-0.02736/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $94B

- Daily Overnight Bank Funding Rate: 5.32% volume: $247B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.465T

- Broad General Collateral Rate (BGCR): 5.30%, $567B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $556B

- (rate, volume levels reflect prior session)

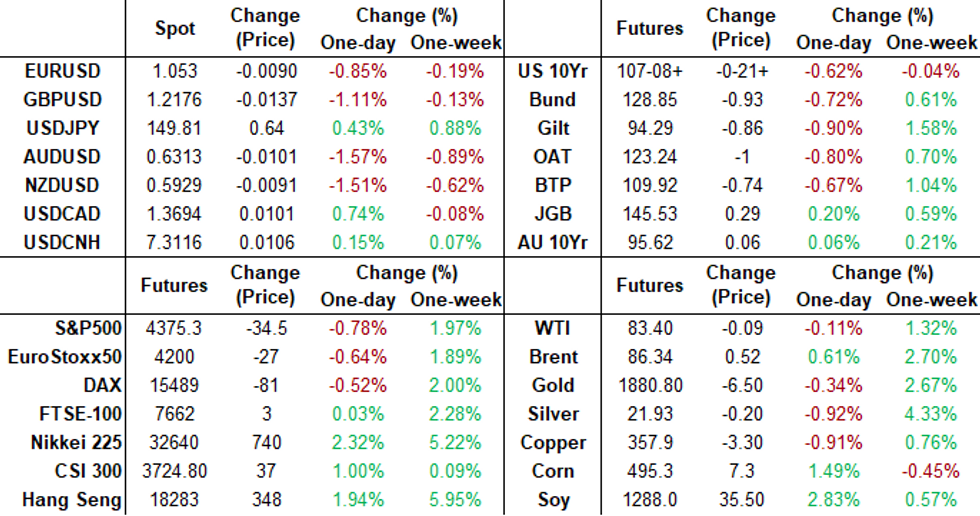

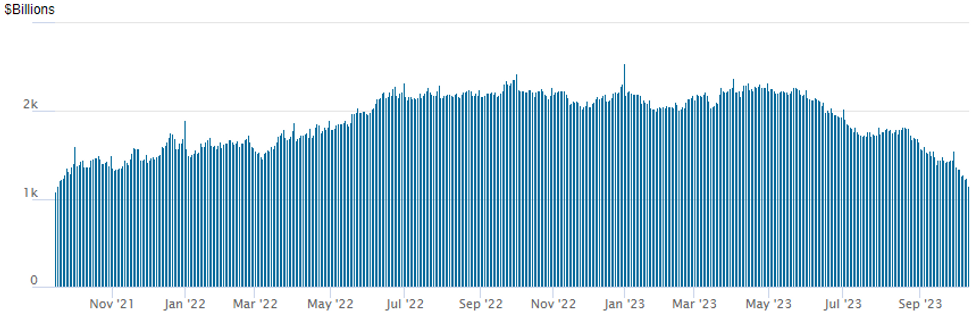

FED REVERSE REPO OPERATION - Usage Falls to New Cycle Low

NY Federal Reserve/MNI

Repo operation usage falls to the lowest since mid-September 2021 at $1,157.319B w/97 counterparties vs. $1,239.382B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Interest in low delta SOFR and Treasury puts and put structures gained traction as underlying futures extended lows well after this morning's CPI data. Curves bear steepened as bonds traded back to early Monday levels. Projected rate hikes into early 2024 are holding near session highs has as weaker short end rates outperform bonds in post-auction trade: November up to 11.9% vs. 9.8% earlier, w/ implied rate change of +3bp to 5.358%, December cumulative of 10.6bp at 5.433%, January 2024 10.9bp at 5.438%. Fed terminal at 5.438% in Jan'24. Fed terminal at 5.44% in Feb'24.- SOFR Options:

- Block, -10,000 2QH4 94.75/95.00 put spds, 2.75 ref 95.94

- Block, 6,000 SFRZ3 94.50/94.56/94.62 call flys, 0.5 ref 94.53, more on screen

- 1,500 SFRM4 94.50/95.00 2x1 put spds

- 8,000 SFRZ3 94.68/94.75/94.81/94.87 call condors ref 94.575

- 3,500 SFRX 94.43/94.50 put spds ref 94.575

- 9,000 SFRX3 94.62 calls ref 94.57

- 4,600 SFRV3 94.50/94.56/94.62 call flys ref 94.57 to -.575

- Block, 5,000 SFRV3 94.50/94.56 put spds, 1.25 ref 94.575

- 3,000 SFRV3 94.50 puts ref 94.575

- Treasury Options:

- over 39,000 TYX3 107 puts, 39-35 ref 107-06.5 to -08

- over 46,000 TYZ3 105 puts, 27 last ref 107-06

- 2,000 USZ3 107/108/109/110 put condors

- 3,000 USX3 105/107 put spds vs. USX 116/118 call spds

- 5,000 FVX3 105.25 puts, 36.5 ref 105-01

- 2,000 TYZ3 103/104/105/106 put condors, 11 ref 107-16

- 16,000 FVX3 105.25/105.75/106.25/106.75 call condors ref 105-15.75

- 1,500 TYX3 108/109/110 call flys, 14 ref 108-04

- 8,000 TYZ3 105/106/107.5 TYZ3 broken put flys on 2x3x1 ratio

- 2,500 TYX3 107 puts, 19 ref 108-03.5

- 1,500 TYX3 108/108.5 put spds ref 108-03

EGBs-GILTS CASH CLOSE: Bear Steepening On Strong US Inflation Data

EGB and Gilt yields retraced some of the drop seen earlier in the week on Thursday after stronger-than-expected US September inflation data.

- The European morning session saw some modest gains (Gilts benefited from softer-than-expected manufacturing data) that faded as oil prices and equities found a footing.

- But trade was tentative ahead of US CPI data, which saw global core FI retreat sharply as the implications of unexpectedly strong core/supercore figures were digested. The selling momentum carried on through the cash close.

- German and UK curves bear steepened on the day, with Gilts underperforming Bunds.

- Periphery EGB spreads widened led by BTPs, having cheapened post-CPI and on ECB's Vasle calling for a debate to begin on shrinking the balance sheet.

- The week concludes Friday with final Sept Eurozone CPI data and Eurozone industrial production for August, along with multiple central bank speakers once again including BoE's Bailey and ECB's Lagarde.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.3bps at 3.161%, 5-Yr is up 5.7bps at 2.716%, 10-Yr is up 6.8bps at 2.786%, and 30-Yr is up 7.6bps at 2.975%.

- UK: The 2-Yr yield is up 5.3bps at 4.85%, 5-Yr is up 8.3bps at 4.471%, 10-Yr is up 9.5bps at 4.423%, and 30-Yr is up 9.6bps at 4.864%.

- Italian BTP spread up 2.6bps at 197.7bps / Spanish up 1.4bps at 111.3bps

EGB Options: Plenty Of Euribor Upside Structures Cross Thursday

Thursday's Europe bond / rate options flow included:

- ERM4 96.37/97.00 call spread bought for 12 in 4k

- ERM4 96.25/96.37cs vs 96.12/96.00ps, bought the cs for flat in 5k

- ERU4 97.00/98.00 call spread bought for 12 in 4k

- ERZ3 95.87/96.00/96.12c fly 1x3x2, bought for 2.25 in 3.5k

- 0RF4 97.00/97.50cs bought for 10.75 in 5k

FOREX USD Index Rises 0.7% Following Above-Estimate Inflation Data

- The slightly firmer than expected US inflation data sparked a shift higher for US treasury yields and an associated recovery for the greenback. A persistent USD bid throughout the session tilted the USD index back into positive territory on the week and those moves extended in late trade amid the weakness for global equity benchmarks.

- Equities weakness weighed substantially on the likes of AUD and NZD, which are registering losses of over 1.5% on the session as we approach the APAC crossover, with GBP closely behind, dropping 1.1% and back below the 1.2200 mark.

- EURUSD’s traded with a renewed downward bias, sinking back to 1.0530 at typing, over a big figure from the earlier session highs.

- In similar vein, USDJPY narrowed the gap once more to 150.00 with Japanese authorities reiterating that FX volatility is problematic and that currency adjustments must reflect fundamentals. USDJPY’s recovery from last Tuesday’s low at 147.43 is a bullish technical development and - for now - the uptrend remains in play. A clear break of the 150.00 handle would reinforce bullish conditions. The bull trigger is 150.16, the Oct 3 high and a break would initially open 150.40 and 151.09, both Fibonacci projections.

- Reversing much of the prior positive sentiment earlier in the week, EM currencies such as MXN and ZAR were among the worst performers amid the higher US yields and waning equities.

- Chinese CPI/PPI data will be released overnight on Friday, alongside September trade data. BOE Governor Bailey is due to speak at the Institute of International Finance Annual Membership Meeting, in Morocco. The US docket is highlighted by UMich consumer sentiment and inflation expectations.

FX Expiries for Oct13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E1.2bln), $1.0470-75(E4.5bln), $1.0515(E2.7bln), $1.0565-75(E2.6bln), $1.0625-35(E3.4bln), $1.0650(E1.3bln), $1.0700-20(E1.6bln)

- USD/JPY: Y146.00($628mln), Y146.50($850mln), Y148.00($705mln) Y148.95-15($1.2bln)

- EUR/JPY: Y158.25(E769mln)

- GBP/USD: $1.2145-50(Gbp602mln), $1.2245-55(Gbp572mln)

- USD/CAD: C$1.3490-00($595mln)

- USD/CNY: Cny7.3500($3.1bln)

Late Equity Roundup: Utilities, Materials Sectors Underperform

- Stocks extending losses in late trade, risk appetite souring as short end rate markets project a higher chance of a rate hike before year end. Currently, S&P E-Mini futures are down 39 points (-0.88%) at 4370.5, Nasdaq down 104.9 points (-0.8%) at 13554.85, DJIA down 286.33 points (-0.85%) at 33518.44.

- Laggers: Utilities and Materials sectors underperform, water and electricity providers weighing on the former: American Water Works -2.77%, Eversource -6.48%, PPL Corp -2.49%. Metals and mining shares weighing on Materials sector: Nucor -5.17%, Steel Dynamics -5.07% while Freeport-McMoRan Inc declined -3.63%.

- Leaders: Information Technology and Energy sectors continued to outperform in late trade, semiconductor shares buoying the former: KLA Corp +3.64%, Broadcom +3.5%, Applied Materials +2.62%.

- Meanwhile, oil and gas shares continued to trade firm despite crude reversing course to weaker (WTI -0.88 at 82.68): Diamondback Energy +1.97%, EOG Resources +1%, Hess Corp +0.8%.

- Reminder, Q4 earnings cycle gets underway with several bank shares reporting tomorrow Friday: JP Morgan, Wells Fargo, Blackrock, PNC Financial and Citigroup expected.

E-MINI S&P TECHS: (Z3) Bear Cycle Hits Pause

- RES 4: 4566.00 High Sep 15 and a key resistance

- RES 3: 4514.50 High Sep 18

- RES 2: 4431.80 50-day EMA

- RES 1: 4430.50 High Oct 12

- PRICE: 4372.00 @ 1445 ET Oct 12

- SUP 1: 4235.50 Low Oct 4

- SUP 2: 4194.75 Low May 24

- SUP 3: 4166.25 1.50 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 4: 4134.00 Low May 4

The e-mini S&P trades higher for a fifth consecutive session, with the index narrowing in on the cluster of resistance at the 50/100-dmas for the Dec contract. Overall, a bear cycle remains in play, however downside momentum has paused in favour of a corrective rally. Pivot resistance remains above at the 50-day EMA at 4431.80, with the medium-term outlook remaining bearish the longer price holds below this level.

Oil End of Day Summary: Crude Plummets

WTI plummeted following the larger than expected build in US crude and record production levels.

- WTI NOV 23 down -1.1% at 82.58$/bbl

- WTI-Brent down -0.39$/bbl at -4.18$/bbl

- EIA Weekly US Petroleum Summary - w/w change week ending Oct 06: Crude stocks +10,176 vs Exp -431, Crude production +300.

- OPEC has kept its 2023 global oil-demand growth forecast steady at 2.4m b/d, based on its monthly oil outlook for October.

- The IEA Monthly Oil Market Report revised up global oil demand growth for this year by 100kbpd to 2.3mbpd to reach 101.9mbpd in 2023, driven by growth in China, India and Brazil according to

- The Biden administration has targeted two tankers and their owners with sanctions for being in breach of the G7 oil price cap of $60/bbl.

- Kazakh KEBCO oil exported out of Russian ports fell 19% in September m/m to 0.64mn metric tons according to LSEG data.

- Brent prices could rise to 105$/bbl if Iran’s oil exports were to fall to year-ago levels due to increased enforcement of sanctions according to Goldman Sachs.

- Saudi’s Energy Minister Prince Abdulaziz bin Salman and Russia’s Deputy PM Alexander Novak interview: Oil producers will continue to work together and act pre-emptively according to bin Salman while Novak said the balance between supply and demand is fragile and could be affected by slowing global economic growth.

- Russia forecasts global oil demand to grow by 2.4mbpd, hitting a new all-time high this year, Russia’s Deputy PM Alexander Novak said.

- Iraq is ready to restart oil flows through the Iraq/Turkey pipeline (ITP) but still requires an agreement with the Kurdistan Regional Government according to Iraqi prime minister.

- Forties October crude supplies are facing increased demand from Asian buyers according to Kpler and LSEG data pushing it to a $2.15/bbl premium to dated Brent October 6 – its highest since August 2022.

- Crude and condensate output in Nigeria rose to 1.57m b/d in September, the highest monthly output since Jan 2022, according to Bloomberg citing data from Nigeria’s upstream petroleum regulatory commission.

- Russia’s Deputy PM Alexander Novak and Azerbaijan’s Energy Minister discussed expanding oil link Baku-Tikhoretsk for reverse flows so that Russian crude could flow to Azerbaijan, according to Bloomberg.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/10/2023 | 0100/0900 | *** |  | CN | Money Supply |

| 13/10/2023 | 0100/0900 | *** |  | CN | New Loans |

| 13/10/2023 | 0100/0900 | *** |  | CN | Social Financing |

| 13/10/2023 | 0130/0930 | *** |  | CN | CPI |

| 13/10/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 13/10/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 13/10/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 13/10/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/10/2023 | 0800/0900 |  | UK | BoE's Bailey speaks at Institute of International Finance Annual Membership Meeting | |

| 13/10/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/10/2023 | - | *** |  | CN | Trade |

| 13/10/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 13/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/10/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 13/10/2023 | 1300/0900 |  | US | Philadelphia Fed's Pat Harker | |

| 13/10/2023 | 1300/1500 |  | EU | ECB's Lagarde participates in IMF seminar | |

| 13/10/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 13/10/2023 | 1630/1730 |  | UK | BoE's Cunliffe speaks at Institute of International Finance |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.