-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Short Rates Explode on Bank Fails

HIGHLIGHTS

- NOMURA FORECASTS 25BP FED RATE CUT AND QT HALT IN MARCH, Bbg

- MNI ENERGY SECURITY: Sources: Biden Admin Will Approve Willow Project Today

- GOLDMAN SACHS NO LONGER EXPECTS FED TO HIKE AT MARCH MEETING, Bbg

- NATWEST: WE DO NOT BELIEVE THAT THE FED WILL HIKE RATES IN MARCH, Bbg

- FED WEIGHS EASING ACCESS TO DISCOUNT WINDOW TO BACKSTOP BANKS

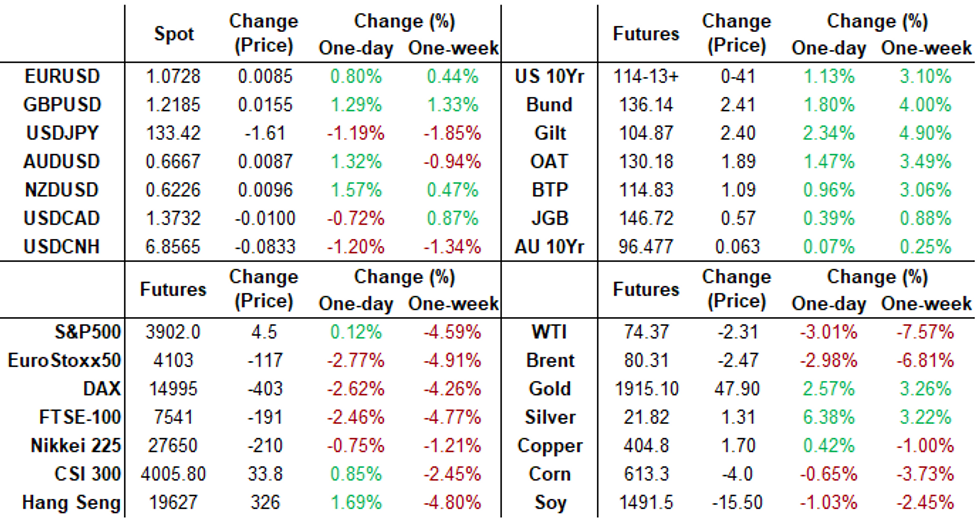

US TSYSY: Markets Roundup: Paradigm Shift In Hike Expectations Post Bank Fails

- Surge in short end rates resumed as Silicone Valley Investment Bank collapsed late last week, followed by New York's Signature Bank on Sunday, the bank run on deposits continued to send shock waves across markets Monday.

- A paradigm shift from last week's rate hike expectations to rate cuts occurred as short end exploded higher: Fed terminal rate fell to 4.810 in May'23, down over 80bp for August late last week. Fed funds implied hike for Mar'23 at 18.7bp, May'23 cumulative 25.9bp to 4.819%, Jun'23 dipped to 13.4bp to 4.694%. Rate cuts start pricing in for Jul'23: -16.5 cumulative at 4.398%.

- In Treasuries, 2Y futures traded over a full point higher to 103-15.38, yield fell below 4.0% to 3.9889% low in the first half while yield curves bull steepened: 2s10s tapped -54.707 high -- nearly 50% higher than last week's four decade lows.

- Of note, Goldman Sachs, Barclays, NatWest and Wells Fargo all revised their rate call to steady next week from +50bp prior.

- Despite sharply lower bank stocks on the day, US equities are modestly firmer in recent trade, the e-mini S&P futures near middle of the session range at 9818.0 (+21) below initial resistance of 3960.75 Low Mar 2.

- No data on the day, CPI tomorrow MoM (0.5% prior, 0.4% est); YoY (6.4%, 6.0%) while the Federal Reserve will remain in media blackout regarding monetary policy through March 23.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00114 to 4.55600% (-0.00243 total last wk)

- 1M -0.11414 to 4.68443% (+0.08943 total last wk)

- 3M -0.27185 to 4.86629% (+0.15414 total last wk)*/**

- 6M -0.37758 to 5.05071% (+0.11158 total last wk)

- 12M -0.59557 to 5.14257% (+0.04371 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.57% volume: $81B

- Daily Overnight Bank Funding Rate: 4.56% volume: $279B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.088T

- Broad General Collateral Rate (BGCR): 4.51%, $466B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $454B

- (rate, volume levels reflect prior session)

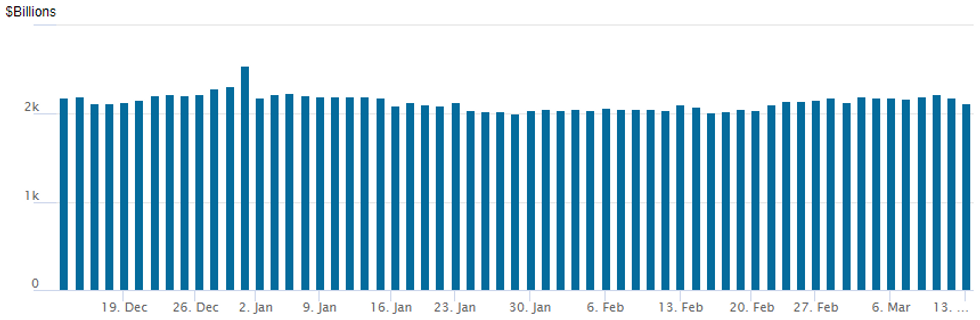

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,126.677B w/ 97 counterparties vs. prior session's $2,188.375B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

SOFR options mixed after the bell, buyers in call and put structures alternately hedging further rally and/or looking for pull-back as short end explodes (SFRU3 +.940 at 95.815). Put structure buying accelerated around midmorning as underlying futures receded from more extreme highs in the first couple hours of the NY session.

- SOFR Options:

- Block, 5,000 SFRZ3 95.75/96.25 call spds, 22.0 ref 95.98

- Block, 6,000 SFRH4 95.00/95.50 put spds, 15.5 ref 96.165

- Block, 10,000 SFRU3 97.00/98.00 call spds, 4.25 ref 95.40 to -.42

- Block, 6,700 SFRU3 94.12/94.37 put spds, 3.5 ref 95.585

- Block, 5,000 SFRU3 94.00/94.50 put spds, 7.0 ref 95.64

- Block, 6,250 SFRU3 94.12/94.62 put spds, 8.0 ref 95.665

- Block, 5,000 SFRZ3 96.75/97.25 call spds, 11.0 ref 95.94

- Block, 5,000 SFRJ3 95.12 puts, 16.5 vs. 95.44 /0.32%

- Block, 6,000 SFRU3 95.87/97.00 call spds, 27.5 ref 95.60

- Block, 17,380 SFRU3 96.25/96.75 call spds, 11.5

- 3,000 SFRJ3 94.50/94.75/95.00 put flys, 2.75

- Block, 5,000 SFRM3 94.50/94.75 put spds 5.5 ref 95.28

- Block, 40,000 SFRJ3 94.18/94.31 put spds, 0.5 ref 95.34

- Block, 6,700 SFRU3 96.25/96.75 call spds, 10.0 ref 95.655

- Block, 60,000 SFRM3 94.62/94.75 put spds, 1.25 ref 95.39 to -.365

- Block, 9,000 SFRU3 95.87/97.00 put spds, 28.5 ref 95.845

- 5,000 SFRN3 94.68/94.87/95.06 call flys ref 95.87

- Block, 20,000 SFRU3 95.00/95.25 put spds, 6.0 ref 95.825

- Block, 12,000 SFRU3 95.87/97.00 call spds, 28.5 ref 95.845

- Block, 20,000 SFRU3 94.37/95.31 put spds, 20.0 ref 95.815

- Block, 7,000 SFRM3 94.87 calls, 42.0 ref 95.13/0.67

- over 11,000 SFRJ3 94.87 puts, 14.0

- over 10,000 SFRJ3 95.25/95.37 call spds, 3.0 ref 95.20

- over 7,000 SFRK3 94.25/94.50/94.75 put flys

- total 40,000 SFRZ3 93.75/94.25/94.75 put flys, 5.5-6.5 vs. 95.61 to -.27

- 10,000 SFRJ3 94.75/95.00 put spds, 17.0 ref 95.20 to -.21

- Block/screen 15,000 SFRJ3 95.87 calls, 3.5 ref 95.21 to -.205

- Block/screen 7,000 SFRJ3 95.06/95.12/95.25/95.37 call condors, 1.5 ref 95.23

- 15,000 SFRJ3 94.93/95.06 call spds, 5.5 ref 95.04 to -.035

- 5,000 SFRN3 94.68/94.87/95.06 call flys ref 95.87

- 5,000 SFRZ3 97.12 calls, 5.0 ref 95.09

- Block, 5,000 SFRK3 94.18/94.31/94.37/94.50 put condors, 1.0 ref 94.86

- Treasury Options:

- over 19,600 TYK3 112 puts, 30-32 ref 114-26.5 to -23

- over 7,400 TYK3 118.5 calls, 27 ref 114-31.5

- over 21,000 TYK3 111/113 put spds, 18 ref 114-09.5 to -10

- 4,000 TYJ3 111/112 put spds, 13 ref 113-11.5 to -13.5

- 7,500 TUM3 103 calls, 25 ref 102-17.88

- 5,000 TYM3 119 calls, 21 ref 9=113-31.5

- Block, 4,000 TYJ3 111/112 put spds, 8 ref 114-00

- 11,600 FVJ3 110 calls, 8.0-11.53,000 USJ3 126/129 put spds, 114

EGBs-GILTS CASH CLOSE: US Bank Panic Sparks Massive Short-End Rally

A global flight to safety and sharp downward repricing of ECB and BoE tightening expectations saw a historic rally across EGBs and Gilts Monday.

- With concerns over US banking stability mounting, the German curve bull steepened sharply, with Schatz yields seeing their biggest-ever drop (41bp, and 52bp at one point).

- March ECB implied hike pricing (our meeting preview is here) fell 8bp on the day, but rose from session lows of 33bp to just under 38bp after MNI's sources piece "ECB Clings To 50Bp Hike Plan Amid Market Turmoil".

- Around 80bp of hikes have been priced out of the ECB cycle altogether, including 50bp today (had been as much as 100bp intraday ), with terminal now seen at 3.38% vs 4.18% last week.

- Periphery spreads widened sharply, led by GGBs.

- The Gilt move was more limited from a historical standpoint given comparisons to last autumn's budget-related volatility, but 2Y yields dropped the most since October. BoE hike pricing dropped 37bp Monday, and is off 55bp since last Thursday (terminal Bank rate now seen at 4.36%).

- Further developments in US banks will be eyed overnight, with the focus of Tuesday's schedule being US CPI.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 40.7bps at 2.69%, 5-Yr is down 31.5bps at 2.328%, 10-Yr is down 24.9bps at 2.259%, and 30-Yr is down 19.2bps at 2.276%.

- UK: The 2-Yr yield is down 27.9bps at 3.363%, 5-Yr is down 24.8bps at 3.277%, 10-Yr is down 27bps at 3.37%, and 30-Yr is down 17.7bps at 3.835%.

- Italian BTP spread up 11.3bps at 192.4bps / Greek up 21.8bps at 204.4bps

EGB Options: Big Vol Buying And Position Closing In Rates

Monday's Europe rates / bond options flow included:

- DUK3 105.6/105.8 call spread bought for 12.25 in 16.6k

- OEK3 113 puts bought for 7 in 5k

- RXJ3 135/133/131 put fly bought for 28.5/29.5 in 20k

- RXK3 128/126 put spread bought for 9.5 in 5k

- RXM3 125.00/122.00 put spread sold out at 13 in 3k

- ERU3 96.625^ bought for 80 in 62.5k

- ERU3 95.75/95.50/95.25 put fly sold out at 1.25 in 43k

FOREX: Greenback Pressure Extends Ahead Of US CPI, DXY Down 0.9%

- Despite equity markets stabilising throughout the US session on Monday, the substantial moves across fixed income markets and the related Fed re-pricing have continued to weigh on the greenback, with the USD index looking set to close with a 1% decline as we approach the APAC crossover.

- Punchy ranges have been witnessed across the G10 currency space, none more so than for USDJPY which printed a low of 132.29 from overnight highs of 135.08. Lower core rates and the associated narrowing of interest rate differentials key here. Despite a bounce into the close, USDJPY still resides down 1.15%.

- With more stable price action for equity markets in Monday’s US session, the Australian dollar has been able to capitalise on the broad greenback weakness, with AUDUSD now ~1.5% higher as we approach the APAC crossover. Despite this climb, the trend condition remains bearish for now and initial firm resistance remains defined at 0.6784, the Mar 1 high.

- Spot USD/CNH (-1.30%) is consolidating sharp losses on Monday. The pair briefly tried below its 50-DMA, intersecting today at 6.8373, which has underpinned price action since mid-February. A close under the March 01 low of CNH6.8634 would mark the completion of a double top formation, with the bearish theme being reinforced by a sustained move through the 50-DMA.

- Elsewhere in emerging markets, substantial volatility was seen in the Mexican peso, with USDMXN briefly spiking back above the 19.00 handle. The pair has advanced 2.25% on Monday and MXNJPY had been down as much as 5.3% at worst levels.

- Focus turns to Tuesday’s US inflation data, made more interesting by the plethora of Fed view changes for the March decision that have crossed the newsfeeds today.

FC: Expiries for Mar14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E931mln), $1.0695-00(E724mln), $1.0740-50(E1.5bln), $1.0780-00(E1.4bln)

- USD/JPY: Y130.00($720mln), Y131.00($562mln)

- EUR/GBP: Gbp0.8830-50(E752mln)

- AUD/USD: $0.6781-00($694mln)

E-MINI S&P (M3): Fresh Trend Lows

- RES 4: 4244.00 High Feb 2 and key resistance

- RES 3: 4200.00 Round number resistance

- RES 2: 4119.50 High Mar 6

- RES 1: 3960.75/4045.27 Low Mar 2 / 50-day EMA

- PRICE: 3910.50 @ 13:12 GMT Mar 13

- SUP 1: 3822.00 Low Dec 22 and a key support

- SUP 2: 3811.50 Intraday low

- SUP 3: 3778.00 Low Nov 3

- SUP 4: 3724.86 76.4% retracement of the Oct 13 - Feb 2 bull cycle

The short-term condition in S&P E-Minis remains bearish and today’s move lower reinforces this theme. Price last week cleared key short-term support at 3960.75, the Mar 2 low to confirm a resumption of the bear cycle that has been in place since the Feb 2 reversal. The move lower signals scope for an extension towards 3822.00 next, the Dec 22 low. Initial firm resistance is seen at 4045.27, the 50-day EMA.

COMMODITIES: Oil Slides Whilst Gold Surges On Continued US Regional Bank Fallout

- Crude oil has seen a volatile session but ultimately sees sizeable declines as the fallout from US regional banking issues continues to hamper risk sentiment and demand expectations.

- WTI is -2.9% at $74.44 off a low of $72.30 that now forms initial support after which lies the bear trigger at 80.86 (Dec 9 low).

- Heavy trading today has seen the day’s most active strikes in the CLJ3 at $70/bbl puts.

- Brent is -2.9% at $80.35, off a low of $78.41 that forms initial support after which lies $77.76 (Jan 5 low).

- Gold on the other hand jumps +2.3% at $1911.4 on a weaker USD and a slump in Treasury yields. It moves closer to resistance at $1923.2 (76.4% retrace of Feb 2 – 28 sell-off) after which sits the key $1959.7 (Feb 2 high). To the downside sits the day’s low $1871.6 and then the 50-day EMA of $1844.3.

Tuesday Data Calendar: CPI on Tap

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/03/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 14/03/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/03/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 14/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/03/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/03/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 14/03/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/03/2023 | 1230/0830 | *** |  | US | CPI |

| 14/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/03/2023 | 1400/1000 | * |  | US | Services Revenues |

| 14/03/2023 | 2120/1720 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.