-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY288.1 Bln via OMO Friday

MNI BRIEF: Japan Oct Real Wages Unchanged Y/Y

MNI ASIA MARKETS ANALYSIS: Short Term Inflation Decline

HIGHLIGHTS

- NY Fed: Short-Term Inflation Expectations Decline, Household Spending Expectations Fall Sharply

- FED BOSTIC: A COOLER CPI REPORT COULD PUT 25 BPS HIKE ON THE TABLE, Bbg

- FED BOSTIC: VERY HESITANT TO DECLARE VICTORY IN BID TO COOL PRICES, Bbg

- FED DALY: ABSOLUTELY EXPECT US ECONOMY TO CONTINUE SLOWING, Bbg

- DALY: DON'T NEED TO SEE INF. GET DOWN TO 2% BEFORE WE HOLD, Bbg

- CHINA'S CAPITAL HAS PASSED COVID INFECTION PEAK: ACTING MAYOR, Bbg

Key links: MNI UST Issuance Deep Dive: Jan 2023 / MNI US Employment Insight -Jan'23: Mixed Report Sees CPI Next In Downshift Debate / US$ Credit Supply Pipeline / US Treasury Auction Calendar

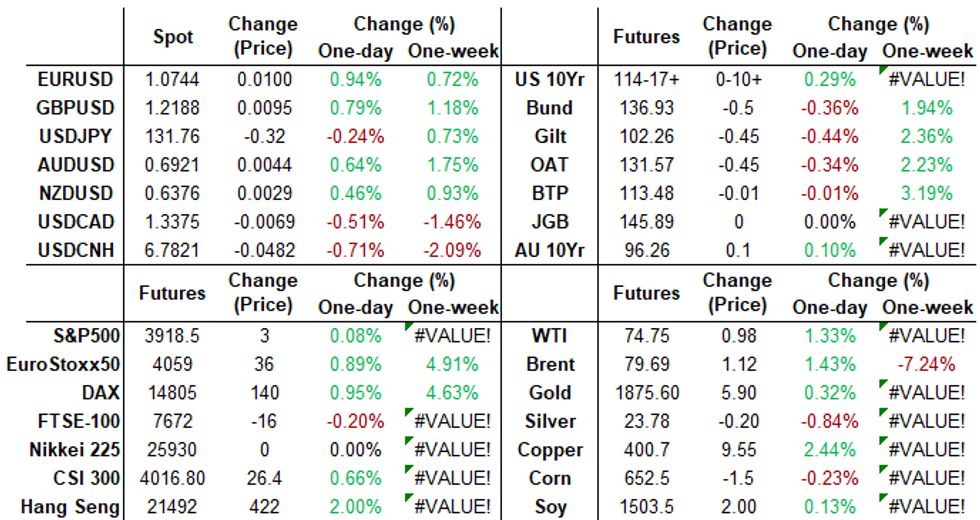

US TSYS: Tsys Extend Past Friday Highs

Tsys futures near top end of session range after extending highs past to early Friday/post-NFP highs. Current 30YY -.0399 at 3.6475%; yield curves off steeper levels (2s10s +2.280 at -67.880 vs. -65.820 high).

- While bounce coincided with similar move in German Bunds into the London close, support in line w/ NY Fed SURVEY OF CONSUMER EXPECTATIONS that shows decline in short term inflation and household spending exp.

- "Median one-year-ahead inflation expectations declined to 5.0 percent, its lowest reading since July 2021, according to the December Survey of Consumer Expectations. Medium-term expectations remained at 3.0 percent, while the five-year-ahead measure increased to 2.4 percent. Household spending expectations fell sharply to 5.9 percent from 6.9 percent in November, while income growth expectations rose to a new series high of 4.6 percent."

- Short end maintaining bid as terminal rate slips to 4.93% in Jun'23-Jul'23. Fed funds implied hike for Feb'23 -.8 to 30.9bp, Mar'23 cumulative -1.0 to 50.1bp to 4.833%, May'23 -1.0 to 59.5bp to 4.927%.

- Fed speak coming up (main focus on Chairman Powell Tue):

- Atl Fed Bostic moderated discussion (no text, Q&A) at 1230ET,

- SF Fed Daly WSJ interview, live event at 1230ET

- Fed Chair Powell on central Bank independence, Riksbank event at 0900ET

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00114 to 4.31129% (-0.00457 total last wk)

- 1M +0.00272 to 4.40429% (+0.01000 total last wk)

- 3M -0.02729 to 4.78257% (+0.04257 total last wk)*/**

- 6M -0.05600 to 5.14100% (+0.05814 total last wk)

- 12M -0.09700 to 5.46186% (+0.07672 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.81171% on 1/5/23

- Daily Effective Fed Funds Rate: 4.33% volume: $114B

- Daily Overnight Bank Funding Rate: 4.32% volume: $290B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.118T

- Broad General Collateral Rate (BGCR): 4.27%, $424B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $391B

- (rate, volume levels reflect prior session)

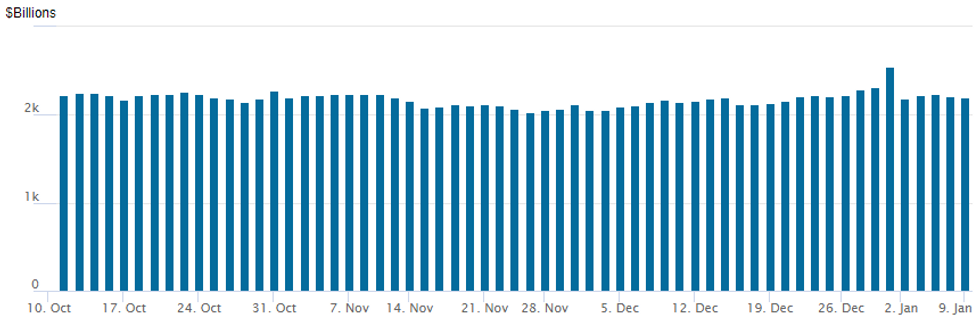

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,199.121B w/ 103 counterparties vs. prior session's $2.242.486B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

- SOFR Options:

- Block, 16,000 SFRZ3 97.50/98.50 call spds, 3.5 ref 95.645-.65

- Block, 10,000 SFRH3 95.00/95.06/95.18/95.25 put condors, 3.0 net vs. 95.10/0.05%

- Block, 9,500 SFRF3 95.12/95.37 3x2 call spds

- Block, 12,500 SFRG3 95.18/95.43 4x5 call spds

- Block, 7,500 SFRH3 93.00/94.00 put spds, 2.5

- Block, 11,000 SFRG3 95.31/95.37 call spds, 0.25 ref 95.115

- Block, 2,500 SFRK3 94.62/94.87/95.06 put flys, 2.5 net ref 95.09

- Block, +3,760 SFRZ3 98.25/98.75 call spds, 1.0 ref 95.62

- Block, 3,000 SFRU3 95.75/96.00 call spds, 4.5

- Block, 7,500 SFRZ3 95.62 straddles, 83.0

- 4,000 SFRF3 95.00 puts, 1.0 ref 95.11

- 4,000 OQH3 95.25/95.75 2x1 put spds

- 2,000 SFRM3 94.12/94.25/94.50 broken put flys

- Block, 8,880 SFRJ3 94.68/94.75 put spds, 1.25 vs. 95.07

- 1,900 OQJ3 96.50/96.75/97.25/97.50 call condors

- Blocks, total 16,000 SFRH3 95.25/95.43 call spds 2.5 ref 95.11-.105

- Block, 1,250 SFRF3 95.06 calls, 6.5 ref 95.105

- Blocks, total 8,000 SFRZ3 96.50/97.00 call spds, 7.0 vs. 95.60

- 4,000 SFRJ3 94.50/94.75/95.37/95.62 call condors

- Block, 4,000 SFRM3 94.75/94.87/95.00 put flys, 1.75 ref 95.065

- 25,000 SFRH3 95.31/95.43 call spds ref 95.10-.11

- Treasury Options:

- 2,500 USH 122/124 put spds, 20 ref 128-30

- 4,200 TYH3 109.5/110.5 call spds, 9 ref 114-08.5

- 3,500 USG3 126 puts vs. USH3 1121/125 put spds, 10 net March over

- 10,000 TYG 114.25/115.25/116.25 call flys ref 114-03

- 2,000 TYH 109.5/111 put spds, 9 ref 114-02

- 2,000 FVG 107/108 put spds, 7.5 ref 108-29.5

- 5,100 FVH 110/112 call spds ref 109-01.5

EGBs-GILTS CASH CLOSE: Slightly Weaker With Supply Eyed

Bunds and Gilts weakened modestly Monday in a risk-on session for equities in which periphery EGBs outperformed.

- BoE Chief Economist Pill's speech - the most anticipated event of the session - was initially taken hawkishly by markets with short-end yields ticking up a couple of basis points, but while February BoE hike pricing remained firm, it softened further down the strip.

- The German curve bear flattened, with the UK's steepening and the 5Y segment outperforming with today's short-dated APF sale seeing high bid-cover.

- BTPs outperformed, with 10Y spreads closing below 200bp for the first time this year.

- Tuesday's docket is highlighted by central bank speakers (including Bailey, Schnabel, and Powell) and huge supply with auctions from Austria, Germany, Netherlands, UK, and syndications from Belgium, Italy, Latvia.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.2bps at 2.613%, 5-Yr is up 1.5bps at 2.266%, 10-Yr is up 1.8bps at 2.228%, and 30-Yr is up 2.4bps at 2.179%.

- UK: The 2-Yr yield is up 0.8bps at 3.446%, 5-Yr is down 0.4bps at 3.446%, 10-Yr is up 5.5bps at 3.527%, and 30-Yr is up 7.4bps at 3.945%.

- Italian BTP spread down 5.8bps at 195.7bps / Spanish down 1.3bps at 104.5bps

EGB Options: Multiple German Feb Put Structures Monday

Monday's Europe rates / bond options flow included:

- OEG3 117/116 put spread sold at 31 in 2k

- RXG3 134/132 1x3 put spread bought for flat in 1.25k

- RXG3 135/133/132 put fly bought for 30 in 1k

- RXG3 135/133/132/131 put condor bought for 35 in 1k

- RXH3 134/132/130 put fly bought for 20 in 500

- ERH3 97.375/97.125/96.875p fly, sold at 8 in 10k

- RXG3 134/131/129 put ladder bought for 28 in 2k

FOREX: Greenback Maintains Downward Bias Ahead of Critical Week

- The USD index is trading with a 0.82% decline on Monday, continuing the weaker price action seen post US employment and ISM data on Friday. Greenback weakness comes ahead of a critical week, with both the US CPI release as well as the beginning of the US earnings season to come.

- Among the majors, the single currency is outperforming with EURUSD, extending its recovery to print fresh seven-month highs above 1.0750.

- The Japanese Yen showed relative underperformance in European trade and was the sole currency falling against the USD. However, USDJPY’s bounce to 132.66 was short-lived before fresh selling emerged and the pair finds itself gravitating towards the overnight 131.30 lows approaching the APAC crossover.

- Tech levels of note remain somewhat unchanged, with 133.73 marking the 20-day EMA. The key support and trigger for a resumption of the downtrend is 129.52, Jan 3 low. Initial key short-term resistance has been defined at 134.77.

- Despite major equity indices reversing a significant portion of their gains throughout US trade, the likes of AUD, NZD and GBP have remained buoyant, gaining a tailwind from the renewed optimistic sentiment. AUD/USD has now traded close to 4% above last week's lows, keeping momentum tilted in favour of the bulls for now. Prices now hold within range of the $0.69 handle, which marks a sizeable expiry for Wednesday's NY cut, with A$1.6bln notional set to roll off.

- Central bank governors on the speaker slate on Tuesday with Fed’s Powell, BOC’s Macklem and the BOJs Kuroda all participating in a panel discussion titled "Central bank independence and new risks: climate" at the Riksbank’s International Symposium on Central Bank Independence, in Stockholm.

- The data focus is primarily on US CPI, scheduled on Thursday.

FX: Expiries for Jan10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0825-50(E512mln), $1.1222-38(E1.6bln)USD/JPY: Y131.80-00($520mln)

- GBP/USD: $1.2000(Gbp867mln), $1.2065-85(Gbp510mln)

- AUD/USD: $0.6800(A$501mln)

- USD/CAD: C$1.3500($2.0bln)

Late Equity Roundup: Paring Gains, Dow Weaker Late

Major indexes continue to slip off midday highs, mixed levels w/ Dow components underperforming. SPX eminis currently trade +8.5 (0.22%) at 3925.25; DJIA - 77.44 (-0.23%) at 33561.19; Nasdaq +106.9 (1%) at 10678.13.

- SPX leading/lagging sectors: Information Technology sector (+1.41%) continued to outperform, semiconductor makers outpacing software/hardware makers w/ AMD+6.33%, NVDA +6.28%, MPWR +5.05%. Utilities (+0.92%) and Materials (+0.88%) up next, chemicals driving the latter (FMC +2.79%, LIN +2.08%, CF +2.07%).

- Laggers: Health Care (-1.56%), Consumer Staples (-0.89%) and Industrials (-0.43% underperformed - the latter weighed by aerospace and defense shares (Northrop Grumman -6.05%).

- Dow Industrials Leaders/Laggers: Salesforce.com (CRM) +6.81 at 147.32, Goldman Sachs (GS) +5.36 at 353.44, Microsoft (MSFT) +2.93 at 227.83. Laggers: Amgen -5.80 at 269.40, Boeing (BA) -4.72 at 208.28, JNJ -4.55 at 175.70.

E-MINI S&P (H3): Pierces The 50-Day EMA

- RES 4: 4180.00 High Dec 13 and the bull trigger

- RES 3: 4043.00 High Dec 15

- RES 2: 4000.00 Round number resistance

- RES 1: 3972.25 Intraday high

- PRICE: 3959.00 @ 1320ET Jan 9

- SUP 1: 3788.50/78.45 Low Dec 22 / 61.8% of Oct 13-Dec 13 uptrend

- SUP 2: 3735.00 Low Nov 3

- SUP 3: 3670.00 76.4% retracement of the Oct 13 - Dec 13 uptrend

- SUP 4: 3735.00 Low Oct 21

S&P E-Minis trend signals remain bearish. However, key resistance at 3917.50, the 50-day EMA, has been pierced. A continuation higher and a clear break of this hurdle would suggest potential for a stronger recovery and this would also highlight a possible reversal that would open 4000.00 next. On the downside, a break lower would confirm a resumption of the downtrend - the bear trigger is at 3788.50, the Dec 22 low.

EQUITIES: Quarterly Earnings Cycle Kicks Off Friday

- This week marks the beginning of the quarterly US earnings cycle, with big banks and financials first up from Friday. Full MNI Schedule here: https://roar-assets-auto.rbl.ms/files/50444/MNIUSE...

- Earnings season begins in earnest in the w/c 24th Jan, with both the number of reports picking up as well as the cumulative market cap of the S&P 500. Financials and large cap US banks are the initial focus, with markets watching for headlines on provisions, costs and capital plans.

- Morgan Stanley write that the market's attention is to shift from inflation & the Fed to earnings growth and recession concerns. They write that the earnings outlook has worsened, with corporate confidence at historically depressed levels. Meanwhile biz surveys have rolled over while supply chains/backlogs have eased.

- They retain a 2023 price target of 3,900 for the S&P500 (bull case: 4,200, bear case: 3,500). They recommend overweight healthcare, staples, utilities. Underweight discretionary & tech hardware.

COMMODITIES: Oil Buoyed By China Demand Hopes

- Crude oil sees a mixed but ultimately stronger day, climbing with help from China issuing a fresh round of import quotas which could bode well for demand before fading later in the session.

- WTI is +1.4% at $74.81 off a high of $76.74 as it fleetingly poked above the 20-day EMA before retreating, a clearer break of which could open $78.80 (50-day EMA).

- The recent upward momentum is reflected in the day’s most active strikes in the CLG3 being at $83/bbl calls.

- Brent is +1.5% at $79.76 off a high of $81.37, within resistance at the 20-day EMA of $81.96.

- Gold is +0.3% at $1872.00 off a high of $1881.54 as the trend conditions remain bullish, with resistance seen at $1896.5 (61.8% retrace of the Mar-Sep bear leg).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/01/2023 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 10/01/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/01/2023 | 0700/0800 | ** |  | SE | Private Sector Production |

| 10/01/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 10/01/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 10/01/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/01/2023 | 1010/0510 |  | CA | Governor Macklem at Riksbank Conference | |

| 10/01/2023 | 1010/1010 |  | UK | BOE Governor Bailey at Riksbank conference | |

| 10/01/2023 | 1010/1110 |  | EU | ECB's Isabel Schnabel at Riksbank conference | |

| 10/01/2023 | 1010/1910 |  | JP | BOJ Governor Haruhiko Kuroda at Riksbank conference | |

| 10/01/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 10/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 10/01/2023 | 1400/0900 |  | US | Fed Chair Jerome Powell at Riksbank conference | |

| 10/01/2023 | 1400/1500 |  | DE | Buba Vice President Claudia Busch as Riksbank conference | |

| 10/01/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 10/01/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 10/01/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.