-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

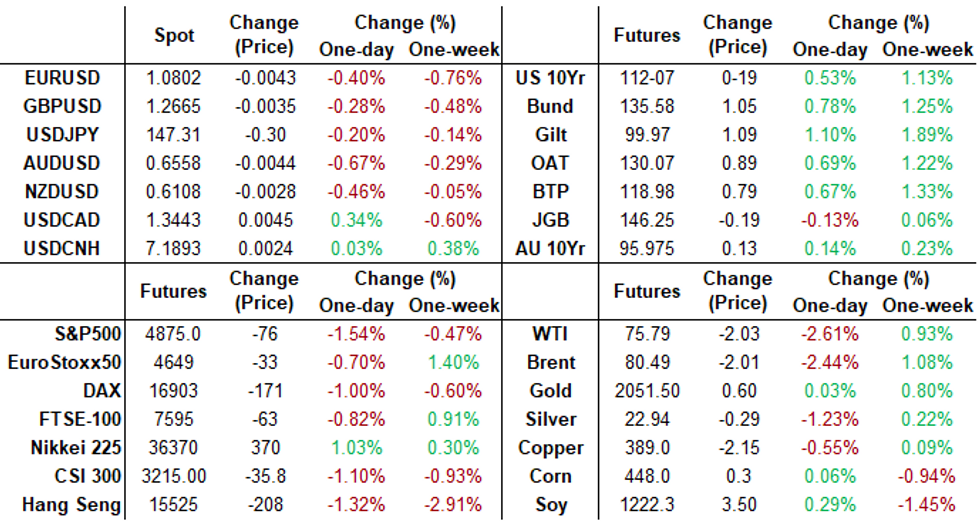

Free AccessMNI ASIA MARKETS ANALYSIS: Steady FOMC, March Cut Unlikely

- MNI FOMC MAINTAINS FED FUNDS RATE TARGET RANGE AT 5.25%-5.5%

- MNI FED: WILL NOT CUT RATES UNTIL MORE CONFIDENT ON INFLATION

- MNI FOMC: RISKS TO HITTING LABOR, INFLATION GOALS MORE BALANCED

- MNI FOMC: INFLATION HAS EASED BUT REMAINS ELEVATED

- MNI FOMC: NO MENTION OF CHANGES TO QT PLANS

- MNI TREASURY TO ANNOUNCE REGULAR BUYBACKS IN MAY REFUNDING

- MNI TRESAURY-NO AUCTION BOOSTS FOR AT LEAST SEVERAL QUARTERS

- UKRAINE SAYS CRITICAL ARMS SHORTAGE GIVES RUSSIA 3:1 ADVANTAGE, Bbg

Key Links: MNI FOMC: Fed Needs More Confidence In Inflation Drop Before Cuts / MNI: FOMC Statement Comparison: January vs December / MNI: Rough Transcript of Fed's Powell's Jan 31 Press Conference / MNI INTERVIEW: Swift Inflation Decline To Prompt Early Fed Cut / Chicago Business Barometer™ - Tempered to 46.0 in January / MNI Coupon Size Increases And Bill Trajectory As Expected

US TSYS Extending Highs After Fed Keeps Rates Steady, March Cut Unlikely

- Treasury futures are extending highs into the close (TYH4 112-18.5 +30.5, 10Y yield 3.9199% low) after paring post-FOMC gains following Chairman Powell said chances of a rate cut at the next FOMC on March 20 was unlikely.

- Chairman Powell was more balanced on net, however, while providing his own executive summary: Growth is solid to strong over the course of last year; 3.7% unemployment indicates that the labor market is strong. We have had just about two years now of unemployment under 4% -- that hasn't happened in 50 years, so it is a good labor market. And we have seen inflation come down. So, we have six months of good inflation data and expectation there is more to come. Let's be honest, this is a good economy. But what is the Outlook? We expect growth to moderate."

- Rates gained after this morning's lower than expected ADP Employment Change: 107k vs. 135k est (prior down-revised to 158k from 164k). Further supported after Tsy Quarterly Refunding announcement and Employment Cost Index at 0.9% vs. 1.0% est.

- Focus turns to Weekly Claims, Flash PMIs, ISMs tomorrow followed by headline employment data for January on Friday.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00161 to 5.32995 (-0.00652/wk)

- 3M +0.00890 to 5.31533 (-0.00210/wk)

- 6M +0.01888 to 5.16501 (+0.00761/wk)

- 12M +0.03663 to 4.82603 (+0.02705/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.642T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $675B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $655B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $92B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $265B

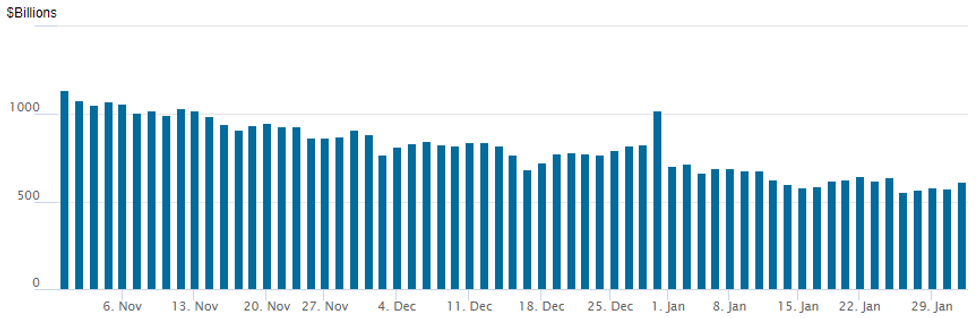

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $615.379B vs. $577.755B yesterday. Compares to cycle low of $557.687B on Thursday, January 25 -- the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties climbs to 82 from 78 Tuesday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

- SOFR, Treasury options shifted gears this morning, and continued to favor bullish sentiment via upside call buys, unwinding puts and conditional curve steepeners - all counter to bearish hedge theme over the past few sessions after the Fed left rates steady.

- Underlying futures are back near mid-January levels (TYH4 112-15.5, yield sub-4% at 3.9634%) while curves are steeper despite ongoing blocks: real$ adding to large flatteners this week in lead up to this afternoon's FOMC.

- Projected rate cut chances are higher but post-FOMC highs: March 2024 chance of 25bp rate cut -36.8% vs. -63.5% post FOMC w/ cumulative of -9.2bp at 5.229%, May 2024 at -89.7% vs. -97.2% w/ cumulative -31.6bp at 5.005%, while June 2024 climbs to -111.4% vs. -110.4% (-94.6% late Tuesday) w/ cumulative -59.5bp at 4.726%. Fed terminal at 5.325% in Feb'24.

- SOFR Options:

- appr 50,000 SFRH4 95.00 calls at 3.5

- 10,000 SFRH4 94.87/94.93/95.00 call flys on screen

- Block, 10,000 SFRH4 94.75/95.25/95.75 call flys, 11.0

- Block, 8,000 SFRH4 95.06/95.12 call spds, 0.75 ref 94.91

- Block, 20,000 SFRK4 95.50/95.75/96.12 broken call trees, 2.0 net, 2 legs over ref 95.395

- Block, +15,000 SFRH4 95.06/95.12 call spds 1.0 ref 94.94

- Block, +5,000 SFRU4 96.50 calls 7.0 over 2QU4 97.12/97.50 call spds repeats:

- Block, +12,000 SFRU4 96.50 calls 5.0 over 2QU4 97.12/97.50 call spds

- 13,000 SFRG4 94.87/94.93 1x2 call spds

- 6,600 SFRM4 and SFRU4 94.00/94.56 put spds

- 2,000 SFRH4 94.87/94.93 1x2 call spds

- 4,000 0QG4 95.93/96.00/96.12 broken put flys ref 96.345

- 4,000 SFRM4 95.00/95.25 2x1 put spds ref 95.275

- 1,500 3QH4 96.62/96.87/97.25 broken call flys

- Block, 3,500 SFRH4 94.87/94.93/95.06 call flys, 0.5 belly over vs. 94.87/0.08%

- 3,000 SFRG4 94.68/94.75/94.81 put trees, ref 94.865

- 2,500 SFRH4 94.68 puts, 0.5 last

- Treasury Options:

- 2,500 TYK4 115/116 call spds, 15 ref 113-03

- 3,000 TYH4 108/111/114 call flys ref 112-02.5

- 2,300 TYH4 111.75 puts ref 111-26

- Over 3,000 FVH4 108.5 calls, 23 last

- Over 4,900 FVH4 110 calls, 5 last

EGBs-GILTS CASH CLOSE: Strongest Core FI Rally Of 2024 Led By Belly

European core FI rallied strongly Wednesday in a session beset with heavy data flow and event risk.

- Early focus was on French inflation data which came in on the soft side of expectations, with German state level readings later in the morning pointing to a largely in-line national print.

- While the initial Bund gains faded by late morning, European safe havens enjoyed their best rally of 2024 so far as Treasuries soared.

- Multiple factors were involved: weakness in banking equities, an as-expected US Treasury quarterly auction size announcement removing some uncertainty, and soft US labour market indicators and January MNI Chicago PMI raising potential for near-term rate cuts.

- The rally in both the German and UK curves was led by the belly, with 5Y yields down 11bp.

- Periphery EGB spreads widened amid a broader risk-off move; GGBs underperformed.

- The Federal Reserve decision takes focus after the European cash close, with attention set to swiftly turn to Italian/Eurozone inflation data Thursday morning (consensus remains relatively unchanged since the start of the week), followed by the Bank of England.

- MNI's BoE preview is here: the vote split, guidance and forecasts will be in focus.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 10bps at 2.428%, 5-Yr is down 11.3bps at 2.051%, 10-Yr is down 10.2bps at 2.166%, and 30-Yr is down 9.1bps at 2.405%.

- UK: The 2-Yr yield is down 8.1bps at 4.258%, 5-Yr is down 11.2bps at 3.745%, 10-Yr is down 10.7bps at 3.794%, and 30-Yr is down 7.4bps at 4.456%.

- Italian BTP spread up 3.3bps at 156.2bps / Greek up 3.9bps at 104.9bps

EGB Options: Schatz Structures Sold Wednesday

Wednesday's Europe rates/bond options flow included:

- DUH4 106.40/106.60cs sold at 4.5 in 5k (closing position)

- DUH4 106.40c sold at 10.5 and 11 in 9.5k (closing position)

- DUH4 105.30/105.50/105.70/105.90p condor, sold at 5 in 3.4k

- ERU4 96.87/97.25/97.37/97.75c condor vs 96.50p, bought the condor for 4.5 in 7.5k

FOREX Greenback Rips Higher As Powell Plays Down March Cut Likelihood

- An initial hawkish reaction to the January FOMC statement was followed by the greenback resuming a downward trend on Wednesday as Powell began his January press conference. However, with the Fed Chair expecting the committee to not be in a position to cut in March, the US Dollar has spiked higher, prompting the DXY to quickly erase all prior declines and tilt into positive territory as the APAC crossover approaches.

- Given the sensitivity to front end US rates, USDJPY has predictably been among the most volatile G10 pairs. The original dip to session lows of 146.01 has been overshadowed by the impressive near 1% bounce since. Spot deals around 147.35, still a way off the much earlier overnight highs of 147.90.

- The USD index stands 0.3% higher on the session and with equities hard hit by the news, the likes of AUD (-0.67%) and NZD (-0.46%) are among the poorest performing currencies on Wednesday. The Euro and GBP losses are more reflective of the advance seen for the broad USD index as Powell’s late remarks have trumped the plethora of weak US data points that crossed in early US hours.

- Focus quickly turns to Eurozone inflation data on Thursday, which will be followed by the Bank of England decision. In the US, ISM manufacturing PMI headlines the docket before Friday’s release of non-farm payrolls.

FX OPTION EXPIRY

- Expiries for Feb1 NY cut 1000ET (Source DTCC)

- EURUSD: 1.0800 (783mln), 1.0845 (298mln), 1.0850 (336mln), 1.0860 (830mln), 1.0875 (281mln), 1.0880 (280mln), 1.0900 (784mln).

- GBPUSD: 1.2760 (464mln).

- USDJPY: 146.00 (431mln), 146.50 (333mln), 147.00 (200mln).

- AUDUSD; 0.6640 (724mln), 0.6650 (596mln).

- NZDUSD: 0.6200 (294mln).

- USDCNY: 7.1500 (479mln), 7.1510 (615mln).

Late Equities Roundup: Testing Session Lows Post FOMC

- Stocks are weaker late Wednesday, near lows after the Fed left rates steady yet again, while Chairman Powell poured cold water on current chances of a rate cut at the next FOMC on March 20. Currently, the DJIA is down 294.34 points (-0.77%) at 38174.96, S&P E-Mini futures are down 75.5 points (-1.52%) at 4875.75, Nasdaq down 320.3 points (-2.1%) at 15191.4.

- Laggers: Communication Services and Information Technology sectors led laggers for the second day running, interactive media and entertainment shares weighed on the former: Alphabet -6.9% after disappointing ad revenue annc, Meta -1.89%, Charter Communications -1.557%. Software and services weighed on the IT sector late: Roper Technologies -4.24%, Fortinet -2.64%, Intuit -2.39%.

- Couple notable mentions: NY regional bank shares came under pressure after New York Community Bancorp fell over 40% on the open cut it's dividend after posting a loss on purchase of collapsed Signature Bank shares. While KBW Regional Banking Index was nearly -4%, larger banks traded firm.

- On the flipside, shares of Boeing gained 5.1% after the CEO tried to get out in front of ongoing safety issues and efforts to improve waning confidence. Boeing declined to provide 2024 guidance after Q4 earnings, cash flow and revenue all surpassed analysts’ expectations this morning.

- Leading gainers: Health Care and Utility sectors outperformed late, equipment and services names buoyed the former: Stryker +6.92%, Edwards Lifesciences +6.54% while Cencora gained 5.24%. Meanwhile, multi energy and electricity providers supported the Utility sector: DTE Energy +0.73, Dominion +0.20%

- Looking ahead: corporate earnings docket after the close: MetLife and Qualcomm. Already annc'd: Boston Scientific, Phillips 66, Thermo Fisher, Old Dominion, Boeing, Mastercard, Hess Corp. On tap for Thursday: International Paper, Call Corp, Stanley Black & Decker, Honeywell, Sirius XM, Apple, Merck, Eaton Corp,

E-MINI S&P TECHS: (H4) Trend Signals Remain Bullish

- RES 4: 5012.80 1.618 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 5000.00 Psychological round number

- RES 2: 4982.62 1.50 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 4957.25 High Jan 30

- PRICE: 4878.0 @ 1545 ET Jan 31

- SUP 1: 4854.35/4753.05 20- and 50-day EMA values

- SUP 2: 4702.00 Low Jan 5

- SUP 3: 4594.00 Low Nov 30

- SUP 4: 4550.75 Low Nov 16

The uptrend in S&P E-Minis remains intact and this week’s fresh cycle highs, reinforce current conditions. Resistance at 4841.50, the Dec 28 high, has recently been cleared. This confirmed an extension of the price sequence of higher highs and higher lows. Moving average studies remain in a bull-mode condition too, highlighting positive market sentiment. Sights are on 4982.62 next, a Fibonacci projection. Key support lies at 4753.05, the 50-day EMA.

COMMODITIES Crude Suffers With Stock Build And Weak Data Whilst Gold Swings With USD

- The oil market has fallen on the day, amid rising US crude stocks and weak economic data from China. WTI has shown a largely muted reaction to the Fed’s decision to hold rates steady and subsequent communications.

- EIA Weekly US Petroleum Summary - w/w change week ending Jan 26: Crude stocks +1,234 vs Exp -225, Crude production +700, SPR stocks +892, Cushing stocks -1,972

- The number of tankers carrying crude oil through the Gulf of Aden has significantly declined after a laden fuel-tanker was hit by a missile strike on Friday, Clarkson data showed. Countries in the Middle East are still awaiting the US response to the killing of three of its service personnel in a drone strike at a Jordanian outpost.

- WTI is -2.5% at $75.86, a step closer to support at $74.76 (50-day EMA).

- Brent is -1.4% at $81.71, a step closer but still a little way off support at $79.40 (50-day EMA).

- Gold is -0.25% at $2031.60 after a volatile session that saw a high of $2055.92 as the dollar slumped on weak US data before an intraday resurgence as Powell pushed back on March Fed cut prospects.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2024 | 0030/1130 | * |  | AU | Building Approvals |

| 01/02/2024 | 0030/1130 | ** |  | AU | Trade price indexes |

| 01/02/2024 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/02/2024 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/02/2024 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0830/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 01/02/2024 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/02/2024 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/02/2024 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/02/2024 | 1000/1100 | ** |  | EU | Unemployment |

| 01/02/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/02/2024 | 1130/1230 |  | EU | ECB's Lane remarks at EIEF | |

| 01/02/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 01/02/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 01/02/2024 | 1230/1230 |  | UK | BoE Press Conference | |

| 01/02/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 01/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/02/2024 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 01/02/2024 | 1400/1400 |  | UK | DMP Data | |

| 01/02/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2024 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2024 | 1500/1000 | * |  | US | Construction Spending |

| 01/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 01/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 01/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/02/2024 | 1630/1130 |  | CA | BOC Governor Macklem testifies at House finance committee. |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.