-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Still Adjusting to FED Policy Pivot

- MNI SECURITY: Axios: US Calls On Israel To End High Intensity Phase Of War

- MNI EU: European Council Opens EU Accession Negotiations With Ukraine/Moldova

- FINLAND TO CLOSE RUSSIA BORDER AGAIN, INTERIOR MINISTER SAYS, Bbg

- FINLAND, US TO SIGN DCA IN WASHINGTON ON MONDAY: VALTONEN, Bbg

- ECB LARGELY UNITED ON SEEING RATE CUTS LATER THAN MARKET BETS, Bbg

- ECB LAGARDE: DON'T HAVE A RECESSION IN OUR BASELINE, Bbg

- Atlanta Fed GDPNow Q4 estimate, raised to +2.6% from +1.2%

US TSYS Policy Pivot, 10Y Tsy Yield Falls to 3.8835% Low

- Cash Tsys remain stronger on heavy volumes after the close (TYH4>2.8M), 10Y yield fell to 3.8835% 5-month low as markets continue to react to Wed's FOMC steady rate annc, acknowledging inflation has eased but reiterated the Fed is "prepared to tighten policy further, if appropriate".

- Tsy futures receded slightly w/ EGBs, Gilts, position adjusts following the BOE and ECB steady rate annc's, little to no change to guidance.

- Still bid, Tsys pared support after lower than expected Initial Jobless Claims (202k vs. 220k est, 221k prior revised from 220k), Continuing Claims (1.876M vs. 1.879M est, prior 1.856M revised from 1.861M);

- Higher than expected Retail Sales Advance MoM (+0.3% vs. -0.1% est, prior -0.2% revised from -0.1%), Retail Sales Ex Auto MoM (0.2% vs. -0.1% est) Retail Sales Control Group (0.4% vs. 0.2% est) and

- Higher than expected Import Price Index MoM (-0.4% vs -0.8% est), YoY (-1.4% vs. -2.1% est); Export Price Index MoM (-0.9% vs. -1.0% est), YoY (in line w/ -5.2% est).

- Tsy 10Y futures traded at 112-19 (+22.5) after the close - still well within technical levels: resistance at 112-28.5 (1.618 proj of the Oct 19 - Nov 3 - Nov 13 price swing). Initial support well below at 111-09+ (High Dec 7 and a recent breakout level).

- Projected rate cuts for early 2024 gained momentum: January 2024 cumulative -5bp at 5.283%, March 2024 chance of rate cut climbs to -81.9% vs. -62% late Wednesday w/ cumulative of -25.5bp at 5.078%, May 2024 fully pricing in the first cut with cumulative -50.8bp at 4.824%, June'24 cumulative -76.8bp at 4.565%. Fed terminal at 5.33% in Feb'24.

- Friday Data Calendar: Fed Speak Returns, IP/Cap-U, S&P PMI, TIC Flow

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00356 to 5.35825 (-0.00178/wk)

- 3M -0.00689 to 5.37775 (+0.01170/wk)

- 6M -0.03844 to 5.29380 (+0.00169/wk)

- 12M -0.09040 to 5.01476 (-0.00536/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.635T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $611B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $600B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $106B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $259B

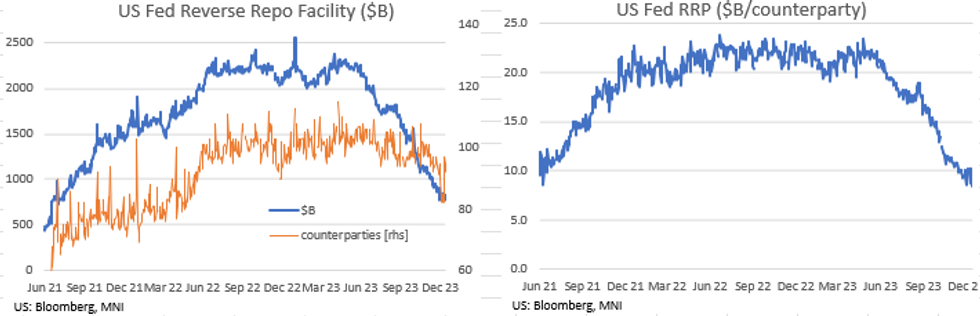

FED: RRP Usage in Retreat

- RRP usage retreated to $769B (-$54B) -- just above December 1 low of $768B, the lowest usage since early July 2021.

- The number of counterparties down to 92 from 95 yesterday.

SOFR/TREASURY OPTION SUMMARY

Heavy FI option trade reported Thursday, two-way positioning that favored upside/rate cut insurance amid a strong carry-over bid for Tsys Thursday after the FOMC held rates steady and acknowledged inflation has eased Wednesday. Not only did 10Y yield fall below 4.0% this morning, but under 3.9% by midday -- to 3.8835% at midday (5 month lows) as market as markets fully price in the first rate cut at the March 20, 2024 FOMC.

Projected rate cuts for early 2024 gained momentum: January 2024 cumulative -5bp at 5.283%, March 2024 chance of rate cut climbs to -81.9% vs. -62% late Wednesday w/ cumulative of -25.5bp at 5.078%, May 2024 fully pricing in the first cut with cumulative -50.8bp at 4.824%, June'24 cumulative -76.8bp at 4.565%. Fed terminal at 5.33% in Feb'24.

- SOFR Options:

- Block, 10,000 SFRU4 95.25 puts, 22.0 ref 95.80

- +20,000 SFRF4 95.00/95.12/95.25 call flys, 2.25

- Block, 14,000 SFRH4 94.93/95.06/95.18 call flys, 1.75 ref 95.00

- Block, 10,650 SFRF4 94.84/94.93/95.00 put flys, 1.75 ref 94.995

- over 20,000 SFRH4 94.75/94.87 /95.00 call flys ref 94.99

- 3,000 SFRH4 94.87/95.37/95.87 call flys ref 94.98

- 3,000 SFRH4 94.68/94.81/94.87/94.93 put condors ref 94.985

- Block, 5,000 SFRU4 95.75/96.00/96.25 call flys, 2.0 ref 95.905

- Block, 4,000 SFRJ4 95.12/95.25/95.37 put flys, 1.0 ref 95.495

- Block, 5,500 SFRG4 94.68/94.75 call spread, 5.25 ref 95.015 at 0617:16ET. Same spread crossed earlier 5.0 over the SFRG4 94.37 puts.

- 1,500 SFRH4 94.37/94.62/94.75 broken put flys

- 2,000 SFRK4 94.62/94.75 put spds vs. SFRK4 95.37/95.50 call spds

- 3,750 SFRG4 94.75/94.87 put spds ref 95.025

- 7,500 0QG4 97.00/97.25 call spds ref 96.515

- 4,000 0QH4 97.50/98.00 call spds ref 96.525

- 6,000 SFRH4 94.50 puts, 0.5 ref 95.02

- 4,000 SFRU4 97.00/97.50 call spds ref 95.90

- Block/screen 11,000 SFRM4 97.00/97.50 call spds, 2.0 ref 95.48

- Block, 2,000 SFRM4 96.50/97.50 call spds, 5.5 ref 95.455

- 5,600 SFRZ3 94.62 calls, .75-1.0 ref 94.63 to -.635

- 1,800 0QH4 95.75/96.00 put spds vs. 0QH4 96.62/97.12 call spds ref 96.435

- Treasury Options:

- 10,000 TYG4 109.5/110/111/112 2x2x1x1 put condors, 23

- Block/screen, over -26,000 FVF4 107.5 calls from 62 (13k block) to 1-00 (screen)

- +15,000 TYG4 110.5/112 2x1 put spds, 11 ref 112-16.5 to -17

- +11,000 wk5 TY 113/114/115 call flys from 9-8

- +8,000 FVF4 108 calls 47 over the FVF 106/107 put spd

- +25,000 TYF4 111/114 call over risk reversals 47 vs. 112-16.5

- 5,000 TYF4 112.5 calls, 35 ref 112-15.5

- 6,000 TYF4 112 calls, 55 ref 112-15.5

- 3,000 FVG4 107.75/108.25 call spds ref 108-15 to -14.75

- 6,200 TYF4 111 calls, 129-130 ref 112-15.5

- 2,000 TYH4 114/115 call spds, 15 ref 112-06.5

- Block, 5,000 TYF4 111.25 calls, 63 ref 112-01.5

EGBs-GILTS CASH CLOSE: Fed-Led Gains Pared As BoE/ECB Stand Their Ground

Bunds and Gilts closed slightly higher Thursday, following an intraday reversal of the large gains after last night's unexpectedly dovish Federal Reserve meeting.

- Following through from the drop on the open into early European trade, 10Y Gilt yields fell as much as 17bp at one point, with Bund yields down nearly 15bp, before erasing most of the move as the BoE and ECB decisions were digested. The German curve bull steepened with the UK's bull flattening.

- The BoE decision was largely in line, with a 6-3 vote breakdown and the statement seen leaning more hawkish than dovish versus expectations.

- Apart from announcing that PEPP reinvestments would begin to be tapered off in H2 2024, there were no major surprises from the ECB. However the Lagarde press conference delivered a few hawkish-leaning soundbites (they didn't discuss cuts "at all", "should not lower our guard" against inflation) that were sufficient to pull Bunds to session lows. Solid US data (retail sales, jobless claims) helped keep pressure on core FI through the afternoon.

- Periphery EGB spreads tightened as PEPP runoff won't be as onerous as some analysts had expected.

- Friday sees flash December PMIs as well as appearances by multiple ECB (Holzmann, Centeno, Vasle, Kazimir, Muller, Scicluna, Simkus, Vujcic) speakers, and BOE's Ramsden.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 10bps at 2.567%, 5-Yr is down 8.8bps at 2.079%, 10-Yr is down 5.4bps at 2.119%, and 30-Yr is down 1.9bps at 2.327%.

- UK: The 2-Yr yield is down 1.9bps at 4.362%, 5-Yr is down 6.9bps at 3.817%, 10-Yr is down 4.1bps at 3.789%, and 30-Yr is down 3.9bps at 4.294%.

- Italian BTP spread down 8.3bps at 167.3bps / Greek down 8.2bps at 116.8bps

EGB Options Mixed Rates Trade Pre-ECB

Thursday's Europe rates / bond options flow included:

- ERH4 96.37/96.25ps vs 97.00c, bought the ps for 1.25 in 8k

- ERH4 96.12/96.00ps 1x2, bought the 1 for 1 in 5k

- ERJ4 96.75/96.62/96.50 put fly bought for 1.5 & 1.75 on16.5K all day

- SFIF4 94.75/94.85/94.95c fly bought for 2 in 2k

FOREX EGB Greenback Extends Fed-Inspired Weakness, USD Index Drops 0.90%

- The greenback has extended losses on Thursday, in further reaction to the FOMC's dovish pivot at the December meeting. The weakness has been broad based, which is emphasised by the USD index extending its impressive decline to 1.80% from pre-Fed levels. Late weakness for equities did little to bolster the USD.

- Both EUR and GBP are among the best performing majors, with the former briefly trading back above 1.10 and the latter receiving an additional boost from today’s Bank of England decision.

- As such, GBPUSD has risen 1.15% to trade at the highest level since mid-August, narrowing in on 1.28. Wednesday’s rally and Thursday’s extension, reinforces a bullish technical theme. Key resistance and the bull trigger at 1.2733, the Nov 29 high, has broken, confirming the resumption of the uptrend. Highs of 1.2800 and 1.2819 in August are the next topside levels of note.

- USDCAD has declined 0.80% on the session, with today's price action driven by the persistent Fed-inspired USD weakness as well as solid oil prices. This prompted the USDCAD trend outlook to deteriorate sharply through the London close, as the bear trigger at 1.3480, the Dec 4 low, has given way. This confirms a resumption of the downtrend and ends the consolidation phase posted since the beginning of December. Sights are on 1.3401, the 61.8% retracement of the Jul 14 - Nov 1 bull phase.

- More of a consolidatory session for USDJPY, after further sharp weakness was seen during APAC hours, resulting in a print of 140.97. The pair retains losses of 0.75% but stands well off the lows, around 141.80 as we approach the APAC crossover.

- The NOK trades sharply higher after the Norges Bank took a large part of the market by surprise in hiking rates by a further 25bps to 4.50%. EUR/NOK traded lower by as much as 3% on the initial decision, piercing key support at both the 100- and 200-dma to print the lowest level since early October.

- Data on Friday includes China activity figures, before a round of European flash PMIs. In the US, empire manufacturing, industrial production and PMI’s will be in focus.

FX Expiries for Dec14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0715-25(E2.7bln), $1.0790-10(E3.3bln), $1.0825-35(E1.8bln), $1.0855-70(E2.5bln), $1.0900(E1.8bln)

- USD/JPY: Y145.00($698mln), Y147.50-55($1.1bln), Y146.25-30($745mln), Y147.50-55($1.1bln)

- GBP/USD: $1.2465-75(Gbp755mln), $1.2640(Gbp528mln)

- AUD/USD: $0.6500-15(A$1.8bln), $0.6600(A$1.7bln), $0.6700(A$2.1bln)

- NZD/USD: $0.6090(N$750mln), $0.6150(A$611mln), $0.6190(N$1.1bln)

Late Equity Roundup: Inching Higher, Energy, Real Estate Leading

- Stocks making marginal gains again after trading weaker in the second half, lending to the opinion of profit taking/position squaring ahead Friday's data.

- Others had suggested marginally hawkish ECB sources piece and the EU/Ukraine news helped cap the rally. Our political risk analyst notes on the latter that the accession process will likely be drawn out, and faces an unclear track considering complications from the war ongoing with Russia.

- Currently, DJIA trades up 106.49 points (0.29%) at 37197.67, S&P E-Mini futures up 9 points (0.19%) at 4770, Nasdaq up 13.8 points (0.1%) at 14748.08.

- Leading gainers: Energy and Real Estate sectors continued to outperform in late trade, energy and equipment service shares buoyed the former as crude prices bounce (WTI +2.0 at 71.47): Schlumberger +6.12%, Halliburton +2.62%, Baker Hughes +2.19%. Oil and gas shares also traded stronger: Hess Corp +3.63%, Chevron +3.15%, Valero +2.72%. Real Estate management and service shares supported the latter: CBRE Group +4.85%, CoStar Group +2.24%.

- Laggers: Consumer Staples and Utilities sectors underperformed in late trade, household products weighed on the former: Clorox and Church & Dwight both down -3.3%, Procter & Gamble -2.42, Kimberly-Clark -2.13. Meanwhile, multi-energy providers weighed on the Utilities sector: Ameren -6.96% amid concerns the Illinois Commerce Commission may negatively impact the firm its regular open meeting, WEC Energy -2.32%, Public Services Enterprises -2.01%.

E-MINI S&P TECHS: (H4) Heading North

- RES 4: 4899.09 1.382 proj of Nov 10 - Dec 1 - 7 price swing (cont)

- RES 3: 4862.08 1.236 proj of Nov 10 - Dec 1 - 7 price swing (cont)

- RES 2: 4808.25 High Jan 4 2022 and major resistance

- RES 1: 4800.00 Round number resistance

- PRICE: 4768.5@ 1510 ET Dec 14

- SUP 1: 4698.75 Low Dec 13

- SUP 2: 4617.32 20-day EMA

- SUP 3: 4594.00 Low Nov 30

- SUP 4: 4539.38 50-day EMA

A bullish theme in S&P e-minis remains intact and the contract traded sharply higher yesterday. Price is firmer again today and confirms a resumption of the uptrend that started Oct 27. Note too that the contract has cleared resistance at 4738.50, the Jul 27 high, reinforcing current positive trend conditions. This signals scope for a climb towards 4800.00 next. On the downside, initial firm support lies at 4617.32, the 20-day EMA.

COMMODITIES

- WTI Crude Oil (front-month) up $1.99 (2.86%) at $71.45

- Gold is up $6.45 (0.32%) at $2033.36

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/12/2023 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 15/12/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 15/12/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/12/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/12/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/12/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 15/12/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 15/12/2023 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/12/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 15/12/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 15/12/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 15/12/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 15/12/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 15/12/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 15/12/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 15/12/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 15/12/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 15/12/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 15/12/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 15/12/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 15/12/2023 | 1000/1000 |  | UK | BOE's Ramsden Speech at Deloitte on Bank resolution regime | |

| 15/12/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/12/2023 | 1330/0830 | * |  | CA | International Canadian Transaction in Securities |

| 15/12/2023 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 15/12/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/12/2023 | 1415/0915 | *** |  | US | Industrial Production |

| 15/12/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 15/12/2023 | 1445/0945 | *** |  | US | S&P Global Services Index (flash) |

| 15/12/2023 | 1630/1630 |  | UK | BoE announce APF Sales schedule for Q124 | |

| 15/12/2023 | 1725/1225 |  | CA | BOC Governor Macklem speech/press conference | |

| 15/12/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 15/12/2023 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.