-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:Strong March Finish For Tsys, Stocks

HIGHLIGHTS

- MNI RUSSIA: New RU Foreign Policy Strategy Identifies China/India As Main Allies

- MNI US-JAPAN: Japan Synchs With US On Semiconductor Export Controls

- China’s Strong PMIs Show Economic Recovery Gaining Traction, Bbg

- BOSTON FED COLLINS: NEW DATA IN WEEK HASN'T MATERIALLY CHANGED HER OUTLOOK, Bbg

- ECB RATE HIKES POSSIBLY STILL HAVE A LITTLE WAY TO GO: VILLEROY, Bbg

- ECB LAGARDE: CORE INFLATION IS STILL SIGNIFICANTLY TOO HIGH, Bbg

Key Links: MNI: Fed's Williams Gauging Credit Impact On Inflation Outlook / MNI: Chicago Business Barometer™ Edges up to 43.8 in March / MNI: Italy To Boost Stock Market, Loosen Investment Rules-Draft / MNI Global Macro Outlook-Mar 2023: Don't Bank On A Crisis

Tsys Near Wk Highs Into Month/Quarter End

- Treasury futures are pushing late session highs, volumes climbing into the month/quarter end, front month 10Y futures traded over 300k from 114-28 to 115-01 high (+14.5), 10Y yield down to 3.4752% low.

- Little market reaction to NY Fed Williams' economic outlook speech to the Housatonic Community College in Connecticut. "I expect inflation to decline to around 3-1/4 percent this year, before moving closer to our longer-run goal in the next two years," he added, slightly increasing his forecast a quarter point since mid-February.

- Fed speakers still scheduled for this evening: Fed Gov Cook, eco outlook/mon-pol, Midwest Economics Assn at 1745ET; Fed Gov Waller re: Phillips curve, text, no Q&A at 2200ET.

- Yield curves flat to mildly steeper (2s10s -57.487 +.205), well off session lows as Jun'23 2Y futures making new late session highs (TUM3 103-08, +3.0), 2Y yield marks session low of 4.0459%.

- Implied May Fed hike pricing fell from 16bp to 13.5bp after that soft Feb PCE report, but it's since bounced back to 14.4bp. The soft services ex-housing number is key to any Fed pause narrative but as we noted earlier, the April 28 PCE release will carry far more weight for FOMC Fed going into the May 3 decision. Let alone the rest of the year, for which 55bp of cuts from peak are priced (basically unchanged from pre-data).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.01057 to 4.80086% (-0.00800/wk)

- 1M +0.01014 to 4.85771% (+0.02714/wk)

- 3M +0.01614 to 5.19271% (+0.09128/wk)*/**

- 6M +0.04071 to 5.31300% (+0.32571/wk)

- 12M +0.07372 to 5.30529% (+0.46943/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.19271% on 3/31/23

- Daily Effective Fed Funds Rate: 4.83% volume: $95B

- Daily Overnight Bank Funding Rate: 4.82% volume: $240B

- Secured Overnight Financing Rate (SOFR): 4.82%, $1.319T

- Broad General Collateral Rate (BGCR): 4.79%, $505B

- Tri-Party General Collateral Rate (TGCR): 4.79%, $497B

- (rate, volume levels reflect prior session)

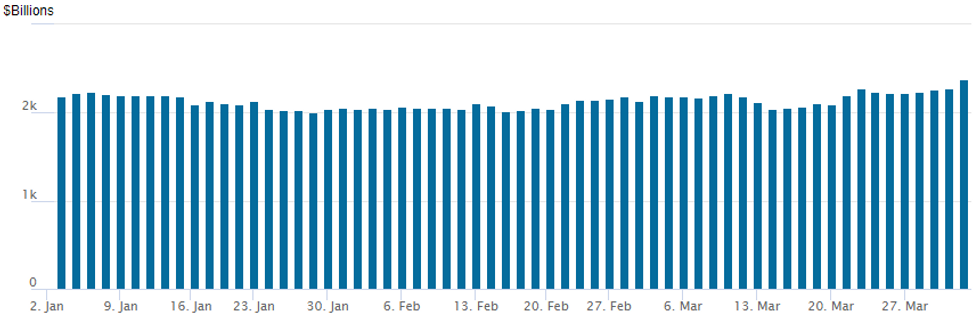

FED Reverse Repo Operation: New 2023 High

NY Federal Reserve/MNI

NY Fed reverse repo usage surged to $2,375.171B a new high for 2023 w/ 108 counterparties, compares to yesterday's $2,271.531B. Record high of $2,553.716B from December 30, 2022 remains intact.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Generally modest volume with a couple notable exceptions were reported Friday. Salient Treasury option trade involved a two Jun'23 10Y call spread sales, position unwinds (-13.5k TYM 112/114 call spds and over 36k TYM 111.5/113.5 call spds from 27-28) as underlying TYM3 futures see-sawed to session high of 114-27 in the second half. Conversely, SOFR options saw better put trade on net as short end futures held 0.030 weaker to steady out to Dec'23 as implied rate cuts remain well below last week's highs (Dec'23 cumulative 44.1bp vs. over 100.0bp last week). Net short vol put tree buy of 40k SFRK3 94.81/94.93/95.18 put trees noted after midday. Highlights:- SOFR Options:

- Block, total +40,000 SFRK3 94.81/94.93/95.18 put trees, 11.0-11.5 ref 95.11

- Block, total 10,000 SFRK3 95.00/95.50 2x1 put spds, 25.0 ref 95.10

- 2,500 SFRJ3 95.31/95.43/95.50 2x2x1 2x2x1 broken call trees ref 95.095

- Block, 19,250 SFRM3 94.62/95.75 call spds, 40.0 vs. 95.095/0.65%

- +2,000 SFRM3 95.25/95.50 call spds, 5.0 vs. 95.135

- -3,000 SFRM3 94.75/95.00 put spds, 9.0 ref 95.11

- +5,000 OQJ3 95.62/95.93 2x1 put spds, 2.5

- -2,500 SFRH4 96.00 straddles, 129

- -1,000 SFRM4 95.37/96.37/97.37 iron flys, 73.5

- +5,000 SFRU3 94.00/94.50 3x2 put spds, 6.5

- 3,000 SFRM3 95.00/95.50/96.00 2x5x3 call flys ref 95.10

- 2,600 SFRM3 94.50/95.00/95.50 call flys, ref 95.09

- 2,000 SFRJ3 95.18 calls ref 95.09

- 5,000 SFRM3 94.81/94.93/95.06 put flys ref 95.09

- 2,000 SFRJ3 95.00/95.06/95.12 put flys, ref 95.095

- 1,000 SFRJ3 95.00/95.18/95.37 call flys, ref 95.10

- 2,000 SFRM3 94.37/94.62/94.87/95.12 put condors ref 95.13

- Treasury Options:

- 2,500 TYM3 110/112 2x1 put spds, 9 ref 114-24

- -13,500 TYM3 112/114 call spds, 1-20 ref 114-23.5

- Over -36,000 TYM3 111.5/113.5 call spds, 1-27 to 1-28 ref 114-21.5 to -24.5

- Over 6,500 FVM3 112/114 call spds ref 109-05.75 to -04.75

EGBs-GILTS CASH CLOSE: Euro Inflation Seen Giving ECB Less "Way To Go"

Bunds led a broader European bond sell-off in early Friday trade after a stronger-than-expected French inflation print, but soft Italian/European price data mid-morning spurred a strong bounce across the space.

- This pushed back against Thursday's hawkish response to strong German core CPI readings, and for the first time this week, ECB and BoE peak rate pricing pulled back, though only slightly (under 1bp for each).

- Markets interpreted mid-afternoon comments by ECB centrist Villeroy as leaning dovish ("we may possibly still have a little way to go" on rates).

- BTPs outperformed, with the 10Y spread/Bunds compressing sharply after the soft Italian inflation numbers.

- The belly of the German curve outperformed on the day, with the UK's relatively mixed (amid largely directionless rangebound trade led by EGBs).

- A comparatively quiet week lies ahead, with the long Easter weekend starting Friday. French and German industrial production data feature (we get PMIs too but they are finals). BoE 's Tenreyro and Pill also make appearances.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 6.3bps at 2.686%, 5-Yr is down 9bps at 2.316%, 10-Yr is down 7.8bps at 2.296%, and 30-Yr is down 5.5bps at 2.366%.

- UK: The 2-Yr yield is down 0.9bps at 3.446%, 5-Yr is down 1bps at 3.356%, 10-Yr is down 2.7bps at 3.491%, and 30-Yr is down 0.8bps at 3.841%.

- Italian BTP spread down 5.7bps at 180.4bps / Spanish down 2bps at 101.2bps

EGB Options: Large ECB Cut Plays To Conclude The Quarter

Friday's Europe rates / bond options flow included:

- ERK3 96.62/96.50/96.37p fly, bought for 3 in 2k

- ERK3 96.25/96.125/96.00p ladder, bought for 0.25 in 18k

- ERZ3 95.50p, bought for 12 in 10k (ref 96.435, 20 del)

- ERZ3 97.50/98.00/98.50c fly, bought for 2 in 6k.

- ERZ3 98.00c, bought for 9 in 7k - This was bought for 14 on Tuesday. Looks like over 100k now for the ERU3 and ERZ3 98.00c that have been bought.

FOREX: Mixed Performance in G10, Greenback Consolidating Weekly Decline

- The USD index is slightly firmer on Friday but looks set to post a 0.65% decline on the week amid a more stable global outlook and an associated ~3% rally for the S&P 500.

- A mixed performance across G10 on Friday with a raft of US data potentially muddied by month-end flows as we approach the weekend.

- Early strength was seen in USDJPY, which showed above 133.50 for the first time since March 17th, largely in response to the BoJ outlining their bond-buying schedule for Q2, expanding the maturity range of purchases to incorporate the super-long end of the curve. The tweaked schedule outlines the ability of the BoJ to remain flexible amid global pressures.

- Despite the firm price action this week for USDJPY, in the face of broad greenback weakness, medium-term bearish signals continue to prevail from a technical perspective. This may have been highlighted by some weakness into the close which sees the pair around 80 pips off best levels at 132.80.

- EURUSD was also unable to gather further topside momentum on Friday, again stalling just short of key short-term resistance at 1.0930, the Mar 23 high. A break of this level is required to reinstate the recent bull theme and signal scope for a climb towards 1.1033, the Feb 2 high.

- Instead, the pair gradually drifted lower, but picked up the pace approaching the WMR month-end fix, which saw the pair trade down to 1.0858. Similar price action for GBPUSD which after failing to make early headway above 1.24, now sits at the day’s worst levels around 1.2340 approaching the close.

- A relatively quiet week lies ahead, with the long Easter weekend starting Friday and China out early next week. Swiss CPI and US ISM Manufacturing PMI will headline Monday’s docket. Monetary policy decisions in both Australia and New Zealand are due on Tuesday and Wednesday respectively.

FX: Expiries for Apr03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0850-55(E672mln), $1.0900(E1.1bln), $1.1000-10(E1.1bln)

- USD/JPY: Y128.00($1.5bln)

LATE EQUITY ROUNDUP: Finishing Month/Quarter-End Strong

- US stocks continue to march higher in late session trade, SPX Emini futures currently at 4134.5 - through resistance of 4119.5 (March 6 high) with focus on the next key resistance level of 4148.48, 76.4% retracement of the Feb 2 - Mar 13 downleg.

- Month end portfolio rebalancing playing a part as equities started extending highs over the last hour. Current sector leaders are Consumer Discretionary (+2.5%), Communication Services (+1.95%) and Real Estate (+1.7%) sectors.

- Laggers: Utilities (+0.58%), Energy (+0.63%) and Consumer Staples (+0.75%) sectors firmer but lagging the pace of session gainers.

- In the event of a reversal, key short-term support lies at 3937.00, the Mar 24 low. A break of this support would be bearish. Initial support lies at 4012.49, the 20-day EMA.

E-MINI S&P (M3): Nearing Overbought

- RES 4: 4205.50 High Feb 16

- RES 3: 4148.48 76.4% retracement of the Feb 2 - Mar 13 downleg

- RES 2: 4119.50/4143.9 High Mar 6 / 3.0% 10-dma envelope

- RES 1: 4118.00 High Mar 31

- PRICE: 4117.50 @ 17:04 BST Mar 31

- SUP 1: 4012.49 20-day EMA

- SUP 2: 3937.00/3897.25 Low Mar 24 / 20

- SUP 3: 3839.25 Low Mar 13

- SUP 4: 3822.00 Low Dec 22 and a key support

Upside in the e-mini S&P persisted through the London close as the post-PCE rally continued. This tipped prices north of resistance at the Mar 6 high of 4116.50 and also above the 2.0% 10-dma envelope (4103.6) - a level that historically indicates the index can appear technically overbought. Nonetheless, further strength here opens 4148.48, the 76.4% retracement of the Feb 2 - Mar 13 downleg. The 20-day EMA of 4012.50 remains as support.

COMMODITIES

- WTI Crude Oil (front-month) up $1.11 (1.49%) at $75.48

- Gold is down $9.3 (-0.47%) at $1970.97

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/04/2023 | 2350/0850 | *** |  | JP | Tankan |

| 03/04/2023 | 0030/1030 | * |  | AU | Building Approvals |

| 03/04/2023 | 0030/1030 | ** |  | AU | Lending Finance Details |

| 03/04/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 03/04/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 03/04/2023 | 0630/0830 | *** |  | CH | CPI |

| 03/04/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/04/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 03/04/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 03/04/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/04/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/04/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/04/2023 | 1400/1000 | * |  | US | Construction Spending |

| 03/04/2023 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 03/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/04/2023 | 2015/1615 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.