-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA MARKETS ANALYSIS: Tempering 2024 Rate Cut Projections

- MNI US: House Republicans May Hold Biden Impeachment Inquiry Vote This Week

- MNI US: Ukraine Funding In Jeopardy As Progress On US-Mexico Border Talks Stalls

- MNI RUSSIA: Putin Could Visit UAE And Saudi Arabia This Week

- US DOE TO BUY BACK AS MUCH OIL ‘AS WE POSSIBLY CAN:’ OFFICIAL, Bbg

- HUNGARY DEMANDS EU DROP UKRAINE MEMBERSHIP FROM SUMMIT AGENDA, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US Tsys Tempering 2024 Rate Cut Projections

- Tsy futures finishing weaker, near second half lows on moderate volumes (TYH4 over 1.4M). Mar'24 10Y futures currently trading 110-08.5 last, -13 vs. 110-03.5 low -- well above technical support of 109-02.5 (20-day EMA), the trend direction still bullish with today's pullback considered corrective. Curves mostly flatter (3M10Y +8.192 at -111.818; 2Y10Y -2.461 at -36.949).

- Tsys had pared early losses, marked session highs after Factory Orders receded more than expected (-3.6% vs. -3.0 est, prior down-revised to 2.3% from 2.8%), Durables in line at -5.4%.

- Futures reversed course soon after, unwinding a portion of Friday's rally as markets tempered 2024 rate cut projections ahead of Friday's headline employment data: December at -.3bp at 5.333%, January 2024 cumulative -3.3bp at 5.302%, March 2024 pricing in -54.2% chance of a rate cut with cumulative at -16.8bp at 5.167%, May 2024 pricing in -66.0% (-71.2% this morning) with cumulative -33.3bp at 5.002%.

- Tuesday Data Calendar includes S&P PMIs, JOLTS and ISMs. Fed speakers in Blackout through December 14, day after the final COMC rate annc for 2023.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00079 to 5.34587 (-0.00569 total last wk)

- 3M -0.01226 to 5.36297 (-0.01798 total last wk)

- 6M -0.03832 to 5.30258 (-0.06000 total last wk)

- 12M -0.07928 to 5.03913 (-0.15505 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.39% (+0.06), volume: $1.650T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $607B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $594B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $107B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $262B

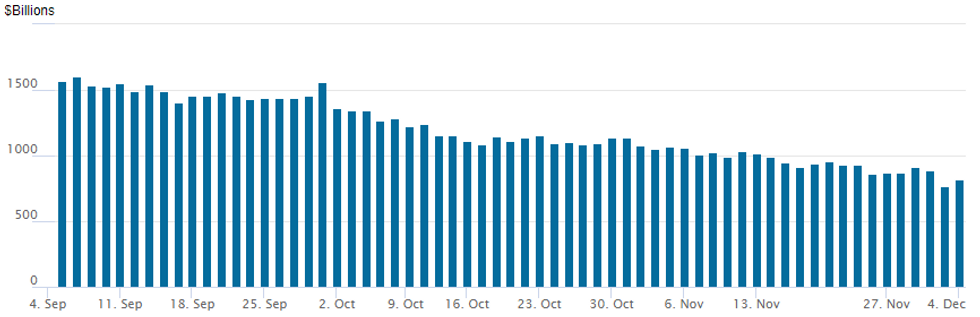

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage rebounds to $815.847B vs. last Friday's $768.543B (lowest since early July 2021) w/84 counterparties today. Usage fell below $1T for the first time since August 2021 last on November 9 ($993.314B).

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option focus shifted from better call volume overnight to mixed during the NY session, puts traded on decent size as underlying futures unwound a portion of Friday's rally as markets tempered 2024 rate cut projections: December at -.3bp at 5.333%, January 2024 cumulative -3.3bp at 5.302%, March 2024 pricing in -54.2% chance of a rate cut with cumulative at -16.8bp at 5.167%, May 2024 pricing in -66.0% (-71.2% this morning) with cumulative -33.3bp at 5.002%. Fed terminal at 5.330% in Feb'24.- SOFR Options:

- +14,000 pit/Screen and Block: SFRF4 94.68/94.81/94.87/95.00 call condors, 5.5-5.25

- 1,600 SFRH4 94.62 puts vs. SFRM4 94.75/95.12 put spds

- 7,200 SFRZ3 97.00/97.12 put spds, ref 94.625

- 2,635 SFRF4 94.50/94.75/94.87 broken put flys, ref 94.88

- +14,000 SFRG4 94.75 puts, 5.0 vs. 94.89/0.27% remains bid

- Block, 1500 0QZ3 95.43/95.93/96.37 2x6x3 call flys 7.5/wings over, 19.0

- Block, 3,000 0QZ3 96.12/96.37/96.50 broken call flys, 4.0 vs. 95.955/0.12%

- Block, 1,250 0QZ3 95.43/95.87/96.25 2x6x3 call flys 7.5/wings over

- Block, 5,000 0QG4 97.00/97.25 call spds, 3.0 vs. 96.185/0.05% at 0607:05ET

- 3,000 SFRH4 95.00/96.00 call spds ref 94.89

- 10,000 2QZ3 96.56/96.75/96.93 call flys ref 96.52

- 2,500 0QZ3 95.75 puts, 6.0 ref 95.96

- 2,000 SFRH4 94.93 puts, ref 94.87

- 1,500 0QM4 97.25/97.75 call spds ref 96.425

- 2,000 0QM4 96.50/97.25 call spds ref 96.425

- Treasury Options:

- +10,000 wk3 TY 109.75/110.75 strangles, 1

- 2,000 FVH4 104.75/106.25 2x1 put spds ref 107-04.75

- +15,000 wk3 10Y 111 calls, 32 vs. 110-14.5/0.38%

- over 11,500 TYF4 107.5 puts, 4-6

- over 9,400 TYF4 109 puts, 19 last

- over 7,200 TYF4 111.5 calls, 31 last

- 4,200 TYG4 107.5/110 2x1 put spds

- 1,500 TYF3 110.5/111.5 call spds ref 110-21.5

EGBs-GILTS CASH CLOSE: Greece Outperforms, Bunds And Gilts Mixed

Gilts underperformed Bunds to start the week, with European curves flattening.

- In a day of few catalysts, early trade saw fairly rangebound yields, leaning higher after the rally late last week.

- Yields fell back to session lows (and testing last Fridays' lowest levels) in seemingly risk-off mid-afternoon trade, as the USD strengthened, equities faded, and periphery spreads widened.

- Greece outperformed across the space, following Fitch's upgrade to BBB- (outlook stable) after hours on Friday.

- The day's central bank speakers (ECB's Lagarde, BoE's Dhingra) had little to say on current monetary policy and didn't move rates markets specifically.

- Even so, ECB rate cut pricing did deepen slightly on the day, though BoE implied cuts reversed somewhat. The UK curve closed bear flatter, with Germany's twist flattening.

- Tuesday's early highlight will be final Nov services PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.3bps at 2.695%, 5-Yr is up 1.1bps at 2.275%, 10-Yr is down 0.8bps at 2.354%, and 30-Yr is down 4.4bps at 2.59%.

- UK: The 2-Yr yield is up 8bps at 4.618%, 5-Yr is up 8bps at 4.186%, 10-Yr is up 5.4bps at 4.194%, and 30-Yr is up 5bps at 4.724%.

- Italian BTP spread up 3.3bps at 177.2bps /Greek down 2.3bps at 120bps

Downside Begins To Come Back Into Favour To Start The Week

Monday's Europe rates / bond options flow included:

- OEF4 117.50/116.50ps vs 118c, bought the ps for -7 (receive) in 5k.

- RXG4 130.50p, bought for 55 in 5k.

- RXF4 130.5/128.5ps bought for 11.5 in 8.8k.

- ERH4 96.12/96.25cs vs ERM4 96.12/96.25cs sold the March at -2.5 (receive) in13k

- ERH4 97.00/97.50/98.00c fly, bought for 1 in 2k.

- 0RZ3 97.00/97.50/98.00c fly, sold at 25.5 in 4k

- 0RZ3 96.50/96.75/97.00/97.25c condor, sold at 5.5 down to 4.75 in 11.5k

FOREX Higher US Yields Provoke Broad Greenback Strength, EMFX Underperforms

- The 0.45% move higher for the USD index on Monday has broadly been a function of yield differentials, with Fed ’24 pricing moving away from Friday’s dovish extremes as participants continue to assess the viability/speed of the Fed easing priced into markets. The associated extension of post-inflation Euro weakness and heavy price action for equities are also assisting the greenback recovery.

- As such EURUSD (-0.50%) continues its short-term grind lower and traded within four pips of the 1.0800 handle during today’s session. The move lower appears to be a technical correction with support to watch at 1.0770, the 50-day EMA.

- With a less optimistic risk backdrop the likes of AUD and NZD are underperforming, with the Norwegian Krone the weakest in G10. Furthermore, the higher US yields have had a notable impact on some emerging market currencies, with the Mexican peso briefly extending losses to 2.00% and USDMXN trading above its firm initial resistance of 17.4888, the 50-day EMA.

- The re-widening of yield differentials also underpinned a recovery for USDJPY which had a 120pip bounce from the 146.23 lows printed during APAC hours. The recent move lower for the pair highlights a resumption of the bear cycle that started Nov 13. Attention is on a key support at 146.76, a trendline drawn from the Mar 24 low. With today’s breach, a clear break would signal a stronger reversal and open 145.91, the Sep 11 low. Key short-term resistance to watch is 148.51, the Nov 30 high.

- The focus in PAAC on Tuesday will be the RBA decision, where It is widely expected that the central bank will leave rates at 4.35%. In the US, the ISM Services PMI and JOLTS data headline the docket.

Late Equity Roundup: Real Estate, Consumer Staples Take Lead

- Still weaker, stocks are holding off late morning lows, Real Estate and Consumer Staples sectors outperforming. Currently, DJIA is down 56.91 points (-0.16%) at 36187.52, S&P E-Mini future down 31 points (-0.67%) at 4569.75, Nasdaq down 158.3 points (-1.1%) at 14146.91.

- Leading gainers: Investment trusts buoyed the Real Estate sector in the second half: Hotel and Resort and retail REITS leading: Host Hotels +1.92%, Kimco +2.22%, Federal Realty +1.85%. Consumer Staples supported by low cost retailers: Dollar Tree +1.4%, Costco +0.25%, Walmart +0.12%.

- Laggers: Information Technology and Communication Services sectors continued to underperform. Semiconductor shares weighed on the IT sector: Intel -3.75%, Nvidia -3.34%, Applied Materials -2.65% amid profit taking ahead this Friday's employment data. Interactive media and entertainment shares weighed on the Communication Services sector: Netflix -2.99%, Google -2.46, Meta -2.02%.

- Today’s move lower is considered corrective as a bullish theme in S&P e-minis remains intact after Friday’s push higher. A strong rally on Nov 14 resulted in the break of a trendline drawn from the Jul 27 high. This breach and the subsequent rally, reinforces bullish conditions and opens 4644.75 next, the Aug 2 high.

E-MINI S&P TECHS: (Z3) Corrective Pullback

- RES 4: 4700.00 Round number resistance

- RES 3: 4685.25 High Jul 27 and a bull trigger

- RES 2: 4644.75 High Aug 2

- RES 1: 4607.75 High Dec 1

- PRICE: 4590.00 @ 08:28 GMT Dec 4

- SUP 1: 4501.23 20-day EMA

- SUP 2: 4442.65 50-day EMA

- SUP 3: 4354.25 Low Nov 10

- SUP 4: 4257.75 Low Nov 3

A bullish theme in S&P e-minis remains intact and Friday’s push higher is a positive development. Today’s move lower is considered corrective. A strong rally on Nov 14 resulted in the break of a trendline drawn from the Jul 27 high. This breach and the subsequent rally, reinforces bullish conditions and opens 4644.75 next, the Aug 2 high. MA studies are in a bull-mode position highlighting an uptrend. Initial firm support is at 4501.23, the 20-day EMA.

COMMODITIES Crude Ends Volatile Session Lower, Gold Slumps Back From All-Time High

- Crude markets are finishing the US session near the day’s lows after a volatile session. A surge in the US Dollar and stronger than expected non-OPEC supplies have been put pressure on prices and offset planned OPEC production cuts.

- OPEC+ cuts can “absolutely” go beyond the first quarter of 2024 according to Saudi Energy Minister Prince Abdulaziz bin Salman speaking with Bloomberg. He would have preferred to see a reduction in output but couldn’t convince his Russian counterpart.

- Speaking to Bloomberg TV on refilling the US SPR, David Turk, US Department of Energy Deputy Secretary said, “We will buy as much as we possibly can, but there are some physical constrains given the way the caverns are set up.”

- WTI is -1.2% at $73.19 but support remains at the bear trigger of $72.37 (Nov 16 low).

- Brent is -0.9% at $78.18, with support seen at the bear trigger of $76.71 (Nov 16 low).

- Gold is -2.0% at $2030.95 having pulled back sharply from an overnight all-time high of $2135.4, with a second wind to earlier declines off those highs coming with USD strength alongside higher US Treasury yields. The overnight high opened $2135.4 (Fibo projection of Oct -Nov price action) whilst it’s already breached support at $2052.03 (Nov 29 high) to open $2001.5 (20-day EMA).

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/12/2023 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 05/12/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/12/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/12/2023 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 05/12/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 05/12/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 05/12/2023 | 0815/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/12/2023 | 0845/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/12/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/12/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/12/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/12/2023 | 0900/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 05/12/2023 | 0930/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/12/2023 | 1000/1100 | ** |  | EU | PPI |

| 05/12/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 05/12/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/12/2023 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/12/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 05/12/2023 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/12/2023 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 05/12/2023 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 05/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.