-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

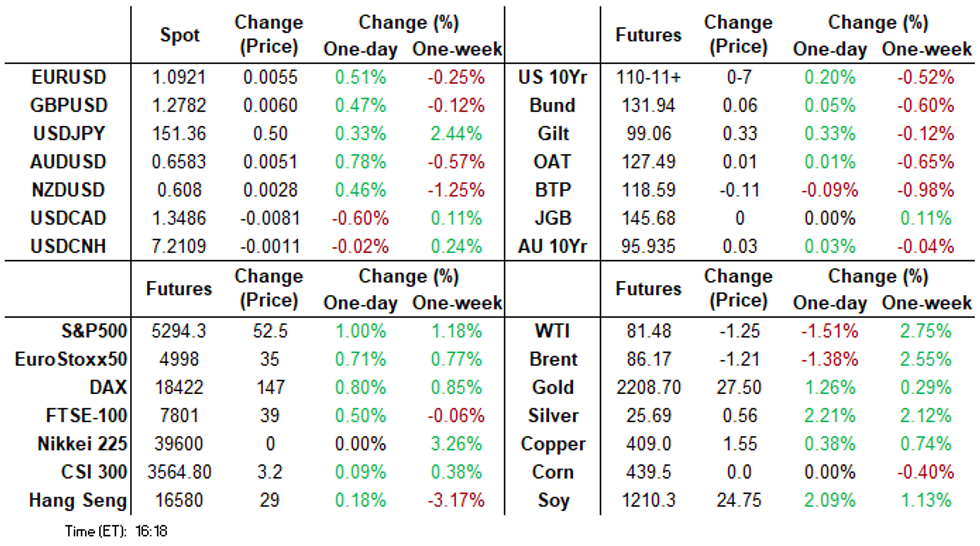

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Curves Steepen on Fed Dots

HIGHLIGHTS

Treasuries rally as Fed holds rate steady, projects 3 cuts for 2024.

Treasury Curves twist steeper as short end outperforms/adjusts to projections.

Stocks react positively to FOMC projections, S&P Eminis market new all-time high of 5295.25.

US TSYS: Tsy Curves Steepen on Fed Projections

- Treasury futures look to finish the session mostly higher/off highs after the Fed held rates steady while projecting three rate cuts by the end of 2024. After the bell, TYM4 trades 110-12.5 (+8) vs. 110-22 high - just off technical resistance at 110-24 (20-day EMA).

- Treasury futures had reversed course and extended session lows in 10s-30s briefly after Chairman Powell discussed the FOMC decision and policy projections. Jun'24 10Y tapped 110-01.5 (-3) low while curves held steeps (2s10s marked -33.119 high).

- Tsys rebounded (as did stocks) as Chairman Powell said the Fed had "discussed issues related to slowing the pace of decline in our securities holdings. While we did not make any decisions today on this, the general sense of the committee is that it will be appropriate to slow the pace of run-off fairly soon."

- Look ahead: focus turns to Thursday's Wkly Claims, S&P Global US PMIs, Home Sales. Fed VC Barr fireside chat "View from the Fed", Q&A at 1200ET.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00018 to 5.32882 (+0.00007/wk)

- 3M -0.00448 to 5.33300 (-0.00399/wk)

- 6M -0.00797 to 5.27160 (-0.00354/wk)

- 12M -0.01726 to 5.07960 (+0.00101/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.813T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $698B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $669B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $89B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $253B

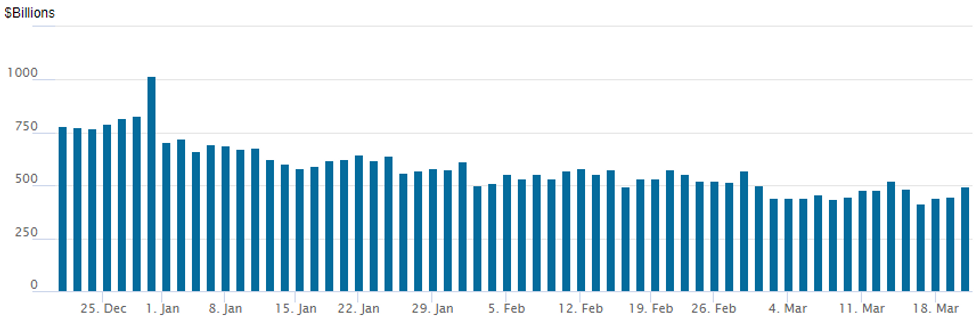

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage bounces back up to $496.245B from $446.978B on Tuesday, potentially driven by influx of GSE flows. Slight delay, Wrightson had expected a $60B increase on Monday but only $27B materialized before $6B gain on Tuesday. Last Friday saw usage fall to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties climbs to 78 vs. 70 yesterday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TEASURY OPTION SUMMARY

Mixed SOFR and Treasury option trade revolved around better downside (read hedging less dovish Fed hedging) prior to the steady FOMC rate announcement. Large legacy upside call positions remain open, however, nicely hedging the post-FOMC rally and steeper curves as underlying surged on the Fed's 3 rate cut projections in 2024.

Market rate cut pricing inched higher: May 2024 at -14.5% vs -10.3% earlier w/ cumulative -3.6bp at 5.291%; June 2024 -66.7 vs. -59.6% earlier w/ cumulative cut -20.3bp at 5.125%. July'24 cumulative -32.5bp vs. -28.2bp at 5.003%.

- SOFR Options:

- Block, +10,000 SFRJ4 94.81/95.06 call spds, 9.5

- Block, 5,000 SFRK4/SFRM4 94.93/95.00 call spd spd, 0.75 net/June over

- Block, +5,000 0QZ4 94.50/95.50 put spds, 14.5 ref 96.175

- +20,000 SFRM4 94.62/94.75/94.81 put trees vs. SFRM4 94.93/95.00 call spds, 0.75 net

- +10,000 SFRM4 94.75/94.87/95.06/95.18 call condors, 5.75

- Block -5,500 SFRM4 94.68/94.81 put spds 5.0 ref 94.86

- -4,000 SFRM4 94.75/94.87/95.00/95.12 call condors, 5.25 ref 94.86

- +2,500 0QM4 96.06/96.43 call spds vs. 2QM4 96.37/96.62 call spds, 2.25 net

- +7,500 SFRM4 95.00/95.62 call spds, 3.0 vs. 94.87/0.20%

- +4,000 0QK4 96.25/96.43/96.62 call flys, 1.5 ref 95.895

- +3,000 SFRM4 94.75/94.87 put spds 2.0 over SFRM4 94.87/95.00 call spds

- +1,500 0QU4 96.06 straddles, 71.5

- +2,000 SFRU4 95.12 straddles, 41.5

- 2,500 SFRU4 95.06/95.18/95.50/95.62 call condors ref 95.125

- Block, 4,000 SFRM4 94.87/95.00/95.12 put flys, 2.75 ref 94.86

- +3,000 SFRM4 94.87/95.00/95.12 put flys, 3.0 ref 94.86

- 1,000 SFRM4 94.81/94.93/95.06 call flys ref 94.86

- 2,250 SFRM4 94.75 puts ref 94.86

- 2,500 SFRZ4 94.50/94.62 2x1 put spds, ref 95.425

- 2,000 SFRU4 95.12 puts ref 95.125

- Treasury Options:

- 2,000 TYJ4 109/109.5/110 2x3x1 put flys, 1 ref 110-07

- 2,100 TYJ4 109/109.25 put spds, 1

- 6,500 FVK4 106.75/107.5/108 call flys

- 5,000 TYK4 107.5/109 put spds, 19 ref 110-05

- +30,000 Wk 4 Wednesday 109.25/109.5/110 put trees, 3

- 6,000 TUK4 102.25/102.75 1x2 call spds ref 102-06

- +11,000 Wed wkly 10Y 110.5/110.75 call spds, 3-3.5 ref 110-05.5

- 10,500 TYK4 110.5/111.5 1x2 call spds ref 110-08.5 to -09

- 1,300 TYK4 111/113 call spds vs. TYK4 108 puts, ref 110-08.5

- 2,000 FVJ4 106.75/107.25/107.5 broken call trees ref 106-21.5

- 2,000 wk4 FV/FVJ4 107 call spds

EGBs-GILTS CASH CLOSE: Gilts Outperform On CPI Progress Ahead Of BoE

Gilts outperformed Bunds Wednesday, with soft UK and German inflation data a key theme ahead of the Fed and Bank of England decisions.

- UK inflation data came in slightly lower than expected. As we note in our UK Inflation Insight publication (here), given how close the print was to the Bank of England's forecast, MNI's Markets Team doesn't think there is a significant impact on tomorrow's MPC meeting.

- Nonetheless it spurred a jump in Gilts at the open which only slowly faded through the session, helping buoy the broader space. The UK curve leaned bull flatter on the day.

- While below-expected German PPI helped an early Bund bid, the German curve twist flattened Wednesday, with short-end rates broadly unchanged amid ECB speakers bringing little new on near-term policy (Lagarde, Lane and Schnabel).

- Periphery spreads widened again in a continued reversal of the sizeable compression seen earlier in the year, with BTPs underperforming.

- The Federal Reserve decision is the focus overnight, with a busy Thursday that includes the Bank of England (MNI's preview here, noting that the MPC vote split and guidance will be in focus) and flash March PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at 2.925%, 5-Yr is down 0.7bps at 2.446%, 10-Yr is down 1.8bps at 2.432%, and 30-Yr is down 2.2bps at 2.589%.

- UK: The 2-Yr yield is down 2.6bps at 4.234%, 5-Yr is down 3.9bps at 3.915%, 10-Yr is down 4.1bps at 4.016%, and 30-Yr is down 3.4bps at 4.479%.

- Italian BTP spread up 2.7bps at 128.1bps / Spanish up 1.5bps at 81.5bps

EGB Options: Mixed Rates Trade Ahead Of Fed/BoE

Wednesday's Europe rates/bond options flow included:

- ERM4 96.37/96.25ps 1x2, bought the 1 for 1.5 in 9k total

- ERM4 96.75/97.00cs bought for 0.75 in 2.5k

- SFIM4 95.30/95.40/95.50c fly, bought for half in 5k

FOREX Greenback Weakens As May/June Fed Cut Not Categorically Ruled Out

- Dovish interpretations of the March FOMC press conference have weighed on the greenback late Wednesday, with the USD index reversing roughly 0.7% lower from intra-day highs, sitting down 0.3% on the session as we approach the APAC crossover.

- The focus has been on the Japanese Yen, following the earlier price action in USDJPY narrowing the gap substantially to the multi-decade inflection point at 151.91-95. The key resistance level has held, for now, and the ensuing reversal saw USDJPY briefly print fresh session lows at 150.73 before paring some of these losses back above 151.00. Initial firm support remains much lower at 149.06, the 20-day EMA, while overall, technical bulls remain in the driver’s seat.

- Regarding intra-day adjustments, US equities reaching fresh all-time highs have underpinned the Australian dollar, the standout performer on Wednesday. AUDUSD trades 0.80% in the green and clearance of resistance at 0.6668, the Mar 8 high, is required to resume the recent bull cycle and open 0.6708, a Fibonacci retracement.

- Half a percent gains for the likes of EUR, GBP, NZD and CAD show moderate outperformance to the DXY’s adjustment, with equities strength providing the key tailwind. This has also filtered through to strength in EM currencies, with ZAR, BRL and MXN all outperforming.

- GBPUSD will be in focus Thursday, as the BOE decision is due. Key resistance for the pair is at 1.2894, a break of which would resume the uptrend.

- Australia employment kicks off the data docket Thursday before flash PMIs from the Eurozone. The SNB will also decide on rates. Jobless claims, Philly Fed manufacturing and Flash PMIs highlight the US data docket.

FX Expiries for Mar21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0825-30(E911mln), $1.0900-20(E2.7bln), $1.0990-05(E1.9bln)

- USD/JPY: Y150.00($573mln)

- AUD/USD: $0.6500(A$1.0bln)

Late Equities Roundup: S&P Eminis New All-Time Highs

- Stocks surged to new all-time highs after the Federal Reserve held interest reates steady but projected three 25bp rate cuts by the end of this year. Currently, S&P E-Minis trades up 45.75 points (0.87%) at 5287.5 high, Nasdaq up 197.3 points (1.2%) at 16364.69, DJIA up 414.46 points (1.06%) at 39527.63.

- Leading Gainers: Consumer Discretionary and Communication Services sectors outpaced Industrials and Financial sectors that led in the firs half. Car and parts makers buoyed the former with Ford +4.55%, GM +2.65% Borg Warner +2.5%. Interactive media and entertainment shares supported Communication Services in the second half: Paramount surged 8.9% after Apollo Global Management offered $11B to buy the former's Hollywood Studios. Warner Brothers +2.59%, Take Two Interactive +2.21%.

- Laggers: Health Care and Energy sectors continued to underperform in late trade, pharmaceutical and biotech shares weighed on the former: Insulet -2.49%, AbbVie -1.95%, Moderna -1.78%. Oil and gas stocks traded weaker as crude prices remained under pressure at midday (WTI -1.70 at 81.77): Hess -1.37%, Chevron -0.88%, Diamondback Energy -0.37%.

E-MINI S&P TECHS: (M4) Trend Needle Points North

- RES 4: 5322.11 3.0% Bollinger Band

- RES 3: 5305.35 2.0% 10-dma envelope

- RES 2: 5300.00 Round number resistance

- RES 1: 5287.50 High Mar 20

- PRICE: 5282.50 @ 1535 ET Mar 20

- SUP 1: 5175.27 20-day EMA

- SUP 2: 5065.11 50-day EMA

- SUP 3: 4994.25 Low Feb 13

- SUP 4: 4921.00 Low Jan 31

The trend condition in S&P E-Minis remains bullish. Recent fresh cycle highs, reinforce current conditions and note that price action continues to highlight the fact that corrections remain shallow. This is an important bullish signal, reflecting positive market sentiment. Support to watch is 5175.27 the 20-day EMA. A clear break of this EMA would open 5065.11, the 50-day EMA. Sights are on 5300.00 next.

COMMODITIES Spot Gold Rises 1.2%, Keeps All-Time High In Sight

- Spot gold is up 1.2% on the day to $2,181/oz, with all the move occurring following the Fed decision as a dovish FOMC press conference weighed on the greenback. The USD index reversed roughly 0.7% lower from its intra-day highs as a May/June Fed cut was not categorically ruled out.

- The move brings the yellow metal within sight of the all-time cycle high of $2,195 reached earlier this month. The trend condition in gold is bullish and having cleared previous resistance at $2135, sights are on $2206.6 next, a Fibonacci projection.

- Crude futures have continued their pull back during the day, as US crude draws were in line with expectations.

- WTI is down 2.1% on the day at $81.7/bbl.

- For WTI futures, a bull theme remains intact and sights are still on $83.87 next, the Oct 20 ‘23 high. A break of this level would open $84.87, the Sep 15 ‘23 high and a key resistance. On the downside, support to watch is $78.44, the 20-day EMA.

- Henry Hub extended its losses on Wednesday, with downside driven by ongoing works at the Freeport LNG export terminal and high end of season storage levels.

- US natural gas APR 24 is down 2.9% at $1.69/mmbtu.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/03/2024 | 0030/1130 | *** |  | AU | Labor Force Survey |

| 21/03/2024 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 21/03/2024 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/03/2024 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 21/03/2024 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 21/03/2024 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 21/03/2024 | 0830/0930 | *** |  | CH | SNB PolicyRate |

| 21/03/2024 | 0830/0930 | *** |  | CH | SNB Interest Rate Decision |

| 21/03/2024 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 21/03/2024 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 21/03/2024 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 21/03/2024 | 0900/1000 | ** |  | EU | Current Account |

| 21/03/2024 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 21/03/2024 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 21/03/2024 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 21/03/2024 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 21/03/2024 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 21/03/2024 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 21/03/2024 | 1100/0700 | *** |  | TR | Turkey Benchmark Rate |

| 21/03/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 21/03/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 21/03/2024 | 1200/1200 |  | UK | BOE's Agents' summary of business conditions | |

| 21/03/2024 | 1200/1200 |  | UK | BOE's MPS and minutes | |

| 21/03/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 21/03/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/03/2024 | 1230/0830 | * |  | US | Current Account Balance |

| 21/03/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/03/2024 | 1335/0935 |  | CA | BOC Deputy Gravelle speech on balance-sheet normalization. | |

| 21/03/2024 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 21/03/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 21/03/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/03/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 21/03/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/03/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/03/2024 | 1600/1200 |  | US | Fed Vice Chair Michael Barr | |

| 21/03/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 21/03/2024 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

| 22/03/2024 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.