-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:Tsy Sec Yellen Spurs Late Safe Haven

HIGHLIGHTS

- YELLEN: PREPARED FOR ADDITIONAL DEPOSIT ACTIONS `IF WARRANTED', bbg

- UBS AIMS TO CLOSE CREDIT SUISSE DEAL AS SOON AS LATE APRIL, Bbg

- GRANHOLM: IT WILL TAKE A FEW YEARS TO REFILL US OIL RESERVE, Bbg

- BOE'S BAILEY: INFLATION TO COME DOWN `SHARPLY' FROM THIS SUMMER, Bbg

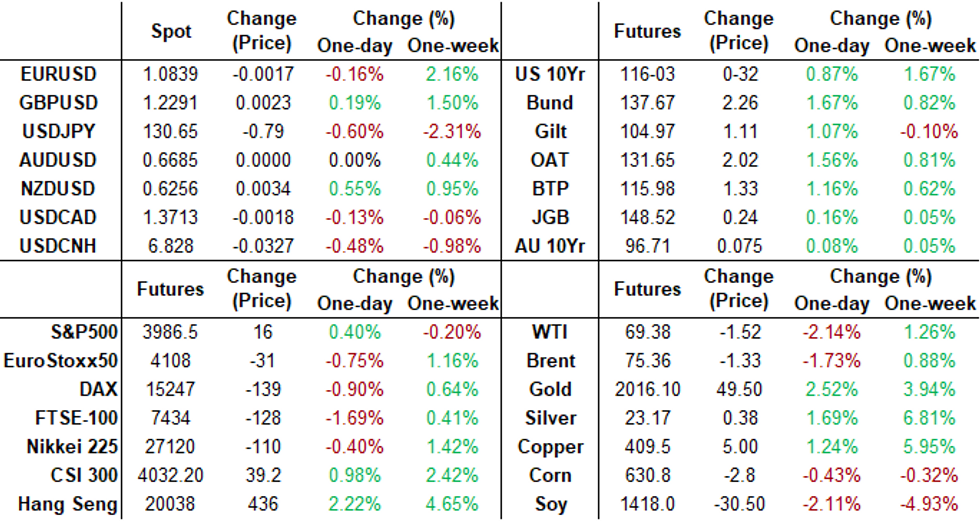

US TSYS: Yellen 2.0 Shakes Markets Up

- Treasury futures surged higher across the board in late trade, partially tied to the sell-off in sock indexes lead by banks while a safe haven tone accelerated even as Tsy Secretary Yellen attempted to softens her comments on deposit insurance yesterday, pledging additional actions "if warranted".

- Front month bonds initially surged to 132-01 high. reversed to 131-14 briefly before see-sawing back to 132-08 high

- SPX Emini futures had fallen to 3954.5 low are back near 3975 at the moment.

- Wednesday's testimony from Tsy Sec Yellen weighed on stocks after stating the Tsy is "not considering broad increase in deposit insurance", at odds with Chairman Powell's comment supportive of regional banks.

- Prepared text earlier than expected: Yellen to say "We have used important tools to act quickly to prevent contagion. And they are tools we could use again," she said in prepared testimony to Congress. "The strong actions we have taken ensure that Americans’ deposits are safe. Certainly, we would be prepared to take additional actions if warranted."

- Yield curves continue to climb off deeper inverted levels: 2s10s marking -38.116 high as short end rates outperform 2Y futures mark 103-30.25 high, yield 3.7535% low. In line, implied rate cuts by year end accelerate with Dec'23 cumulative -86.6 at 3.946%, Fed Terminal slips to 4.89% in May.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.24857 to 4.90714% (+0.24628/wk)

- 1M +0.04829 to 4.84529% (+0.01929/wk)

- 3M +0.05371 to 5.13371% (+0.13528/wk)*/**

- 6M +0.02757 to 5.14271% (+0.09042/wk)

- 12M -0.07423 to 5.10686% (+0.7272/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $92B

- Daily Overnight Bank Funding Rate: 4.57% volume: $281B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.203T

- Broad General Collateral Rate (BGCR): 4.52%, $512B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $499B

- (rate, volume levels reflect prior session)

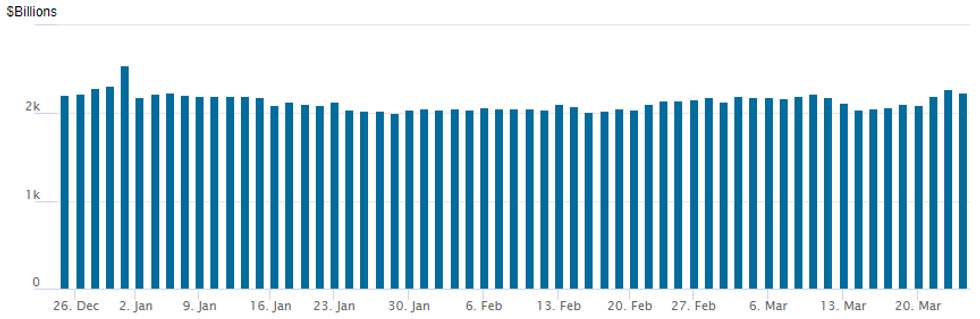

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,233.956B w/ 99 counterparties vs. the prior session's new high for 2023 of $2,.279.608B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Modest overall volumes despite the late session volatility. Accounts still trying to regroup following Wednesday's 25bp rate hike and dovish statement tempering forward guidance ("Some" firming "May" be appropriate), see underlying futures exploded late Thursday as Treasury Secretary Yellen testimony to the Senate shakes things up again. Overnight flow leaned toward better call interest with a couple decent put structures in SOFR options. Call trade turned two-way in the second half. Salient trade includes:- SOFR Options:

- Block, -23,750 SFRM3 95.18/95.43/95.68 call flys, 2.5 ref 95.305

- Block, total 10,000 OQM3 96.75/97.75 call spds, 25.25 net on splits ref 96.59 to -.595

- Block, 6,500 SFRJ3/SFRK3 95.06/95.18/95.37/95.50 call condor strip, 8.0

- 2,000 SFRJ3 94.68/94.75/94.81/94.87 put condor vs. SFRM3 95.00 puts

- 9,000 SFRJ3 95.00/95.18/95.31/95.43 put condors ref 95.28

- 5,000 SFRK3 95.06/95.18 call spds ref 95.31

- 2,500 SFRJ3 95.18/95.43/95.68 call flys ref 95.31

- 3,000 SFRM3 95.18 calls ref 95.28

- Block, total 17,102 SFRM3 94.43 puts, 1.5-1.0 vs. 95.32/0.07%

- Treasury Options:

- 2,600 TYM3 116/121 1x2 call spds, 60 ref 115-24.5

- 1,250 USK3 135/140 call spds, 42 ref 131-12

- 3,000 FVK 111/112/112.5 broken call flys ref 110-07.5

- 7,500 FVK3 112/114 call spds, 15 ref 110-04.25

- 4,600 TYK3 116.5 calls, 51 ref 115-12

- 2,500 FVK3 112/113.5 call spds ref 109-27.5

EGBs-GILTS CASH CLOSE: Bull Steepening As Hike Pricing Fades

EGBs and Gilts saw strong bull steepening Thursday as Wednesday's dovish Fed decision pulled down European central bank hike pricing.

- The BoE delivered a modest hawkish surprise with its 25bp hike on a 7-2 vote today. But the initial jump in terminal rate pricing of about 6bp faded over the course of the session with the focus on BoE's expectation for inflation to fade.

- Peak Bank Rate pricing dropped 16bp on the day, including 4bp compared with just before the BoE decision (just another 30bp of hikes are seen).

- ECB hike pricing faded along the same lines (terminal -10bp vs pre-Fed), with various hawks (including Muller) sounding half-hearted about future raises.

- Norges Bank and the SNB hiked by 25bp and 50bp respectively as expected.

- Periphery spreads edged wider with risk assets flat on the session.

- Little let-up ahead with UK retail sales data first thing Friday morning, followed by flash March PMI figures across Europe.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 18.1bps at 2.526%, 5-Yr is down 17.4bps at 2.198%, 10-Yr is down 13.3bps at 2.195%, and 30-Yr is down 7.2bps at 2.251%.

- UK: The 2-Yr yield is down 19.9bps at 3.295%, 5-Yr is down 15.9bps at 3.215%, 10-Yr is down 9.1bps at 3.36%, and 30-Yr is down 5.3bps at 3.833%.

- Italian BTP spread up 2.9bps at 187.1bps / Greek up 6.5bps at 195.2bps

EGB Options: Plentiful Euribor Rate Cut Trades

Thursday's Europe rates / bond options flow included:

- DUK3 105.9/106.00 call spread bought for 5.5 in 16k

- RXK3 129/128ps, bought for 5.5 in 4.7k

- OEM3 122/125cs, bought for 32 in 15k

- ERU3 98.00/99.00/100.00c fly, bought for 2.75 in 5k

- ERU3 98.00c bought for 7.75 in 25k total

- ERZ3 98.00c, bought for 13 in 25k total

FOREX: Late Safe Haven Demand As Equities Falter

- The greenback spent much of Thursday consolidating the post-FOMC decline. However, a late bout of weakness across equity markets, led by the decline in regional bank indices, spurred some solid demand for safe havens which benefitted both the greenback and the Japanese Yen.

- The likes of EURJPY and AUDJPY extended their losses to around 1% in the late session and despite a brief bout of turbulence over Yellen bank deposit headlines, USDJPY also printed fresh session lows below 130.40 approaching the APAC crossover.

- Fresh short-term trend lows for the pair maintains the current bearish price sequence of lower lows and lower highs and now exposes a move to 129.75, the 76.4% retracement of the Jan 16 - Mar 8 rally.

- EURUSD was unable to consolidate gains around the 1.09 handle and fell sharply towards the close. However, the pair maintains a firmer short-term tone overall. A clear breach of the Fibonacci hurdle at 1.0911 is required to strengthen bullish conditions and open 1.1000 and a key resistance at 1.1033, the Feb 2 high and a bull trigger. Initial firm support is seen at 1.0760, the Mar 15 high and a recent breakout point.

- UK retail sales on Friday before Eurozone data comes thick and fast throughout the morning, with French flash manufacturing and services PMI’s kicking off a raft of Eurozone data points. Capping off the week, durable goods and PMIs highlight the US docket.

FX: Expiries for Mar24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600-05(E1.7bln), $1.0675-80(E627mln), $1.0700-10(E1.4bln), $1.0800(E1.6bln), $1.0850(E539mln), $1.0875(E509mln), $1.0890-10(E656mln)

- USD/JPY: Y130.00($830mln), Y131.00($592mln), Y132.95-00($1.3bln), Y133.75($749mln)

- EUR/GBP: Gbp0.8900(E635mln)

- AUD/USD: $0.6700(A$669mln)

- USD/CAD: C$1.3600-05($606mln), C$1.3620-30($1.1bln)

- USD/CNY: Cny7.3635($1.4bln)

Late Equity Roundup: Reversing Midday Highs, Banks Fading (Again)

- So much for hopes of holding above the 50-day EMA technical resistance of 4023.28, a key level to strengthen bullish conditions. S&P Emini futures have reversed midday support and looking to test early overnight lows.

- Risk appetite is cooling as front month Emini futures tapped 3973.5 low last couple minutes - not far from late Wednesday low of 3968.75

- Key support at 3966.25, yesterday’s low - where a break would be deemed bearish. Next key support is 3839.25 Low, March 13.

- Current leading gainers are Communication Services (+1.64%) and Information Technology (+1.31%). Energy sector shares still underperform (-1.48%) while Financials sector has faded back near lows (-0.67%) as bank shares reverse course (CMA -9.25%, FRC -7.73%, Zion -6.74%).

E-MINI S&P (M3): Fails To Remain Above The 50-Day EMA - For Now

- RES 4: 4148.48 76.4% retracement of the Feb 2 - Mar 13 downleg

- RES 3: 4119.50 High Mar 6

- RES 2: 4089.39 61.8% retracement of the Feb 2 - Mar 13 downleg

- RES 1: 4023.28/4073.75 50-day EMA / High Mar 22

- PRICE: 3998.75 @ 13:35 GMT Mar 23

- SUP 1: 3966.25 Low Mar 22

- SUP 2: 3897.25/3839.25 Low Mar 20 / 13

- SUP 3: 3822.00 Low Dec 22 and a key support

- SUP 4: 3778.00 Low Nov 3

S&P E-Minis reversed sharply lower Wednesday. It is too early to tell whether the pullback marks the start of a bearish cycle. However, the move lower means that price has - so far - failed to hold above pivot resistance around the 50-day EMA. The average intersects at 4023.28 and a clear break is required to strengthen bullish conditions. Watch support at 3966.25, yesterday’s low - a break would be bearish. Key S/T resistance is at 4073.75.

COMMODITIES: Gold Briefly Clears $2000 Whilst Oil Slips With Risk-Off

- Crude oil reverses earlier gains to fall -1.5-2% on growing risk-off moves later in the session with added downward pressure from the US Energy Secretary Granholm saying SPR refills will take years and that it will be difficult to refill in the $70/bbl range this year.

- WTI is -2.2% at $69.37, having earlier cleared resistance at $71.31 (Mar 22 high) to open the 20-day EMA at $73.16 before retracing. After gains earlier in the week, it doesn’t test support at $66.90 (Mar 21 low).

- A mixed session sees most active strikes in the CLK3 at both $75/bbl calls and $60/bbl puts.

- Brent is -1.7% at $75.37, also having cleared $77.12 (Mar 22 high) but still clearly above support at $72.82 (Mar 21 low).

- Gold is +1.3% at $1996.2 after an earlier clearance of $2000 – read more here.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/03/2023 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 24/03/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/03/2023 | 0700/0800 | ** |  | SE | PPI |

| 24/03/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 24/03/2023 | 0730/0730 |  | UK | DMO to Publish Apr-Jun Gilt Op Calendar | |

| 24/03/2023 | 0800/0900 | ** |  | ES | PPI |

| 24/03/2023 | 0800/0900 | *** |  | ES | GDP (f) |

| 24/03/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/03/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/03/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/03/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/03/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/03/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/03/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/03/2023 | 1330/0930 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/03/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/03/2023 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 24/03/2023 | 1500/1500 |  | UK | BOE Mann Panellist at Global Independence Center Conference Ukraine | |

| 24/03/2023 | 1630/1630 |  | UK | BOE Announces Q2 Active Gilt Sales Schedule |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.