-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Soft on Short Session

- MNI US-CHINA: Sentiment Improves After Blinken-Xi Meeting, But Defense Issues Remain

- MNI US: Senate Appropriators To Meet Thursday Amid Government Shutdown Concerns

- ECB'S STOURNARAS SAYS POSSIBLE TO END RATE HIKES IN 2023, Bbg

US TSYS

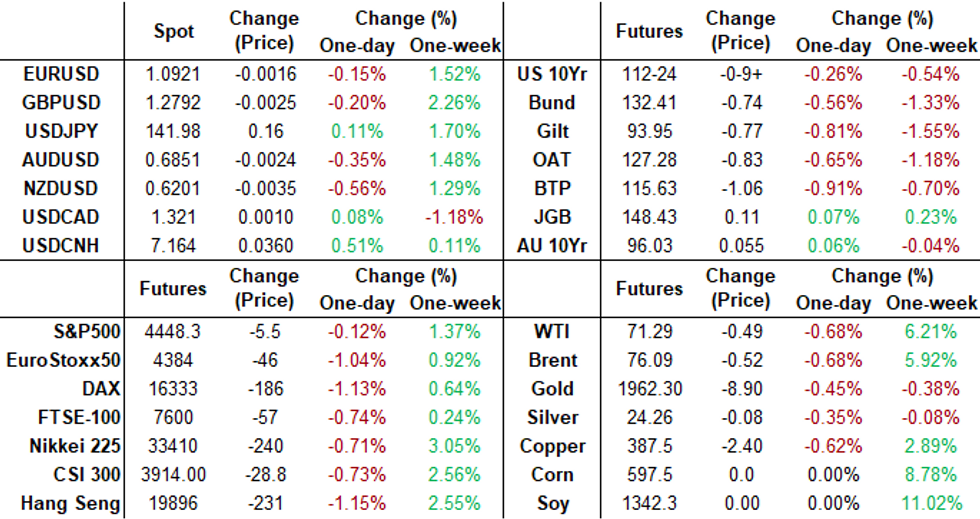

Juneteenth national holiday Monday, saw severely limited electronic trade and early closes in US markets. Treasury futures finished weaker across the board: front month 10Y futures -9.5 at 112-24, on very light volumes (under 190k).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- 1M +0.00614 to 5.16271%

- 3M +0.00429 to 5.51429 */**

- 6M -0.00957 to 5.65643%

- 12M +0.01814 to 5.89514%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.54443% on 6/9/23

EGBs-GILTS CASH CLOSE: UK Short-End Remains Under Pressure Pre-BoE

The UK curve bear flattened sharply Monday, with no relief evident at the short end ahead of CPI data and the BoE decision later this week. German yields leaned bear steeper.

- Short-end Gilt yields rose relentlessly from the open onward as BoE implied peak rates neared 6% in anticipation of Thursday's MPC move (25bp hike fully priced, with 20% prob of a 50bp raise). 2Y yields posted their 8th biggest daily rise of the year (nearly 14bp), closing at fresh post-2008 highs.

- ECB yields edged higher in sympathy with UK developments, with pressure maintained by a (characteristically) hawkish speech by Schnabel warning against the risks of underestimating inflation and doing too little tightening outweighing those of overtightening.

- Periphery EGB spreads finished modestly wider, with BTPs underperforming (a modest unwind after hitting 14-month tights to Bunds on Monday).

- German PPI is the data highlight early Tuesday, while we get multiple ECB speakers starting with Rehn and Muller, with Simkus at an MNI event later.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.7bps at 3.16%, 5-Yr is up 3.8bps at 2.62%, 10-Yr is up 4.3bps at 2.517%, and 30-Yr is up 5.3bps at 2.599%.

- UK: The 2-Yr yield is up 13.8bps at 5.083%, 5-Yr is up 11.1bps at 4.685%, 10-Yr is up 8bps at 4.492%, and 30-Yr is up 3.2bps at 4.557%.

- Italian BTP spread up 4.1bps at 160.4bps / Spanish up 1.4bps at 92.6bps

EGB Options: Bund Rolls, Modest Call Spread Buying

Monday's Europe rates / bond options flow included:

- RXQ3 137/140cs sold at 12.5 vs buying RXQ3 136/138cs for 17 in 17k (said to be rolling)

- RXN3 134/135cs 1x2, bought for 4.5 in 3.5k

FOREX: Greenback Firms, CNH Underperforms Amid US Holiday Thinned Trade

- It was no surprise that currency markets traded with a subdued tone as the US Juneteenth holiday kept volatility broadly in check. With that said, the greenback has traded with a surer footing, with the USD index rising around 0.3% on Monday. Antipodean FX consolidated early weakness amid waning risk appetite on the lack of detail on further Chinese stimulus.

- There was a similar story for the Chinese Yuan, with most of today’s onshore trading session dominated by a feeling of disappointment re: a lack of immediate stimulus announcements at the end of Friday’s State Council meeting with focus now on July’s Politburo meeting re: a potential ground for such announcements. Spot last deals just above CNH6.1600, ~350pips higher on the day, with the well-defined technical uptrend in the pair intact.

- Despite the considerable moves for gilts, there has been little impact on GBPUSD which actually trades 0.25% lower on the session amid the greenback strength. However, the pair is broadly consolidating its impressive advance last week, just below the 1.2800 mark. Moving average studies remain in a bull-mode condition reflecting current trend conditions and the focus turns to 1.2877, the Apr 25 2022 high.

- After breaking the top of a bull channel drawn from the Jan 16 high last week, USDJPY has confirmed a resumption of the uptrend, maintaining the bullish sequence of higher highs and higher lows. The pair has been consolidating on Monday and sits just below the 142.00 handle with the next target at 142.25, the Nov 21 2022 high.

- A very light data docket on Tuesday, void of tier-one releases. RBA minutes will be the highlight overnight before markets focus on UK CPI, due Wednesday.

US EQUITIES

Early close for national Juneteenth holiday, S&P E-Mini Future down 5.5 points (-0.12%) at 4448.25

COMMODITIES

- WTI Crude Oil (front-month) down $0.49 (-0.68%) at $71.29

- Gold is down $7.49 (-0.38%) at $1950.49

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/06/2023 | 0115/0915 | *** |  | CN | Loan Prime Rate |

| 20/06/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/06/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/06/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 20/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/06/2023 | 1030/0630 |  | US | St. Louis Fed's James Bullard | |

| 20/06/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 20/06/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.