-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Ylds Climb Off Lows Ahead FOMC

HIGHLIGHTS

- JAMIE DIMON LEAD EFFORTS FOR NEW FIRST REPUBLIC RESCUE PLAN: WSJ

- ECB'S VISCO: ECB MUST EVALUATE PACE, SIZE OF HIKES MEETING BY MEETING, Bbg

- ECB'S STOURNARAS: RATE HIKES ARE MOSTLY A STORY OF THE PAST, Bbg

- LAGARDE: READY TO ACT AS NEEDED ON PRICE, FINANCIAL STABILITY, Bbg

- AMAZON IS LAYING OFF AN ADDITIONAL 9,000 EMPLOYEES, Bbg

US TSYS: Yield Climb Amid Unwinds Ahead Wed's FOMC

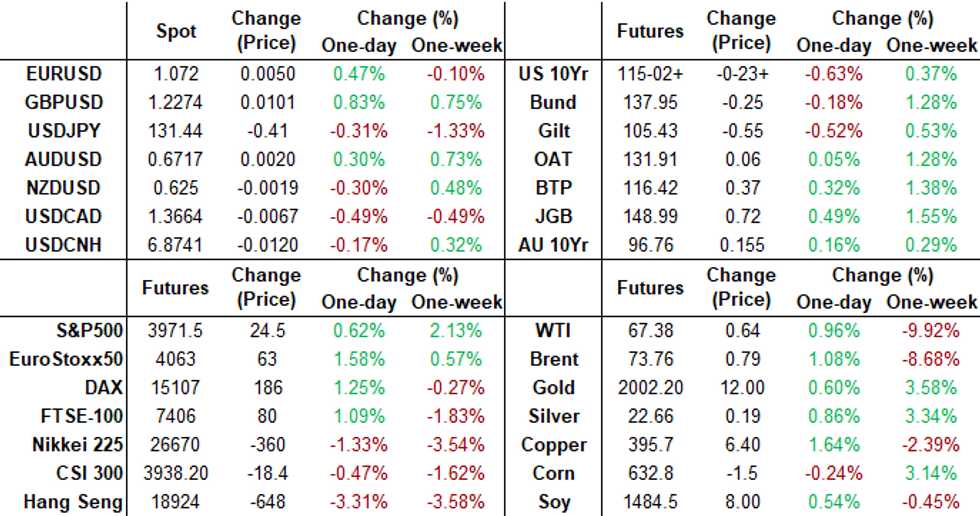

- Front month Treasury futures are trading near session lows after the bell. maintaining a relatively narrow range in the second half. Treasuries had traded moderately firmer in early London trade, unwinding support amid various Central Bank efforts to stem regional bank panic.

- Risk improved briefly after liquidity operations via standing U.S. dollar liquidity swap line arrangements announced Sunday, while the SNB also announced UBS's $3.25B takeover of Credit Suisse.

- Concerns over credit risk remained after CS' AT1 bond rout with holders of $17B debt taking the loss in full. A distracting narrative ahead of this Wednesday's FOMC policy announcement, the collapse of Silicone Valley Bank and Signature Bank over a week ago continues to weigh on regional banks (FRC -40%).

- While the collapse in financial shares over the past week have loosened policy expectations from: how many 50bp rate hikes by year end, to how soon will the Fed cut rates (implied pricing targeting July this morning), short end rates are traded lower (2Y yield currently 3.9177% +.0803), yield curves bear flattened amid ongoing wide ranges: 2s10s tapped -53.105 low earlier, vs. -33.080 overnight.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00529 to 4.55557% (+0.00372 total last wk)

- 1M -0.02542 to 4.75229% (-0.02086 total last wk)

- 3M -0.05129 to 4.94714% (-0.13971 total last wk)*/**

- 6M -0.20358 to 4.84871% (-0.37600 total last wk)

- 12M -0.33071 to 4.70343% (-0.70400 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $85B

- Daily Overnight Bank Funding Rate: 4.57% volume: $269B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.265T

- Broad General Collateral Rate (BGCR): 4.53%, $500B

- Tri-Party General Collateral Rate (TGCR): 4.53%, $484B

- (rate, volume levels reflect prior session)

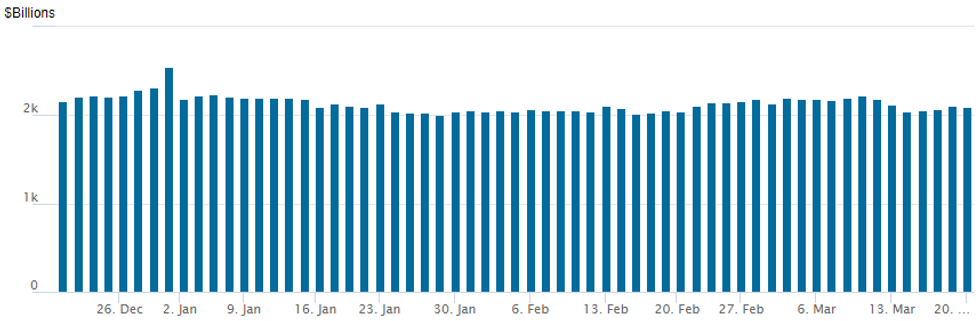

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,098.393B w/ 97 counterparties vs. prior session's $2,.106.166B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better overall call volume overnight carried over to the NY session with underlying futures trading firmer in the short end firmer as markets anticipate 25bp hike from the FOMC on Wednesday. Chasing direction, calls segued to puts in the second half as underlying futures looked to test early overnight lows.- SOFR Options:

- Block, 5,000 SFRU3 94.00/94.50 put spds, 6.0 ref 95.805

- Block, 6,000 SFRM3 95.00/96.00 1x2 call spds, 4.0 ref 95.54

- Block, 8,000 SFRM3 94.68/94.75 put spds 1.50 ref 95.54

- Block, 8,000 SFRM3 94.62/94.75 put spds 3.25 ref 95.54

- Block, 20,000 SFRZ3 94.50 puts, 14.0 vs. 96.21/0.15%

- Block, 5,000 SFRZ3 95.00/95.50 3x2 put spds, 10.5 vs. 96.04 to -.06/0.03%

- Block, 20,000 SFRZ3 94.50 puts, 14.0 vs. 96.21/0.15%

- Block, 15,000 SFRM3 96.00/97.00 call spds, 20.5-20.0 ref 95.63

- 19,000 SFRJ3 95.18/95.43/95.68 call flys, 11.0 ref 95.64 to -.615

- 2,000 2QM3 96.68/96.87/96.93/97.12 call condors

- 2,000 SFRK3 95.00/95.502x1 put spds ref 95.70

- 5,000 SFRJ3 95.43 calls 55.5 ref 95.615 to -.645

- 4,000 SFRJ3 94.62/94.87/95.12 put flys ref 95.675

- 2,000 3QM3 97.50/98.00 call spds ref 97.03

- 4,500 OQJ3 96.75/97.00 call spds, ref 96.94

- 2,000 OQM3 98.00/99.00 call spds, ref 96.88

- 4,000 SFRM3 94.12/94.37 put spds vs. SFRN3 94.00/94.12 put spds

- Treasury Options:

- over 9,000 FVJ3 108.25 puts, 7.5 ref 109-20.5 to -20.75

- over 18,800 FVJ3 108 puts, 4.5 ref 109-20.5

- over 13,600 FVJ3 108.5 puts, 10 ref 109-20.25

- 6,500 FVK3 111/112 call spds, 32 ref 110-02

- 3,000 USK3 123/124/126/127 put condors

- 3,000 TYJ 117/117.5 call spds, 10 ref 116-19

- Over 13,000 TYJ3 116.25/116.75 call spds, ref 115-24.5 to -06.5

FOREX: Greenback Extends Weakness, USD Index To Fresh One-Month Low

- The USD index looks set to post a third consecutive losing session, declining 0.35% on Monday and falling below last week’s lows of 103.44 in the process. Despite an early sell-off across equity markets, the greenback failed to garner any upward momentum during European hours and the subsequent bounce for risk has in turn weighed consistently on the US dollar.

- GBPUSD (+0.85%) has outperformed on the session, second to only the Swedish Krona. The pair has been grinding consistently higher to breach the mid-Feb resistance of 1.2269. A close and break above this mark would be a bullish development in the near-term, but the more solid upside level crosses at the Dec/Jan highs of 1.2446/48. GBP/JPY has also traded back into positive territory and has seen a near 1.5% recovery off the 158.97 session lows.

- In similar vein, the likes of the Euro and the Canadian dollar are making advances of around 0.5% amid the improved risk backdrop and market calm following the CS/UBS tie-up and the associated headlines concerning a write-down for Credit Suisse AT1 holders. Conversely, the Swiss Franc does remain under pressure with notable 0.75% gains for EURCHF, extending the bounce from last week’s lows and narrowing the gap with parity once more.

- RBA minutes and Canadian CPI highlight Tuesday’s docket. Focus the turns to Wednesday’s FOMC decision/statement. There aren't many sell-side analysts calling for a Fed hold this week, however of 25 FOMC previews we've reviewed so far (and only taking into account those written/updated at the end of last week or today, given how quickly events have moved), four see a pause, with the rest eyeing a 25bp hike.

FX: Expiries for Mar21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E565mln), $1.0665-75(E797mln), $1.0690-10(E2.0bln)

- USD/JPY: Y133.25-50($805mln)

- GBP/USD: $1.2100(Gbp504mln), $1.2150-70(Gbp570mln)

- USD/CAD: C$1.3690-10($945mln)

- USD/CNY: Cny6.9225($918mln), Cny6.9300($501mln), Cny6.9500($574mln)

Late Equities Roundup: Bank Shares Mostly Higher

Support for US equities continues, trading near session highs after a brief pullback into midday. Front month S&P futures currently trading around 3977.0, buoyed by Energy, Materials and ironically, Financial sectors

- Bank stocks bounced for the most part (the notable exception was First Republic, FRC, down 33% in the second half) after liquidity operations through standing U.S. dollar liquidity swap line arrangements announced Sunday.

- UBS's $3.25B takeover of Credit Suisse also announced Sunday, though risk appetite soured amid credit risk concerns after news CS' AT1 bond rout with holders of $17B debt taking the loss in full.

- From a technical standpoint, despite the recent gains, the trend condition in S&P E-Minis remains bearish. E-Minis have recently cleared a key support at 3960.75, the Mar 2 low, to confirm a resumption of the bear cycle that started Feb 2.

- The move lower signals scope for an extension towards 3822.00 next, the Dec 22 low. Initial firm resistance is seen at 4026.76, the 50-day EMA. A break of this EMA would alter the picture.

E-MINI S&P (M3): Resistance At The 50-Day EMA Remains Intact

- RES 4: 4244.00 High Feb 2 and key resistance

- RES 3: 4200.00 Round number resistance

- RES 2: 4119.50 High Mar 6

- RES 1: 4026.76 50-day EMA

- PRICE: 3975.00 @ 1510 ET Mar 20

- SUP 1: 3839.25 Low Mar 13

- SUP 2: 3822.00 Low Dec 22 and a key support

- SUP 3: 3778.00 Low Nov 3

- SUP 4: 3724.86 76.4% retracement of the Oct 13 - Feb 2 bull cycle

The trend condition in S&P E-Minis remains bearish and recent short-term gains, including today’s recovery, appear to be a correction. Price has recently cleared a key support at 3960.75, the Mar 2 low, to confirm a resumption of the bear cycle that started Feb 2. The move lower signals scope for an extension towards 3822.00 next, the Dec 22 low. Initial firm resistance is seen at 4026.76, the 50-day EMA. A break of this EMA would alter the picture.

COMMODITIES: Crude Oil Recovers To Edge Higher After Prior Week Slide

- Crude oil has edged higher today having reversed earlier downward pressure along with a recovery in equities and cross asset risk sentiment more broadly.

- However, up less than 1% on Friday’s close, it does little to claw back last week’s 13% slide for WTI (the largest since Apr’22), whilst the Brent Dec-Dec spread narrowed to its weakest level since Dec’21 as long-term demand fears still weigh.

- WTI is +0.9% at $67.31 off an intraday low of $64.12 that forms initial support after which sits a key support at $62.43 (Dec 2, 2022 low cont). Resistance is seen at $69.64 (Mar 17 high).

- In options space, most active strikes in the CLK3 have been at $75/bbl calls today.

- Brent is +0.8% at $73.52 off a low of $70.12 and round number support at $70. Resistance is seen at $70.57 (Mar 17 high).

- Gold is -0.3% at $1983.1 as it pulls back from a high of $2009.7 with a reversal of an earlier rally in Treasury yields, The clearance of the psychological $2000 handle further strengthens the current uptrend and opens $2034 (2.00 proj of Sep 28-Oct rally drawn from Feb 28).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/03/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 21/03/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 21/03/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 21/03/2023 | 1230/0830 | *** |  | CA | CPI |

| 21/03/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/03/2023 | 1230/1330 |  | EU | ECB Lagarde Panellist at BIS Summit | |

| 21/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/03/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.