-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Continue to React to Jobs Data

HIGHLIGHTS

- MNI US-EU: Treasury Sec Yellen To Meet Ger/Fra Counterparts Habeck And Le Maire Tues

- US PLANS 200% TARIFF ON RUSSIAN ALUMINUM AS SOON AS THIS WEEK, Bbg

- US KIRBY: BIDEN TO TALK STRATEGIC CHINA COMPETITION IN TUES. SPEECH

- BOE'S HUW PILL: US RATES MAY NEED TO STAY HIGHER FOR LONGER, Bbg

Key links: MNI US Employment Insight, Feb'23: Storming Report Helps Higher For Longer Theme / MNI POLICY: Swedish Wage Growth To Slow After This Year - NIER / US Treasury Auction Calendar / US$ Credit Supply Pipeline

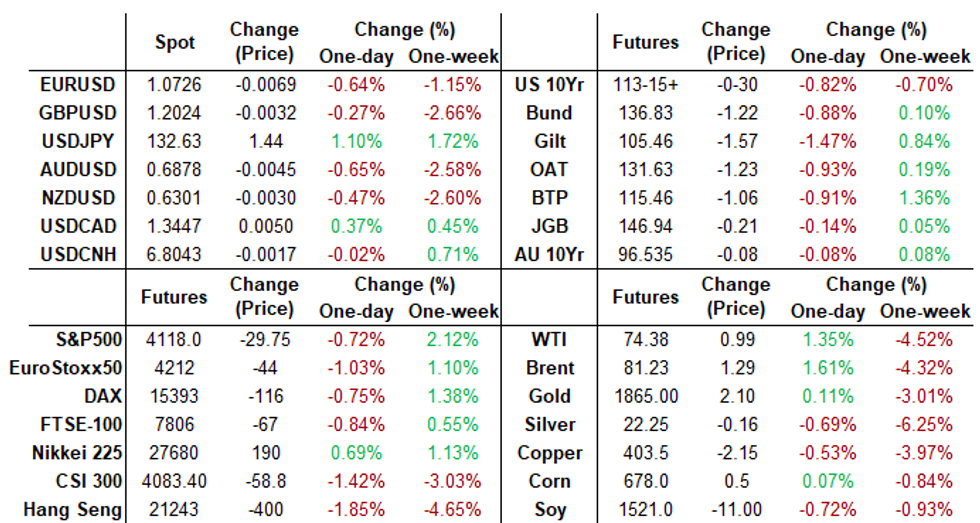

US TSYS: No React to Atlanta Fed Bostic, Focus on Fed Chair Talk on Tuesday

Still weaker, off opening levels - while yield curves extend inversion back near mid-Dec's multi decade lows: 2s10s currently -83.160 (-6.163) vs. Dec 7, 2022 low of -85.240 - last seen late 1981.

- Heavy volumes, TYH3 over 1.7M (two-thirds of which occurred in the first half) as FI markets continue to price in higher rates for long following last Fri's blowout January jobs surge (+517k vs. +189k est) while annual benchmark revision left a notably stronger than first thought trend through 2H22 and with strong revisions for hours worked.

- FED'S BOSTIC SAYS HIS BASE CASE IS STILL FOR TWO MORE HIKES

- FED’S BOSTIC SAYS MAIN JOB IS TO CONTROL INFLATION

- BOSTIC: NEED TO STUDY IF JAN. JOBS REPORT WAS ANOMALOUS

- Fed Chair Powell expected Tue at Economic Club of Washington interview (no text) time adjustment to Chairman Powell event to 1230ET, though Fed site has 1240ET. Link to Economic Club of DC..

- Fed VC Barr on financial inclusion (text and moderated Q&A) at 1400ET.

- Massive option volumes, particularly in SOFR derivatives favoring low delta puts and put spds on net.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.01186 to 4.56457% (+0.24800 total last wk)

- 1M +0.01643 to 4.58829% (-0.00701 total last wk)

- 3M +0.00900 to 4.84314% (+0.00885 total last wk)*/**

- 6M +0.08228 to 5.13971% (-0.04486 total last wk)

- 12M +0.15329 to 5.40443% (-0.06500 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.84314% on 2/6/23

- Daily Effective Fed Funds Rate: 4.58% volume: $104B

- Daily Overnight Bank Funding Rate: 4.57% volume: $284B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.216T

- Broad General Collateral Rate (BGCR): 4.52%, $470B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $459B

- (rate, volume levels reflect prior session)

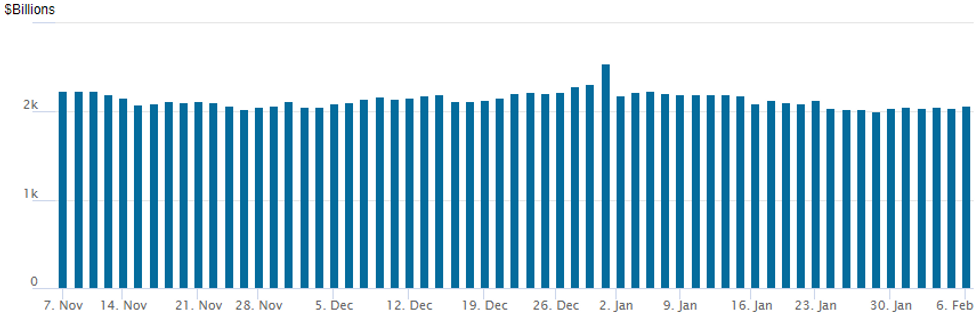

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,072.261B w/ 103 counterparties vs. prior session's $2,041.217B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

- SOFR Options:

- Block, total 20,000 SFRH3 95.00/95.06/95.12 put trees, 2.75

- Block, update total 25,000 2QH3 96.50 puts, 5.0-5.5 ref 96.86 to -.855

- Block, 10,000 SFRM/SFRU 94.68/94.75 call spd strip, 4.0

- Blocks, 20,000 SFRU3 94.25/94.62 put spds, 6.75 on splits ref 94.975

- Blocks, 20,000 SFRU3 94.31/94.68 put spds, 7.75 on splits ref 94.985

- Block, 15,000 SFRU3 94.37/95.25 put spds, 36.0 ref 94.99

- Blocks, 20,000 SFRM3 94.56/95.00 2x1 put spds, 13.0

- Block, 17,500 SFRJ3 94.68 puts, 2.75 vs. 94.935

- Block, 5,000 OQM3 95.75/96.00 put spds, 8.5 ref 96.275

- 40,000 SFRZ3 95.50/97.50 call spds

- Blocks, 10,000 SFRZ3 93.75/94.25 put spds, 3.0 ref 95.325

- Blocks, 11,400 SFRN3 95.56/95.87 call spds, 2.75

- Blocks, 35,000 SFRH3 95.06/95.12 2x1 put spds ref 95.10

- Block, 10,000 OQJ3 95.75/96.00 put spds, 6.75

- Block, 5,700 SFRN3 95.50/95.75 call spds, 3.0 ref 95.015

- Block 4,700 SFRN3 95.43/95.68 call spds, 3.5

- Block, 7,500 SFRJ3 94.68 puts, 2.5 vs. 94.935

- 12,000 SFRZ3 93.75/94.00 put spds, ref 95.34

- 9,000 OQJ3 95.50/95.75/96.00 put flys ref 96.30

- Block, 5,000 OQM3 95.50/96.00 put spd, 14.0 ref 96.265

- Block, 20,000 SFRM3 94.56/95.00 put spds, 13.0 ref 94.89 to .895

- Blocks, 11,500 SFRU3 95.00/95.50/96.00 call flys, 8.5 ref 95.03

- 18,000 SFRU3 94.81/94.87 put spds

- 14,000 SFRJ3 95.00/95.06/95.12 put flys ref 94.93

- Blocks, 7,000 SFRM3 94.62/94.75 put spds, 2.5 ref 94.93

- Block, 3,000 SFRZ3 95.75/96.75/97.75 call flys, 12.0 ref 95.365

- 7,500 SFRU3 94.50/95.75 strangles ref 95.035

- +15,000 SFRJ3 95.00/95.06/95.12 put flys, 0.5

- -10,000 SFRJ3 94.93/95.06 call spds, 4.0

- Block, 2,500 SFRH4 97.25/98.00 call spds, 6.0 ref 95.88

- Block, 4,000 SFRZ3 96.50/97.00 call spds, 3.5 ref 95.345

- Block, 8,000 SFRZ3 96.25/96.75 call spds, 5.0 ref 95.36

- 2,000 SFRU3 94.68/94.81/94.87/95.00 put condors ref 95.065

- 15,000 SFRM3 94.62/94.75 put spds, 2.5 ref 94.965

- 5,000 SFRN3 94.50/94.62 put spds, ref 95.055

- 5,200 SFRH4 97.00/96.62 call spds, ref 95.885

- Treasury Options:

- over 20,000 wk2 FV 109/109.25 call spds, 1.5 ref 108-16

- 10,000 TUM3 102.75/103.25 put spds, ref 102-27

- Block, 40,000 FVM3 111/112.5 call spds, 16.5-17 ref 109-04.5 -03.75

- 3,500 FVH3 108.5/109.25 put spds ref 108-19.75

- -20,000 FVH3 108/108.5 put spds, 12-12.5 ref 108-17

- over 31,500 TYH3 112.75 puts, 20 ref 113-25.5

- +18,000 TYH3 114.25/115.25 call spds vs. 113.25 puts 2 net ref 114-05

- +10,000 wk2 FV 107.5/107.75 put spds, 1.5

- 4,100 TYH 116 calls, 10

- 13,000 TYH3 112.5 puts, 12-13 ref 114-04.5 to -05

FOREX: USD Grinds Higher Extending Friday’s Sentiment, JPY & EMFX Underperform

- Currency markets had a similar feel to the end of last week on Monday as the post-payrolls relief rally for the greenback extended which sees the USD index registering gains of around 0.6% approaching the APAC crossover.

- With little data on the docket and an vacant speaker slate, the price action was uneventful as the USD steadily climbed throughout US trade. With core fixed income continuing to drift lower in the as markets reassess terminal rate pricing higher, the Japanese yen is among the worst performers in G10.

- This comes alongside overnight reports in the Nikkei that cited current BoJ deputy governor Amamiya as the name-in-the-frame to take over from Kuroda in a few months' time. Despite very swift denials from government spokespeople, markets have taken the prospect of an Amamiya adminstration as a signal of continuity for ultra-easy policy. USDJPY climbed as high as 132.90, within close proximity of touted resistance at 132.96, the 50-day exponential moving average.

- While other major currencies declined with a similar magnitude to the USD move, emerging market currencies were notable victims of the greenback squeeze.

- In CEEMEA, USDHUF (+2.20%) and USDZAR (+1.00%) are standouts and in LatAm, both the Mexican and Colombian pesos have come under further pressure. USDMXN is now roughly 4% above last Thursday’s low, which notably was a new marginal low from February 2020. Today’s break of 19.11 strengthens a bullish theme and signals scope for a stronger short-term recovery, towards the 19.40 handle initially with the December highs around 19.90 marking a more significant chart point.

- The RBA kicks off Tuesday’s overnight docket where it is widely expected to hike rates 25bp to 3.35% given the elevated Q4 CPI data. Thus, the focus is likely to be on any change in tone of the statement and indications of how the RBA's forecasts have changed.

FX: Expiries for Feb07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E829mln), $1.0700-20(E816mln) $1.0800(E1.3bln), $1.0830-50(E1.6bln), $1.0890-00(E1.1bln), $1.0990-00(E1.2bln)

- USD/JPY: Y130.00($1.1bln), Y133.50($500mln)

- GBP/USD: $1.1900-25(Gbp588mln)

- EUR/GBP: Gbp0.8850-70(E1.2bln)

Late Equity Roundup: Utilities, Consumer Staples Rally Late

Major indexes trading modestly weaker, inside narrow session range after the FI close, Communication Services and Information Technology sectors underperforming. SPX eminis currently trades -27.5 (-0.66%) at 4120.75; DJIA -56.64 (-0.17%) at 33871.06; Nasdaq -128.1 (-1.1%) at 11879.44.

- SPX leading/lagging sectors: Communication Services (-1.41%) continued to trade weak, weighed by media & entertainment shares: Activision off ahead Q4 earnings annc after the equity close (ATVI, -4.09%), DISH -2.75%, NWS -2.24%, Para -2.20%. Hardware and equipment makers weighed on IT: (FFIV -2.87%, HPQ -2.85%, TRMB -2.26%, STX -2.2%).

- Leaders: Utilities rallied late (+0.45%), outpacing Consumer Staples (-0.08%), Financials (-0.16%) and Consumer Discretionary both (-0.27%) the latter buoyed as Tesla continues to trade strong (TSLA +2.57%) while leisure product shares weighing on consumer durables and apparel.

- Dow Industrials Leaders/Laggers: McDonalds (MCD) +2.70 at 267.93, Caterpillar (CAT) +3.46 at 251.22, Travelers (TRV) +3.15 at 185.91. Laggers: Apple (APPL) -2.75 at 151.75, Home Depot (HD) -2.57 at 328.93 and American Express (AXP) -2.51 at 176.35

E-MINI S&P (H3): Uptrend Remains Intact

- RES 4: 4361.00 High Aug 16

- RES 3: 4300.00 Round number resistance

- RES 2: 4250.00 High Aug 26, 2022

- RES 1: 4208.50 High Feb 2

- PRICE: 4115.00 @ 1520ET Feb 6

- SUP 1: 4040.48 20-day EMA

- SUP 2: 4007.50/3985.04 Low Jan 31 / 50-day EMA

- SUP 3: 3901.75 Low Jan 19

- SUP 4: 3788.50 Low Dec 22 and a key support

S&P E-Minis traded higher last week and in the process cleared recent highs to confirm a resumption of the current bull cycle that started Dec 22. A key resistance and a bull trigger at 4180.00, the Dec 13 high, has been pierced. A clear break of this level would confirm a resumption of a broader uptrend and open 4250.00, the Aug 26 2022 high. Initial firm support lies at 4007.50, the Jan 31 low. The latest pullback is considered corrective.

COMMODITIES: Crude Oil Closing Higher After Bounce From Technically Oversold

- Crude oil has edged out gains after Friday’s losses following payrolls and ISM beats despite Treasury yields and the USD continuing to climb for a second day. The move firmer came after pulling back from an earlier slide on oil demand concern which pushed it briefly into technically oversold territory.

- WTI is +1.0% at $74.10 off a low of $72.28 that briefly cleared a key support at $72.74 (Jan 5 low) that could next open the bear trigger at $70.56 (Dec 9 low).

- Brent is +1.2% at $80.90 off a low of $79.13 that remained above the Jan 5 low of $77.77.

- Gold is +0.3% at $1870.22 as it holds up surprisingly well against a stronger USD backdrop, still seeing support at Friday’s post-payrolls/ISM low of $1861.4 whilst resistance remains the 20-day EMA at $1903.4.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/02/2023 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 07/02/2023 | 0030/1130 | ** |  | AU | Trade Balance |

| 07/02/2023 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 07/02/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 07/02/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/02/2023 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/02/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/02/2023 | 0900/0900 |  | UK | BOE Ramsden Intro at UK Women in Economics Event | |

| 07/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/02/2023 | 1015/1015 |  | UK | BOE Pill Chairs UK Women in Economics Panel | |

| 07/02/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 07/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/02/2023 | 1430/1430 |  | UK | BOE Cunliffe Speech at UK Finance | |

| 07/02/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/02/2023 | 1700/1800 |  | EU | ECB Schnabel in Finanzwende e.V. Webinar | |

| 07/02/2023 | 1730/1230 |  | CA | BOC Governor Macklem speech/press conference in Quebec City | |

| 07/02/2023 | 1740/1240 |  | US | Fed Chair Jerome Powell | |

| 07/02/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/02/2023 | 1900/1400 |  | US | Fed Vice Chair Michael Barr | |

| 07/02/2023 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.