-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Gain Ahead Thu's GDP, PCE, PMI

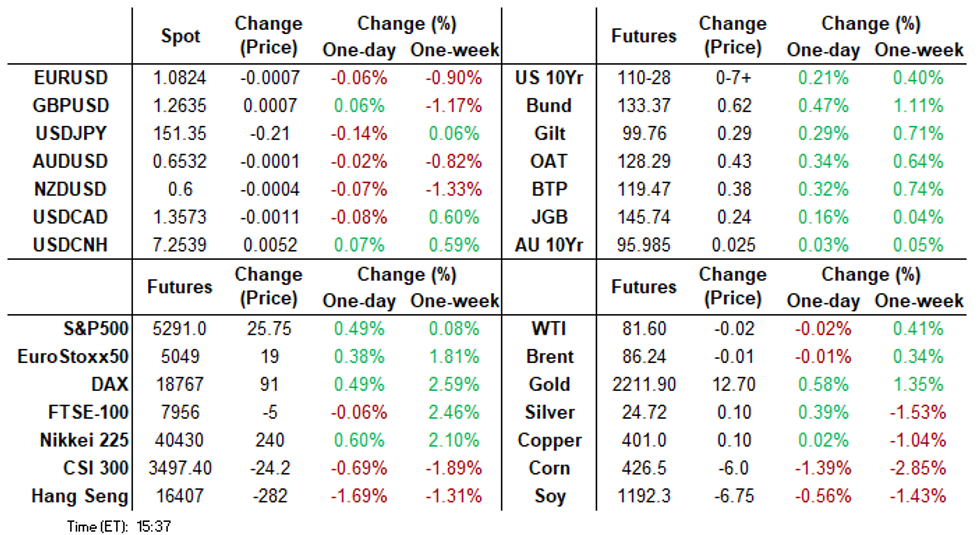

- Treasuries traded higher Wednesday, partially driven by month end extensions and result of strong 7Y auction.

- Treasury futures actually climbed to the highest level since March 14 post auction before sellers emerged.

- Relatively quiet midweek session focus on Thursday's Weekly Claims, GDP, PCE, PMI, UofM Sentiment.

US TSYS Near Week Highs, Month End, Strong 7Y Note Sale, Fed Waller Tonight

- Treasuries are trading higher after the bell, partially driven by month end extensions and result of strong 7Y auction. Futures actually climbed to the highest level since March 14 (TYH4 110-31.5 last - testing 50-day EMA resistance) after the $43B 7Y note auction (91282CKC4) stopped through with 4.185% high yield vs. 4.192% WI; 2.61x bid-to-cover vs. 2.58x last month.

- Jun'24 10Y futures receded to 110-28.5 (+8) by the bell, rather modest volumes on the shortened Easter Holiday week. Sole data: MBA composite mortgage applications fell for the second consecutive week, by a seasonally adjusted -0.7% in the week to March 22, with purchases -0.2% and refis -1.6%.

- Fed Governor Christopher Waller will discuss his economic outlook at an event hosted by the Economic Club NY this evening at 1800ET, text and Q&A is expected.

- Focus on Thursday's Weekly Claims, GDP, PCE, PMI, UofM Sentiment.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00282 to 5.32734 (-0.00137/wk)

- 3M -0.00751 to 5.30191 (-0.01057/wk)

- 6M -0.00109 to 5.22404 (-0.00496/wk)

- 12M +0.00224 to 5.01214 (+0.00836/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.849T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $664B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $656B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $238B

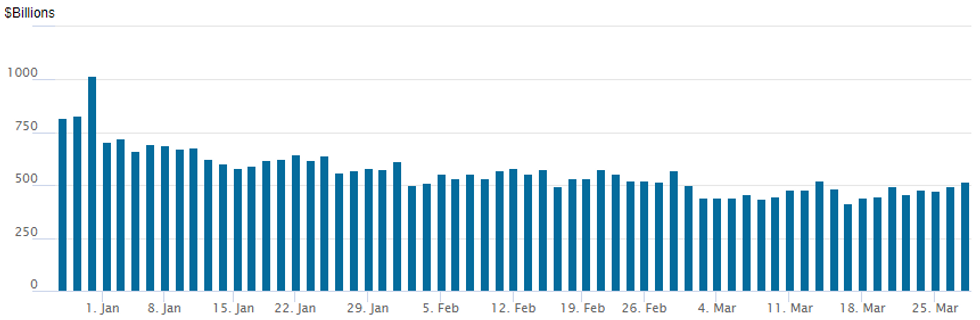

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbed back over $500B hurdle to $518.357B today vs. $496.062B on Tuesday. Compares to Friday, March 15 when usage fell to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties climbed to 83 vs. 73 yesterday (compares to 65 on January 16, the lowest since July 7, 2021)

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury option trade remained mixed Wednesday, repositioning after underlying futures broke narrow overnight range earlier. Projected rate cut pricing regained some traction: May 2024 at -15.0bp from -13.9% this morning w/ cumulative -3.7bp at 5.291%; June 2024 -63.1% w/ cumulative rate cut -19.5bp at 5.134%. July'24 cumulative at -30.06bp vs. -29.6bp, Sep'24 cumulative -49.3bp from -48.6bp.

- SOFR Options:

- +10,000 SFRU4 94.62 puts, 1.25 ref 95.18

- +5,000 SRZ4 94.75/95.25 strangles, 47.0 vs. 95.50/0.56%

- +5,000 SFRN4 95.50 puts, 0.50 ref 95.17

- -4,000 SFRU4 95.25/95.50 call spds vs. 12,000 SFRU4 94.50/94.75 put spds, 0.5 net ref 95.175

- +10,000 SFRZ4 95.00/95.25/95.50/95.62 broken put condors 0.0-0.25

- +2,000 SFRU4 95.50/96.00 call spds, 4.0

- +2,000 SFRJ4 95.12/95.37 call spds, 0.25

- -2,000 SFRZ6 96.50 calls 65.0 vs. 96.40/0.40%

- Block, 5,000 SFRZ4 95.18/95.50 put spds 5.0 over SFRZ4 96.00/97.25 call spds ref 95.465

- 3,400 SFRM4 95.12/95.25 put spds ref 94.89

- Block, 3,000 0QJ4 96.06 calls, 6.5 ref 95.96

- Block 3,000 SFRM4 94.81/0QM4 96.31 call spds, 1.5

- 5,000 SFRZ4 95.18/95.31 put spds vs. 2,500 SFRZ4 96.00/97.25 call spds ref 95.46

- 4,000 SFRK4 94.68/94.75 put spds ref 94.885

- 3,000 3QK4 96.50 calls ref 96.36

- Treasury Options:

- 8,000 TYK4 109/109.5 1x2 put spreads (wrong way) ref 1134:57ET

- 2,500 TYK4 111/113 call spds vs. TYK4 108.5 puts, 24 net/call spd over

- 1,900 FVK4 105/106 put spds

- 2,500 TUK4 102.12/102.25/102.37 call flys ref 102-09.25

EGBs-GILTS CASH CLOSE: Further Gains Going Into Month/Quarter-End

Bunds and Gilts rallied again Wednesday, with gains extending toward the close.

- With an eye on month/quarter-end Thursday (markets are closed Friday), rebalancing dynamics were seen as positive for global core bonds.

- A positive tone was set early in the session with modestly below-consensus inflation data from Spain, which was the first glimpse of the flash March round that ends next Wednesday.

- While futures volumes were relatively limited for most of the session, strength was evident across both the German and UK curves, with bellies outperforming.

- Periphery EGB spreads widened slightly, though no particular catalyst was evident.

- Eurozone data Thursday includes flash Portuguese and Belgian inflation, with German labour market indicators and retail sales also of interest - and appearances by ECB's Panetta and Villeroy.

- UK data to end the shortened week consists of final Q4 GDP.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.3bps at 2.829%, 5-Yr is down 5.8bps at 2.313%, 10-Yr is down 5.8bps at 2.292%, and 30-Yr is down 5.1bps at 2.456%.

- UK: The 2-Yr yield is down 3.7bps at 4.144%, 5-Yr is down 4bps at 3.817%, 10-Yr is down 3.9bps at 3.932%, and 30-Yr is down 3.4bps at 4.422%.

- Italian BTP spread up 1.8bps at 132.1bps / Spanish bond spread up 1.2bps at 84.3bps

EGB Options: Active Session For Euribor Options

Wednesday's Europe rates/bond options flow included:

- OEK4 119/117.5ps 1x2 sold 60.5 in 3k (ref 118.10)

- ERM4 96.50/96.37ps, sold at 10 in 4k

- ERM4 96.75/96.87cs 1x2, bought for 1.5 in 5k

- ERQ4 96.50/96.62/96.75b fly, bought for 2.25 in 5k

- ERU4 96.25/96.00ps, bought for 1.5 in 6k

- 0RM4 97.87c vs 2RM4 98.00/98.37cs, bought the 1yr for 0.25 in 8k total

FOREX JPY Moves Contained Despite Strengthening Rhetoric, USDMXN Selloff Extends

- The Japanese yen was in focus Wednesday, as Bank of Japan, Ministry of Finance and FSA officials met to discuss financial markets, raising speculation that currency market intervention could be imminent.

- USDJPY traded as low as 151.03 amid firmer language on speculative weakening in the yen and the ability to counteract these moves. Earlier on Wednesday, USDJPY traded to the highest level since 1990 at 151.97. Subsequently, MOF Kanda’s press conference failed to spark a further correction lower for USDJPY and the pair has since traded in a tight range between 151.20-40 as markets contemplate the developments ahead of the long holiday weekend.

- Diverging monetary policy trajectories and this verbal intervention could place CHF in a particularly vulnerable position to further yen strength at this juncture, corroborated by CHFJPY (-0.35%) trading below 167.00 this morning, and printing a fresh three-month low for the cross.

- Elsewhere in G10, major currency pairs and the dollar index held very narrow ranges. Both EURUSD and GBPUSD extremes are roughly 30 pips apart.

- Perhaps most the interesting development occurred in emerging markets with USDMXN breaking key support and trading at the lowest level since 2015. The next target for the selloff resides at 16.4218, a Fibonacci projection.

- Initial easing from the central bank has not weighed on the MXN, as analysts have highlighted there remains room for carry compression without a negative impact on the currency. Furthermore, the low vol environment remains supportive for high carry FX, local fundamentals remain solid and election risk premium remains low.

- Australia MI Inflation Expectations and February retail sales data are highlights overnight on Thursday, before German retail sales figures. Later in the day, final readings for Q4 US GDP, initial jobless claims, MNI Chicago PMI and pending home sales are all scheduled, alongside Canada January GDP.

FX Expiries for Mar28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675(E710mln), $1.0700-15(E1.7bln), $1.0750-52(E803mln), $1.0815-30(E2.4bln), $1.0840-50(E1.7bln), $1.0925(E544mln)

- USD/JPY: Y148.25($894mln), Y150.00($1.3bln), Y150.50($2.9bln), Y151.00($732mln), Y152.00-25($2.8bln)

- GBP/USD: $1.2600(Gbp1.1bln), $1.2700-09(Gbp569mln)

- USD/CAD: C$1.3585-00($1.6bln), C$1.3625($744mln)

- USD/CNY: Cny7.2500($1.2bln)

Late Equities Roundup: Inching Higher

- Inside relatively narrow ranges, stocks are inching higher in late session trade, the DJIA still outperforming. Currently, DJIA is up 310.8 points (0.79%) at 39592.52, S&P E-Minis up 17.75 points (0.34%) at 5283, Nasdaq up 18.5 points (0.1%) at 16334.68.

- Leading Gainers: Utility and Real Estate sectors outperformed in the second half, water and multi-energy providers supported the Energy sector: Eversource +4.17%, CenterPoint Energy +3.31%, Dominion Energy +3.15%. Real estate investment trusts, particularly industrial and retail REITS buoyed the latter: Extra Space Storage +3.03%, Public Storage +3.25% Healthpeak Properties +3.02%.

- Laggers: Reversing prior session gains media and entertainment shares weighed on the Communication Services sector in late trade: Netflix -2.42%, Match -0.73%, Meta -0.62%. Meanwhile, chip stocks weighed on the Information Technology sector as trading accounts squared up ahead the extended Easter holiday weekend: Arista Networks -3.88%, ServiceNow Inc -2.64%, Nvidia -2.42%.

E-MINI S&P TECHS: (M4) Trend Structure Remains Bullish

- RES 4: 5428.25 1.00 proj of the Oct 27 - Dec 28 - May 1 price swing

- RES 3: 5407.23 Bull channel top drawn from the Jan 17 low

- RES 2: 5400.00 Round number resistance

- RES 1: 5322.75 High Mar 21 and the bull trigger

- PRICE: 5278.50 @ 1515 ET Mar 27

- SUP 1: 5245.60 Bull channel base drawn from the Jan 17 low

- SUP 2: 5218.00 20-day EMA

- SUP 3: 5157.00 Low Mar 11

- SUP 4: 5104.90 50-day EMA

The trend condition in S&P E-Minis is unchanged and remains bullish. Last week’s extension reinforces this theme and the break of 5257.25, Mar 8 high, confirmed a resumption of the uptrend. Note that moving average studies remain in a bull-mode position reflecting positive market sentiment. Sights are on 5407.23, the top of a bull channel drawn from the Jan 17 low. Initial firm support is 5218.00, the 20-day EMA. A move lower is considered corrective.

COMMODITIES Spot Gold Rises For A Third Session Running

- Spot gold has risen for a third session running and is currently up 0.6% on the day at $2,191/oz.

- Sights are still on $2230.1 next, a Fibonacci projection, while key short-term trend support has been defined at $2146.2, the Mar 18 low.

- Oil prices are broadly unchanged Wednesday, despite a surprise build in US crude inventories. A Bloomberg survey had expected a small draw, while API data had suggested a large build.

- WTI MAY 24 is currently unchanged on the day at $81.6/bbl.

- For WTI futures, a bull theme remains intact. Sights remain on $83.87 next, the Oct 20 ‘23 high. Support to watch is $79.83, the 20-day EMA.

- For Brent, JPMorgan maintains a baseline view for prices to reach $90/bbl by May, and $85/bbl in H2 2024, but has the potential to rally to $100/bbl this year.

- Meanwhile, the Henry Hub May24 contract showed weakness Wednesday, driven by curtailed LNG feedgas flows and high end of winter storage flows.

- US Natgas MAY 24 is down 3.8% at $1.72$/mmbtu.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/03/2024 | 0030/1130 | ** |  | AU | Retail Trade |

| 28/03/2024 | 0700/0700 | *** |  | UK | GDP Second Estimate |

| 28/03/2024 | 0700/0700 | * |  | UK | Quarterly current account balance |

| 28/03/2024 | 0700/0800 | ** |  | DE | Retail Sales |

| 28/03/2024 | 0700/0800 | ** |  | SE | Retail Sales |

| 28/03/2024 | 0800/0900 | ** |  | CH | KOF Economic Barometer |

| 28/03/2024 | 0855/0955 | ** |  | DE | Unemployment |

| 28/03/2024 | 0900/1000 | ** |  | EU | M3 |

| 28/03/2024 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/03/2024 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/03/2024 | 1100/1200 | ** |  | IT | PPI |

| 28/03/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 28/03/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/03/2024 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/03/2024 | 1230/0830 | * |  | CA | Payroll employment |

| 28/03/2024 | 1230/0830 | *** |  | US | GDP |

| 28/03/2024 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 28/03/2024 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 28/03/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 28/03/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/03/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 28/03/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/03/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/03/2024 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 28/03/2024 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 29/03/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 29/03/2024 | 2330/0830 | * |  | JP | Labor Force Survey |

| 29/03/2024 | 2350/0850 | * |  | JP | Retail Sales (p) |

| 29/03/2024 | 2350/0850 | ** |  | JP | Industrial Production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.