-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Near Lows on Strong PPI

- MNI US: Looming UAW Strike Further Complicates Biden's Bid For Union Support In 2024

- MNI US: WaPo: Biden Admin Prepares Aid To Insulate Smaller Firms From UAW Strike

- LAGARDE: CAN'T SAY THAT ECB RATES HAVE REACHED THEIR PEAK, Bbg

- LAGARDE: SOLID MAJORITY OF ECB MEMBERS AGREED WITH DECISION, Bbg

US TSYS Rates Hold Lows After Stronger PPI, Stocks 1-Wk Highs

- Treasury futures trading sideways after quietly extending session lows in late trade, intermediates to bonds lead move off midmorning levels as curves rebounded: 3M10Y +6.674 at -118.025, 2Y10Y -.244 at -72.742 vs. -76.154 low.

- Current TYZ3 futures at 109.24 (-8.5) still above initial technical support of 109-03 (Sep 13 low) followed by 109-00 (round number support).

- No obvious headline driver for the drift lower in the second half (though markets await formal annc of a UAW strike, not to mention the impending shutdown as UIS Gov expected to run out of capital at the end of the month.

- Knock-on factors: stronger than expected PPI and lower than expected weekly claims reversed a post-ECB rate hike bid earlier (rally tied to policy statement that was less hawkish than expected).

- Stocks are grinding to new two week highs, ignoring for the moment projected rate hike increase in early 2024. Meanwhile, the US$ gains strength (BBDXY +3.4 to 1253.99), and crude prices forge higher: WTI +1.89 at 90.41.

- Friday focus: Import/Export Price index, Industrial Production/Capacity Utilization and UofM Sentiment.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00163 to 5.33057 (+0.00111/wk)

- 3M +0.00066 to 5.41009 (-0.00038/wk)

- 6M +0.00417 to 5.47767 (+0.00570/wk)

- 12M +0.00501 to 5.43665 (+0.01273/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $104B

- Daily Overnight Bank Funding Rate: 5.32% volume: $264B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.385T

- Broad General Collateral Rate (BGCR): 5.30%, $570B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $556B

- (rate, volume levels reflect prior session)

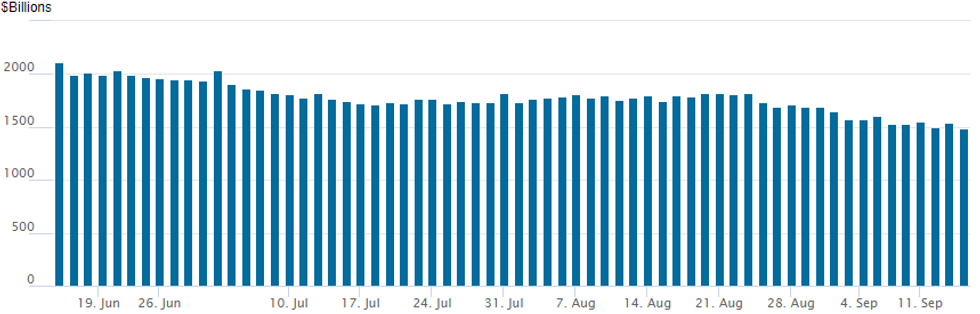

FED REVERSE REPO OPERATION: Back to Extending Lows

NY Federal Reserve/MNI

Repo operation falls back new lowest level since early March 2022: 1,492.427B w/97 counterparties, compared to $1,546.225B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION ROUNDUP

FI option trade remained mixed through Thursday's session, SOFR options seeing slightly better low delta call and call spreads in the second half. Reminder, Sep SOFR options expire Friday, seeing a steady trickle of position unwinds and position rolls. Underlying futures trading firmer in the short end vs. weaker long end. Rate hike projections through year end cooling slightly: Sep 20 FOMC is 2.3% w/ implied rate change of +0.06bp to 5.338%. November cumulative of +8.8p at 5.420, December cumulative of 10.8bp at 5.439%. Fed terminal has slipped to 5.435% in Jan'24.

- SOFR Options:

- Block, 7,270 SFRZ4 97.25/97.75 call spds 5.5 ref 95.565

- -15,000 SFRH4 96.00/97.00/98.00 call flys, 1.75

- Block, 6,000 SFRX3 94.43/94.56 put spds, 5.5 vs. 94.535/0.22%

- +2,500 SFRU4 96.25/97.75/99.25 call flys, 11

- 6,700 SFRH4 94.87/95.25 call spds ref 94.685 to -.675

- 4,000 SFRZ3 94.37/94.43/94.50 put flys

- 2,000 SFRX3 95.06 calls, 1.75 ref 94.545

- 5,700 SFRZ3 95.56 calls, 2.0 ref 94.545

- 6,000 SFRH4 94.43/94.62 ref 94.68

- 3,000 0QU3 96.00/96.25 put spds ref 95.27

- 2,500 SFRU3 98.25/98.50 call spds ref 95.265

- 4,000 SFRV3 94.25/94.50 put spds ref 94.545

- 3,500 SFRV3 94.62 calls, 2.5 last

- Treasury Options:

- 4,700 TYV3 111/111.5 1x2 call spds, 1 ref 109-31

- over +14,700 TYX3 109.5 puts, 47 ref 110-00

- 6,000 FVV3 106 puts puts, 11 ref 106-11.75

- 7,500 TYV3 109 puts, 7 ref 110-05.5

- over 3,000 TYV3 110 puts, 27 ref 110-05.5

- over 6,300 wk3 TY 109.5puts, 2 ref 110-01.5

- over 5,700 wk3 FV 106.5 calls, 1 ref 106-02.75

- 2,000 TUV3101.75 calls ref 101-19.62

- over 3,100 TYV3 109 puts, 9 last

- 2,000 FVV3 105.75 puts, 8.5 ref 106-10.25

EGBs-GILTS CASH CLOSE: Belly Outperformance On Dovish ECB Hike

European yields fell Thursday, with curve bellies outperforming as the ECB was seen to have delivered a dovish hike.

- While the ECB's decision to hike its policy rates by 25bp was not fully priced (around 70% probability implied beforehand), leading to a knee-jerk jump in yields, a reversal swiftly followed.

- The accompanying statement implied that the Governing Council saw this as the last hike in the cycle ("rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target").

- The 2Y and 30Y segments lagged the rally across both the German and UK curves, with the policy-rate sensitive belly of the curve noticeably outperforming as European central banks are increasingly seen nearing the end of tightening.

- Periphery spreads fell sharply after the decision, helped by Lagarde brushing off talk of curtailing PEPP.

- Friday morning sees some final Aug inflation data and the Euro labour force survey, along with appearances by ECB's Villeroy and Lagarde.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.4bps at 3.166%, 5-Yr is down 6.2bps at 2.62%, 10-Yr is down 5.8bps at 2.593%, and 30-Yr is down 2.6bps at 2.727%.

- UK: The 2-Yr yield is down 3.5bps at 4.95%, 5-Yr is down 8.4bps at 4.481%, 10-Yr is down 6.6bps at 4.281%, and 30-Yr is down 5.6bps at 4.608%.

- Italian BTP spread down 4.9bps at 174.7bps / Spanish bond spread down 2.3bps at 104.8bps

EGB Options: Mixed Rates Trade, Mostly Pre-ECB

Thursday's Europe rates / bond options flow included:

- RXX3 131.00/132.00/132.50 broken c fly bought for 2 in 2k

- SFIZ3 94.40/94.55/94.70c fly vs SFIZ3 94.00p, bought the fly for half in 2k

- ERV3 96.00/96.12cs 1x1.5, bought the 1 for 3.5 in 6k

- ERF4 96.125/96.00/95.875p fly, bought for 3 in 4.25k

FOREX Post-ECB Euro Weakness Extends, EURUSD Prints Six-Month Low

- Despite a very brief spike on the moderately surprising 25bp hike from the ECB, downgrades to Eurozone growth forecasts and a potentially dovish signal on rate guidance has prompted some significant weakness for the single currency on Thursday.

- Since the decision and President Lagarde’s press conference, any upticks for the single currency have been met with solid supply. EURUSD has continued to edge lower over the course of the US session, extending intra-day lows and most recently piercing a key support level from earlier this year.

- The May 31 low at 1.0635 has represented the key short-term support and a sustained breach will solidify the current downtrend in place. Below here we have 1.0611, the 38.2% Fibonacci retracement Sep’22 - Jul’23 upleg, before 1.0516 the Mar 15 low and a key medium-term support.

- EURJPY has now crossed below its 50-day EMA at 156.95 but more notably, the likes of EURAUD, EURCAD have extended losses to over 1%, as the more optimistic tone for equity markets adds particular weight to Euro crosses.

- Elsewhere, the USD index is rising 0.58% on the back of better-than-expected US August retail sales data, leaving little to support a bearish near-term US growth view. Higher US PPI figures are also underpinning the greenback resilience.

- In response, the trend needle in GBPUSD (-0.70%) continues to point south and the pair has traded to a fresh cycle low today, a few pips below the 124.00 handle. This confirms a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs.

- Chinese industrial production and retail sales overnight will be the next important release for global risk sentiment. For the Eurozone, final French CPI and Italian trade balance data headline a relatively quiet regional docket. On the US side, empire state manufacturing, industrial production and UMich sentiment data will be released. ECB president Lagarde is also scheduled to speak again, due to hold a press conference at the Eurogroup meeting, in Spain.

Late Equities Roundup: Real Estate, Materials, Energy sectors Shine

- Stocks continue to extend session highs in late trade, the broad based rally helping S&P E-Mini futures back to one week highs, up 43.25 points (0.96%) at 4560.25, Nasdaq up 136.8 points (1%) at 13950.21, DJIA up 388.76 points (1.12%) at 34963.16.

- Leaders: Real Estate, Materials and Energy sector shares outperformed. Office and health care real estate investment trusts (resilient to recession and/or higher rates) lead the former: Boston Properties +3.84%, Ventas Inc +3.41%, Alexandria Real Estate +2.2%.

- Materials edged past Energy sector in the second half with metals and mining shares trading strong: Steel Dynamics +3.15%, Freeport-McMoRan +2.85%, Nucor +2.55%. Energy sector shares were buoyed by higher crude prices (WTI +1.69 at 90.21): Hess +2.9%, Oneok +2.25%, Marathon +2.15%.

- Laggers: Health Care, Information Technology and Consumer Staples sectors underperformed the day's rally, equipment and service providers weighing on the former: Davita -1.95%, Dexcom -1.15%, Centene -0.7%. Chip stocks lagged software and services, AMD -0.7%, Nvidia -0.34%.

- Technicals: Despite the rally a bear cycle in the E-mini S&P contract remains in play, the latest gains are considered corrective - for now. Key resistance is unchanged at 4597.50, the Sep 1 high where a break is required to reinstate the recent bullish theme. For bears, a resumption of weakness would signal scope for a move towards the key support and bear trigger at 4397.75, the Aug 18 low. Clearance of this support would strengthen a bearish case.

E-MINI S&P TECHS: (Z3) Short-Term Recovery Extends

- RES 4: 4685.25 High Jul 27 and key resistance

- RES 3: 4617.40 61.8% retracement of the Jul 27 - Aug 18 sell-off

- RES 2: 4597.50 High Sep 1 and a near-term bull trigger

- RES 1: 4553.25 High Sep 6

- PRICE: 4560.00 @ 1510 ET Sep 14

- SUP 1: 4482.00 Low Aug 29

- SUP 2: 4397.75 Low Aug 18 and a bear trigger

- SUP 3: 4378.75 Low Jun 9

- SUP 4: 4352.50 Low Jun 8

A bear cycle in the E-mini S&P contract remains in play and the latest gains are considered corrective - for now. Key resistance is unchanged at 4597.50, the Sep 1 high where a break is required to reinstate the recent bullish theme. For bears, a resumption of weakness would signal scope for a move towards the key support and bear trigger at 4397.75, the Aug 18 low. Clearance of this support would strengthen a bearish case.

COMMODITIES Strong Crude Gains Kicked Off By China RRR Cut, Equity Gains

- Crude front month futures have gained strongly today, with WTI surpassing $90/bbl for the first time since November. Prices were supported by the 25bp RRR cut in China, which countered the ECB’s dovish 25bp hike to 4%, along with some stronger than expected US data.

- The strengthening crude curve backwardation highlights the tight supplies expected in Q4 amid low global inventories driven largely by the Saudi Arabia and Russia cuts until the end of the year.

- A total of 587kbbls of open October 23 options positions on CME and ICE are due to expire against the October future close tomorrow. Current aggregate open interest is 271k calls and 316k puts.

- Global oil demand will peak in approximately 2027 at just below 104mb/d with OECD oil demand never returning to pre-Covid-19 levels according to HBSC. Against that, consistent and data-based forecasts do not support the IEA assertion that fossil fuel demand would peak before 2030 according to a statement by OPEC.

- WTI is +1.8% at $90.12, clearing yesterday’s $89.64 and then the psychological round $90 to open $92.17 (Nov 8, 2022 high cont).

- Brent is +1.9% at $93.61, clearing $92.91 (Nov 17, 2022 high cont) to open $94.79 (Nov 16 high).

- Gold is +0.05%, holding up well considering a solidly higher DXY index (a function of the ECB indicating potentially no further hikes ahead) as well as modestly higher Treasury yields.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/09/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/09/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/09/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/09/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 15/09/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/09/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 15/09/2023 | 0830/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 15/09/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 15/09/2023 | 0900/1100 |  | EU | Labour Force Survey (Q2) | |

| 15/09/2023 | 0945/1145 |  | EU | ECB's Lagarde & Panetta speak in Spain | |

| 15/09/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 15/09/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/09/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/09/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/09/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/09/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 15/09/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 15/09/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.