MNI ASIA MARKETS ANALYSIS: Tsys Rebound, Cons Confidence Dip

- Treasuries look to finish near late session highs Tuesday, rebounding from early session lows following a drop in consumer confidence figures.

- Curves steepened with the short end outperforming, new 2+ highs in the 2s10s curve climbing to 20.213, 5s30s taps 62.011 high.

- Projected rate cuts into early 2025 gain traction, latest vs. this morning's levels (*) as follows: Nov'24 cumulative -39.8bp (-38.5bp), Dec'24 -78.6bp (-74.4bp), Jan'25 -113.0bp (-108.0bp).

US TSYS: Curves Twist to New 2+ Year Highs, Consumer Confidence Dips

- Treasuries looked to finish mixed Tuesday, curves twisting steeper with the short end outperforming. Rates bounced off modestly weaker levels after this mornings lower than expected Conference Board consumer survey.

- Data was markedly weaker than expected in September. Consumer confidence fell to 98.7 (cons 104.0) for a sizeable slip after an upward revised 105.6 (initial 103.3) in Aug. Declines were seen in both the present situation and expectations components.

- Dec'24 10Y Tsy futures are currently +3.5 at 114-28 vs. 114-09.5 low -- still well off initial technical resistance at 115-02+/23+ High Sep 19 / 11 and the bull trigger.

- Curves steepened with the short end outperforming, new 2+ highs in the 2s10s curve climbing to 20.213, 5s30s taps 62.011 high.

- Projected rate cuts into early 2025 gain traction, latest vs. this morning's levels (*) as follows: Nov'24 cumulative -39.8bp (-38.5bp), Dec'24 -78.6bp (-74.4bp), Jan'25 -113.0bp (-108.0bp).

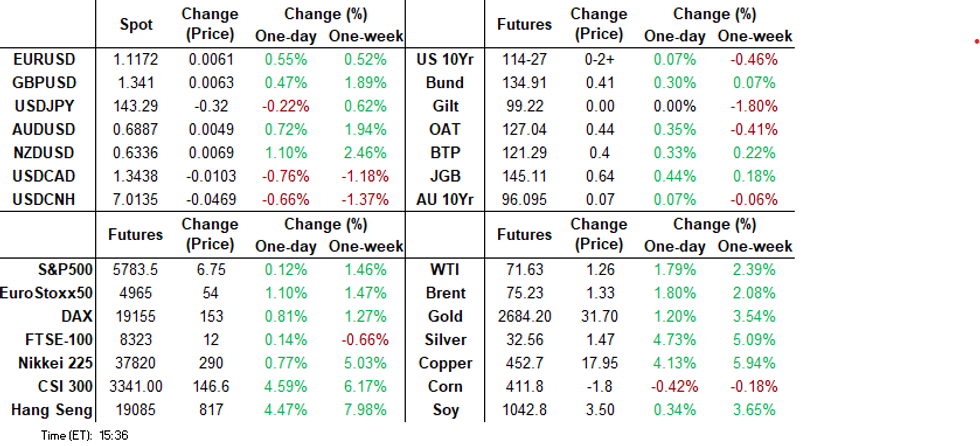

- Cross asset summary: Stocks held modest gains after the bell, near all-time highs, Eminis 5793.50, the Dow 42,232.0; Gold marked new high of 2,660.50.

- Looking ahead to Wednesday's session: MBA Mortgage apps, New Home Sales, $28B 2Y FRN, $62B 17W bill auctions, $70B 5Y at 1300ET.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00031 to 4.85447 (-0.00275/wk)

- 3M -0.00912 to 4.65883 (-0.03242/wk)

- 6M -0.02407 to 4.30962 (-0.04177/wk)

- 12M -0.02828 to 3.79522 (-0.03627/wk)

- Secured Overnight Financing Rate (SOFR): 4.83% (+0.00), volume: $2.198T

- Broad General Collateral Rate (BGCR): 4.82% (+0.01), volume: $811B

- Tri-Party General Collateral Rate (TGCR): 4.82% (+0.01), volume: $781B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 4.83% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 4.83% (+0.00), volume: $284B

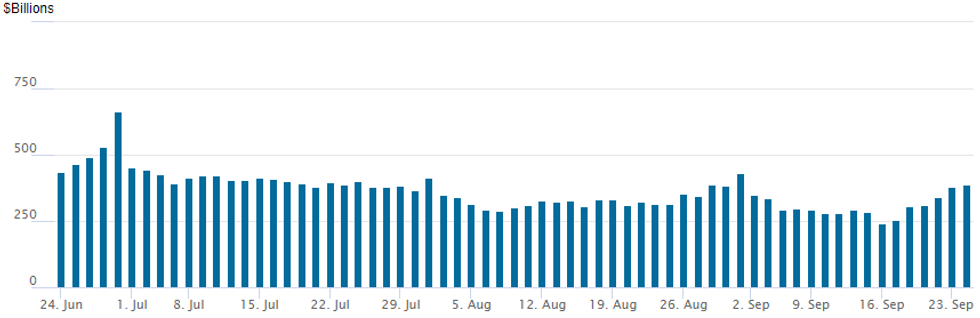

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage climbs to $388.977B this afternoon from $380.372B prior. Compares to $239.386B on Monday September 16 2024 -- the lowest level since early May 2021. Number of counterparties at 65 from 71 prior.

US SOFR/TREASURY OPTION SUMMARY

Pick-up in upside calls continued as underlying futures continued to inch higher after bouncing off morning lows tied to lower than expected consumer confidence data. Projected rate cuts into early 2025 gain traction, latest vs. this morning's levels (*) as follows: Nov'24 cumulative -39.8bp (-38.5bp), Dec'24 -78.6bp (-74.4bp), Jan'25 -113.0bp (-108.0bp). Salient trade includes:- SOFR Options:

- +4,000 SFRV4 96.31/96.56 call spds, 1.25 ref 96.08

- +5,000 SFRX4 95.50/95.68 put spds, 0.5 ref 96.08

- +5,000 SFRV4 95.93/96.00 2x1 put spds, 0.5 vs. 96.07/0.10%

- +10,000 SFRF5/SRH5 97.00 call spds 4.25 ref 96.645

- -15,000 SFRH5 97.00 calls 16.0 ref 96.645

- Block, +5,000 SFRH5 98.00/98.25/98.50/98.75 call condors .75

- Block, 6,000 SFRV4 95.62 puts, cab

- +5,000 SFRX4 95.87/96.12/96.37 call flys, 7.75 ref 96.07

- +6,000 SFRV4 95.87/95.93/96.00 put trees, 1.5 vs 96.035/0.10%

- +5,000 SFRZ4 96.00/96.25 call spds, 8.5 vs. 96.04 to -.035/0.45%

- +5,000 SFRZ4 95.87/96.00/96.06/96.18 call condors, 2.5 ref 96.03

- +5,000 SFRH5 96.00/96.37/96.50 put trees, cab ref 96.60

- +12,000 SFRH5 97.00 calls, 15.0 vs 96.61/0.28%

- -5,000 SFRZ4 96.00 calls, 15.0 vs. 96.03/0.53%

- 4,000 2QV4 96.81/96.87 put spds ref 96.975

- 3,000 3QZ4 95.75/96.50 3x2 put spds, 13.5-14.0 ref 96.845 to -.84

- Treasury Options:

- -20,000 wk4 TY 114 puts, 3 expire Friday

- 5,000 TYZ4 117.5/118 call spds

- over 7,300 TYX4 113.5 puts, 23 ref 114-12

- 3,000 FVX4 108.5/109.25 put spds

- 2,000 TYZ 112.5/114 put spds

- over 6,000 TYX4 113/114 put spds

- +1,750 TYZ4 113.75/114/114.25 put trees, 2 ref 114-16.5

- +6,500 wk4 TY 113.75/114.25 put spd, 8 vs. 114-11 to -12/0.08%

BONDS: EGBs-GILTS CASH CLOSE: German Short End Rallies Again

The core EGB short-end rally continued Tuesday, with 2Y German yields seeing the lowest close since Dec 2022 on deepening central bank easing prospects.

- EGBs and Gilts weakened in early trade, weighed down by news overnight that China was enacting economic stimulus measures.

- Another soft German data point in September IFO failed to have much of a positive bond impact.

- But global core FI rallied in the European afternoon, with a weak US consumer confidence reading boosting Treasuries, and Bunds/Gilts on the follow.

- ECB October rate cut expectations continue to ratchet up amid the poor survey data this week: now priced at 60% implied of 25bp, vs 40% at Monday's close (post-PMIs) and 20% to start the week. BoE Nov cut pricing (last up 1bp at 30bp, or 25bp + 20% of a 50bp cut) deepened less dramatically.

- Bunds outperformed Gilts, with the German curve bull steepening. The UK curve bear steepened modestly.

- Periphery EGB spreads tightened, with a broader risk-on move keyed by the China stimulus.

- Wednesday's docket includes an appearance by BoE's Greene, French consumer confidence, Spanish PPI, and the Riksbank decision (MNI preview here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.2bps at 2.097%, 5-Yr is down 3.2bps at 1.968%, 10-Yr is down 0.8bps at 2.148%, and 30-Yr is down 0.2bps at 2.479%.

- UK: The 2-Yr yield is up 0.3bps at 3.918%, 5-Yr is up 1.8bps at 3.772%, 10-Yr is up 1.8bps at 3.941%, and 30-Yr is up 1.9bps at 4.515%.

- Italian BTP spread down 2bps at 133.2bps / Spanish down 1bps at 78.7bps

EGB OPTIONS: Upside Plays Continue Tuesday

Tuesday's Europe rates/bond options flow included:

- RXX4 135/136/137 call ladder 3K given at 12.5 & 12.

- ERX4 97.00/97.12 1x2 call spread paper paid 0 on 4K

- ERX4 97.12/97.25 call spread paper paid 3.25 on 10K

- 2RZ4 97.375/97.625/98.375/98.625 call condor paper paid 20.5 on 4K

FOREX: Antipodean FX Outperforms as China Announces Stimulus Package

- After pausing for breath over the past two trading sessions, lower front-end yields (aided by weaker-than-expected US consumer confidence) in the US have helped tilt the USD index back into its weakening trend, currently down 0.27% as we approach the APAC crossover. 101.50 has proved supportive so far and markets will be eyeing a daily close below this level, something that has not occurred since July 2023.

- While the China stimulus news has failed to spark a huge boost for major equity benchmarks, the potential ramifications of renewed China optimism is filtering through to risk sensitive currencies such as the Australian, Canadian and New Zealand dollars.

- NZD (+0.89%) is the strongest in G10, with the latest leg higher gaining momentum through the August highs around 0.6300. Today’s high at 0.6328 matches the year’s peak from Jan 02, with 0.6369 the most obvious short-term target for the move.

- AUD slightly lags the move, but has been subject to some decent two-way action on Tuesday. As noted, the RBA not discussing a rate hike at today’s meeting was seen as a very modest dovish development.

- Elsewhere, EURUSD has made very slow progress back above 1.1150 and seems content to trade within the 1.11/1.12 for now as offsetting themes of weak Eurozone growth and optimistic global sentiment play out. USDJPY trades around 143.40, which is towards the bottom of another substantial, near 1%, intra-day range.

- Australian CPI and US new home sales headline the economic calendar on Wednesday.

US STOCKS: Late Equities Roundup

- Stocks are trading mostly higher late Tuesday, off highs with the Dow trading mildly weaker after climbing to a new all-time high in the first half (42,232.0) - as did S&P Eminis (5793.0).

- Currently, the DJIA trades down 14.72 points (-0.03%) at 42109.5, S&P E-Minis up 4.75 points (0.08%) at 5781.5, Nasdaq up 77.7 points (0.4%) at 18052.52.

- Materials and Information Technology sectors led gainers in late trade, metals and mining shares supporting the Materials sector for the second day running as gold surged to new highs (2656.25): Freeport-McMoran +7.75%, Newmont +2.50%, Nucor +2.01%.

- Semiconductor stocks buoyed the IT sector with Nvidia gaining 4.31%, Monolithic Power +2.12%, HP Inc +1.58%.

- On the flipside, Financials and Health Care sectors underperformed, services stocks weighing on the former: Global Payments -7.05%, Visa -4.33%, Discover Financial Services -3.31%.

- Meanwhile, pharmaceuticals weighed on the Health Care sector: Regeneron Pharmaceuticals -5.82% amid ongoing legal battle with Amgen, McKesson Corp -3.89% following severtal downgrades, Labcorp Holdings -2.17%.

EQUITY TECHS: E-MINI S&P: (Z4) Trend Needle Points North

- RES 4: 5868.50 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5818.12 0.50 proj of the Sep 6 - 17 - 8 minor price swing

- RES 2: 5800.00 Round number resistance

- RES 1: 5797.50 High Sep 19

- PRICE: 5786.25 @ 1455 ET Sep 24

- SUP 1: 5668.73 20-day EMA

- SUP 2: 5615.51 50-day EMA

- SUP 3: 5500.00 Round number support

- SUP 4: 5451.25 Low Sep 6 and a bear trigger

A bull cycle in S&P E-Minis remains in play and last week’s gains reinforce the current bullish condition. The contract has traded through a key and major resistance at 5785.00, the Jul 16 high and a bull trigger. A clear break of this hurdle would confirm a resumption of the long-term uptrend. Sights are on the 5800.00 handle next. First key support is 5615.51, the 50-day EMA. Initial support lies at 5668.73, the 20-day EMA.

COMMODITIES: Gold Extends Gains To Fresh Record High, Crude Rises

- Spot gold has extended gains on Tuesday, buoyed by China stimulus measures that created an optimistic backdrop for risk sentiment and a favourable reaction across the commodities complex.

- The yellow metal is up 1.1% on the day, reaching another all-time high of $2,657/oz in recent trade.

- Gold has now pierced resistance at $2,642.7, with attention on $2,660.9 next, a Fibonacci projection, after which focus will shift to the $2,700 level.

- Copper has also rallied by 3.7% to $451/lb today, taking total gains this month to around 10%, amidst increased optimism for Chinese demand.

- The rally in copper exposes $453.83, a Fibonacci retracement. Clearance of this level would expose $464.60, the Jul 5 high.

- Meanwhile, WTI is on track for gains today, although it has eased back from intraday highs. Support comes from some near-term supply disruptions and risks from Libya, US, Kazakhstan and a recent drop in Russian exports.

- WTI Nov 24 is up 1.7% at $71.5/bbl.

- Wires carrying comments from IDF spox Rear Admiral Daniel Hagari saying "we must not give Hezbollah a break, attacks will be accelerated.”

- For WTI futures, the next key resistance to watch is $72.34, the 50-day EMA. A break would undermine a bear theme.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 25/09/2024 | 2301/0001 | * |  GB GB | Brightmine pay deals for whole economy |

| 25/09/2024 | 0130/1130 | *** |  AU AU | CPI Inflation Monthly |

| 25/09/2024 | 0600/0800 | ** |  SE SE | PPI |

| 25/09/2024 | 0600/1400 | ** |  CN CN | MNI China Liquidity Index (CLI) |

| 25/09/2024 | 0645/0845 | ** |  FR FR | Consumer Sentiment |

| 25/09/2024 | 0700/0900 | ** |  ES ES | PPI |

| 25/09/2024 | 0730/0930 | *** |  SE SE | Riksbank Interest Rate Decison |

| 25/09/2024 | 0800/0900 |  GB GB | BOE's Greene Speech on Consumption | |

| 25/09/2024 | 0900/1000 | ** |  GB GB | Gilt Outright Auction Result |

| 25/09/2024 | 1100/0700 | ** |  US US | MBA Weekly Applications Index |

| 25/09/2024 | 1300/1500 |  EU EU | MNI Connect Video Conference on ‘The EU and Global Trade Challenges’ | |

| 25/09/2024 | 1400/1000 | *** |  US US | New Home Sales |

| 25/09/2024 | 1430/1030 | ** |  US US | DOE Weekly Crude Oil Stocks |

| 25/09/2024 | 1530/1130 | ** |  US US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/09/2024 | 1700/1300 | * |  US US | US Treasury Auction Result for 5 Year Note |