-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump's First Post Election Interview

MNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI ASIA MARKETS ANALYSIS: UK CPI Miss Lent Early Bid to Tsys

- POWELL TOLD HOUSE DEMOCRATS STABLECOIN BILL NEEDED: POLITICO

- NETANYAHU DECIDES ISRAEL TEAM WON'T RETURN TO CAIRO TALKS: YNET/Bbg

- AUSTIN SAYS UKRAINE NEEDS `INTEGRATED AND LAYERED' AIR DEFENSES, Bbg

- BOE BAILEY: LATEST INFLATION DATA SHOWS MORE DOWNWARD PRESSURE THAN WE EXPECTED, RTRS

Key Links:MNI INTERVIEW: Fed Could Cut As Early As June - Quarles / MNI Fed Goolsbee: Disinflation On Track Even If Prices Bounce / MNI US DATA: PPI Annual Revisions See Only Marginally Cooler Recent Trend / MNI INTERVIEW: Housing Inflation To Keep Fed Cautious-Fannie

US TSYS Modest Risk-On Ahead Heavy Data Calendar Thursday

- Tsys look to finish higher Wednesday, off second half highs amid modestly improved risk appetite. Tsys climbed off to new cycle low overnight Mar'24 10Y 109-16.5 low, yield tapped 4.3301% high, levels not seen since early Dec'23) following UK CPI miss (tempered by EU IP strength notably in Ireland).

- Support dipped briefly after the BLS down revised PPI data for Dec from -0.1% to -0.2%. Minimal revisions for PPI final demand in latest months, December revised down from just -0.13% to -0.16% M/M with the rounded change heavily flatter by rounding. Recent weakness slightly more pronounced for various core measures: ex food & energy trimmed 5bps in Dec, ex food, energy & trade services trimmed 7bps.

- Futures inched higher over the next four hours with 10s tapping 110-05 high before settling in at 110-00.5 after the bell. Yield curves recovered slightly from Tuesday's bear flattening, 2s10s currently +3.100 at -31.459, 10Y yield -.0511 at 4.2632%.

- Looking ahead: heavy data calendar Thursday with weekly Claims, Retail Sales, Imp/Exp$, IP/Cap-U, TIC Flows. Thursday Fed speak includes Fed Gov Waller on US$ international role at 1315ET, Atlanta Fed Bostic on mon-pol (text, Q&A) later in the evening at 1900ET.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00371 to 5.32135 (+0.00063/wk)

- 3M +0.01869 to 5.32568 (+0.01663/wk)

- 6M +0.06080 to 5.25695 (+0.06829/wk)

- 12M +0.11897 to 5.01897 (+0.13872/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.714T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $682B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $662B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $98B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $274B

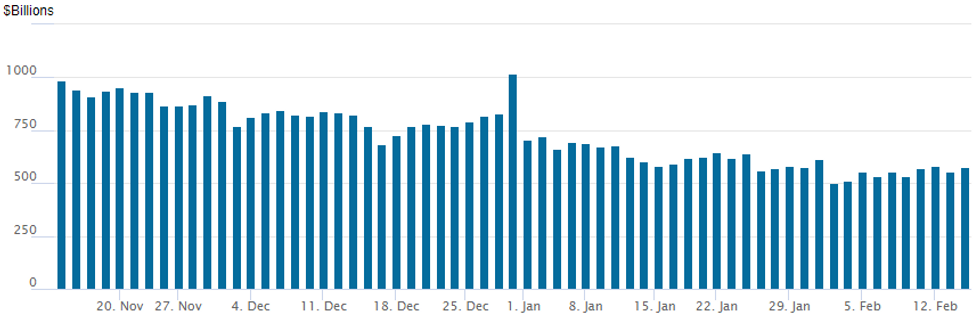

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounded to $575.332B vs. $553.648B Tuesday - remains well above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the latest number of counterparties is at 91 from 84 Tuesday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

Heavier SOFR and Treasury option volumes leaned towards downside put structures Wednesday even as underlying futures bounced off lows - Tsys followed rebound in Gilts overnight after UK CPI miss (tempered by EU IP strength notably in Ireland). Projected rate cut pricing held steady in the near term to mildly higher by mid-year (Jun fully priced): March 2024 chance of 25bp rate cut currently -14.4% vs. -10.1% late Tuesday w/ cumulative of -3.6bp at 5.293%; May 2024 at -35.6% vs. -33.0% late Tuesday w/ cumulative -11.4bp at 5.215%; June 2024 -71.2% vs. -64.3% late Tuesday w/ cumulative cut -29.2bp at 5.037%. Fed terminal at 5.3275% in Feb'24.

- SOFR Options:

- Block +10,000 SFRJ4 94.75/94.87/95.12/95.25 put condors, 7.0 ref 95.02

- +5,000 SRM4 94.87/94.93/95.06/95.12 call condor, 1.5 vs. 9501.5/0.10%

- +8,000 SRH4 94.75 puts 5.5 vs. 94.725/0.58%

- +8,000 SRH4 96.00 calls .5 ref 9472

- +5,000 SRM4 95.00/95.25 call spds vs. 94.99/0.20%

- +5,500 SRM4 94.75 puts vs 95.12/95.25/95.56/95.68 call condors 5.5

- Block, 11,000 SFRZ4 95.50 puts, 33.5 ref 95.65, 8k more in pit

- Block, +90,000 SFRZ4 93.5/94.00 put spds 1.5 vs. 95.635 to -.61/0.05%

- Block, total -24,500 SFRM4 94.75 puts, 6.0 ref 94.975

- Block, -16,000 2QU4 97.12/97.50 call spds SFRU4 97.50 calls, 1.75 net/spits

- Block/screen, +30,000 SFRZ4 94.25/95.00/95.75 2x3x1 put flys, 11.5 ref 95.605 to -.61

- Block, 5,000 SFRZ4 96.50/98.00 call spds vs. 10,000 2QZ4 97.25/98.00 call spds 3.5 net/Green Dec over

- Block, 8,000 SFRK4 94.75/94.87/94.93/95.06 put condors, 4.0

- 2,000 2QJ4 96.62/96.75/96.87 put trees, 33.5 ref 96.29

- Treasury Options:

- 4,000 TYK4/TYM4 108 put spds, 13 ref 110-19

- 3,000 FVH4 103.5/104/104.5/105 put condors

- Block, 10,000 TYJ4 114 calls, 8 ref 110-20.5

- 3,500 TYH4 109.25/109.5 put spds, 7 ref 109-31

- over 16,000 FVH4 107 puts, 39.5 ref 106-18.75 to -17.37

EGBs-GILTS CASH CLOSE: Soft UK CPI Print Sets Bullish Tone For Short End

Gilt yields fell sharply Wednesday on softer-than-expected UK inflation data, with Bunds following suit in a generally constructive session.

- While the details of the UK CPI data meant the print wasn't as soft as it initially appeared (e.g. an unexpected drop in volatile airfares), the 0.3pp miss in services Y/Y CPI vs expectations in particular drove a solidly dovish reaction that helped Gilts outperform throughout the session.

- That said, BoE's Bailey noted later in the day that the CPI and previous session's (solid) labour force data "don't broadly" change the timing of the first rate cut.

- Multiple ECB speakers didn't really shift pricing, including Guindos, Makhlouf, Vujcic and Lane. Data (Eurozone GDP / Industrial Production) didn't move the needle either.

- The UK curve closed bull steeper, with Germany's leaning bull flatter. As equity futures regained ground from Tuesday's drop, periphery EGB spreads closed tighter, with BTPs outperforming - the 10Y differential to Bunds fell to its lowest close of the month.

- The heavy UK data slate continues first thing Thursday with GDP figures, while ECB's Lagarde and and Lane, and BoE's Greene and Mann, make appearances.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.7bps at 2.73%, 5-Yr is down 5.6bps at 2.302%, 10-Yr is down 5.6bps at 2.337%, and 30-Yr is down 4.9bps at 2.509%.

- UK: The 2-Yr yield is down 13.6bps at 4.575%, 5-Yr is down 12.8bps at 4.057%, 10-Yr is down 10.7bps at 4.044%, and 30-Yr is down 7.3bps at 4.579%.

- Italian BTP spread down 3.5bps at 151.6bps / Spanish down 2.2bps at 93bps

EGB Options: A Few Euro Rates Call Structures Feature Wednesday

Wednesday's Europe rates/bond options flow included:

- ERM4 96.50/96.62/96.75 call fly, bought for 1.75 in 5k

- ERU4 96.62/96.75 call spread sold at 6.75 in 40k

FOREX USD Momentum Stalls as Yields Partially Retrace Post-CPI Move

- A retracement for US yields on Wednesday, and specific outperformance for the front-end of the treasury curve, has weighed on the USD index. The 0.25% decline, however, remains very small compared to the post-CPI 0.85% advance. A recovery across major equity benchmarks, softer UK CPI inflation and Chicago Fed’s Goolsbee sticking to his dovish guns have all helped stall the greenback's topside momentum.

- Outperformers on the session include the likes of AUD and NZD, to be expected after their punchy declines on Tuesday. They join both the SEK and NOK at the top of the G10 leaderboard.

- EUR/USD crept to a new daily high through the London close, extending the bounce off the overnight lows to just over 30 pips, but highlight the contained ranges on Wednesday. Conditions remain bearish overall, with the recent breach of both 1.0724, the Dec 8 low, and 1.0712, 61.8% of the Oct - Dec bull leg, reinforcing current sentiment. Focus on the downside will be on 1.0656 next, the Nov 10 low, whereas initial resistance comes in at 1.0816, the 20-day EMA.

- A very quiet session for USDJPY, although it is worth noting that neither lower US yields nor verbal warnings from the MOF have been able to prompt a meaningful relief bounce, with the pair consolidating around 150.50 as we approach the APAC crossover. Above here, 151.43, the November 16 high comes into focus, inching ever closer to the multi-decade highs at 151.95. Initial support moves up to 148.03, the 20-day EMA.

- A busy docket on Thursday is kickstarted by RBA Governor Bullock speaking before Australian employment data for January. UK growth data headlines the European session before retail sales, initial jobless claims, Philly fed and industrial production data cross in the US.

FX Expiries for Feb15 NY cut 1000ET (Source DTCC)

- USD/JPY: Y149.10($1.0bln), Y150.20-25($550mln)

- USD/CAD: C$1.3550($823mln)

Late Equity Roundup: Inching Higher

- Stocks are holding modestly higher in late trade, still shy of first half highs as stocks recover nearly half the ground lost in Tuesday's post-CPI selloff. Currently, the DJIA is up 48.15 points (0.13%) at 38322.52, S&P E-Minis up 26.5 points (0.53%) at 4997.5, Nasdaq up 129.6 points (0.8%) at 15785.94.

- Leading gainers: Industrials and Communication Services sectors continue to outperform, ground transportation shares buoyed the former: Uber +12.32% after announcing a $7B share buyback overnight, Southwest Airlines +3.6%, United Airlines +3%. Media and entertainment shares supported the Communication Sector: Netflix +3.56%, Electronic Arts +2.55%, Warner Brothers +2.25%.

- Laggers: Consumer Staples and Energy sectors continued to underperform, food and beverage shares weighed on the former: Kraft Heinz -6.06%, Conagra -2.27%, Campbell Soup -2.24%. Reversing prior session gains, Oil and gas shares weighed on the Energy sector: Williams Cos -2.73%, EQT Corp -1.96% (well off lows), ONEOK -0.62%.

- Looking ahead: corporate earnings expected after the close: American Water Works, Equinix, Rollins Inc, Occidental Petroleum, Albemarle Corp, Cisco Systems, TripAdvisor Inc, Altice USA Inc.

E-MINI S&P TECHS: (H4) Corrective Pullback

- RES 4: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 5110.50 2.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5100.00 Round number resistance

- RES 1: 5066.50 High Feb 12 and the bull trigger

- PRICE: 5001.25 @ 1510 ET Feb 14

- SUP 1: 4940.49 20-day EMA

- SUP 2: 4866.000/4823.72 Low Jan 31 / 50-day EMA values

- SUP 3: 4702.00 Low Jan 5

- SUP 4: 4594.00 Low Nov 30

The trend condition in S&P E-Minis is unchanged and remains bullish. The pullback from Monday’s 5066.50 high is - for now - considered corrective. Support to watch lies at 4940.49, the 20-day EMA. A clear break of this average would suggest potential for a deeper retracement, possibly towards the 4866.00 key support, the Jan 31 low. For bulls, the trigger for a resumption of gains is 5066.50, the Feb 12 high.

COMMODITIES WTI Slides On Large Inventory Build, Gold Can't Shake Off CPI Hit

- WTI furthered its losses during US hours, more than reversing yesterday’s gains, after the latest weekly EIA petroleum data showed a significantly larger build in US crude inventories.

- EIA Weekly US Petroleum Summary - w/w change week ending Feb 09: Crude stocks +12,018 vs Exp +3,299, Crude production 0, SPR stocks +746, Cushing stocks +710

- The oil Ministries of both Kazakhstan & Iraq said Feb. 14 that they will compensate for its overproduction in January over the next four months, as part of its OPEC+ obligations.

- A brent price above $90/bbl would more adequately reflect current fundamentals and risk to the oil markets according to Paul Horsnell, Standard Chartered’s head of commodities research.

- WTI is -1.6% at $76.60 off a high of $78.77 that had taken a step closer to a next key resistance at $79.29 (Jan 29 high).

- Brent is -1.45% at $81.57, also pulling back off $83.60 and away from a key short-term resistance at $84.17 (Jan 29 high)

- Gold is -0.1% at $1991.08, seeing little respite from a lower dollar today after yesterday’s CPI-induced rout for the yellow metal. Key support is seen at $1973.2 (Dec 13 low).

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2024 | 0030/1130 | *** |  | AU | Labor Force Survey |

| 15/02/2024 | 0430/1330 | ** |  | JP | Industrial production |

| 15/02/2024 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 15/02/2024 | 0700/0700 | ** |  | UK | Trade Balance |

| 15/02/2024 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 15/02/2024 | 0700/0700 | ** |  | UK | Index of Services |

| 15/02/2024 | 0700/0700 | *** |  | UK | Index of Production |

| 15/02/2024 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 15/02/2024 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/02/2024 | 0800/0900 |  | EU | ECB's Lagarde statement at ECON hearing | |

| 15/02/2024 | 1000/1100 | * |  | EU | Trade Balance |

| 15/02/2024 | 1200/1300 |  | EU | ECB's Lane seminar at Florence School | |

| 15/02/2024 | 1300/1300 |  | UK | BOE's Greene fireside chat with Fitch Ratings | |

| 15/02/2024 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 15/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/02/2024 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/02/2024 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 15/02/2024 | 1330/0830 | *** |  | US | Retail Sales |

| 15/02/2024 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/02/2024 | 1350/1350 |  | UK | BOE's Mann panellist at 40th NABE Conference | |

| 15/02/2024 | 1415/0915 | *** |  | US | Industrial Production |

| 15/02/2024 | 1500/1000 | * |  | US | Business Inventories |

| 15/02/2024 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 15/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 15/02/2024 | 1815/1315 |  | US | Fed Governor Christopher Waller | |

| 15/02/2024 | 2100/1600 | ** |  | US | TICS |

| 15/02/2024 | 0000/1900 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.