-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - USD Fails to Sustain Fed-Induced Gains

HIGHLIGHTS:

- Dollar fades initial Fed-induced rally

- US curve steepens as Fed decline to extend the maturity of QE purchases

- WTI hits new post-COVID crisis highs on large draw in DoE reserves

US TSYS SUMMARY; Tsys Round-Trip As Fed Holds Steady (Apart From Guidance)

The FOMC decision was in line with expectations, with new asset purchase guidance but no change to the asset purchase program itself. The decision and optimistic-looking summary of economic projections were rightly seen hawkish, with TYs selling off 8+ ticks, but not quite to session lows.

- Tsys rebounded and curve steepening reversed as the Powell press conference went on, as he did not rule out future action if required. Effectively Tsys round-tripped to levels pre-decision by the end.

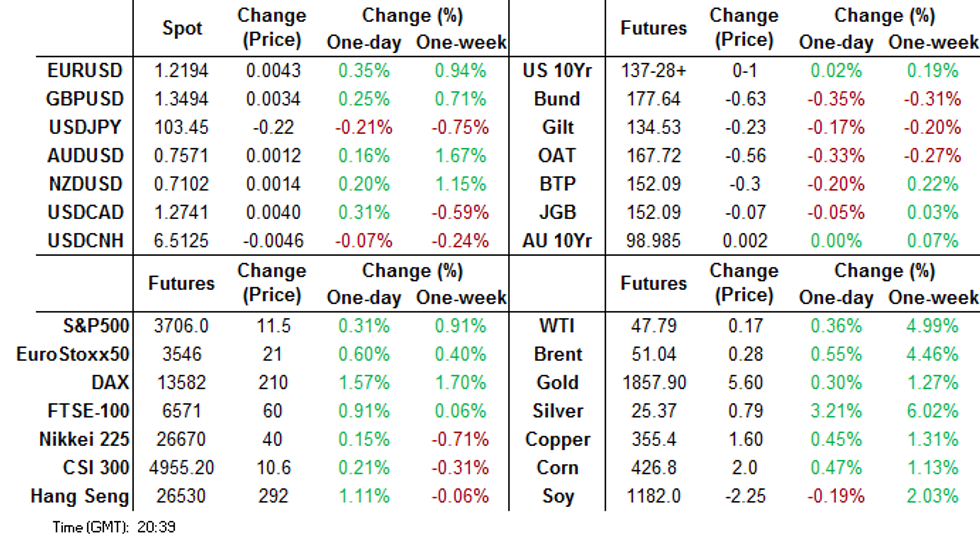

- The 2-Yr yield is up 0.4bps at 0.117%, 5-Yr is up 0.6bps at 0.3702%, 10-Yr is up 1.7bps at 0.9246%, and 30-Yr is up 1.6bps at 1.6662%.

- Mar 10-Yr futures (TY) up 0.5/32 at 137-28 (L: 137-19.5 / H: 138-00.5)

- Earlier in the day, very weak November retail sales data were met with a shrug.

- Just as Powell urged the stimulus focus be put on fiscal policy, we now look to Capitol Hill for a deal which sounds from all the main players to be forthcoming.

OPTIONS: US SUMMARY

Wednesday's Tsy/Eurodollar options flow included:

- TYG1 137.50/136.50ps 2x3, bought for 19 in 2kx3k

- TYH1 132p, bought for '03 in 5k

- 2EH1 99.37/99.00ps, bought for 0.5 in 3.5k

- EDU2 99.12p, bought for 1.5 in 1.4k

- EDZ1 99.62/75/87c fly, traded 6 in 2k

- EDM1 99..12/99.87cs 1x2, traded 1.25 in 1k

- EDH1 99.87c, bough for 0.75 in 5k

- 3EM1 99.25/99.12/99.87 broken put tree, bought for 0.25 in 5k

EGBs-GILTS CASH CLOSE: UK Yields Close On Lows Ahead Of BoE

The European FI space has moved more or less in line with global risk appetite and data. Strong Eurozone PMIs in the morning, and weak U.S. retail sales in the afternoon, helped move the needle for core FI weaker and stronger, respectively.

- BTP spreads tightened as risk appetite was generally positive (equities +, EUR and GBP hitting post-2018 highs).

- There remains some optimism on a Brexit deal soon, but headlines have been mixed as ever, and longer-dated Gilt yields ended the day up but at/near session lows. Of course contributing to Gilt uncertainty is Thursday's Bank of England meeting - contact us if you haven't seen our preview.

Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 3.1bps at -0.725%, 5-Yr is up 4.3bps at -0.744%, 10-Yr is up 4.4bps at -0.567%, and 30-Yr is up 3.9bps at -0.162%.

- UK: The 2-Yr yield is down 2.3bps at -0.077%, 5-Yr is down 0.2bps at -0.031%, 10-Yr is up 1.2bps at 0.272%, and 30-Yr is up 0.8bps at 0.834%.

- Italian BTP spread down 2.7bps at 110.3bps

- Spanish bond spread down 0.4bps at 59bps / Portuguese up 0.6bps at 56.1bps

EUROPE OPTIONS SUMMARY: Plenty Of Early 2021 Bund

- RXF1 177.50/177.00/176.50p fly, sold at 5 in 900

- RXF1 179c, bought for 7 in 1k

- RXF1 179.50c bought for 3 in 5k

- RXG1 177.00/175.5ps, trades 26 in 2k

- RXG1 176.5/175.5ps 1x2, bought for 9 in 1k

- IKF1 150.50/149.50ps, bought for 6 in 1.3k

- ERH2 100.50^ bought for 16.25 in 1.5k

- LZ1 100^, bought for 18.5 in 2k

FOREX: USD Fails to Hold Fed-Induced Gains

The greenback initially rallied on the back of the Fed's decision not to extend the duration of their asset purchase program - a move that markets interpreted hawkishly, which saw EUR/USD fall sharply to new daily lows of 1.2125. This move swiftly reversed ahead of the close, however, as Fed's Powell reassured markets that the Fed would use communication tools and guidance to avoid any future taper tantrum - allowing equities to resume their uptrend and, once again, challenge all time highs.

CAD was easily the poorest performer Wednesday, extending the market reaction to Tuesday's speech from BoC Governor Macklem, who warned that Canada could resume an economic tailspin in early 2021. Nonetheless, USD/CAD's rise stopped short of breaking the 1.28 handle.

NOK, GBP and EUR were the strongest in G10. CAD, CHF and USD were the weakest.

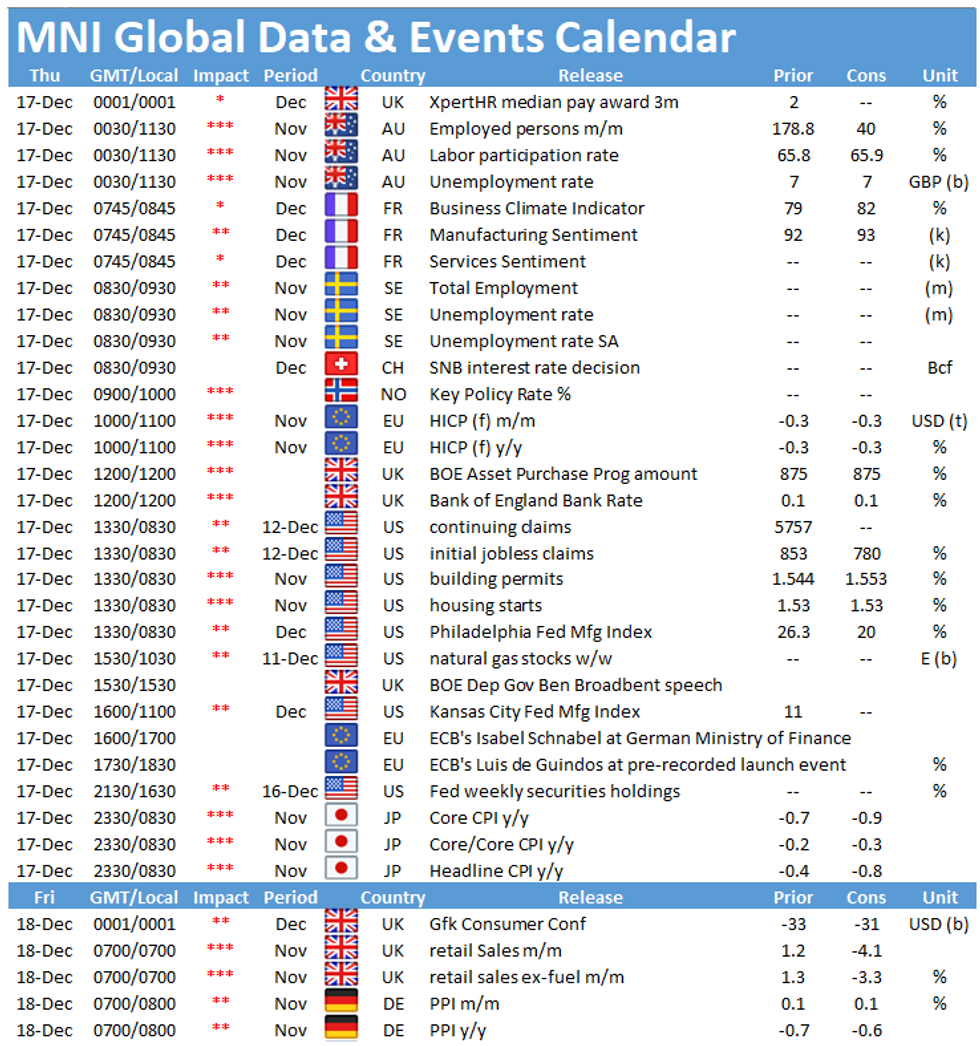

Focus turns to further central bank rate decisions, with the UK, Norwegian, Swiss and Mexican policy announcements all due Thursday.

Expiries for Dec17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1875-80(E1.1bln), $1.2000(E1.2bln), $1.2050(E543mln), $1.2100-15(E841mln), $1.2200-05(E508mln)

- USD/JPY: Y102.95-103.00($500mln-USD puts), Y103.75-90($1.0bln), Y104.15-20($633mln), Y104.30($610mln)

- AUD/USD: $0.7300(A$541mln), $0.7350(A$531mln), $0.7550(A$609mln-AUD puts)

- USD/CNY: Cny6.50($1.2bln)

EQUITIES: Stocks Narrow Gap with Alltime Highs

US equity futures narrowed the gap with alltime highs following the Fed rate decision, despite the initial statement being interpreted as somewhat hawkish. The Fed declined to extend the duration of asset purchases, however forced the message home to markets that the Fed would use communication tools to avoid any future taper tantrum. This makes further alltime highs a firm possibility before the end of the week.

Consumer discretionary and tech names outperformed, with utilities and industrials lagging slightly. The VIX pulled lower following the Fed decision.

COMMODITIES: Gold Recovers Fed-Induced Dip

Spot gold initially fell after the market interpreted the Fed's decision not to extend the duration of their asset purchases as hawkish. This pressured gold prices lower initially, prompting new session lows at $1844.90 before bouncing into the close to trade broadly flat on the day.

WTI and Brent crude futures found some support into the close following the weekly DoE crude oil inventories report. Headline oil inventories saw a larger draw than expected, with 3.1mln barrels drawn vs. Exp. draw of 1.1mln. WTI touched a new post-COVID crisis high at $47.94/bbl Wednesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.