-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Italy Makes NextGenEU Targets Easier - Gov't Sources

MNI POLITICAL RISK - Trump Agenda Uncertain Amid CR Backlash

MNI ASIA MARKETS ANALYSIS: Weak 10Y, Heavy Corp Debt Weigh

- Treasuries are broadly lower Wednesday, firmly below last Friday's pre-NFP levels.

- Curves bear steepening but still inverted (2s10s +4.571 at -4.158) while projected rate cut pricing gained slightly.

- Weak $42B 10Y Treasury auction (3Bp tail) and heavy corporate issuance ($30B) contributed to the extended decline.

US TSYS Rates Extended Lows After Weak 10Y Tsy Sale, 3Bp Tail

- Treasuries look broadly weaker after the bell, firmly below last Friday's pre-NFP levels. The Sep'24 10Y contract trades 112-29 (-15.5) after the bell, with initial technical support at 112-21 (Aug 2 low). Still inverted, Tsy curves bear steepened in the second half, 2s10s +4.412 at -4.317

- Treasury futures gapped lower after the $42B 10Y auction (91282CLF6) tails 3bp: 3.960% high yield vs. 3.930% WI; 2.32x bid-to-cover is lowest since Dec'22 vs. 2.58x prior last month.

- Early session calm saw a backlog of corporate debt issuance with $30B in high grade supply contributing to the second half sell-off.

- Second tier data saw MBA composite mortgage applications jump to a seasonally adjusted 6.9% last week to fully reverse the prior two weekly declines.

- Manheim used car prices increased a seasonally adjusted 2.8% M/M in July (revised up from the 1.8% indicated in the fifteen-day update), the first increase since Sep’23. It follows two consecutive -0.6% M/M declines in May/June and the heavier -2.3% in April.

- Look ahead to Thursday: Weekly Claims, Wholesale Data and 30Y Bond Sale. Richmond Fed President Barkin will attend a NABE Webinar, moderated Q&A at 1500ET.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.03549 to 5.32501 (-0.02703/wk)

- 3M +0.04765 to 5.10416 (-0.12357/wk)

- 6M +0.12930 to 4.78476 (-0.22287/wk)

- 12M +0.16537 to 4.31135 (-0.28473/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.01), volume: $2.086T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $812B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $791B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $89B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $220B

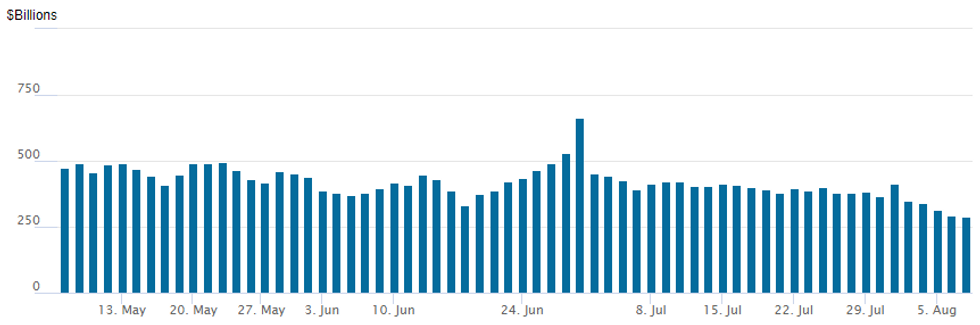

FED Reverse Repo Operation: Dips Below $300B

NY Federal Reserve/MNI

RRP usage continues to decline after falling below $300B for the first time since mid-May 2021 yesterday: currently $286.660B vs. $291.958B on Tuesday. Number of counterparties falls to 52 from 60 prior.

SOFR/TEASURY OPTION SUMMARY

Option desks continued to report better SOFR call structure trade Wednesday, Treasury options more paired as underlying futures trade back to pre-employment data levels (TYU4 112-26.5). Nevertheless, projected rate cut pricing into year end rebound slightly vs. early morning levels (*) as curves bear steepen: Sep'24 cumulative -44.3bp (-43.2bp), Nov'24 cumulative -76bp (-74.7bp), Dec'24 -107.8bp (-105.1bp).

- SOFR Options:

- -17,000 SFRU4 95.25 calls, 8.5

- +10,000 0QH5 96.62 puts 30.5 vs. 96.82/0.42%

- +20,000 SFRU5 96.00/96.12/96.37/96.50 call condors, 2.0 vs. 96.665/0.10%

- +5,000 SFRV4 95.75/96.06 1x2 call spds, 0.25-0.5

- -5,000 SFRZ4 96.00/96.06 call spds, 1.5 vs. 95.805/0.05%

- +4,000 SFRZ4 96.50/96.75 call spds 2.0 ref 95.78

- -6,000 0QZ4 96.25/96.75 call spds v 2QZ4 96.37/96.75 call spds, 6.5

- +6,000 SFRU4 94.75/94.87/95.00 Iron Fly 11.75 ref 95.195

- 13,500 SFRU4 95.00/95.06 call spds ref 95.175

- 2,500 SFRU4 95.31/95.43/95.56 call flys ref 95.18

- Block, 7,000 SFRV4 96.00/96.25/96.37 broken call flys vs. 95.43/95.50 put spds, 1.25 net

- Block/screen, 7,000 SFRU4 95.18/95.25/95.31 call flys, .75 ref 95.20

- 2,000 SFRU4 94.81/94.87/95.00/95.06 call condors

- 5,000 SFRZ4 95.62/96.00 call spds vs. SFRH5 96.50/97.00 call spds

- 5,000 SFRU4 94.87/94.93/95.00 call flys ref 95.175

- 10,000 SFRU4 95.18/95.31/95.43 call flys ref 95.175 to -.17

- 4,000 SFRU4 94.75 puts, cab last ref 95.20

- 2,000 SFRV4 95.37/95.62 put spds ref 95.76

- 22,500 SFRU4 95.18/95.31/95.37/95.50 call condors, ref 95.185 to -.175

- Treasury Options:

- 6,000 FVV4 106/107 put spds ref 109-11.75

- 5,000 TYU4 114 calls, 22 ref 113-03.5

- 2,000 TYV4 110/112 2x1 put spds ref 113-18.5

- 3,800 TYU4 112.5/114 call spds ref 113-02.5

- 2,000 TYU4 113/115 call spds, 35 ref 113-04

- 1,250 TYU4 111.5/113 2x1 put spds ref 113-03.5

- 5,500 FVU4 107 puts, 1.5 last

- 2,500 FVU4 109/109.5/110 call flys

- over 5,100 TYU 112 puts, 13 last, ref 113-05

- 4,500 wk2 TY 103/103.12 put spds, expire Friday

FOREX: Risk Optimism Weighs on Yen and CHF, NZD Outperforms

- Dovish remarks from BOJ Deputy Governor Uchida overnight stoked a strong reversal lower for the Japanese Yen on Wednesday. Limited global event risk has seen USDJPY consolidate towards the best levels of the session, trading close to 147.50 as we approach the APAC crossover.

- As a reminder, BOJ’s Uchida stated that rates won't be raised if the market is unstable, and the rate path will shift if market moves affect the economic outlook. USDJPY is up 2.15% on the day and the extension of the latest recovery appears to be a correction - allowing an oversold condition to unwind and initial resistance coming in at 149.77, the Aug 2 high.

- NZDJPY stands out as the key outperforming cross, rising over 3% on the day. This follows the earlier Q2 employment data beat, which prompted RBNZ easing expectations for next week's meeting considerably diminish. NZD/USD remains up 1% and is back above 0.6000, while AUDNZD (-0.50%) continues to grind lower, hovering around the 1.0900 mark.

- Higher core yields and the associated pressure on the yen also filtered through to the Swiss Franc, a trend that would steadily gain traction throughout the session. Both EURCHF and USDCHF have risen around 1.5% on the day, as the low yielders benefit from the risk-on backdrop. EURCHF price action has significantly narrowed the gap to initial resistance at 0.9478, the June lows, and 0.9527, the 20-day EMA.

Other major pairs such as EURUSD and GBPUSD remain in very tight ranges as the action remains on currencies sensitive to both widening rate differentials and firmer equity markets. Notably USDMXN has fallen 1.92% and is now lower on the week and trading back below the prior breakout level of 19.20. MXNJPY is up 4.2% on the session ahead of tomorrow’s Banxico decision. - Elsewhere on Thursday, RBA Governor Bullock is due to speak at the Annual Rotary Lecture, with Q&A expected. Additionally, RBNZ Inflation Expectations data and US jobless claims data is scheduled.

Late Equities Roundup: Late Reversal, Pharma, Chips, Resorts Lag

- Stocks have reversed first half gains over the last couple hours, trading moderately weaker in late trade, pharmaceuticals, travel/resort and chip maker shares underperforming. Currently, the DJIA trades down 175.41 points (-0.45%) at 38820.03, S&P E-Minis down 16.75 points (-0.32%) at 5249.25, Nasdaq down 83.7 points (-0.5%) at 16282.81.

- Health Care and Consumer Discretionary sectors continued to underperform in late trade, pharmaceuticals weighing on the former: Charles River Labs falling 1278% after earning miss coupled with drop in demand, Bio-Techne -7.15%, Dexcom Inc -7.0%. Travel/resort related shares continued to weigh on Consumer Discretionary: Airbnb -15.65% on tourism slowdown (and multiple downgrades), Carnival Corp -3.68%, Expedia -3.65%, Norwegian Cruise Line -3.61%.

- On semiconductor stocks: Broadcom -4.31%, Nvidia -3.96%, Monolithic Power -3.68%.

- Conversely, Energy and Utility sector shares continued to lead (but had pared gains) in late trade, a rebound in crude prices (WTI +1.88 at 75.08) supporting oil & gas stocks: Devon Energy +3.97% after better than expected earnings, Targa Resources +2.51%, Kinder Morgan +1.65%. The Utility sector buoyed by Dominion Energy +1.92%, American Electric +1.30%, PG&E +1.28%.

- Expected earnings announcements after the close include: CF Industries Holdings, McKesson Corp, Robinhood Markets, Occidental Petroleum, AppLovin Corp, Equinix Inc, Energy Transfer LP, Duolingo Inc, Warner Bros Discovery, Zillow Group Inc, Bumble Inc, Viasat Inc, Core Scientific Inc, Monster Beverage Corp, Dutch Bros Inc, Guardant Health Inc, Leslie's Inc and HubSpot Inc.

E-MINI S&P TECHS: (U4) Gains Considered Corrective

- RES 4: 5721.25 High Jul 16 and Key resistance

- RES 3: 5600.75 High Aug 1

- RES 2: 5474.83 50-day EMA

- RES 1: 5345.50 High Aug 5

- PRICE: 5245.00 @ 14:35 ET Aug 7

- SUP 1: 5120.00 Low Aug 5

- SUP 2: 5185 50.76.4% retracement of the Apr 19 - Jul 16 bull leg

- SUP 3: 5092.00 Low May 2

- SUP 4: 5020 Low Apr 19 and a key support

S&P E-Minis traded lower late last week and the contract started this week on a bearish note - Monday’s move lower marks an extension of the bear cycle. The move down has resulted in a print below 5185.50, 76.4% of the Apr 19 - Jul 16 bear leg. A clear break of this level would open 5092.00 next, the May 2 low. Monday’s intraday high of 5345.50 marks initial resistance. The 50-day EMA, a firmer level, is at 5474.83. Gains are considered corrective - for now.

COMMODITIES Crude Prices Extend Gains, Copper Falls Towards Fresh Cycle Low

- Crude markets are headed to US close trading higher, supported by a larger than expected draw in US crude inventories according to the updated EIA weekly petroleum data.

- WTI Sep 24 is up 2.7% at $75.2/bbl.

- US State Department spokesperson Matthew Miller, commenting on escalating tensions in the Middle East, has told reporters that, "we are in the final stages of a ceasefire deal.”

- A bear threat in WTI futures remains present, with sights on the next key support at $72.23, the Jun 4 low.

- Key resistance is seen at $78.88, the Aug 1 high.

- Spot gold is down by 0.1% at $2,387/oz, keeping it around3.5% below last week’s high.

- Recent weakness in gold appears to be a correction for now, but the yellow metal has pierced support at the 50-day EMA at $2,375.8, and a clear break would signal scope for a deeper retracement towards $2,277.4, the May 3 low.

- Silver has fallen by 1.2% today to $26.7/oz, approaching key support at $26.018/oz, the May 2 low.

- Meanwhile, copper has fallen by 2.2% to $393.9/lb, just above Monday’s cycle low at $393.05, which itself marked the lowest level since March 11.

- A bear cycle in copper futures remains intact, with the contract breaching $405.57, 76.4% of the Feb 9 - May 20 bull cycle. A clear break of this price point sets the scene for weakness towards $372.35, the Feb 9 low.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/08/2024 | 2301/0001 | ** |  | UK | KPMG/REC Jobs Report |

| 08/08/2024 | 0500/1400 |  | JP | Economy Watchers Survey | |

| 08/08/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 08/08/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/08/2024 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/08/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 08/08/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/08/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/08/2024 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 08/08/2024 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

| 08/08/2024 | 1900/1500 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.