-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Weak JOLTS Spurs Rate Cut Comeback

HIGHLIGHTS

- MNI US-CHINA: China Raises Export Control Concerns With WTO

- MNI POLITICAL RISK: EU's Borrell-China Has 'Moral Duty' To Support Ukraine

- FINLAND OFFICIALLY JOINS NATO AS 31ST MEMBER

- PUTIN TO HOLD RUSSIA SECURITY COUNCIL MEETING APRIL 5: KREMLIN, Bbg

- TAIWAN'S TSAI HOLDS CONFERENCE TO MONITOR SURROUNDING SITUATION, Bbg

- US IRS to unveil $80 billion 10-year spending plan this week, Yellen says - Reuters

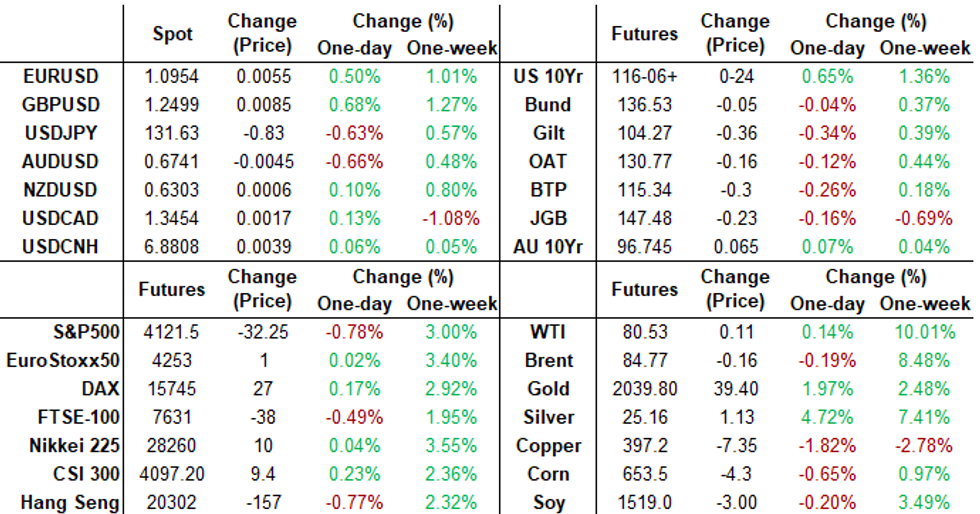

US TSYS: Near Post-Data Highs, Yld Curves Bull Steepen

- Treasury futures holding narrow range near session highs since midday. After a slow start to the NY session, decent two way flow followed lower than expected JOLTS job openings to 9.93M (cons 10.50M) after a downward revised 10.56M.

- Yield curves broadly steeper but off highs (2s10s now at -49.753 vs. -45.578 high) as the short-end saw a pick-up in selling, discounting a rebound in implied rate hikes for year end..

- At the moment, Fed funds implied hike for May'23 is currently at 12.3bp vs. 17.3bp on the open, Jun'23 +6.0bp vs. +15.9bp earlier cumulative at 4.876%.

- Projected rate cuts later in the year surged on the post-data gap bid but pared the move slightly by late morning: Sep'23 cumulative currently -29.1 vs. -34.6bp high (-11.0bp on the open) to 4.525%, to -66.4bp vs. -71.5bp high for Dec'23 (-46.0bp on the open) at 4.153.

- Front month 10Y futures, TYM3 currently 116-05.5 vs. session high of 116-08.5 (10Y yield 3.3331% low). For a technical perspective, today's strong bounce undermines recent bearish signals and price has pierced resistance at 116-06+, the Mar 27 high. A continuation higher would signal scope for gains towards 117-01+, the Mar 24 high and a key short-term resistance. Key support has been defined at 114-07, the Mar 29 and 30 low.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00542 to 4.81171% (+0.01085/wk)

- 1M +0.01343 to 4.87114% (+0.01343/wk)

- 3M -0.00371 to 5.21886% (+0.02615/wk)*/**

- 6M +0.01685 to 5.33671% (+0.02371/wk)

- 12M -0.03500 to 5.29614% (-0.00915/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.22257% on 4/3/23

- Daily Effective Fed Funds Rate: 4.83% volume: $105B

- Daily Overnight Bank Funding Rate: 4.82% volume: $261B

- Secured Overnight Financing Rate (SOFR): 4.84%, $1.477T

- Broad General Collateral Rate (BGCR): 4.80%, $509B

- Tri-Party General Collateral Rate (TGCR): 4.80%, $494B

- (rate, volume levels reflect prior session)

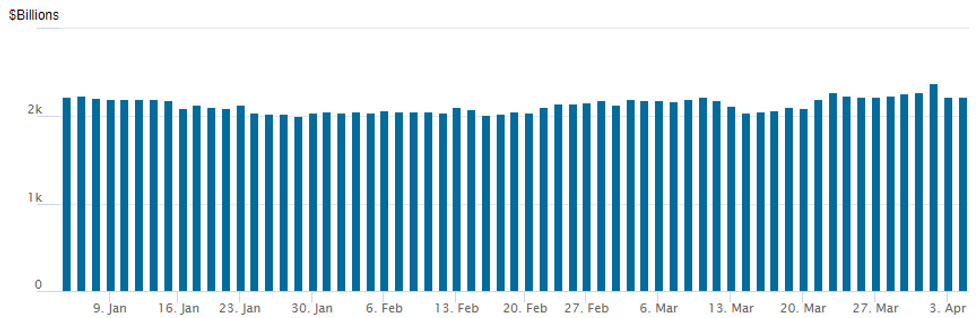

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $2,219.375B w/ 103 counterparties, compares to yesterday's $2,221.010B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better call structure trade on net, carried over from overnight, overall volume modest as the session ground on. Underlying futures holding near post-JOLTS data highs, many option desks plying the sidelines ahead of Wednesday's ADP private employment data release, March NFP on Friday's shortened session.

- SOFR Options:

- Block, 5,000 SFRJ3 95.50/95.75 call spds, 2.25 vs. 95.20/0.10%

- Block, 5,000 SFRK3 94.81/94.93/95.06 put flys, 2.5

- +10,000 SFRM3 94.75/95.50 1x3 call spds, 3.0-4.5

- 1,500 SFRJ3 95.06/95.43/95.81 put flys ref 95.05

- 1,750 OQJ3 96.18/96.37 2x1 put spds, ref 96.505

- over 6,000 SFRJ3 95.25 calls, 3.75 ref 95.045

- 3,000 SFRZ3 96.00/96.50/97.00/97.50 call condors, ref 95.69

- 1,000 OQZ3 95.50/95.75/96.25/96.50 put condors, ref 97.02

- Block, 4,000 SFRH4 97.50/98.50 call spds, 11.0 ref 96.175

- Block, 4,000 OQU3 97.50/98.50 call spds, 8.5 ref 96.865

- Treasury Options:

- 2,250 TYM3 116.5/118.5/120.5 call flys, 18 ref 116-07

- 7,500 TYM3 113 puts, 24 ref 116-03.5

- over +20,000 FVK3 109.25/109.75 put spds, 11.5

- over 10,000 FVK3 112 calls

- 1,850 TYK3 121 calls

EGBs-GILTS CASH CLOSE: Impressive Rally As Rate Hike Pricing Fades

In a near-repeat of Monday's price action, early losses in core European FI were erased in the second half of Tuesday's session after the release of weaker-than-expected US job openings data.

- Yields rose in the morning with moderate bear steepening as equities gained and the euro and sterling pushed to multi-month highs versus the dollar.

- The outsized reaction to the 600k US job openings miss was exaggerated by thin volumes throughout the session.

- Regardless, curves twist steepened sharply with short-ends rallying as ECB and BoE hikes were priced out in sympathy with rising expectations of Fed cuts.

- Periphery EGB spreads widened moderately throughout the session.

- Little reaction to European data, with Eurozone PPI in line. BoE Chief Econ Pill's gave a speech that tilted to the hawkish side, but market reaction was limited as it was released amid the JOLTS rally.

- German factory orders and French industrial production data feature early Wednesday, with Spain/Italy Services PMIs eyed later in the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.3bps at 2.601%, 5-Yr is down 4.5bps at 2.242%, 10-Yr is down 0.6bps at 2.249%, and 30-Yr is up 3bps at 2.336%.

- UK: The 2-Yr yield is down 3.7bps at 3.353%, 5-Yr is down 2.6bps at 3.274%, 10-Yr is up 0.4bps at 3.434%, and 30-Yr is down 0.7bps at 3.751%.

- Italian BTP spread up 2bps at 186.6bps / Spanish up 1.1bps at 103.1bps

EGB Options: Euribor Upside Remains In Demand

Tuesday's Europe rates / bond options flow included:

- ERZ3 98.00 call, bought for 10 in 5k (around 60k bought in past couple weeks)

FOREX: US Dollar Weakness Extends, GBPAUD Rallies 1.30%

- Bull steepening across the US yield curve following the surprisingly large decline for US JOLTS job openings to 9.93M (cons 10.50M) prompted further greenback weakness on Tuesday. The USD index has declined another 0.5% and is now trading below the March lows of 102.00 turning the focus to the February lows at 100.82.

- The broad dollar weakness has prompted strength across the majority of G10 currencies, with GBP and CHF the notable outperformers. GBP spent the US session consolidating its prior advance after cable broke a confluence of resistance points between 1.2425-50.

- On the other end of the spectrum, AUD is the notable laggard, falling after the RBA held rates at 3.6%. The RBA board watered down previously hawkish forward guidance as the bank noted in the final paragraph that some further tightening "may" be needed, at the previous meeting the board had noted further tightening will be needed. GBPAUD has erased the entirety of yesterday’s decline, rallying an impressive 1.3% to trade at the highest level since February 2022.

- The lower US yields assisted a very strong rebound for the Japanese yen. USDJPY fell over 1% from the earlier 133.17 high to trade just north of 131.50 ahead of the APAC crossover.

- EURUSD continued to make ground above noted 1.0930 resistance which represents a key short-term hurdle for bulls. A clear break would reinstate the recent bull theme and signal scope for a move towards 1.1033, the Feb 2 high. Worth noting there is currently 4.266B worth of options expiries at 1.0900 for tomorrow's NY cut which could potentially limit the topside momentum.

- A step down to 25bp from February’s 50bp is widely expected for the RBNZ overnight. Focus will then be on US ADP employment data and the US ISM Services PMI.

FX OPTION EXPIRY

- Big expiration in EURUSD Wednesday: Of note:

- EURUSD 1.06bn at 1.0950.

- USDCNY 1.46bn at 6.9000.

- EURUSD 4.12bn at 1.0900 (wed).

- USDJPY 1.32bn at 133.00 (wed).

- Elsewhere:

- EURUSD: 1.0900 (654mln), 1.0950 (1.06bn), 1.1000 (720mln).

- USDJPY: 132.00 (300mln). 132.10 (327mln), 133.00 (992mln), 133.30 (475mln).

- AUDUSD: 0.6750 (216mln), 0.6800 (360mln).

- USDCNY: 6.86 (595mln), 6.88 (381mln), 6.90 (1.46bn).

Late Equities Roundup: Bullish Conditions Remain

- US stocks trading weaker in late afternoon trade. After tapping the highest level since mid-February in late overnight trade (4171.25) SPX Eminis reversed course after the open, trading as low 4116.75 early in the second half.

- Generally quiet trade in the lead-up to Wednesday morning's ADP employment data, stocks appeared to retreat along with sharp declines in Treasury yields after lower than expected JOLTS jobs data (openings rate 9.931M vs. 10.500M est).

- Industrials, Energy and Materials sectors the top three S&P index laggers with Financials not far behind, banks underperforming (Zion -6.1%, First Republic -5.9, Key Bank -5.7%).

- For a technical point of view, the late overnight rally re-enforced bullish conditions. The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension towards 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4032.81, the 50-day EMA.

E-MINI S&P (M3): Bull Cycle Still In Play

- RES 4: 4244.00 High Feb 2 and a bull trigger

- RES 3: 4223.00 High Feb 14

- RES 2: 4205.50 High Feb 16

- RES 1: 4171.75 High Apr 4

- PRICE: 4125.25 @ 14:49ET Apr 4

- SUP 1: 4078.00 Low Mar 31

- SUP 2: 4032.81 50-day EMA

- SUP 3: 3980.75 Low Mar 28

- SUP 4: 3937.00 Low Mar 24

S&P E-minis maintains a bullish tone and the contract has traded higher today. Price has recently breached resistance at 4119.50, reinforcing bullish conditions. The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension towards 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4032.81, the 50-day EMA.

COMMODITIES: Gold Surges Past Bull Trigger On JOLTS Miss, Mixed Crude Session

- A mixed session for oil, with the main takeaway being an intraday decline following a surprisingly large reduction in US job openings caused demand concerns to resurface, after what had been further steady increases earlier in the session. Despite dipping, Brent remains 6% higher than Friday’s close before the OPEC+ production cut announcement.

- WTI is +0.3% at $80.65 with a high of $81.74 forming new resistance after which lies the key $83.04 (Jan 23 high).

- Brent is -0.1% at $84.87 with resistance remaining at $86.44 (Apr 3 high) and $87.87 (Jan 27 high).

- Gold is +1.8% at $2020.82, surging with USD weakness and Tsy yields sliding post-JOLTS to clear the bull trigger at $2009.7 (Mar 20 high) in the process. It touched $2024.85 post JOLTS, opening $2034.0 (2.00 proj of the Sep 28 – Oct 4 rally from Feb 28).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/04/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 05/04/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/04/2023 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 05/04/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/04/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/04/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/04/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/04/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/04/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/04/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/04/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/04/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/04/2023 | 0900/1100 | * |  | IT | Retail Sales |

| 05/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/04/2023 | 0915/1015 |  | UK | BOE Tenreyro Panellist at RES Conference | |

| 05/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/04/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/04/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2023 | 1400/1600 |  | EU | ECB Lane Lecture at University of Cyprus | |

| 05/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.