-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

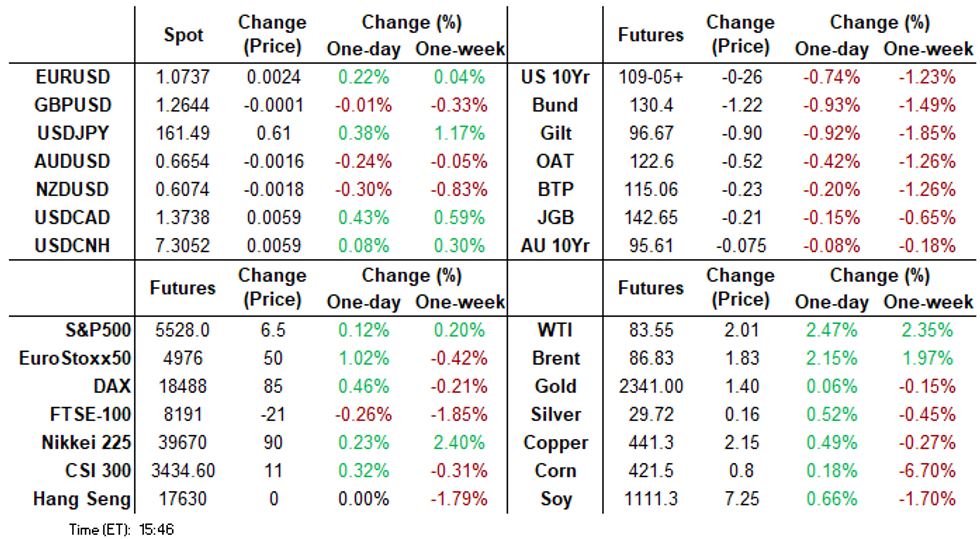

Free AccessMNI US MARKETS ANALYSIS - AUD/JPY Finds Bottom on China News

MNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI ASIA MARKETS ANALYSIS:Ylds Rise Ahead Headline Employ Data

- Treasuries under pressure Monday amid carry-over month end positioning since Tsys reversed early support last Friday.

- Curve flattener unwinds in play (2s10s +6.426 at -29.520), while rate cut pricing cooled.

- Small miss for ISM Mfg and Prices Paid data continues reversal, PMI sees slowest selling price increases YTD.

US Tsys Carry-Over Weakness Ahead Headline Jobs Data, Shortened Holiday Week

- Treasuries remained under pressure late Monday, US rate initially followed EGBs as French election risk premium is unwound.

- Futures marched lower since ISM mfg and prices paid miss, while MFG PMI was revised down fractionally in the final June release to leave a still modest increase to 51.6 (cons & prelim 51.7) after 51.3 in May.

- Other factors at play include carry-over month end positioning since Tsys reversed early support last Friday. Curve flattener unwound, while rate cut pricing cools.

- Sep'24 10Y futures neared key support of 109-00+ (Jun 10 low), trading 109-05 (-26.5) vs. 109-02.5 low. 10Y yield taps 4.4991% high (+.1031), curves steeper: 2s10s +6.634 at -29.312 (May 3 levels).

- Rather subdued trade despite the heavier volumes (TYU4>1.96M), focus on central bank conference in Sintra tomorrow, Fed Chair Powell, Lagarde and Campos Neto speaking at appr 0900ET.

- Light data tomorrow picks up Wednesday with ADP private employment numbers, ISM services, and weekly claims as markets are closed for 4th of July holiday Thursday. Friday headline data risk: June employment data.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00297 to 5.33420 (-0.00806 total last wk)

- 3M -0.00371 to 5.32089 (-0.01795 total last wk)

- 6M -0.00666 to 5.24805 (-0.02087 total last wk)

- 12M -0.01429 to 5.02575 (-0.01161 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (-0.01), volume: $2.024T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $706B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $682B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $67B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $157B

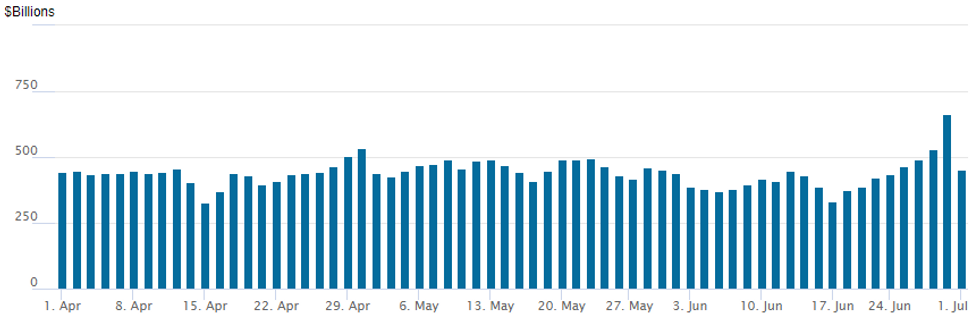

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage gaps below $500M to $451.783B vs. $664.570B last Friday when moth/quarter end usage pushed figure to highest level since January 10; number of counterparties falls back to 67 from 95 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury options traded mixed on net Monday, SOFR favored call spreads on lighter volumes while Treasury options centered on put in 5s, 10s and 30s. Underlying futures weaker on carry-over month end positioning, curve flattener unwinds ahead ADP Wednesday, Thursday mkts closed for 4th of July holiday, NFP Friday. Projected rate cut pricing through year end running steady to mildly lower vs. late Friday levels (*): July'24 at -8.5% w/ cumulative at -2.1bp at 5.307%, Sep'24 cumulative -17.4bp (-18.6bp), Nov'24 cumulative -26.8bp (-27.6bp), Dec'24 -45bp (-47.3bp). Salient flow includes:

- SOFR Options:

- +10,000 0QQ4 97.75 calls, cab ref 95.79

- +10,000 SFRH5 96.75/97.75 call spds 4.375 ref 95.385

- -5,000 0QN4 95.75/95.87 call spds, 6.0 ref 95.835

- 6,000 0QU4 96.25/96.37 call spds ref 95.855

- +2,000 0QU4 96.00/96.25 2x3 call spds, 5.5 ref 95.86

- Treasury Options:

- 6,000 FVQ4 106 puts, 25 ref 106-07.5

- 2,000 TYQ4 107.5/109/109.75 broken put flys, 9 ref 109-09

- 3,000 USQ4 119 calls, 50 ref 117-04

- Block, 2,000 TUQ4 102.12/102.37/102.62 call flys, 2.5 vs. 102-01.75/0.06%

- 5,400 FVQ4 106 puts ref 106-09.75

- 12,000 FVQ4 108.25 calls, 3.5 ref 106-11.5

- 3,300 FVQ4 105.5 puts, 10.5 last

- 2,800 USQ4 112/114 put spds ref 117-13

- 4,500 TYQ4 108 puts, 12 last

- over 9,800 TYQ4 108.5 puts, 18-22

- over 4,500 TYQ4 109.5 puts, 40-44

- 3,000 wk2 TY 108.5/109 put spds vs. 110/110.5 call spds ref 109-21.5

- 3,150 wk2 TY 109.75/110.25 call spds vs. 108.75 put ref 109-22

- 1,700 TYU4 105/106 put spds, 11.5 ref 109-16

EGBs-GILTS CASH CLOSE: Bunds Weaken As Political Risk Premium Dissipates

Core European instruments weakened sharply Monday, as political risk premia dissipated somewhat.

- OATs and periphery EGBs enjoyed some respite at the open after Sunday's French first-round elections went largely as expected, with the far-right RN winning the most seats but likely falling short of an absolute majority.

- German flash June inflation data was largely in line with expectations, with services CPI remaining relatively sticky but headline and overall core ticking lower.

- On the day, yields rose across all European curves, and closed near session highs.

- Both the German and UK curves bear steepened. 10Y OAT/Bund spreads fell 6bp to 74.1bp, the tightest level in over two weeks. Periphery EGB spreads tightened sharply, with BTP and GGBs narrowing over 7bp to Bunds.

- Tuesday's schedule includes the Eurozone-wide June flash HICP print (MNI sees modest downside risks to the 2.5% consensus headline expectation) and final PMIs, as well as ECB and other speakers at the Sintra forum.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.1bps at 2.924%, 5-Yr is up 10.6bps at 2.588%, 10-Yr is up 10.7bps at 2.607%, and 30-Yr is up 10.4bps at 2.795%.

- UK: The 2-Yr yield is down 2.3bps at 4.198%, 5-Yr is up 8.6bps at 4.11%, 10-Yr is up 10.9bps at 4.281%, and 30-Yr is up 11.6bps at 4.775%.

- Italian BTP spread down 7.4bps at 149.8bps / Greek down 7.8bps at 117.5bps

EGB Options: Multiple Schatz Put And Call Spreads Feature Monday

Monday's Europe rates/bond options flow included:

- DUQ4 105.50/105.10ps 1x2, bought for 10.5 in 3k

- DUQ4 105.60/105.90cs sold at 9 in 8k

- DUQ4 105.50/105.70cs sold at 8 in 8k

- RXQ4 130/129/128.50p ladder sold at 11.5 in 2k

- RXQ4 131/133cs 1x2, bought for 31 in 2k

- RXQ4 134.50c, bought for 10 and 10.5 in 7.5k

- 0RU4 97.25/97.50/97.62 broken call fly, bought for 3 in 5k

FOREX: Greenback Resilient to Softer US Data, JPY and CHF Pressured

- Higher core yields and the associated widening of yield differentials place specific pressure on the Japanese Yen and Swiss Franc on Monday. As such, USDJPY momentum has built above the 161 handle, briefly printing a new multi-decade high of 161.73. Elsewhere, EURCHF is seen as one of the best performing crosses to start the week, rising 0.72% back to 0.9700.

- In similar vein, and assisted by the initially firmer risk backdrop, AUD/JPY traded a higher high for a tenth consecutive session. Such a streak has only occurred a handful of times since the Global Financial Crisis and another higher high tomorrow would be the longest winning streak for the cross since 2011. Price has cleared 107.50 to touch the highest level since 2007 today.

- Softer-than expected US manufacturing data, and in particular the prices paid component, offered only very brief pressure on the greenback, before a strong reversal higher which persists as we approach the APAC crossover.

- This helped EURUSD a little lower across the session, which had previously been buoyed early Monday following the first-round results of the French election and a moderate reduction of political risk premium. Resistance at the 1.0777 (50-dma) has contained the rally well so far and trades around 1.0730 at typing.

- RBA minutes kick off the Tuesday calendar before Eurozone inflation will highlight the European session. Fed Chair Powell is due to participate in a panel discussion titled "Policy panel" at the ECB Forum on Central Banking, in Sintra. JOLTS job openings data highlights the data calendar in the US.

FX OPTIONS: Expiries for Jul02 NY cut 1000ET (Source DTCC)

- USD/JPY: Y161.00($1.5bln)

Late Equities Roundup: Top End Narrow Range

- Stocks have recovered from modest early sell pressure Monday, drifting mildly higher late Monday, at/near narrow session highs. Currently, the DJIA is up up 23.96 points (0.06%) at 39145.56, S&P E-Minis up 6.75 points (0.12%) at 5529.25, Nasdaq up 113.7 points (0.6%) at 17849.72.

- Information technology and Consumer Discretionary sectors continued to outperform in late trade, hardware makers outperformed semiconductor makers: Apple +2.82% on positive guidance, NetApp +1.55%, Arista Networks +1.48%.

- Auto makers buoyed the Consumer Discretionary sector with Tesla surging 7.45% amid hopes of progress in EU-China tariff talks on electric vehicle imports. Meanwhile, Ford gained +2.51%, GM +1.4%.

- Materials and Real Estate sectors continued to underperform in late trade, construction materials weighed on the former: Vulcan Materials -2.13%, Martin Marietta Materials -2.18%. Estate management shares weighed on the latter: CBRE Group -2.84%, Simon Property -3.22%.

- Reminder, the latest equity earnings cycle kicks off in earnest Friday next week, banks headline: Wells Fargo, Bank of NY Mellon, JP Morgan and Citigroup.

E-MINI S&P TECHS: (U4) Trend Signals Point North

- RES 4: 5622.69 2.764 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5600.00 Round number resistance

- RES 2: 5594.66 2.618 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5588.00 High Jun 20

- PRICE: 5531.50 @ 14:41 BST Jul 1

- SUP 1: 5484.21/5391.82 20- and 50-day EMA values

- SUP 2: 5267.75 Low May 31 and key support

- SUP 3: 5213.25 Low May 6

- SUP 4: 5155.75 Low May 3

The trend condition in S&P E-Minis is unchanged and signals remain bullish. Resistance at 5430.75, the May 23 high and bull trigger, has recently been cleared. This break confirmed a resumption of the primary uptrend. Note that moving average studies are in a bull-mode position and this continues to highlight positive sentiment. Sights are on 5594.66, a Fibonacci projection. Support to watch is 5484.21, the 20-day EMA.

COMMODITIES Crude Highest Since Late April, Spot Gold Unchanged

- WTI has risen to the highest level since April 29, supported by improved sentiment for summer demand.

- WTI Aug 24 is up 2.3% at $83.4/bbl.

- OPEC’s crude production was steady for the third month, while some members continued to exceed their quotas, according to Bloomberg.

- A bull cycle in WTI futures remains in play and the contract has pierced $82.24, 76.4% of the Apr 12 - Jun 4 bear leg. A clear break would open $85.24, the Apr 12 high and a bull trigger.

- In contrast, Henry Hub is on track for its lowest close since May 15. The ongoing retreat is driven by a recent recovery in US production, a softening in cooling demand expectations, and ongoing curtailment to US LNG export feedgas flows.

- Reuters analysts also forecast US natgas storage to be currently about 19% above average.

- US Natgas Aug 24 is down 4.6% at $2.48/mmbtu.

- Spot gold remains broadly unchanged for a second consecutive session at $2,328/oz on Monday.

- A clear break of the 50-day EMA, at $2,318.7, would open $2,277.4, the May 3 low. Initial firm resistance is $2,387.8, the Jun 7 high.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/07/2024 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 02/07/2024 | 0130/1130 |  | AU | RBA Minutes | |

| 02/07/2024 | 0730/0930 |  | EU | ECB's De Guindos chairing session on inflation | |

| 02/07/2024 | 0830/1030 |  | EU | ECB's Elderson chairs session on biodiversity | |

| 02/07/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 02/07/2024 | 0900/1100 | ** |  | EU | Unemployment |

| 02/07/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 02/07/2024 | 1030/1230 |  | EU | ECB's Schnabel chairing panel on Geopolitical shock and inflation | |

| 02/07/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 02/07/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 02/07/2024 | 1330/1530 |  | EU | ECB's Lagarde in policy panel at ECB forum | |

| 02/07/2024 | 1330/0930 |  | US | Fed Chair Jerome Powell | |

| 02/07/2024 | 1400/1000 | *** |  | US | JOLTS jobs opening level |

| 02/07/2024 | 1400/1000 | *** |  | US | JOLTS quits Rate |

| 02/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.