-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Ylds Up Ahead CPI, Mixed Fed Speak

HIGHLIGHTS

- MNI US-UK: Kirby - Biden To Discuss "Trade And Economic Prosperity" In NI Speech

- MNI US Kirby: "No Indication Egypt Is Providing Weapons To Russia"

- MNI US-CHINA: Yellen Says She Still Hopes To Go To China

- MNI ISRAEL: Netanyahu Reinstates Def Min As Security Threats Increase

Tsys Off Midday Lows, Squaring Up Ahead Wednesday CPI, FOMC Minutes

- Tsys remain moderately weaker, short end underperforming with curves unwinding early steeper profiles to flatter (2s10s -.562 at -60.481). Overall volumes still rather modest (TYM3 >930k), are an improvement compared to the last couple sessions with London back on-line.

- Midday selling partly related to IMF rhetoric over central banks (in)ability to tackle inflation until 2025 - more so than the measured comments by NY Fed Williams during Yahoo Finance interview this morning:

- "ONE MORE RATE HIKE IS A REASONABLE STARTING PLACE BUT WE WILL BE DRIVEN BY THE DATA" followed by "IF INFLATION COMES DOWN, WE WILL HAVE TO LOWER RATES" Bbg.

- Treasury futures gradually recovered after the Treasury $40B 3Y note auction (91282CGV7) awarded 3.810% high yield, steady to the WI; 2.59x bid-to-cover vs. 2.33x prior month.

- Futures continued pare losses in the second half as accounts squared positions ahead Wednesday's CPI and March FOMC minutes release.

- Fed funds implied hike for May'23 back to 17.9bp, Jun'23 at +19.9bp cumulative at 5.025%, while projected rate cuts later in the year continues to cool: Sep'23 at -7.9bp, November cumulative -24.9bp to 4.577%, Dec'23 42.7bp at 4.417.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00658 to 4.81629% (+0.00885 total last wk)

- 1M +0.03700 to 4.93729% (+0.04258 total last wk)

- 3M +0.04371 to 5.24157% (+0.00515 total last wk)*/**

- 6M +0.11414 to 5.35157% (-0.07557 total last wk)

- 12M +0.19743 to 5.32314% (-0.17958 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.24157% on 4/11/23

- Daily Effective Fed Funds Rate: 4.83% volume: $106B

- Daily Overnight Bank Funding Rate: 4.82% volume: $284B

- Secured Overnight Financing Rate (SOFR): 4.81%, $1.366T

- Broad General Collateral Rate (BGCR): 4.78%, $540B

- Tri-Party General Collateral Rate (TGCR): 4.78%, $531B

- (rate, volume levels reflect prior session)

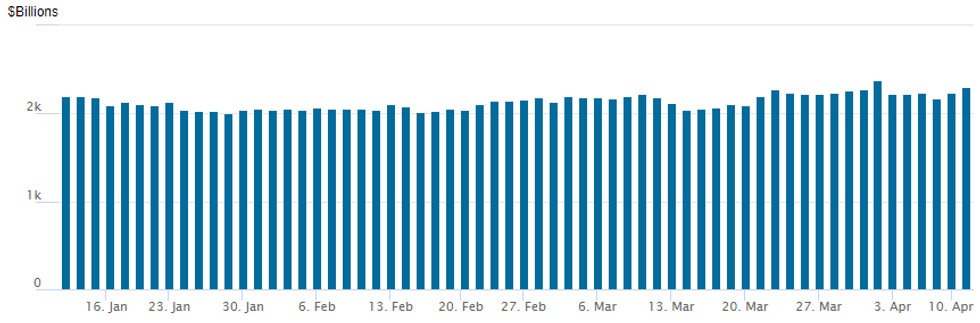

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,297.208B w/ 109 counterparties, compares to prior $2,239.655B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Tuesday saw a concerted pick-up in option volume with Europe back from an extended Easter holiday weekend. But overall trade was mixed, two-way positioning ahead Wednesday's headline CPI inflation metric for March.- SOFR Options:

- Block, -30,000 SFRK3 94.81/94.93/95.18 put trees, 14.0-14.5 ref 95.015-.01

- Block, 9,000 SFRU3 93.75/94.25/94.75 put flys, 7.0 ref 95.275

- +8,000 SFRM3 94.87/95.12 2x1 put spds, 8.0-8.5

- Block, total 10,000 SFRK3 95.06 puts 16.0 ref 95.02

- -3,000 SFRZ3 94.00/94.25/94.75 2x3x1 put flys ref 95.69

- +14,000 SFRM3 94.93/95.06/95.18 put flys, 1.5 ref 95.03

- 6,500 SFRU3 94.75/94.87/95.37/95.50 iron condors ref 95.30

- over 10,000 SFRJ3 95.25 calls

- over 7,500 OQK3 98.00 calls

- 2,000 SFRJ3 95.06/95.12/95.18/95.31 call condors ref 95.025

- 2,000 SFRN3 94.62/94.87/95.37/95.62 iron condors

- 2,000 OQK3 95.75 puts, 3.0 ref 96.615

- 2,000 OQJ3 96.87 calls ref 96.62

- 2,500 SFRZ3 94.87/95.12/95.87/96.12 iron condor

- 1,500 SFRU3 94.62/94.75/94.87 call flys, ref 95.315

- 1,750 SFRM3 94.25/94.75/95.00 broken put flys, ref 95.04

- Block, 3,500 SFRK3 97.50 calls, .5 ref 95.04

- Block, 2,500 SFRM3 94.25/94.75/95.00 put flys, 6.5 ref 95.04

- Block, -5,000 SFRU3 94.75/94.87 put spds vs. SFRU3 95.37/95.50 call spds, iron condor for 0.75 net cr

- Treasury Options:

- -2,000 FVK3 109.75 puts, 33

- Block, 5,000 TYK/TYM 114.5 call spd on 3x2 ratio, 4 net/June sold over

- 2,500 TYM3 114.5/117 call over risk reversals 5 net ref 115-20

- 1,500 FVK109.25/110 put spds

- 3,000 FVK3 108.75 puts, 5 ref 110-02.75

- 2,000 TYK3 114/117.5 combos ref 115-19.5

- over 6,500 wk2 10Y 114.5 puts, 9-10 ref 115-19.5

- -2,000 FVK3 109.75 puts, 33

EGBs-GILTS CASH CLOSE: Catching Up To U.S. Selloff

European yields rose sharply Tuesday in the return to trading following a four-day weekend, with Bunds underperforming Gilts. There were few specific catalysts in the European session, with EGBs/Gilts mainly following the bearish lead of Treasuries after a solid jobs US jobs report Friday.

- The German curve bear flattened sharply, as the short end caught up with weakness in its US counterpart, including a sharp upward repricing in ECB terminal rate expectations (ECB terminal Depo rate pricing +15.9bp to 3.67%).

- The UK's curve saw more of a parallel shift, but like Germany's, the yield rise was in double-digits for the most part.

- Periphery EGB spreads were mixed, with Greece tightening and BTPs widening.

- With another light European data slate Wednesday, most global market attention Wednesday will be on US inflation.

- ECB's Villeroy speaks after the cash close, with appearances Wednesday by multiple speakers including Guindos, de Cos, and BoE's Bailey.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 15.2bps at 2.706%, 5-Yr is up 14.2bps at 2.322%, 10-Yr is up 12.8bps at 2.311%, and 30-Yr is up 10.7bps at 2.389%.

- UK: The 2-Yr yield is up 11.4bps at 3.486%, 5-Yr is up 11.3bps at 3.384%, 10-Yr is up 11bps at 3.542%, and 30-Yr is up 9bps at 3.861%.

- Italian BTP spread up 1.2bps at 186.1bps / Greek down 2.8bps at 188.2bps

EGB Options: Mixed Post-Holiday Rates Trade

Tuesday's Europe rates / bond options flow included:

- ERM3 96.375/96.125/95.75/95.50p condor, sold at 4.5 in 3.5k (unwind)

- SFIM3 95.45/95.35/95.15p ladder, bought for -2 (receive) in 3k

FOREX: USD Index Retraces Monday Climb, NOK Weakness Stands Out In G10

- The USD index weakened on Tuesday, erasing the majority of the post-NFP strength in the lead up to another important CPI report tomorrow. The USD Index is close to 0.6% off the Monday high, with 101.987 marking the immediate support to watch. Moves come as markets see relatively little read through from the jobs report to Fed monetary policy, with a 25bps step in early May likely marking the peak of this tightening cycle.

- The Norwegian Krone was the weakest in G10 on Tuesday, a notable move given the stronger than expected CPI figures for March and firmer oil prices. The data is seen as doing little more to bolster the Norges hiking backdrop and the sell-off is being tied more closely to thin liquidity across Scandi currency markets, exacerbated by EURNOK (+0.85%) breaching the prior 2023 highs above 11.4829. Desks also reported real money demand for EURNOK assisting the move higher.

- European yields rose substantially Tuesday in the return to trading following a four-day weekend. The German curve bear flattened sharply, as the short end caught up with weakness in its US counterpart, including a sharp upward repricing in ECB terminal rate expectations which bolstered the Euro. EURUSD rose 0.42% to regain the 1.09 handle, maintaining the underlying bullish technical outlook for the pair.

- Early USDJPY weakness, however, was shrugged off with higher core yields continuing to weigh on the Japanese yen, which has been under renewed pressure since the release of the US employment data on Friday.

- Despite most recent gains for USDJPY being considered technically corrective overall, attention is on resistance at 133.87, Monday’s high. A break of this level would strengthen a short-term bullish theme and highlight a clear breach of the 50-day exponential moving average. This would open 134.75, a Fibonacci retracement.

- As well as US CPI on Wednesday, the Bank of Canada rate announcement & press conference as well as the FOMC minutes make for a packed schedule.

Expiries for Apr12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900-10(E2.7bln), $1.0940-50(E640mln)

- USD/JPY: Y132.00($732mln), Y132.15-25($863mln), Y134.10-15($1.1bln)

- GBP/USD: $1.2300(Gbp692mln)

- EUR/GBP: Gbp0.8755-70(E480mln), Gbp0.8795-10(E595mln)

- AUD/USD: $0.6700(A$545mln), $0.6750(A$1.2bln)

- USD/CAD: C$1.3800($582mln)

Equities Roundup: Marking Session Highs, Bank Earnings Kick Off

- US stocks are quietly climbing off midmorning lows in early afternoon trade: Dow Industrials (33,742.39 +157.38) and SPX Eminis (4147.50 +11.25) outperforming Nasdaq (12,067.28 -17.06) at the moment.

- No particular headline driver for the support, but position squaring ahead of Wednesday's key data risk, March CPI and FOMC minutes a likely factor.

- Energy, Industrials and Financial sectors are outperforming. Regarding the latter, JPM, Citi, PNC and possibly Wells Fargo are expected to announce earnings this week). Laggers: Communication Services and Information Technology and Consumer Discretionary sectors are underperforming.

- From a technical perspective, S&P E-minis remain in an uptrend and the contract is trading closer to its early April highs. Price has recently breached resistance at 4119.50, Mar 6 high, reinforcing a bullish theme.

- The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension to 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key M/T resistance. Firm support lies at 4050.52, the 50-day EMA.

E-MINI S&P (M3): Trend Needle Points North

- RES 4: 4244.00 High Feb 2 and a bull trigger

- RES 3: 4223.00 High Feb 14

- RES 2: 4205.50 High Feb 16

- RES 1: 4171.75 High Apr 4

- PRICE: 4146.00 @ 1510ET Apr 11

- SUP 1: 4073.42 20-day EMA

- SUP 2: 4050.52 50-day EMA

- SUP 3: 3980.75 Low Mar 28

- SUP 4: 3937.00 Low Mar 24

S&P E-minis remain in an uptrend and the contract is trading closer to its early April highs. Price has recently breached resistance at 4119.50, Mar 6 high, reinforcing a bullish theme. The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension to 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key M/T resistance. Firm support lies at 4050.52, the 50-day EMA.

COMMODITIES: Crude Bounces Despite Demand Uncertainty

- Crude oil has bounced after yesterday’s decline, rising circa 2%. The gains come despite uncertainty remaining over the compliance with current production cut targets from Russia and from OPEC starting next month.

- Further, on the demand side the speed of recovery in China is still unclear and there is uncertainty over global demand with expectations that the US Fed may be getting closer to ending its rate hike cycle.

- WTI is +2.1% at $81.45, approaching resistance at $81.81 (Apr 4 high) after which sits key resitance at $83.04 (Jan 23 high).

- With reasonably wide ranges to the session of $79.37-$81.59, the most active strikes in the CLK3 currently edge out with $75/bbl puts, closely followed by $80/bbl calls.

- Brent is +1.7% at $85.58, off resistance at $86.44 (Apr 3 high) after which sits $87.87 (Jan 27 high).

- Gold is +0.65% at $2004.47 as it resumes gains amidst USD weakness, although it remains some way off resistance at $2032.1 (Apr 5 high).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/04/2023 | 2330/1930 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/04/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 12/04/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 12/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 12/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank, G20 Finance Ministers' Meetings | |

| 12/04/2023 | 1230/0830 | *** |  | US | CPI |

| 12/04/2023 | 1230/1430 |  | EU | ECB de Guindos at Asociacion para el Progreso de Direccion Event | |

| 12/04/2023 | 1300/1400 |  | UK | BOE Bailey Remarks at Institute of International Finance | |

| 12/04/2023 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 12/04/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 12/04/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 12/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 12/04/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 12/04/2023 | 1600/1200 |  | US | San Francisco Fed's Mary Daly | |

| 12/04/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/04/2023 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/04/2023 | 1800/1400 | * |  | US | FOMC Statement |

| 12/04/2023 | 1915/2015 |  | UK | BOE Bailey Speaks at IMF Governor Talks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.