-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI BRIEF: China Passenger Car Sales Up In November Y/Y

MNI ASIA MARKETS ANALYSIS: Yr End Cut Cools, Harker Sees 25bp

- Treasuries look to finish lower Monday, off early lows as last week's French political cooled slightly.

- Projected rate cuts receded from last wk's 50bp by December, as Philly Fed Harker sees one 25bp cut by year end

- Surge in US$ high grade corporate debt issuance Monday, over $20B, also weighed on Treasury earlier.

- US stocks continued to climb higher, S&P Eminis and Nasdaq marking new all-time highs.

US TSYS Corporate Supply Weighs, Projected Yr End Rate Cuts Ease

- Treasury futures looked to finish lower/near midday lows Monday, initial weakness tied to cooling French political uncertainty over the weekend.

- Rates broke through a narrow overnight range amid word Home Depot would issue corporate debt over 9 tranches. Speculative selling added to rate lock hedging well before the $10B 9pt launched, lion's share of just over $20B total issuance on the day.

- Average Treasury futures volumes (TYU4<1.3M), with the Sep'24 10Y contract currently trading -15.5 at 110-11.5 vs. 110-09 low. Despite the decline, a bull cycle remains in play after the contract traded higher Friday, clearing resistance at 110-21, the Jun 7 high. Focus on 111-01 initial resistance - last Friday's high, followed by 111-09, April 1 high. Key support well below at 109-00+, the Jun 10 low.

- Short end selling sees rate cut projections cooling vs. late Friday levels (*): July'24 at -10% w/ cumulative at -2.5bp at 5.302%, Sep'24 cumulative -17.5bp (20bp), Nov'24 cumulative -26.6bp (-29.9bp), Dec'24 -46.1bp (-50.5bp).

- Cash yields are running mildly higher: 5s +.0649 at 4.3032%, 10s +.0561 at 4.2770%, 30s +.0586 at 4.4074%, while curves reversed early steepening to mildly flatter: 2s10s -0.476 at -49.041, 5s30s -.722 at 10.150.

- Look ahead: economic data surge Tuesday with Retail Sales, IP/Cap-U and TIC Flows, Several Fed speakers on tap as well.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00675 to 5.33867 (+0.00428 total last wk)

- 3M -0.00046 to 5.34357 (+0.01004 total last wk)

- 6M -0.00710 to 5.26892 (+0.00473 total last wk)

- 12M -0.02152 to 5.02820 (-0.02238 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.855T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $785B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $771B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $87B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $270B

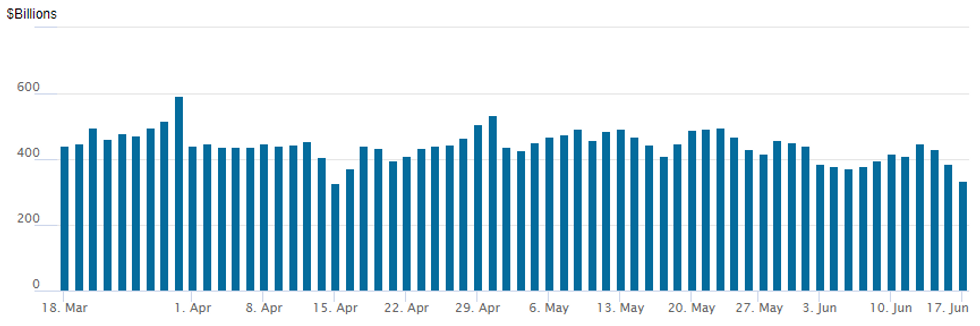

FED Reverse Repo Operation: Near Three Year Lows

NY Federal Reserve/MNI

- Nearing three year lows RRP usage falls to $333.429B from $386.885B prior; number of counterparties down to 66 from 68 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Mixed overnight trade has continued in early NY trade, more consistent put trade in SOFR options, call on lighter volume in Treasury options so far. Weaker underlying futures extended lows on surge in corporate bond hedging. Selling sees rate cut projections cooling vs. late Friday levels (*): July'24 at -10% w/ cumulative at -2.5bp at 5.302%, Sep'24 cumulative -17.5bp (20bp), Nov'24 cumulative -26.6bp (-29.9bp), Dec'24 -46.1bp (-50.5bp).

- SOFR Options:

- +3,500 SFRU4 95.00/95.37 call spds, 2.0 vs. 94.85/0.05%

- +9,000 SFRZ5 94.50 puts, 11.5 vs. 96.065/0.14%

- Block, 5,000 SFRZ4 94.93/95.18/95.56 broken call flys, 2.75 net vs. 95.18/0.05%

- +4,000 0QU4 96.25/96.50/96.75 call fly 2.25 ref 95.925

- +4,000 SFRH5 94.50/94.68/94.87/95.06 put condor 4.25 ref 95.445

- SFRN4 94.93/95.06 1x2 call spds, 0.0 ref 94.845

- +6,000 SFRV4 94.87/95.00/95.12 put trees 2.25 ref 95.155

- +5,000 SFRV4 94.87/95.00/95.12 put trees, 2.25, sizing offers

- +5,000 SFRU4 94.62/94.68/94.75 put trees, 2.0

- 5,000 SFRU4 94.62/94.75 2x1 put spds ref 94.855

- 3,000 SFRZ4 95.37/95.50 put spds ref 95.175

- 2,000 SFRU4 95.12/95.18 call spds ref 94.855

- 1,000 SFRZ4 95.50/96.00/96.50 call flys ref 95.17

- Treasury Options:

- 30,000 TYU4 110 puts, 100 ref 110-12.5

- -5,000 TYU4 110.5 straddles, 224-226

- 4,000 TYQ4 111 calls, 41 ref 110-11

- 2,000 USU4 115 puts, 50

- 1,300 USN4/USU4 120 call calendar spd, 1-63

- 2,900 WNN4 125/WNQ4 127 call spds ref 127-19

- 1,500 TYN4 110/110.75 put spds, 16 ref 110-19.5

- 1,900 TYU4 111/112.5 1x2 call spds ref 110-20

- 1,328 TYU4 112/113.5/115 call flys ref 110-22.5

EGBs-GILTS CASH CLOSE: Modest Political Risk Relief

Yields rose across European curves Monday, with EGB periphery spreads narrowing.

- With weekend developments on the French political front helping soothe market concerns to some degree (e.g. Le Pen saying if victorious in the upcoming election she would work with Pres Macron), some of last week's jump in related risk premia softened.

- This saw Bunds underperform among EGBs with some bear steepening in the German curve. France/Germany 10Y spreads tightened 2.8bp from last week's 7-year wides.

- Weakness extended in the European afternoon amid heavy US corporate issuance.

- Friday's periphery underperformers, BTPs and GGBs, were Monday's outperformers.

- Gilts were weighed down by a poor BoE APF sale of longer-dated instruments. BoE implied cuts were relatively unchanged on the day, with attention on UK CPI Wednesday and the MPC decision Thursday.

- On the Eurozone docket Tuesday, we get German ZEW and final Euro CPI, along with multiple ECB speakers (starting with Knot and Vujcic in the morning).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.1bps at 2.814%, 5-Yr is up 5.1bps at 2.424%, 10-Yr is up 5.4bps at 2.414%, and 30-Yr is up 5.9bps at 2.571%.

- UK: The 2-Yr yield is up 4.2bps at 4.213%, 5-Yr is up 4.9bps at 3.994%, 10-Yr is up 5.9bps at 4.115%, and 30-Yr is up 6.1bps at 4.6%.

- Italian BTP spread down 4.1bps at 152.9bps / Greek down 4.3bps at 124.8bps

EGB Options: Week Opens With Mostly Upside

Monday's Europe rates/bond options flow included:

- OEU4 117/118cs vs 115.50p, sold the put at 1 in 5k (ref 116.89).

- RXN4 129.50p, bought for 1.5 in 7k

- RXQ4 140 call sold at 9-9.5 in 8.8k

- RXQ4 134c vs RXU4 130p, bought the Aug c for 13 in 5.75k

- SFIQ4 94.85/94.75/94.65p fly, bought 1.25 in 2.5k

- ERZ4 97.125 calls paper paid 6.25 on 6K

FOREX Euro Crosses Moderately Reverse Higher as Political Risks Stabilise

- The single currency has traded on a better footing Monday as markets were given a degree of reassurance surrounding the political risk uncertainties in France. A moderate compression of EGB spreads has helped the Euro trade higher against the majority of its G10 counterparts, although ranges across the FX majors remain subdued overall.

- EURUSD has edged from 1.0700 to 1.0725 across the US session, and has also been assisted by more optimistic price action in equity markets. More notable has been the solid bounce for the EURJPY, which matches the likes of EURAUD and EURNZD which all look set to close around 0.5% in the green Monday.

- For EURJPY, despite piercing a key support at 16803, a trendline drawn from the Dec 7 ‘23 low, the trend structure remains bullish, and the recent move lower appears to be a correction. A clear breach of this line would undermine the bullish theme and highlight a potential reversal. Initial firm resistance is at 170.14, the Jun 13 high.

- The largest net shifts in positioning last week see the NZD and GBP net longs improve, while the EUR and MXN net longs were trimmed, and the AUD and CAD net shorts extended. Meanwhile, the CAD net position slips to a new series low, with the net short now amounting to 42.1% of open interest - a fresh 52 week low.

- Immediate attention shifts to Tuesday’s RBA decision & press conference before US retail sales and industrial production take focus later in the session.

FX Expiries for Jun18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0670-80(E2.1bln), $1.0700(E957mln), $1.0725-30(E600mln), $1.0750(E631mln), $1.0880-85(E1.4bln)

- USD/JPY: Y153.50($1.3bln), Y154.00($2.0bln), Y155.00($886mln), Y155.95-00($556mln), Y159.00($537mln)

- AUD/USD: $0.6585-00(A$1.1bln)

- USD/CNY: Cny7.2500($617mln)

Late Equities Roundup: S&P Eminis, Nasdaq Make New All-Time Highs

- Stocks continued to march higher after breaching a narrow overnight range around midmorning, S&P Eminis and Nasdaq indexes making new all time highs (5494.00 and 17,904.26 respectively) while the DJIA gained, industrials remained off May 17 high of 40,003.59.

- Currently, the DJIA is up 200.47 points (0.52%) at 38787.46, S&P E-Minis up 53.25 points (0.97%) at 5555.75, Nasdaq up 220.5 points (1.2%) at 17909.51.

- Leading gainers: Information Technology shares moved to the fore in the second half, trailed by Consumer Discretionary stocks. Hardware/software makers supported the IT sector: Super Micro Computer +8.15%, Autodesk +7.29%, Broadcom +6.14% after the bell. Auto makers continued to support the Consumer Discretionary sector: Tesla +5.48%, GM +1.28%, Ford +1.26%.

- Laggers: Meanwhile, Utilities and Real Estate sectors continued to trade weaker in late trade, independent power providers weighed on the Utilities sector: Vistra -4.54%, AES Corp -2.02%, Dominion Energy -2.00%. Investment Trusts weighed on the latter, particularly Specialized and Industrial REITs: Crown Castle -2.25%, SBA Communications -1.72%, American Tower -1.44%.

E-MINI S&P TECHS: (U4) Bull Cycle Still In Play

- RES 4: 5572.00 2.50 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5549.34 2.382 proj of the Apr 19 - 29 - May 2 price swing

- RES 2: 5521.31 2.236 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5519.50 High Jun 12

- PRICE: 5494.00 @ 1515 ET Jun 17

- SUP 1: 5406.49/5328.35 20- and 50-day EMA values

- SUP 2: 5267.75 Low May 31 and key support

- SUP 3: 5213.25 Low May 6

- SUP 4: 5155.75 Low May 3

The uptrend in S&P E-Minis remains intact and the contract traded higher last week. Price has recently cleared 5430.75, the May 23 high and bull trigger. The move confirmed a resumption of the uptrend. Moving average studies are in a bull-mode position, highlighting bullish market sentiment. Sights are on 5521.31 next, a Fibonacci projection. Key short-term support has been defined at 5267.75, the May 31 low. Initial support is 5406.49, 20-day EMA.

COMMODITIES WTI Crude Extends Gains, Gold Edges Lower

- Oil has extended gains on Monday after its biggest weekly gain since early April last week, supported on technical buying and demand outlook optimism.

- WTI Jul 24 is up 2.5% at $80.4/bbl.

- Crude prices broke through their 200-day moving average as outlooks expected crude balances to tighten and the summer driving season ticks higher.

- For WTI futures, resistance at $78.46, the 50-day EMA, has been pierced. A clear break of this average would expose the key short-term resistance at $80.62, the May 1 high.

- On the downside, a resumption of weakness would open $71.33, the Feb 5 low.

- In contrast, US natural gas slipped on Monday on forecasts for greater gas supply and increasing coal use for power generation.

- US Natgas Jul 24 is down 3.0% at $2.80/mmbtu.

- Meanwhile, spot gold has fallen by 0.6% today to $2,318/oz, leaving the yellow metal around 5% below its May 20 record high.

- Having traded below the 50-day EMA at $2,314.7, this has opened $2,277.4, the May 3 low. Initial firm resistance to watch is $2,387.8, the Jun 7 high.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/06/2024 | 0100/2100 |  | US | Fed Governor Lisa Cook | |

| 18/06/2024 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 18/06/2024 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/06/2024 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/06/2024 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/06/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/06/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/06/2024 | 1200/1400 |  | EU | ECB's Cipollone chairing session on market supervision | |

| 18/06/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 18/06/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/06/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 18/06/2024 | 1330/1530 |  | EU | ECB's De Guindos at EC and ECB joint conference | |

| 18/06/2024 | 1400/1000 | * |  | US | Business Inventories |

| 18/06/2024 | 1400/1000 |  | US | MNI Webcast with Richmond Fed's Tom Barkin | |

| 18/06/2024 | 1540/1140 |  | US | Boston Fed's Susan Collins | |

| 18/06/2024 | 1700/1300 |  | US | Fed Governor Adriana Kugler | |

| 18/06/2024 | 1700/1300 |  | US | Dallas Fed's Lorie Logan | |

| 18/06/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/06/2024 | 1720/1320 |  | US | St. Louis Fed's Alberto Musalem | |

| 18/06/2024 | 1800/1400 |  | US | Chicago Fed's Austan Goolsbee | |

| 18/06/2024 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.