-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Rolls, Heavy Eurodlr LIBOR Transition Hedging

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Debate On Fed Standing Repo Facility To Return

- MNI EXCLUSIVE: More SOEs May Default As China Targets Zombies

- MNI BRIEF: Senate GOP Calls on Europe To Counter China Jointly

- MNI BRIEF: Fed's Williams Says Economy 'More Challenged'

US

FED: The Federal Reserve will need to revive its debate over the creation of a standing repo facility as a permanent source of alternative funding for dealers under stress to avert any repetition of the market strain seen in March, former Fed officials, researchers and market sources told MNI. For more see MNI Policy MainWire at 1306ET.

FED: New York Fed President John Williams said on Wednesday he is worried the economy will be "more challenged" because of waning fiscal support for growth.- The Fed stands ready to support the recovery, he said, but was not specific about how it might do so.

- "We clearly have the ability within monetary policy to make sure that interest rates are low and understood to continue to be low," he told a virtual conference sponsored by the Society of American Business Editors and Writers.

- Senator Jim Risch, Republican of Idaho and chairman of the foreign relations committee, issued the report saying that the committee is "deeply interested" in putting aside differences and partnering with Europe to counter China.

- The strategy, which aligns with comments made by President-elect Joe Biden and those of his advisers, suggests that Democratic and Republican views have converged in seeking a multilateral approach to China.

ASIA

CHINA: China is set to allow more struggling state-owned companies to default or even go bankrupt, forcing investors to re-evaluate assumptions of local government backing for their debt, but authorities will limit failures to out-of-favour sectors such as heavily-polluting industry and be careful to control their pace in order to avoid generating systemic risk, policy advisors told MNI. For more, see 11/18 MNI Policy MainWire at 0928ET.

OVERNIGHT DATA

US OCT HOUSING STARTS 1.530M; PERMITS 1.545M

US SEP STARTS REVISED TO 1.459M; PERMITS 1.545M

US OCT HOUSING COMPLETIONS 1.343M; SEP 1.406M (REV)

US MBA: UNADJ PURCHASE INDEX +26% VS YEAR-EARLIER LEVEL

CANADA OCT CONSUMER PRICE INDEX INFLATION +0.7% YOY

CANADA MOM CPI INFLATION WAS +0.4% IN OCT

BANK OF CANADA AVG 3 CORE CPI RATES +1.8% OCT VS SEPT +1.7%

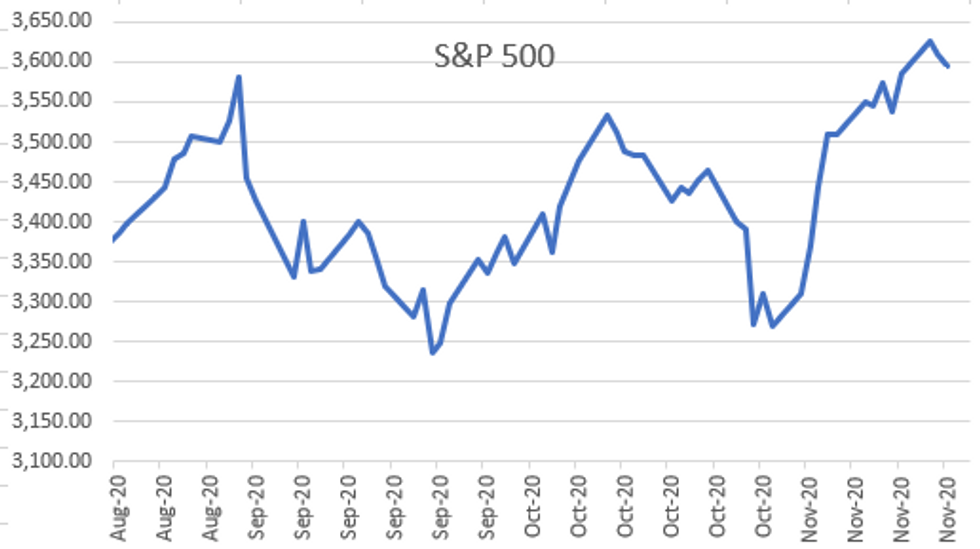

MARKETS SNAPSHOT

- DJIA down 111.44 points (-0.37%) at 29783.35

- S&P E-Mini Future down 13.5 points (-0.37%) at 3615.5

- Nasdaq down 8.3 points (-0.1%) at 11899.34

- US 10-Yr yield is up 2.1 bps at 0.8783%

- US Dec 10Y are down 3/32 at 138-6.5

- EURUSD up 0.0001 (0.01%) at 1.1875

- USDJPY down 0.36 (-0.35%) at 103.83

- WTI Crude Oil (front-month) up $0.54 (1.3%) at $41.77

- Gold is down $6.61 (-0.35%) at $1874.77

- European bourses closing levels:

- EuroStoxx 50 up 13.69 points (0.39%) at 3477.9

- FTSE 100 up 19.91 points (0.31%) at 6369.74

- German DAX up 68.42 points (0.52%) at 13169.27

- French CAC 40 up 28.45 points (0.52%) at 5497.19

US TSY SUMMARY: Long End Outperforms

Bonds outperformed despite a moderately choppy session, couple bouts of weakness (knee-jerk react to early Pfizer headlines and again after the 20Y Bond auction tailed). Decent overall volumes as Dec/Mar futures rolling accelerated.

- Vaccine headline sensitivity continues: Bit of a knee-jerk reaction to latest vaccine related headlines from Pfizer ahead the NY open, announcing 95% effectiveness vs. 90% that sent markets on a risk-asset buy spree last week Monday. Tsys pared gains, extending overnight lows. Futures bounced back to prior lvls, however, as storage and distribution issues remain.

- Weak 20Y bond auction, bonds extend losses: Tsys gapped lower after US Tsy $27B 20Y bond auction (912810ST6) tailed with high yield of 1.422% (1.370% last month) vs. 1.413% WI, on a bid/cover 2.27 (2.43 previous).

- Heavy Eurodollar futures volume centered in Reds (EDZ1-EDU2) centered around spreads most likely due to LIBOR transition to the Secured Overnight Financing Rate (SOFR) positioning and risk mitigation.

- The 2-Yr yield is up 0.4bps at 0.1732%, 5-Yr is up 1.6bps at 0.3952%, 10-Yr is up 2.1bps at 0.8783%, and 30-Yr is up 1.1bps at 1.6164%.

US TSY FUTURES CLOSE: Steady/Mixed, Off Lows

Bonds outperformed despite a moderately choppy session, couple bouts of weakness (knee-jerk react to early Pfizer headlines and again after the 20Y Bond auction tailed). Decent overall volumes as Dec/Mar futures rolling accelerated.

- 3M10Y +2.232, 79.313 (L: 74.542 / H: 81.279)

- 2Y10Y +1.062, 69.647 (L: 66.293 / H: 71.412)

- 2Y30Y -0.672, 142.868 (L: 140.068 / H: 145.699)

- 5Y30Y -1.872, 120.708 (L: 119.813 / H: 123.033)

- Current futures levels:

- Dec 2Y steady at 110-11.75 (L: 110-11.37 / H: 110-12)

- Dec 5Y down 1.25/32 at 125-16.25 (L: 125-14.5 / H: 125-19.25)

- Dec 10Y down 2.5/32 at 138-7 (L: 138-02.5 / H: 138-16.5)

- Dec 30Y up 6/32 at 172-24 (L: 172-05 / H: 173-15)

- Dec Ultra 30Y up 18/32 at 216-17 (L: 215-07 / H: 218-03)

US TSY FUTURES: December/March Futures Roll Update

Dec/Mar volume picked up in earnest Wednesday. Dec futures cede lead to Mar futures on Nov 30 "first notice" date. Dec futures won't expire until mid-late December: 10s, 30s and Ultras on 12/21; 2s & 5s 12/31. All well under 5% completed at the moment:

- TUZ/TUH appr 52,300 0.125 last;

- FVZ/FVH appr 96,900 -10.0 last;

- TYZ/TYH appr 110,100 12.5 last;

- UXYZ/UXYH under 40,600, 19.5 last;

- USZ/USH 22,400, -1-09 last;

- WNZ/WNH 4,900, 1-20.75 last;

US EURODOLLAR FUTURES CLOSE: Heavy Volume On LIBOR Transition, Positioning

Futures traded mostly weaker after the bell, Reds steady to mildly higher amid heavy volume (EDH2>560k), due to spreads traded to mitigate/adjust for risk ahead LIBOR benchmark retirement at end of 2021. Current levels:

- Dec 20 -0.007 at 99.745

- Mar 21 -0.005 at 99.780

- Jun 21 -0.005 at 99.785

- Sep 21 steady at 99.785

- Red Pack (Dec 21-Sep 22) steady to +0.010

- Green Pack (Dec 22-Sep 23) -0.005 to -0.015

- Blue Pack (Dec 23-Sep 24) -0.02

- Gold Pack (Dec 24-Sep 25) -0.02 to -0.025

US EURODLR FUTURES: More Red-Strip Rolls, LIBOR Transition Risk Mitigation?

Heavy volume centered in Eurodollar Reds (EDZ1-EDU2) centered around spreads most likely due to LIBOR transition to the Secured Overnight Financing Rate (SOFR) positioning and risk mitigation.

- Over 114,000 Red Dec'21/Mar'22 spds trade so far, mostly from +0.060 to 0.040 with better sellers reported. Red Mar'22 volume leads with over 560k traded so far, Red Dec'21 second highest with 306k. Various additional spds reported include EDH2 vs. EDM2 and EDU2.

- Expect volume pick-up to continue as myriad entities that use Eurodollar futures (real$, bank & insurance portfolios, global macro, etc) start to adjust to retirement of LIBOR benchmark at end of 2021, particularly 3M of which Eurodollar futures are based on.

- Transition from the traditional LIBOR benchmark to SOFR has been relatively slow, partially due liquidity and fallback provisions costs. Should see pace pick up as 2021 proceeds.

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00012 at 0.08225% (-0.00100/wk)

- 1 Month -0.00300 to 0.14650% (+0.01012/wk)

- 3 Month -0.00725 to 0.22375% (+0.00175/wk)

- 6 Month -0.00112 to 0.25688% (+0.01088/wk)

- 1 Year +0.00000 to 0.33875% (-0.00063/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $60B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $163B

- Secured Overnight Financing Rate (SOFR): 0.09%, $970B

- Broad General Collateral Rate (BGCR): 0.07%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $320B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.456B submission

- Next scheduled purchases:

- Thu 11/19 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 11/20 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: $8.8B High-Grade To Price Wednesday

Waiting for Bausch Health to launch

- Date $MM Issuer (Priced *, Launch #)

- 11/18 $1.75B Bausch Health 8.25NC3.25, 10.25NC5.25

- 11/18 $1.5B #American Electric Power $450M 3NC1 +55, $600M 3NC1 FRN LIBOR+48, $450M 5Y +65

- 11/18 $1.5B *EBRD 5Y +7

- 11/18 $1.25B #VEON Holdings 7Y 3.375%

- 11/18 $1B #TJX $500M +7Y +53, $500M +10Y +73

- 11/18 $700M #Swedish Export Cr 2.5Y SOFR+27

- 11/18 $600M #Stryker WNG 3NC1 +40

- 11/18 $500M #JAB Holdings WNG 10Y +135

FOREX: Dollar Decline Continues, Putting DXY On Track to Test Nov Lows

USD weakness persisted Wednesday, pressuring the USD index to its lowest levels since November 9th. USD weakness was particularly evident against NZD, NOK and JPY, with USD/JPY logging its fifth consecutive session of declines. With the markets' view that fiscal stimulus in the US is highly unlikely, leaving a greater onus on the Fed to prop up the economy headed into the end of 2020.

- The downtick in USD/JPY targets the early November lows at 103.18 initially, which would mark the lowest level for the pair since early March.

- The single currency also traded poorly, prompting EUR/GBP to break back below the 200-dma at 0.8939 and narrow the gap with early November lows of 0.8861.

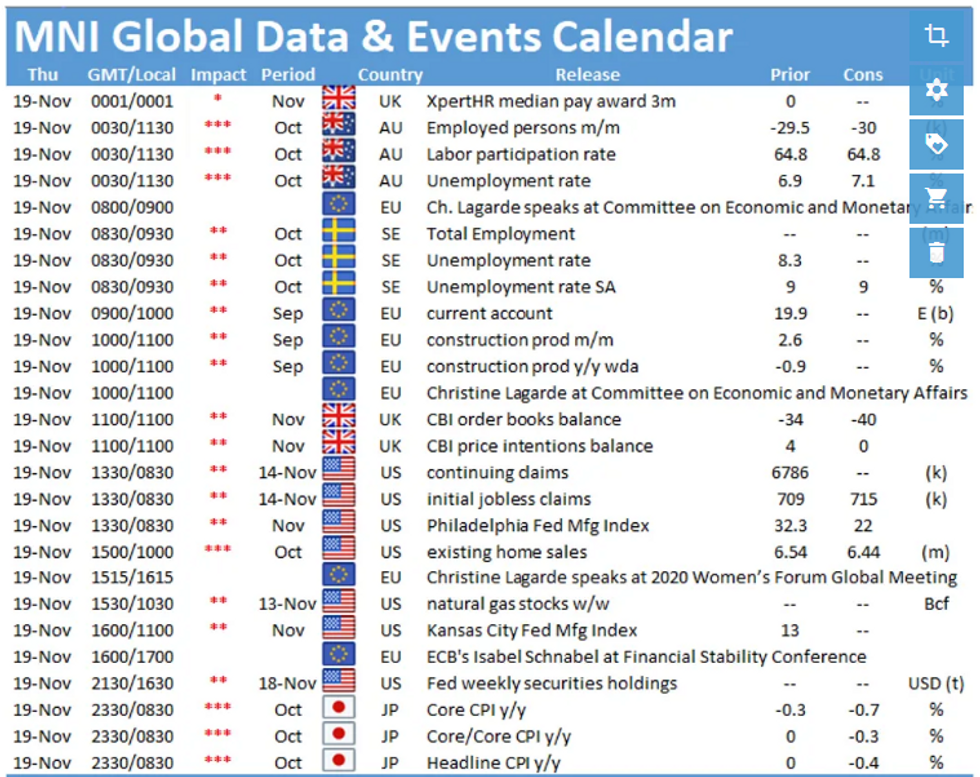

- Australian jobs numbers, weekly US jobless claims & existing home sales and rate decisions from the Turkish, South African central banks are the highlights Thursday.

EGBs-GILTS CASH CLOSE: Yields Come Off Lows

Over the course of Wednesday's session, Bund and Gilt yields climbed from early lows and curves steepened from flattest levels as equities gained ground. Periphery spreads widened from tightest levels (10-yr BTP 3bps wider from 118bps low vs Bunds).

- The session low yields for 10-yr Bunds and Gilts were the lowest since Nov 9 (the day Pfizer announced its COVID vaccine progress).

- Little in the way of driving news flow. Morning Bund and Gilt supply came and went without much fanfare, and UK upside inflation miss was shrugged off.

- On Thursday we get Spanish and French bond supply (E12.5bn) and ECB's Lagarde's hearing before the European Parliament.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.6bps at -0.727%, 5-Yr is up 0.6bps at -0.738%, 10-Yr is up 0.9bps at -0.554%, and 30-Yr is up 0.8bps at -0.149%.

- UK: The 2-Yr yield is up 0.8bps at -0.026%, 5-Yr is up 1bps at 0.016%, 10-Yr is up 1.3bps at 0.337%, and 30-Yr is up 1.9bps at 0.931%.

- Italian BTP spread up 0.7bps at 120.9bps

- Spanish bond spread down 0.3bps at 63.5bps

- Portuguese PGB spread down 0.2bps at 60.4bps

- Greek bond spread down 1.5bps at 121.8bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.