-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: LIBOR Retirement Reprieve, Mid-2023 Target

EXECUTIVE SUMMARY

- MNI INSIGHT: Canada Fiscal Update Sticking to Pandemic Relief

- US Fed, Regulators Amend LIBOR Transition Process

- FED EXTENDS 4 LENDING FACILITIES THROUGH MARCH 31 (MONEY MARKET, PRIMARY DEALER, COMMERCIAL PAPER, PAYCHECK PROTECTION FACILITY)

- US: Biden Team Officially Names Yellen As Treasury Sec Nominee

- MODERNA GAINS 10% ON PLAN TO ASK FDA, EU TO CLEAR COVID VACCINE; SHOT IS FOUND 100% EFFECTIVE AGAINST SEVERE COVID-19, Bbg

US

US EURODOLLAR FUTURES: Eurodollar Reds-Greens reverse losses/trade higher after Fed Board of Govs just announced an extension to key US$ LIBOR benchmarks from December 31, 2021 to June 2023.

- "The LIBOR transition is a significant event that poses complex challenges for banks and the financial system. The agencies encourage banks to cease entering into new contracts that use USD LIBOR as a reference rate as soon as practicable and in any event by December 31, 2021, in order to facilitate an orderly—and safe and sound— LIBOR transition."

- "ICE Benchmark Administration will consult in early December on its intention to cease the publication of the one-week and two-month USD LIBOR settings immediately following the LIBOR publication on December 31, 2021, and the remaining USD LIBOR settings immediately following the LIBOR publication on June 30, 2023, it said. The banking agencies encourage banks to stop entering into new USD-LIBOR-based contracts by the end of 2021, as doing so "creates safety and soundness risks."

- Regarding extension of Fed/Tsy lending facilities: this is not a surprise. Treasury Sec Mnuchin's letter of November 19 to the Fed was specifically to request that the Federal Reserve Board approve the extension of four of the Fed's emergency facilities through the end of March; the other facilities - part of the CARES act - are expiring at end-year by default. As a result the announcement should have limited market impact.

CANADA

CANADA: Canadian Finance Minister Chrystia Freeland's fiscal update Monday afternoon will focus on measures to sustain the economy through the pandemic, rather than new longer-term spending programs, MNI understands. For more see MNI Policy Main Wire at 1012ET.

OVERNIGHT DATA

US DATA: MNI Chicago Business Barometer Fell Further in November

- MNI CHICAGO BUSINESS BAROMETER 58.2 NOV VS 61.1 OCT

- MNI CHICAGO BUSINESS BAROMETER: 5TH CONSECUTIVE READING ABOVE 50-MARK

- MNI CHICAGO: NEW ORDERS SHOWED LARGEST M/M DECLINE

- MNI CHICAGO: SUPPLIER DELIVERIES ABOVE 70 FOR THE FIRST TIME SINCE MAY

- Nevertheless, this marks the fifth consecutive reading in expansion territory after having registered below the 50-mark for a whole year.

- Among the five main indicators, New Orders (60.0) and Production (60.8) were the only categories to show a m/m decline, while Supplier Deliveries recorded the largest gain, rising 65.3 to 70.3.

- Order Backlogs ticked up to 51.4, while Employment gained 0.8pt to 44.0, showing the seventeenth consecutive sub-50 reading.

- Employment is the only main category which registered below the 50-mark in Nov.

- Supplier Deliveries jumped to 70.3, showing the highest level since May with firms noting delivery delays and capacity issues in the logistics and transportation sector.

- Inventories eased to 45.7, while Prices surged 9.8pt to 74.4, hitting a two-year high.

- The majority of respondents (55.4%) reported no change in productivity during the current crisis.

- When asked about the effect of the election outcome on their forecasts, the majority (73.2%) noted that the outcome does not influence their forecasts.

- Anecdotal evidence suggested stagnation of activity with firms noting that client demand is not growing.

- US NAR OCT PENDING HOME SALES INDEX 128.9 V 130.3 IN SEP

- U.S. NOV. DALLAS FED GENERAL BUSINESS ACTIVITY AT 12.0 (14.3 expected, 19.8 prior)

MARKETS SNAPSHOT

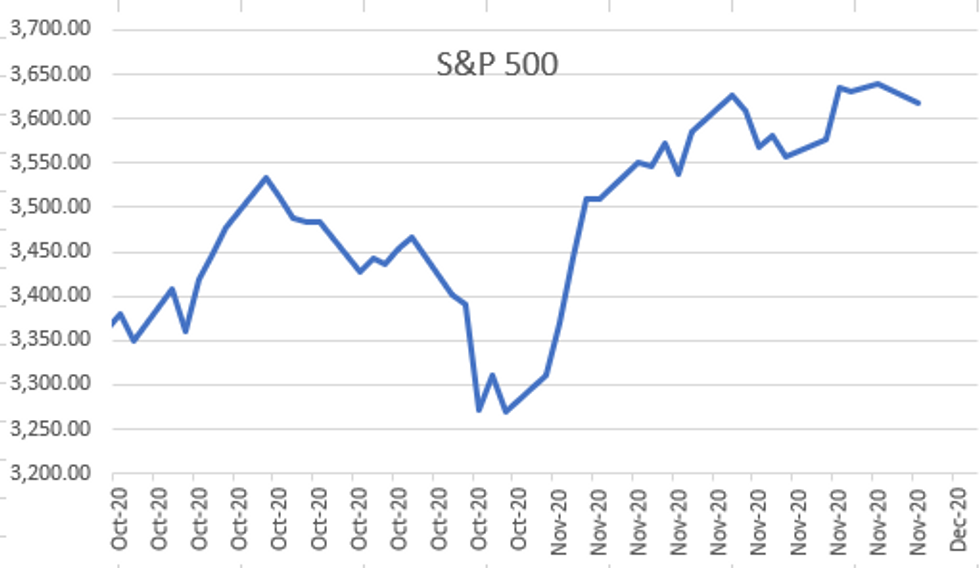

- DJIA down 336.45 points (-1.12%) at 29604.04

- S&P E-Mini Future down 20.75 points (-0.57%) at 3613.5

- Nasdaq down 13.4 points (-0.1%) at 12154.1

- US 10-Yr yield is up 1 bps at 0.8471%

- US Mar 10Y are down 1.5/32 at 138-4.5

- EURUSD down 0.0028 (-0.23%) at 1.1955

- USDJPY up 0.28 (0.27%) at 104.28

- WTI Crude Oil (front-month) up $0.04 (0.09%) at $44.85

- Gold is down $11.44 (-0.64%) at $1778.73

- European bourses closing levels:

- EuroStoxx 50 down 35.25 points (-1%) at 3492.54

- FTSE 100 down 101.39 points (-1.59%) at 6266.19

- German DAX down 44.52 points (-0.33%) at 13291.16

- French CAC 40 down 79.63 points (-1.42%) at 5518.55

US TSY SUMMARY: Active Start To Week, Heavy Month End Rebalance

Nice start to the week, a definite pick-up in action after last week's Thanksgiving holiday torpor.

- Eurodollar futures volume surged (EDH2 over 585k) after the Fed annc to extend LIBOR transition from end of 2021 to June 2023. Nevertheless, "agencies encourage banks to cease entering into new contracts that use USD LIBOR as a reference rate as soon as practicable and in any event by December 31, 2021, in order to facilitate an orderly—and safe and sound— LIBOR transition."

- Choppy Tsy futures despite expected lending facility extension of four emergency lending facility annc that Tsy Sec Mnuchin requested back on Nov 19. Tsy futures volumes spiked again on the closing bell on Heavy month end rebalancing w/near 500k TYH in last 20 minutes (1.565M total/day), 225k FVH, 95k USH and 75k WNH over same period.

- The 2-Yr yield is down 0.6bps at 0.1466%, 5-Yr is down 0.2bps at 0.3624%, 10-Yr is up 1bps at 0.8471%, and 30-Yr is up 0.7bps at 1.5771%.

US TSY FUTURES CLOSE: Moth End Volume Spike On Close

Futures mildly mixed -- well off morning lows to near middle of session range. Heavy month end volumes w/near 500k TYH in last 20 minutes (1.565M total/day), 225k FVH, 95k USH and 75k WNH over same period. Yield curves steeper, near mid-range:

- 3M10Y +1.161, 76.085 (L: 74.087 / H: 77.56)

- 2Y10Y +1.237, 69.369 (L: 67.472 / H: 70.319)

- 2Y30Y +0.974, 142.529 (L: 140.511 / H: 143.835)

- 5Y30Y +0.707, 120.986 (L: 119.536 / H: 122.188)

- Current futures levels:

- Mar 2Y +0.5/32 at 110-13.625 (L: 110-12.75 / H: 110-13.87)

- Mar 5Y +0.25/32 at 126-0.25 (L: 125-30 / H: 126-01.75)

- Mar 10Y -1/32 at 138-5 (L: 138-01.5 / H: 138-08)

- Mar 30Y -6/32 at 174-27 (L: 174-18 / H: 175-10)

- Mar Ultra 30Y -3/32 at 215-29 (L: 215-08 / H: 216-20)

US EURODOLLAR FUTURES CLOSE: Reds-Greens Outperform

Futures trade steady/mixed after the bell, Reds-Greens outperforming on heavy volume. Sector reversed early losses surged higher after Fed Board of Govs annnc'd extension to key US$ LIBOR benchmarks from December 31, 2021 to June 2023. Red Mar'22 lead volumes w/ over 585k.

- Dec 20 -0.005 at 99.745

- Mar 21 -0.005 at 99.785

- Jun 21 +0.005 at 99.80

- Sep 21 steady at 99.790

- Red Pack (Dec 21-Sep 22) steady to +0.050

- Green Pack (Dec 22-Sep 23) +0.010 to +0.050

- Blue Pack (Dec 23-Sep 24) steady to +0.010

- Gold Pack (Dec 24-Sep 25) -0.01 to steady

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00475 at 0.08500% (-0.00238 last wk)

- 1 Month -0.00137 to 0.15338% (+0.00462 last wk)

- 3 Month +0.00225 to 0.22763% (+0.02050 last wk)

- 6 Month -0.00238 to 0.25500% (+0.00863 last wk)

- 1 Year -0.00013 to 0.33025% (-0.00612 last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $61B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $190B

- Secured Overnight Financing Rate (SOFR): 0.08%, $900B

- Broad General Collateral Rate (BGCR): 0.06%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $326B

- (rate, volume levels reflect prior session)

FED: NY Fed operational purchase:

- Tsy 20Y-30Y, $1.733B accepted vs. $6.165B submission

- Tue 12/01 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 12/02 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 12/03 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 12/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Mon 12/07 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 12/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 12/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 12/10 1010-1030ET: TIPS 7Y-20Y, appr $3.625B

- Fri 12/11 1010-1030ET: Tsys 0Y-2.25Y, appr $12.825B

- Fri 12/11 Next forward schedule release at 1500ET

PIPELINE: National Securities Clearing Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/30 $1.75B #National Securities Clearing $1B 3Y +25, $750M 5Y +45

- 11/30 $1.5B #Santander 10Y +190

- 11/30 $750M #Bank of NY Mellon 3Y +20

- 11/30 $650M *Con Edison WNG 3NC1 +47

- 11/30 $500M *McKesson WNG 5Y +55

- 11/30 $Benchmark Istanbul Metro Muni 5Y investor call

- 11/30 $Benchmark Banco Continental investor call

- 11/30 $Benchmark VakifBank 5Y investor call

- Rolled to Tuesday

- 12/01 $Benchmark KBN (Kommunalbanken Norway) 3Y +6a

FOREX: USD Follows the Flow into Month-end

The greenback played catch-up with month-end flows throughout the Monday session, after initially coming under considerable selling pressure as most models pointed to USD sales into the fix. This put the USD index at fresh multi-year lows ahead of the London close, before swiftly reversing once the flow had, presumably, been absorbed.

- As a result, USD swung from being the poorest performer in G10 to mid-table in US hours, leaving Scandi currencies, the JPY and EUR the softest.

- GBP traded constructively, but stopped short of a broad rally as ITV political correspondent Peston wrote that current negotiations are "grounds for optimism that a compromise is within reach."

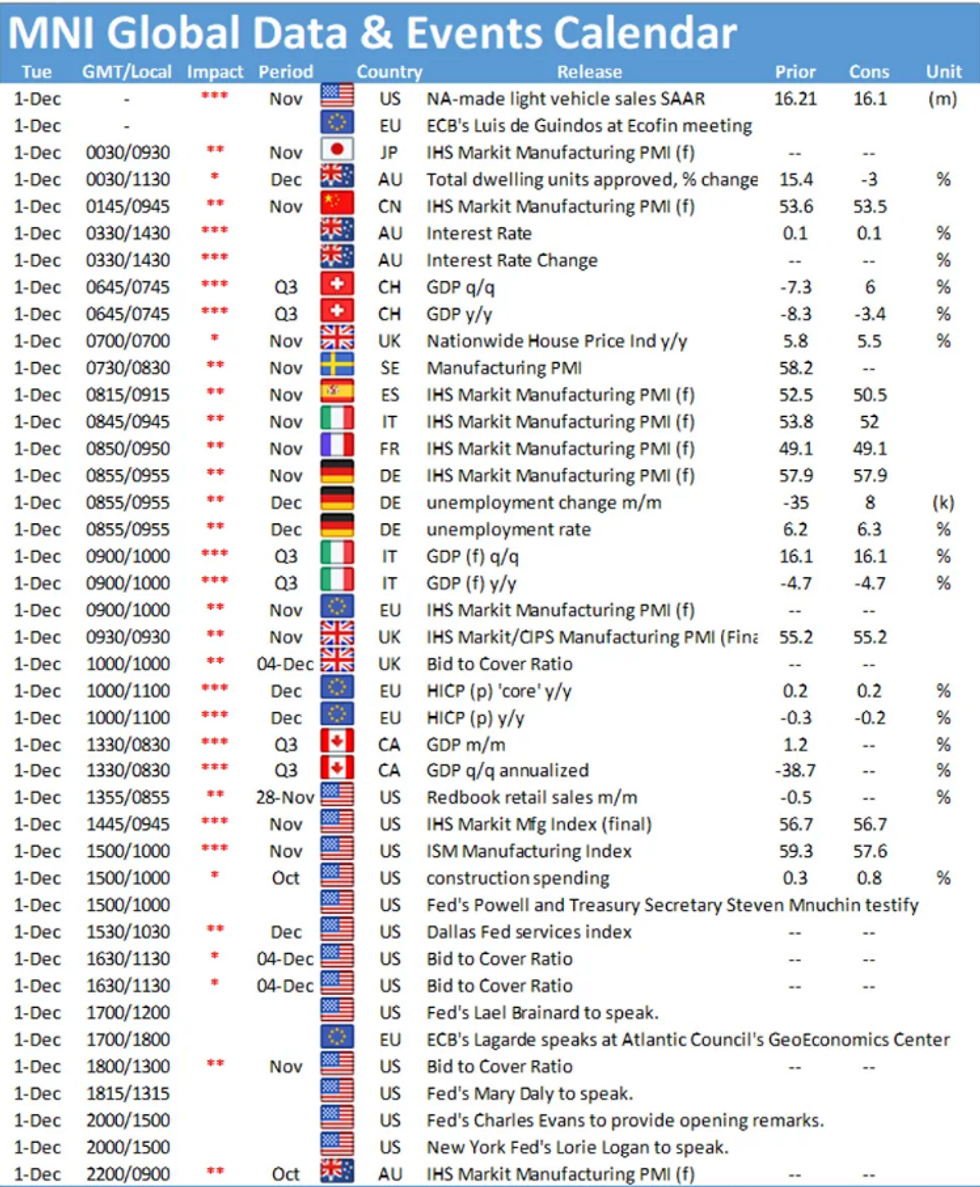

- The RBA rate decision, China's Caixin manufacturing PMI and manufacturing ISM numbers for November are the highlights Tuesday. Speakers include Fed's Powell and ECB's Lagarde.

EGBs-GILTS CASH CLOSE: Month Ends On A Weak Note

The week opened and the month ended with Bund/Gilt selling down the curve for most of the session following a fleeting rally around the open. Periphery spreads widened as BTPS weakened following a brief move into record-low territory for the 10-Yr yield (0.585%).

- Hard to find any coherent drivers of the move (flash Nov inflation data was mixed and did not move markets), with equities under pressure esp in the afternoon, and little new on the Brexit front. Doesn't appear that month-end rebalancing buying materialized.

- Tuesday sees Italy and Spain PMIs and EZ flash inflation, plus another appearance by ECB's Lagarde, and Gilt supply. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 1.2bps at -0.743%, 5-Yr is up 1.7bps at -0.753%, 10-Yr is up 1.7bps at -0.571%, and 30-Yr is up 1.6bps at -0.166%.

UK: The 2-Yr yield is up 2.1bps at -0.022%, 5-Yr is up 1.9bps at 0.008%, - UK: The 2-Yr yield is up 2.1bps at -0.022%, 5-Yr is up 1.9bps at 0.008%, 10-Yr is up 2.1bps at 0.305%, and 30-Yr is up 2.1bps at 0.852%.

- Italian BTP spread up 1.5bps at 119.7bps

- Spanish bond spread up 0.6bps at 65.2bps

- Portuguese PGB spread up 0.4bps at 60.5bps

- Greek bond spread down 3bps at 121bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.