-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS Treasury Auction Calendar Through April 2025

MNI ASIA OPEN: Late Risk-Off On Pfizer Heads, Rollout Tgt Cut

EXECUTIVE SUMMARY:

- PFIZER CUT 2020 VACCINE ROLLOUT TARGET BY HALF: DJ

- MNI INTERVIEW: Rising Virus Cases Keep US Service Workers Away

- MNI REALITY CHECK: November Hiring To See Seasonal Slowdown

- MNI BRIEF: US Senate Confirms Waller As Fed Governor

- MNI SOURCES: EU-UK Near "Sordid Compromises"; Talks In Balance

- BARNIER SET TO RETURN TO BRUSSELS IN SIGN BREXIT TALKS NEAR END; OFFICIALS SAY BREXIT DEAL COULD EMERGE OVER WEEKEND, Bbg

- On the flipside:

- U.K. OFFICIAL SAYS CHANCES OF BREXIT BREAKTHROUGH RECEDING, Bbg

US

US TSY: Tsy Gap Bid/New Highs On Vaccine Distribution Concerns

Late gap bid after Phizer headlines annc Pfizer has cut 2020 vaccine rollout targets by 50%. Developing situation, Tsys have already scaled back half the initial move, bond just off midday highs.

US: Increasing Covid-19 case counts are driving workers away from the U.S. services sector, and even with signs a vaccine is coming it may take years to restore the confidence of customers kept out by health restrictions, Institute for Supply Management chair Anthony Nieves told MNI Thursday.

- Managers are seeking to "over-hire" staff including those who don't have all the needed skills, because they anticipate high turnover and absenteeism as the outbreak worsens, he said in an interview. For more see MNI Policy MainWire at 1347ET.

US: Job growth in the U.S. slowed again in November as lower-than-average seasonal hiring in the services industry and rising Covid-19 case counts across the nation again drove workers away from the market, recruiters and industry leaders told MNI. But positive data from alternative sources through the month means there's potential for an upside surprise.

- "In terms of what was going on in November, it's mixed messages," said Josh Wright, chief economist at Wrightside Advisors in New York. The U.S. economy is approaching a "perilous moment" where relief programs authorized under the USD2.2 trillion CARES Act are "petering out" and mobility is declining as new Covid-19 cases spike, putting downward pressure on consumer spending. For more see MNI Policy MainWire at 1324ET.

FED: The U.S. Senate voted 48-47 Thursday to confirm Christopher Waller of the St. Louis Fed to the Federal Reserve board of governors for a seat that runs thru January 2030.

- Waller's confirmation leaves one open seat on the seven-member board, but Trump's other Fed nominee Judy Shelton's chances of being confirmed are looking increasingly unlikely, as Democrats gained a vote after Senator Mark Kelly was swore in Wednesday. The close vote to confirm Waller is unprecedented during a lame-duck session of Congress.

- Asked on Tuesday about the status of Shelton's nomination, Senate Majority Leader Mitch McConnell said, "We can reconsider it in the future."

EUROPE

UK/EU: Leaders of the two negotiating teams in EU-UK trade talks are stretching - even breaking - mandates from their political leaders to try to identify landing grounds in the three major sticking points to a deal, sources familiar with the discussions on both sides tell MNI. For more see MNI Policy MainWire at 0833ET.

OVERNIGHT DATA

- US JOBLESS CLAIMS -75K TO 712K IN NOV 28 WK

- US PREV JOBLESS CLAIMS REVISED TO 787K IN NOV 21 WK

- US CONTINUING CLAIMS -0.569M to 5.520M IN NOV 21 WK

- US DATA: ISM Services PMI Eased Further in Nov

- US ISM SERVICES PMI 55.9 NOV VS 56.6 OCT

- US ISM SERVICES BUSINESS INDEX 58.0 NOV VS 61.2 OCT

- US ISM SERVICES EMPLOYMENT INDEX 51.5 NOV VS 50.1 OCT

- US ISM SERVICES NEW ORDERS 57.2 NOV VS 58.8 OCT

- US ISM SERVICES SUPPLIER DELIVERIES 57.0 NOV VS 56.2 OCT (NSA)

- The ISM Services PMI dropped 0.7pt to 55.9, coming in weaker than markets expected (BBG: 56.1). November's reading showed the second consecutive decline and the the lowest level since May. Among the main four categories, Business Activity (-3.2pt) showed the largest decline, followed by New Orders (-1.6pt), while Employment (+1.4pt) and Supplier Deliveries (+0.8pt) saw the biggest gains. Supplier Deliveries rose for the second month in a row and posted a three-month high. Among all sub-indicators, Inventories saw the largest fall (-3.8pt to 49.3), while imports revealed the biggest gain (+2.5pt to 55.0). Meanwhile, the Backlog of orders declined (-3.7pt to 50.7) as did Exports (-3.3pt to 50.4) and Inventory Sentiment (-1.2pt to 49.9). Prices ticked up 2.2pt to 66.1 which is the highest level since Sep 2012.

- US CHALLENGER: NOV LAYOFF INTENTIONS 64,797 V OCT 80,666

- US CHALLENGER: NOV 2019 LAYOFF INTENTIONS WERE 44,569

- US CHALLENGER: LAYOFF INTENTIONS LED BY ENTERTAINMENT/LEISURE

- US CHALLENGER: NOV HIRING INTENTIONS 185,504 VS OCT 255,198

- US CHALLENGER: HIRING INTENTIONS LED BY RETAIL, GOVERNMENT

- US CHALLENGER: NOV 2019 HIRING INTENTIONS WERE 19,063

FINAL NOV. SERVICES PMI 58.4 (57.5 EXP., 57.7 FLASH, 56.9 OCT), IHS Markit

FINAL NOV. COMPOSITE PMI 58.6 (57.9 FLASH, 56.3 OCT), IHS Markit

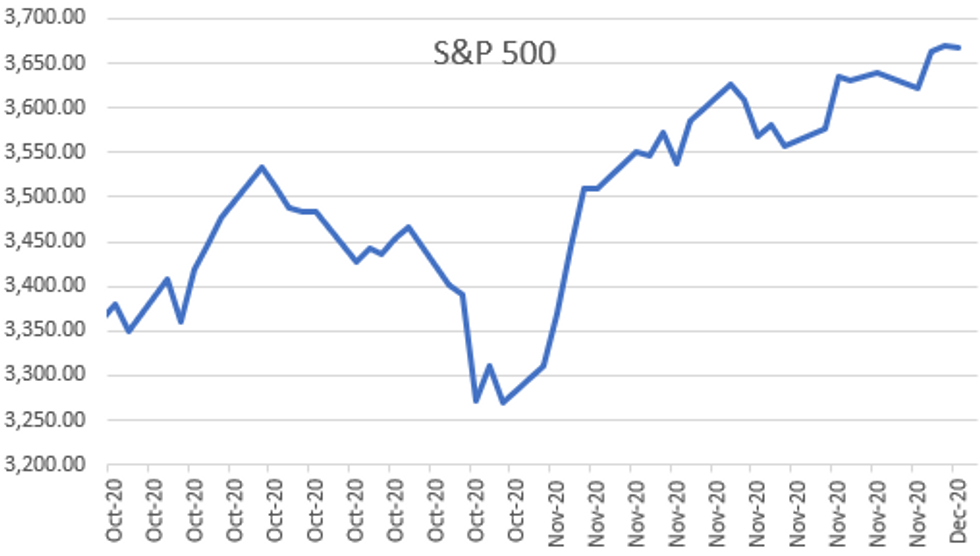

MARKETS SNAPSHOT

- DJIA up 14.88 points (0.05%) at 30068.56

- S&P E-Mini Future down 8.25 points (-0.23%) at 3678.5

- Nasdaq up 21.3 points (0.2%) at 12414.1

- US 10-Yr yield is down 3.5 bps at 0.9013%

- US Mar 10Y are up 12/32 at 137-25.5

- EURUSD up 0.0019 (0.16%) at 1.2145

- USDJPY down 0.52 (-0.5%) at 103.94

- WTI Crude Oil (front-month) up $0.45 (0.99%) at $45.77

- Gold is up $8.71 (0.48%) at $1840.35

- European bourses closing levels:

- EuroStoxx 50 down 4.22 points (-0.12%) at 3518.53

- FTSE 100 up 26.88 points (0.42%) at 6466.33

- German DAX down 60.38 points (-0.45%) at 13271.54

- French CAC 40 down 8.65 points (-0.15%) at 5569.74

US TSY SUMMARY: Rates AND Equities Higher, Stim Heads Inconclusive

Rates held higher levels all session, trading near midday highs through the close even as equities powered higher (DJIA over 30,030.0).

- Rates dipped briefly after weekly claims slipped -75K to 712K and continuing claims fell -0.569M to 5.520M. ISM Services PMI dropped 0.7pt to 55.9, coming in weaker than 56.1 exp.

- Aside from data, mkts remained focused on COVID relief. Bbg headlines inconclusive: "MCCONNELL SAYS STIMULUS COMPROMISE IS WITHIN REACH," however: "SCHUMER SAYS MCCONNELL DOES NOT SEEM INCLINED TO COMPROMISE." Later in the session: House Speaker Pelosi on CNN saying will have a stim deal agreement before House leaves for Dec 11 recess.

- Cross-FX intertest, Pound Sterling receded after late headlines cast doubt over EU/UK talks: "U.K. OFFICIAL SAYS CHANCES OF BREXIT BREAKTHROUGH RECEDING".

- More moderate session volumes, two-way flow with better buying on moderate volumes (TYH just over 1.04M) as accts square up ahead Fri's headline November employ data (+478k est vs. +638k in Oct), yld curves modestly flatter after trading steeper in first half.

- The 2-Yr yield is down 0.6bps at 0.1525%, 5-Yr is down 1.4bps at 0.4003%, 10-Yr is down 1.8bps at 0.9178%, and 30-Yr is down 2.1bps at 1.6642%.

US TSY FUTURES CLOSE: Maintaining Bid

Rates held higher levels all session, trading near midday highs through the close even as equities powered higher (DJIA over 30,030.0). More moderate volume, two-way flow with better buying on moderate volumes (TYH just over 1.04M) as accts square up ahead Fri's headline November employ data (+478k est vs. +638k in Oct), yld curves modestly flatter after trading steeper in first half.

- 3M10Y -0.966, 83.504 (L: 82.679 / H: 86.148)

- 2Y10Y -1.199, 76.165 (L: 75.505 / H: 78.416)

- 2Y30Y -1.496, 150.969 (L: 150.368 / H: 153.678)

- 5Y30Y -0.72, 126.229 (L: 126.003 / H: 127.979)

- Current futures levels:

- Mar 2Y up 0.62/32 at 110-12.625 (L: 110-12 / H: 110-12.87)

- Mar 5Y up 3.5/32 at 125-26.5 (L: 125-23 / H: 125-28)

- Mar 10Y up 8/32 at 137-21.5 (L: 137-14 / H: 137-24)

- Mar 30Y up 24/32 at 172-29 (L: 172-05 / H: 173-04)

- Mar Ultra 30Y up 1-19/32 at 212-6 (L: 210-21 / H: 212-18)

US EURODLR FUTURES CLOSE: Late Bid

Futures mildly bid all session extended highs after Pfizer annc'd they had cut vaccine roll-out estimate by 50%. Equities reversed course, eminis weaker after the bell. Lead quarterly held bid since 3M LIBOR set' -0.00512 to 0.22538% (+0.00000/wk).

- Dec 20 +0.005 at 99.763

- Mar 21 +0.005 at 99.80

- Jun 21 steady at 99.80

- Sep 21 +0.005 at 99.795

- Red Pack (Dec 21-Sep 22) steady to +0.010

- Green Pack (Dec 22-Sep 23) +0.010 to +0.015

- Blue Pack (Dec 23-Sep 24) +0.015 to +0.025

- Gold Pack (Dec 24-Sep 25) +0.030 to +0.035

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00125 at 0.08275% (+0.00250/wk)

- 1 Month +0.00062 to 0.15275% (-0.00200/wk)

- 3 Month -0.00512 to 0.22538% (+0.00000/wk)

- 6 Month -0.00087 to 0.25738% (+0.00000/wk)

- 1 Year +0.00200 to 0.33638% (+0.00600/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $55B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $167B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.08%, $926B

- Broad General Collateral Rate (BGCR): 0.06%, $358B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $338B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.735B accepted vs. $4.437B submission

- Next scheduled purchase:

- Fri 12/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE: $8.6B To Price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 12/03 $1.5B #Barclays 4NC3 +80

- 12/03 $1.5B #Citigroup PerpNC5, 4.0%

- 12/03 $1.5B #BMO $900M 3Y +27, $600M 3Y FRN SOFR+35

- 12/03 $1B #FS KKR Capital 5Y +325 *upsized from $400M

- 12/03 $1B Seagate Tech 8.6NC3, 10.6NC5

- 12/03 $800M #Juniper Networks 5Y +80a, 10Y +115a

- 12/03 $750M #National Bank of Canada 4NC3 +40

- 12/03 $550M *AIG Global 3Y +28

FOREX: Lofty Sterling as Market Still Sees Deal as Likely

GBP was the strongest in G10 Thursday, as the market remains of the view that a post-transition period trade deal could in the offing. Reports continue to suggest some intra-EU divisions, with The Times reporting that Ireland are pressuring France to not sacrifice any workable trade deal on the less important details. In response, GBP/USD rallied to touch 1.35 for the first time since last December's General Election.

- Elsewhere, the USD sank further, pressing the USD index to its lowest levels since H1 2018, helping provide a major leg higher for most pairs. JPY traded well despite better equity markets in the US, while oil-tied currencies bounced back from early weakness.

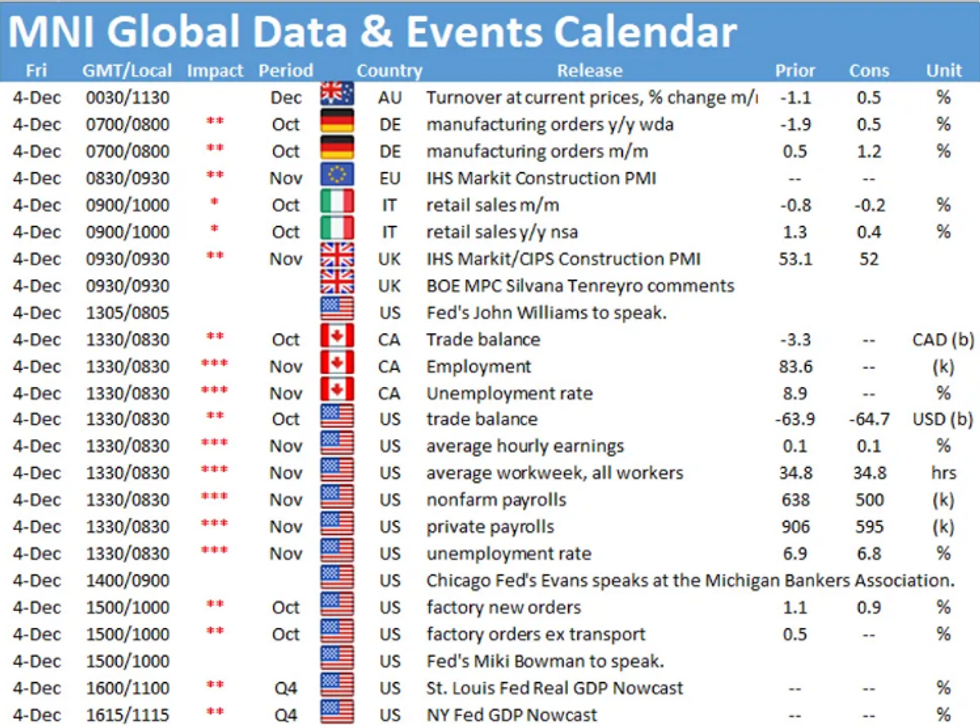

- Focus Friday turns to the November nonfarm payrolls release, with the US expected to have added 475,000 jobs over the month and the unemployment rate seen shedding another 0.1 ppts to 6.8%. The street is a little more bullish, with the whisper number at 505,000.

EGBs-GILTS CASH CLOSE: Core Closes Strong

Bunds rallied for most of the session, sandwiched between stretches of sideways trade. Gilts rose steadily, BTP spreads stayed flat. Both German and UK yields closed on the lows.

- Talk of a Brexit deal being reached by the weekend rebuffed by later headlines pointing to continued UK-EU divides. This was compounded by news that the UK parliament would take up the controversial internal markets bill Monday, seen as a potential obstacle to a deal.

- Largely positive morning data (the only real miss was on Italy Nov Svcs PMI) was shrugged off.

- Friday's highlights include German factory orders and speeches by BOE's Saunders and Tenreyro.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 2.1bps at -0.737%, 5-Yr is down 3.5bps at -0.75%, 10-Yr is down 3.7bps at -0.556%, and 30-Yr is down 3.5bps at -0.14%.

- UK: The 2-Yr yield is down 2.1bps at -0.047%, 5-Yr is down 2.2bps at 0.003%, 10-Yr is down 3.2bps at 0.322%, and 30-Yr is down 2.6bps at 0.893%.

- Italian BTP spread up 0.7bps at 115.8bps

- Spanish bond spread up 0.5bps at 62.7bps

UP TODAY:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.