-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY248 Bln via OMO Tuesday

MNI Eurozone Inflation Insight – November 2024

MNI ASIA OPEN - Impeachment 2.0: Wednesday Night Vote Set

EXECUTIVE SUMMARY

- MNI POLICY: Fed Poll: Odds of Finding New Job Least Since 2014

- MNI POLICY: BOC Says Firms and Consumers See Uneven Recovery

- MNI: BOC OUTLOOK SURVEY: FUTURE SALES GROWTH BALANCE OF OPINION +48

- MNI POLICY: Canada Q4 Consumer Sentiment Up on Spending, Homes

- FBI WARNS OF PLANS FOR ARMED PROTESTS AT 50 STATE CAPITALS: AP

- HOUSE DEMOCRATS INTRODUCE ARTICLE OF IMPEACHMENT AGAINST TRUMP, Bbg

- SUPREME COURT REJECTS TRUMP BID TO EXPEDITE ELECTION APPEALS, Bbg

- U.S. TO PUT CUBA BACK ON LIST OF STATE SPONSORS OF TERRORISM, Bbg

- WHITE HOUSE: U.S. IS EXAMINING FURTHER OPTIONS REGARDING CHINA, Bbg

US

US: U.S. consumers were the most pessimistic about their ability to find another job since 2014, a view shared broadly across demographic groups, the New York Federal Reserve's consumer survey showed Monday.

- The figure declined to 46.2% in December from 47.9% in November, well below the 2019 average of 59.9%. The share of people who said their job was at risk increased to 15% from 14.6%, while expected wage gains remained at 2% for a fifth straight month.

Fed: Bostic Says Liftoff Could Occur As Early As H2 2022

- Atlanta Fed President Raphael Bostic said Monday that he could see liftoff of its benchmark interest rate in as early as late 2022, assuming the economy performs better than expected currently.

CANADA

BOC: The Bank of Canada said companies and households see a slow and uneven recovery amid a mix of news about the second wave of the pandemic and vaccine breakthroughs, a report Monday showed.

- Two-thirds of firms late last year saw inflation at or below the central bank's 2% inflation target over the next two years, even as many reported rising costs to deliver goods and said frayed supply chains meant a majority would struggle to meet an unexpected rise in demand. The balance of opinion about growth of future sales rose to +48, the highest since 2009, but that more reflected a partial comeback from weakness amid the first Covid-19 wave, according to the quarterly Business Outlook Survey.

- Canada's bank regulator on Monday said it's exploring new capital requirements to account for climate-change risks, as part of the launch of a new three-month consultation with industry.

OVERNIGHT DATA

- BOC OUTLOOK SURVEY: FUTURE SALES GROWTH BALANCE OF OPINION +48

- BANK OF CANADA BUSINESS OUTLOOK SURVEY OVERALL INDICATOR +1.29

- BOC SURVEY: 67% OF FIRMS SEE INFLATION OF 2% OR LESS OVER 2 YRS

- BOC: CONSUMERS SEE INFLATION AT 2.02% NOW, 2.86% IN 1 YEAR

- BOC BUSINESS SURVEY: INVESTMENT SPENDING PLANS BALANCE OF OPINION +26

MARKET SNAPSHOT

- DJIA down 52.57 points (-0.17%) at 31039.47

- S&P E-Mini Future down 19 points (-0.5%) at 3798

- Nasdaq down 129.7 points (-1%) at 13071.38

- US 10-Yr yield is up 1.5 bps at 1.1307%

- US Mar 10Y are down 7.5/32 at 136-13.5

- EURUSD down 0.0054 (-0.44%) at 1.2164

- USDJPY up 0.2 (0.19%) at 104.14

- WTI Crude Oil (front-month) down $0.18 (-0.34%) at $52.08

- Gold is down $1.26 (-0.07%) at $1847.75

- European bourses closing levels:

- EuroStoxx 50 down 24.43 points (-0.67%) at 3620.62

- FTSE 100 down 74.78 points (-1.09%) at 6798.48

- German DAX down 112.87 points (-0.8%) at 13936.66

- French CAC 40 down 44.45 points (-0.78%) at 5662.43

US TSY SUMMARY: Ylds Higher Even As Political Risk Remains

Generally muted start to the week: no data Monday, limited early volumes w/Japan out for extended weekend-holiday.

- Tsy futures managed to rack up decent totals by the closing bell, however, TYH1>1.33M futures, as ylds continued to climb (10YY 1.1358% marks March 2020 level) while equities receded as well: ESH1 -23.0 in late trade.

- Headline focus on political risk: "HOUSE TO VOTE TUESDAY ON URGING PENCE TO BACK TRUMP'S REMOVAL" Bbg, after impeachment vote failed to reach unanimous consent Monday. Out late: FBI WARNS OF PLANS FOR ARMED PROTESTS AT 50 STATE CAPITALS:" AP

- Fed speak weighed on equities: Atl Fed Bostic comment that mkts "need to understand Fed policy is open to change" DJ.

- Small tail: US Tsy $58B 3Y Note auction (91282CBE0) drew 0.234% high yield (0.211% last month) vs. 0.230% WI, on a bid/cover 2.52 vs. 2.28 previous.

- Indirects drew 52.20% vs. 49.25% prior, directs 14.57% vs. 15.87% prior, dealers w/ 33.23% vs. 34.88% prior.

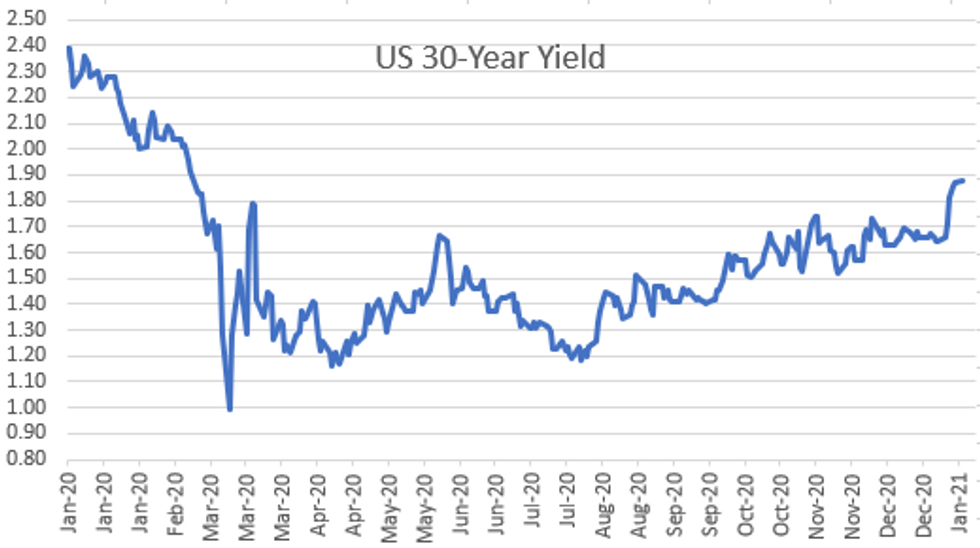

- The 2-Yr yield is up 1.2bps at 0.1449%, 5-Yr is up 1.5bps at 0.4978%, 10-Yr is up 1.9bps at 1.1341%, and 30-Yr is up 0.6bps at 1.8797%.

US TSY FUTURES CLOSE

Futures trade weaker after the bell, holding narrow range -- near session lows since midmorning. Yield curves mixed.

- 3M10Y +1.88, 104.791 (L: 100.454 / H: 105.215)

- 2Y10Y +1.082, 98.722 (L: 96.201 / H: 99.518)

- 2Y30Y -0.441, 173.065 (L: 171.484 / H: 175.714)

- 5Y30Y -1.088, 137.817 (L: 137.364 / H: 140.326)

- Current futures levels:

- Mar 2Y down 0.75/32 at 110-13.5 (L: 110-13.5 / H: 110-14.75)

- Mar 5Y down 2.75/32 at 125-16.25 (L: 125-15.75 / H: 125-20.75)

- Mar 10Y down 8/32 at 136-13 (L: 136-12 / H: 136-24)

- Mar 30Y down 16/32 at 168-8 (L: 168-02 / H: 168-31)

- Mar Ultra 30Y down 24/32 at 204-1 (L: 203-11 / H: 205-13)

US EURODOLLAR FUTURES CLOSE

Steady to mixed after the bell, long end of strip at/near session lows. Whites steady w/lead quarterly EDH1 unchanged since 3M LIBOR set' +0.00012 to 0.22450% (-0.01405 net last wk).

- Mar 21 steady at 99.820

- Jun 21 steady at 99.825

- Sep 21 -0.005 at 99.810

- Dec 21 steady at 99.775

- Red Pack (Mar 22-Dec 22) -0.005 to +0.010

- Green Pack (Mar 23-Dec 23) -0.02 to steady

- Blue Pack (Mar 24-Dec 24) -0.045 to -0.03

- Gold Pack (Mar 25-Dec 25) -0.05 to -0.045

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00013 at 0.08688% (+0.00912 net last wk)

- 1 Month -0.00038 to 0.12600 (-0.01750 net last wk)

- 3 Month +0.00012 to 0.22450% (-0.01405 net last wk)

- 6 Month +0.00375 to 0.25025% (-0.01113 net last wk)

- 1 Year -0.00275 to 0.32688% (-0.01225 net last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $55B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $154B

- Secured Overnight Financing Rate (SOFR): 0.09%, $992B

- Broad General Collateral Rate (BGCR): 0.07%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $340B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- TIPS 1Y-7.5Y, $2.401B accepted vs. $9.476B submission

- Next scheduled purchases:

- Tue 1/12 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 1/13 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

PIPELINE: American Honda Launched; T-Mobile Upsized

- Date $MM Issuer (Priced *, Launch #)

- 01/11 $3B T-Mobile 5NC2 2.375%, 8NC3 2.75%, 10NC5 3.0%

- 01/11 $1..75B #American Honda $900M 3.5Y fix +35, #300M 3.5Y FRN L+35, $550M10Y +70

- 01/11 $1.5B *Korean Development Bank $700M 3Y5M +25, $500M 5.5Y +35, $300M 10Y +52

- 01/11 $1.5B #Simon Property $800M 7Y +95, $700M 10Y +110

- 01/11 $1.25B #Deutsche Bank 11NC10 +260

- 01/11 $900M #NY Life Global 5Y +37

- 01/11 $800M #Berry Global 3Y +77

- 01/11 $Benchmark KFW 5Y +5a

- 01/11 $Benchmark MuniFin 5Y +10a

- 01/11 $Benchmark CADES 10Y +26a

- 01/11 $Benchmark ABC NY 3Y +110a, 5Y +120a

FOREX: Greenback Bounce Fades Ahead Close

The dollar strengthened throughout the Asia-Pac and European session Monday, with profit-taking and short-covering likely responsible. This price action partially reversed into the US close, with EUR/USD recovering off the earlier lows of 1.2132 and USD/JPY failing to make headway above 104.40.

- Nonetheless, the dollar still rose against most others, while commodity-tied currencies including NOK and CAD slipped.

- Data points and notable speakers were few and far between, leaving currencies to follow the macro picture - namely a modest pullback in equities away from all-time highs and the incoming White House team upon Biden's inauguration on January 20th.

- Focus Tuesday turns to Fed speakers, with Brainard, George and Rosengren due, as well as BoE's Broadbent and ECB's de Cos.

EGBs-GILTS CASH CLOSE: Bear Steepening Dies Risk-Off Mood

The German and UK curves bear steepened Monday despite a general risk-off environment (equities lower, BTP spreads wider). Largely following moves in USTs and little in the way of key triggers in Europe.

- BoE's Tenreyro spoke explicitly on applicability of -ve rates in the UK. Arguably increasingly relevant given PM Johnson's comment that more COVID lockdown measures could be put in place, weakening the economy (Chancellor Sunak had little detail on potential relief).

- No key data today, and the supply slate consisted of EFSF syndication of dual 10-/30-Yr tranches. Tuesday sees a very heavy slate, with Netherlands, UK, Austria, Germany all coming to market and likely Belgium 10-Yr syndication as well. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.2bps at -0.699%, 5-Yr is up 1.4bps at -0.716%, 10-Yr is up 2.3bps at -0.496%, and 30-Yr is up 3.6bps at -0.09%.

- UK: The 2-Yr yield is up 1.1bps at -0.117%, 5-Yr is up 1.2bps at -0.032%, 10-Yr is up 2.1bps at 0.309%, and 30-Yr is up 3.3bps at 0.903%.

- Italian BTP spread up 1bps at 106bps / Spain down 0.6bps at 55.4bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.