-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - Grim Covid Numbers For Feb, Better Times Ahead

EXECUTIVE SUMMARY

- Biden Says Total Deaths Will Likely Top 500,000 Next Month, WPT

- MNI STATE OF PLAY: ECB Rates On Hold, Downside Risks Easing

- MNI EXCLUSIVE: Italy Covid Recovery Seen Plan Passed By March

- MNI BRIEF: US Dec Housing Starts Highest Since 2006

- BIDEN POISED TO FREEZE OIL AND COAL LEASING ON FEDERAL LAND, Bbg

- YELLEN: U.S. WILL TAKE ON CHINA'S ABUSIVE, ILLEGAL PRACTICES - Bbg

- PELOSI: WILL BE READY TO PASS VIRUS RELIEF FIRST WEEK OF FEB., CBS, Bbg

- PELOSI: MANAGERS TALKING WITH SENATE ON WHEN TO BEGIN TRIAL, CBS, Bbg

EUROPE

ECB: The European Central Bank left: monetary policy on hold Thursday, with President Christine Lagarde noting downside risks to the economy becoming less pronounced and the roll-out of vaccination programs providing grounds for optimism, even as credit standards tightened tighten across the euro area.

- The ECB reaffirmed its "very accommodative" monetary policy stance, although now saying it was prepared to conduct net purchases under the pandemic emergency programme (PEPP), "over the pandemic period" -- a modest move away from a pledge to continue with purchases through the "pandemic period".

ITALY: Italy is confident of securing approval by early March for a Recovery Plan required to access tens of billions of euros of emergency European Covid funds despite the government's near collapse this week, and parliamentarians from the small party behind the attempt to oust Prime Minister Giuseppe Conte told MNI they will support this and other key economic measures. For more see MNI Policy Main wire at 0936ET.

US

US: The pace of U.S. housing starts quickened in December to a seasonally adjusted annual rate of 1.669 million, the highest since 2006, following November's revised 1.578 million (prev 1.547 million). Markets had expected a pace of 1.560 million.

OVERNIGHT DATA

- US JOBLESS CLAIMS -26K TO 900K IN JAN 16 WK

- US PREV JOBLESS CLAIMS REVISED TO 926K IN JAN 09 WK

- US CONTINUING CLAIMS -0.127M to 5.054M IN JAN 09 WK

- US DEC HOUSING STARTS 1.669M; PERMITS 1.709M

- US NOV STARTS REVISED TO 1.578M; PERMITS 1.635M

- US DEC HOUSING COMPLETIONS 1.417M; NOV 1.223M (REV)

- US JAN PHILADELPHIA FED MFG INDEX 26.5

MARKETS SNAPSHOT

- DJIA up 45.34 points (0.15%) at 31234.63

- S&P E-Mini Future up 7.5 points (0.2%) at 3852.5

- Nasdaq up 90.6 points (0.7%) at 13547.69

- US 10-Yr yield is up 2.6 bps at 1.1058%

- US Mar 10Y are down 3/32 at 136-28

- EURUSD up 0.0053 (0.44%) at 1.2159

- USDJPY down 0.03 (-0.03%) at 103.51

- WTI Crude Oil (front-month) down $0.19 (-0.36%) at $53.12

- Gold is down $2.46 (-0.13%) at $1869.25

- EuroStoxx 50 down 5.69 points (-0.16%) at 3618.35

- FTSE 100 down 24.97 points (-0.37%) at 6715.42

- German DAX down 14.7 points (-0.11%) at 13906.67

- French CAC 40 down 37.65 points (-0.67%) at 5590.79

US TSY SUMMARY: Tsys Track EGBs Lower Post ECB Policy annc

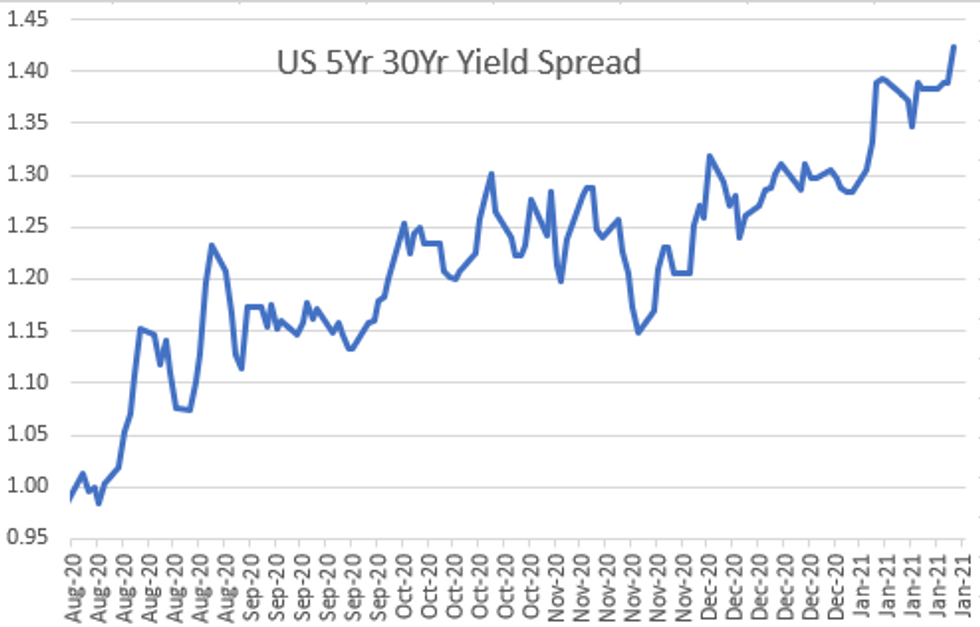

Rates traded mixed into Thursday's close, yield curves steepening to new multi-year levels (5s30s 142.71, level not seen since Nov 2016).

- First full day for Pres Biden, rolling out more executive actions (BIDEN POISED TO FREEZE OIL AND COAL LEASING ON FEDERAL LAND, Bbg) with main focus on grappling with Covid-19 response, says things still likely to get worse before they get better, est's death toll >500k by end of Feb.

- Early kick-start, Tsys followed EGBs lower: focus on "upward inflation pressure as economy recovers" ECB PM Lagarde headlines in post ECB steady rate annc. Volumes surged, yield curves bear steepened.

- Strong auction/aggressive bid: US Tsy $15B 10Y-TIPS auction (91282CBF7), high yield -0.987% (compared to -0.867% prior) vs. -0.972%% WI; 2.68 bid/cover vs. 2.71 prior. Note, record size Tsy auctions next wk: $60B 2Y, $61B 5Y and $62B 7Y.

- Aside from deal-tied positioning, Heavy Eurodollar futures Blocks: 12.5k 2Y bundles +0.0075 after 7.5k Whites -- may be related to talk ICE will annc end of LIBOR date early next week.

- The 2-Yr yield is down 0.4bps at 0.123%, 5-Yr is up 0.5bps at 0.4454%, 10-Yr is up 2.6bps at 1.1058%, and 30-Yr is up 4.1bps at 1.8706%.

US TSY FUTURES CLOSE: Yld Curves Make New Highs

Futures trading mostly weaker, long end under pressure after ECB policy annc, futures tracked EGBs lower after ECB Pres LaGarde noted downside risks to the economy becoming less pronounced. Volumes surged on the move, while trade cooled in second half, holding to narrower range last few hours.

- 3M10Y +2.896, 102.549 (L: 89.593 / H: 104.254)

- 2Y10Y +2.792, 97.908 (L: 94.41 / H: 99.008)

- 2Y30Y +4.145, 174.277 (L: 169.16 / H: 174.987)

- 5Y30Y +3.578, 142.233 (L: 137.861 / H: 142.711)

- Current futures levels:

- Mar 2Y up 0.375/32 at 110-15.25 (L: 110-14.625 / H: 110-15.25)

- Mar 5Y up 0.75/32 at 125-25.5 (L: 125-21.75 / H: 125-25.75)

- Mar 10Y down 2/32 at 136-29 (L: 136-23.5 / H: 137-02)

- Mar 30Y down 15/32 at 168-17 (L: 168-06 / H: 169-11)

- Mar Ultra 30Y down 1-3/32 at 204-16 (L: 204-01 / H: 206-09)

US EURODOLLAR FUTURES CLOSE: Heavy Block Activity

Futures trading mixed after the bell, Whites-Reds outpacing weaker Blues-Golds. Short end gained ground after initially ignoring 3M LIBOR settle: -0.00463 to 0.21775% (-0.00563/wk). Heavy Eurodollar futures Blocks: 12.5k 2Y bundles +0.0075 after 7.5k Whites -- may be related to talk ICE will annc end of LIBOR date early next week. Current Levels:

- Mar 21 +0.005 at 99.815

- Jun 21 +0.005 at 99.825

- Sep 21 steady at 99.815

- Dec 21 steady at 99.785

- Red Pack (Mar 22-Dec 22) +0.005

- Green Pack (Mar 23-Dec 23) -0.005 to steady

- Blue Pack (Mar 24-Dec 24) -0.02 to -0.015

- Gold Pack (Mar 25-Dec 25) -0.025 to -0.02

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00037 at 0.08700% (+0.00037/wk)

- 1 Month +0.00150 to 0.13000% (+0.00050/wk)

- 3 Month -0.00463 to 0.21775% (-0.00563/wk)

- 6 Month -0.00338 to 0.23450% (-0.01363/wk)

- 1 Year -0.00187 to 0.31538% (-0.00725/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $72B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $188B

- Secured Overnight Financing Rate (SOFR): 0.06%, $883B

- Broad General Collateral Rate (BGCR): 0.04%, $355B

- Tri-Party General Collateral Rate (TGCR): 0.04%, $323B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $9.440B submission

- Next scheduled purchase:

- Fri 1/22 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE: $9.5B To Price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 01/21 $2.5B #Citigroup 6NC5 fix-FRN +68

- 01/21 $2B #European Bank for R&D (EBRD) 5Y +3

- 01/21 $1B *Kommunekredit WNG 5Y +6

- 01/21 $1.2B #Bank of NY Mellon $700M 5Y +35, $500M 10Y +55

- 01/21 $1B *Development Bank of Japan WNG 10Y +22

- 01/21 $1B *Canada Pension Plan Inv Brd (CPPIB) 10Y +24

- 01/21 $750M #Aircastle 7Y +230

- Rolled to Friday:

- 01/22 $Benchmark Prov British Columbia 10Y +22a

FOREX

EGBs-GILTS CASH CLOSE

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.