-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN, Fed Positioning; Fiscal Reconciliation?

EXECUTIVE SUMMARY

- MNI POLICY: US & Eurozone Trade Places in IMF Growth Forecast

- MNI BRIEF: US Senate Could Begin Fiscal Reconciliation Next Wk

- MNI JAPAN: Rising Public Disapproval Presents Risks For PM Suga

- US: Janet Yellen Sworn In As 78th Secretary US Treasury Department

- ECB SAID TO QUERY DOLLAR WEAKNESS DESPITE STRONGER U.S. ECONOMY, Bbg

- PFIZER TO SUPPLY U.S. WITH 200 MILLION DOSES TWO MONTHS EARLIER, Bbg

- PFIZER WORKING ON BOOSTER COVID SHOT TO COMBAT VARIANTS: CEO, Bbg

- GERMANY MULLS CUTTING INBOUND FLIGHTS TO `NEAR ZERO': BILD

- ITALIAN PREMIER CONTE OFFERS RESIGNATION TO PRESIDENT: CORRIERE

US

US: U.S. Senate Majority Leader Chuck Schumer on Tuesday said he has told Democrats that a procedural vote beginning the process of passing additional fiscal relief could come as early as next week.

- Schumer remains open to reaching a deal with Senate Republicans on fiscal aid, but as a backup senators should be prepared for a vote on a budget resolution next week. The vote would be an early step in the budget reconciliation process that could take weeks to complete and would depend on party-line passage of the new administration's fiscal relief proposal.

US/EU: The IMF boosted its 2021 economic growth forecast to 5.5% from 5.2% on progress distributing Covid-19 vaccines and new fiscal relief from Japan and the U.S., and despite weaker euro region expansion, according to a new World Economic Outlook published Tuesday.

- The U.S. growth forecast was increased 2 percentage points to 5.1% on December's fiscal package and momentum gathered in the second half of last year. That carried the world's largest economy past the euro area where growth was reduced by 1 percentage point to 4.2% on rising infection rates and renewed lockdowns. Japan's economy will grow 3.1%, up 0.8 percentage points from the last projection, and China was little changed at 8.1%.

ASIA

JAPAN: Latest opinion poll from Asahi Shimbun shows rapidly rising public discontent with the gov'ts response to the COVID-19 pandemic.

- Approval for Government's (LDP-Conservative) response to coronavirus: Approve: 25% (-8), Disapprove: 63% (+7), Don't Know: 12% (+1). +/- vs. 19-20/12/20. Fieldwork: 23-24/01/21. Sample Size: 1,973

- PM Yoshihide Suga remains vulnerable to internal challenges within the LDP ahead of the Japanese lower house elections, which need to be held by 22 October.

- Should Suga's approval ratings continue to slide along with those of his gov't, it could encourage the LDP leadership to seek another candidate to contest the elections for the party, or indeed embolden an alternative to challenge Suga directly for the leadership.

OVERNIGHT DATA

- US JAN PHILADELPHIA FED NONMFG INDEX -17.5

- RICHMOND FED COMPOSITE MANUFACTURING INDEX +14 IN JAN VS +19 IN DEC (19 exp)

- U.S. JAN. CONSUMER CONFIDENCE INDEX RISES TO 89.3 FROM 87.1 -bbg (89.0 exp)

- US REDBOOK: JAN STORE SALES -2.0% V DEC THROUGH JAN 23 WK

- US REDBOOK: JAN STORE SALES +2.7% V YR AGO MO

- US REDBOOK: STORE SALES +3.9% WK ENDED JAN 23 V YR AGO WK

MARKET SNAPSHOT

Key Late Session Market Levels:- DJIA up 16.53 points (0.05%) at 30975.41

- S&P E-Mini Future down 1.5 points (-0.04%) at 3846.75

- Nasdaq up 6 points (0%) at 13642.47

- US 10-Yr yield is up 0.7 bps at 1.0364%

- US Mar 10Y are up 0.5/32 at 137-12.5

- EURUSD up 0.0027 (0.22%) at 1.2166

- USDJPY down 0.1 (-0.1%) at 103.65

- WTI Crude Oil (front-month) down $0.22 (-0.42%) at $52.54

- Gold is down $4.38 (-0.24%) at $1851.57

European bourses closing levels:

- EuroStoxx 50 up 39.69 points (1.12%) at 3592.83

- FTSE 100 up 15.16 points (0.23%) at 6654.01

- German DAX up 227.04 points (1.66%) at 13870.99

- French CAC 40 up 51.16 points (0.93%) at 5523.52

US TSY SUMMARY: Low Variance

Rates traded steady/mixed after the bell, Tsys near the middle of a narrow range on light volumes (TYH1<955k). Trading desks chalked up the muted trade to positioning ahead Wednesday's FOMC policy annc -- steady rate and asset purchases expected, talk of tapering last few week's deemed premature.

- MNI Fed Preview: Chair Powell and other key Fed members have batted away speculation of such an early taper, and absent extraordinary upside surprises in the labor market and inflation, the Fed will almost certainly remain cautious on tapering for the next few FOMC meetings at least.

- Janet Yellen Sworn In As 78th Secretary US Treasury Dept; Anthony Blinken confirmed as Sec of State.

- Tsy-way flow, modest option and deal-tied hedging kept prices close to home. Possibly contributing to light participation, "Verizon says technicians are aware of a a fiber cut in Brooklyn; Internet Outage Hits Broad Swath of Eastern U.S. Customers" Bbg

- Treasury Auction: small stop through on record $61B 5Y note auction, US Tsy $61B 5Y Note auction (91282CBH3) draws high yld of 0.424% (0.394% last month) vs. 0.425% WI; 2.34 bid/cover vs. 2.39 prior.

- The 2-Yr yield is up 0.8bps at 0.123%, 5-Yr is up 0.8bps at 0.4103%, 10-Yr is up 0.9bps at 1.0381%, and 30-Yr is up 0.8bps at 1.8004%.

MONTH-END EXTENSIONS: Prelim Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS -0.16Y; Govt inflation-linked, 0.23.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.09 | 0.07 |

| Agencies | 0.12 | 0.06 | -0.03 |

| Credit | 0.07 | 0.09 | 0.09 |

| Govt/Credit | 0.08 | 0.09 | 0.07 |

| MBS | 0.06 | 0.06 | 0.07 |

| Aggregate | 0.08 | 0.08 | 0.08 |

| Long Gov/Cr | 0.08 | 0.09 | 0.05 |

| Iterm Credit | 0.08 | 0.08 | 0.09 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.08 | 0.08 | 0.08 |

| High Yield | 0.07 | 0.08 | 0.09 |

US TSY FUTURES CLOSE:

Futures have clawed back to steady/marginally mixed levels after the bell, modest overall volumes (TYH1<970k) inside range session on pre-FOMC position squaring.

- 3M10Y +1.273, 96.368 (L: 94.253 / H: 97.557)

- 2Y10Y -0.097, 90.966 (L: 90.511 / H: 92.858)

- 2Y30Y +0.088, 167.327 (L: 166.329 / H: 169.127)

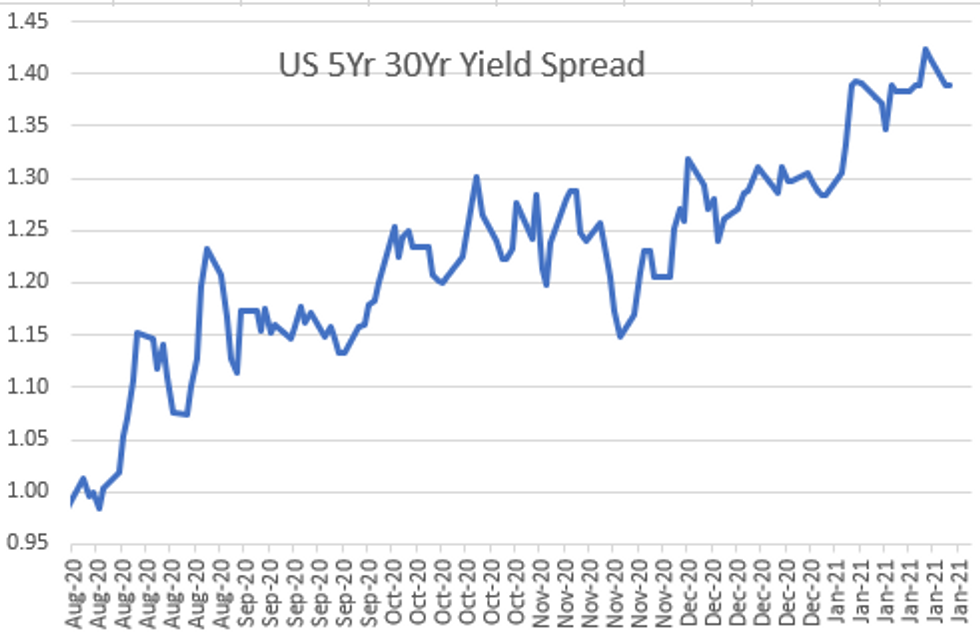

- 5Y30Y -0.016, 138.799 (L: 138.03 / H: 139.922)

- Current futures levels:

- Mar 2Y down 0.125/32 at 110-15.25 (L: 110-15.125 / H: 110-15.5)

- Mar 5Y steady at at 125-30.75 (L: 125-29.5 / H: 126-00)

- Mar 10Y up 0.5/32 at 137-12.5 (L: 137-08.5 / H: 137-14.5)

- Mar 30Y steady at at 169-31 (L: 169-21 / H: 170-09)

- Mar Ultra 30Y down 2/32 at 207-9 (L: 206-20 / H: 207-28)

US EURODOLLAR FUTURES CLOSE

Futures held steady in the short end to marginally weaker out the strip by the bell, lead quarterly unchanged most of the session, little react to 3M LIBOR settle +0.00562 to 0.21850% (+0.00325/wk). Current levels:

- Mar 21 steady at 99.820

- Jun 21 steady at 99.830

- Sep 21 steady at 99.820

- Dec 21 steady at 99.790

- Green Pack (Mar 23-Dec 23) -0.005 to steady

- Blue Pack (Mar 24-Dec 24) -0.005

- Gold Pack (Mar 25-Dec 25) -0.005

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00088 at 0.08375% (-0.00250/wk)

- 1 Month -0.00500 to 0.12250% (-0.00225/wk)

- 3 Month +0.00562 to 0.21850% (+0.00325/wk)

- 6 Month +0.00150 to 0.23450% (-0.00150/wk)

- 1 Year -0.00075 to 0.31150% (-0.00075/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $217B

- Secured Overnight Financing Rate (SOFR): 0.06%, $885B

- Broad General Collateral Rate (BGCR): 0.05%, $354B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $319B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $5.131B submission

- Next scheduled purchases:

- Thu 1/28 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/29 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 01/29 Next forward schedule release at 1500ET

PIPELINE: Saudi Arabia, Credit Suisse Launched

- Date $MM Issuer (Priced *, Launch #)

- 01/26 $5B #Saudi Arabia $2.75B 12Y +130, $2.25B 40Y 3.45%

- 01/26 $4B #Credit Suisse 3Y +32, $1B 3Y FRN SOFR+39, $2B 6NC5 +90

- 01/26 $2.5B #Hong Kong Gov $1B 5Y +22.5, $1B 10Y +37.5, $500M 30Y +62.5

- 01/26 $1.5B *Oesterreichische Kontrollbank (OKB) 5Y +5

- 01/26 $1.25B #SVB Fncl $500M 10Y +80, $750M perpNC10 4.1%

- 01/26 $800M #New York Life 2Y FRN SOFR+22

- 01/26 $750M *Armenia 10Y 3.60%

- 01/26 $Benchmark 7-Eleven investor call, est $11B multi-tranche jumbo

FOREX: EUR Knocked as ECB Study Exchange Rates

After staging a decent late-session recovery, EUR/USD was knocked lower just after the London close as Bloomberg sources reported that the ECB were studying the recent resilience of the EUR/USD exchange rate. The study is to focus particularly on the Fed and ECB's stimulus packages delivered throughout 2020, which was sufficient to knock around 20 pips off the rate.

- Elsewhere, GBP traded well alongside the slightly steeper UK yield curve, prompting a show above 1.3740 in GBP/USD. The strength stopped just short of the Jan21 high at 1.3746, the highest since 2018.

- NZD, AUD and CAD all traded well as equities traded to new all time highs. The S&P500 touched 3870.90, with real estate and communication services outperforming.

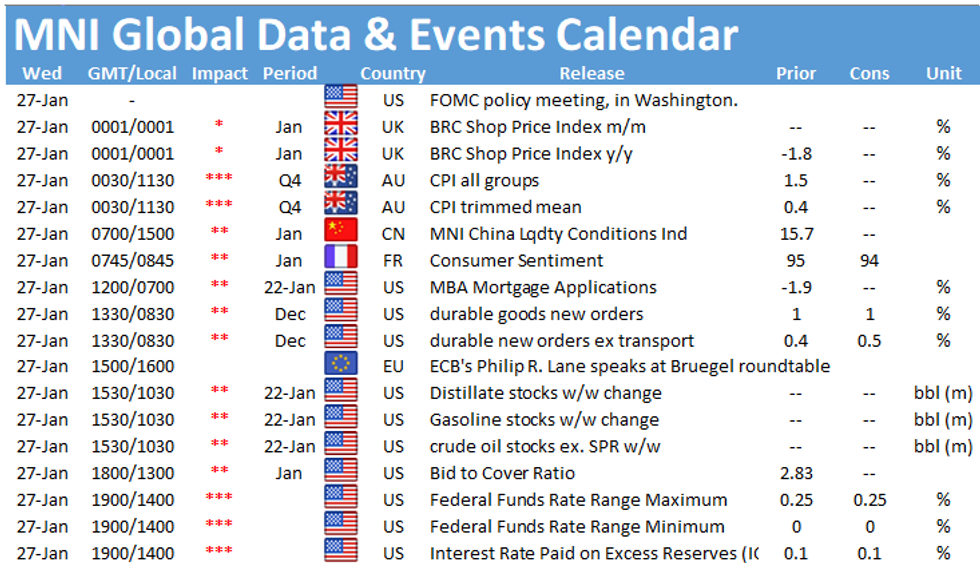

- Australian CPI & NAB business confidence numbers and prelim US durable goods orders are the calendar highlights Wednesday. The FOMC rate decision is due later in the day.

EGBs-GILTS CASH CLOSE: Supply A Key Theme, To Be SURE

Gilts and Bunds traded weaker but in fairly erratic fashion throughout Tuesday's session, with periphery EGB spreads tighter.

- Italian spreads compressed, with optimism that stability will return following PM Conte's decision to resign this morning in order to form a new government.

- Bund yields came off the highs late in the session with the EUR weakening on a BBG report: "ECB Studying If Differences With Fed Policy Are Boosting Euro".

- Issuance was a key theme today with E14bn of E.U. SURE syndication (on books >E132bn!), and the UK, Netherlands and Italy holding auctions. We also had Greece, Austria, and Slovenia announce mandates. Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.4bps at -0.723%, 5-Yr is up 1bps at -0.734%, 10-Yr is up 1.7bps at -0.533%, and 30-Yr is up 2bps at -0.116%.

- UK: The 2-Yr yield is down 0.5bps at -0.138%, 5-Yr is down 0.1bps at -0.063%, 10-Yr is up 0.3bps at 0.265%, and 30-Yr is up 0.4bps at 0.838%.

- Italian BTP spread down 4.8bps at 118bps / Spanish down 1.7bps at 60.6bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.