-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - Stimulus Before March 14

EXECUTIVE SUMMARY

- SCHUMER SAYS SENATE ON TRACK TO PASS STIMULUS BEFORE MARCH 14, Bbg

- MNI INTERVIEW: Market Right to Fear Inflation-Ex-Fed Economist

- MNI POLICY: US Inflation Tame Even With New Fiscal Boost- IMF

- MNI BRIEF: Inflation Expectations Similar to Recent Years -Fed

- MNI BRIEF: Rosengren Sees Longer Drag on US From Pandemic

- FED: Richmond's Barkin: Fed To Stay The Course

- NY Fed Williams: RISE IN YIELDS REFLECTS OUTLOOK, VACCINATIONS, CNBC

nam dob

US

FED: Wall Street's growing concern over the prospect of higher U.S. inflation is warranted given the combination of super-loose monetary policy and a highly proactive fiscal policy that could make future increases in interest rates much more difficult, former St. Louis Fed economist William Gavin told MNI in an interview.

- "The fear of inflation is healthy," said Gavin. "It's the underlying lack of budget discipline combined with a Fed that won't fight it that should worry markets."

- In particular he noted that the economy can return to health "in short order" given a combination of accommodative Fed and fiscal policy, along with use of "excess savings".

- On inflation, he expects there will be higher readings this year amid the above factors stimulating growth, as well as base effects and supply chain issues, but that the structural long-term inflation picture remains benign. * The Fed will "stay the course" on asset purchases absent "substantial further progress" on inflation - it "makes sense" for the Fed to provide ample accommodation including outcome-based fwd guidance.

- This echoes his previous comments including an FT interview last week in which he said 2021 price rises as temporary and volatile, with broader deflationary trends remaining intact.

- Even though he is considered one of the more hawkish voting members in 2021, these comments largely align with those of Fed leadership on maintaining the course of accommodative policy despite potential temporary upticks in inflation in 2021.

- As such, this reinforces the idea that "transient" inflation in the early months of 2021 will fail to spark a significant rethink on the Fed's policy outlook.

- "The evolution of the virus will continue to determine the course of the economy through the middle of the year, as the U.S. and our trading partners continue to grapple with the continually evolving public health crisis," said Rosengren, who is not a voting FOMC member this year.

- "The evidence from the last four decades makes it unlikely, even with the proposed fiscal package, that the U.S. will experience a surge in price pressures that persistently pushes inflation well above the Fed's 2 percent target," Gopinath wrote in a blog post.

- FED ISSUES SEMIANNUAL MONETARY REPORT AHEAD OF POWELL HEARINGS, Bbg

- FED REPORT: PANDEMIC CONTINUES TO WEIGH HEAVILY ON ECONOMY, Bbg

- FED: VACCINES OFFER HOPE FOR MORE NORMAL CONDITIONS THIS YEAR, Bbg

- FED REITERATES BOND-BUYING PACE UNTIL SUBSTANTIAL PROGRESS, Bbg

OVERNIGHT DATA

US FLASH FEB MFG PMI 58.5 (58.8 EXP., 59.2 PRIOR)

US FLASH FEB MFG PMI 58.5 (58.8 EXP., 59.2 PRIOR)

US FLASH FEB SERVICES PMI 58.9 (58.0 EXP., 58.3 PRIOR)

US FLASH FEB COMPOSITE PMI 58.8 (58.7 PRIOR) - IHS Markit

- Notable from the PMI release is this on price pressures: "Input costs across manufacturing and services soared higher as demand outstripped supply, rising at by far the steepest rate since comparable data were first available in 2009. Service providers registered the steepest increase in cost burdens since October 2009, while manufacturers recorded the quickest rise since April 2011. As a result, firms raised their selling prices at the sharpest rate on record (since October 2009), with panellists stating the increase was due to the partial pass-through of greater costs to clients."

US JAN EXISTING HOME SALES +0.6% TO 6.69M SAAR; +24% YOY

US JAN EXISTING HOME SALES +0.6% TO 6.69M SAAR; +24% YOY

NAR'S YUN: SALES EASILY 20% HIGHER IF MORE INVENTORY AVAILABLE

MARKET SNAPSHOT

Key late session market levels:- DJIA up 89.18 points (0.28%) at 31520.0

- S&P E-Mini Future up 3 points (0.08%) at 3905

- Nasdaq up 26.5 points (0.2%) at 13871.04

- US 10-Yr yield is up 4.8 bps at 1.3431%

- US Mar 10Y are down 13/32 at 135-14.5

- EURUSD up 0.0026 (0.22%) at 1.2114

- USDJPY down 0.24 (-0.23%) at 105.5

- WTI Crude Oil (front-month) down $1.61 (-2.66%) at $58.93

- Gold is up $6.7 (0.38%) at $1780.27

- EuroStoxx 50 up 32.42 points (0.88%) at 3713.46

- FTSE 100 up 6.87 points (0.1%) at 6624.02

- German DAX up 106.3 points (0.77%) at 13993.23

- French CAC 40 up 45.22 points (0.79%) at 5773.55

New 1Y Yield Highs

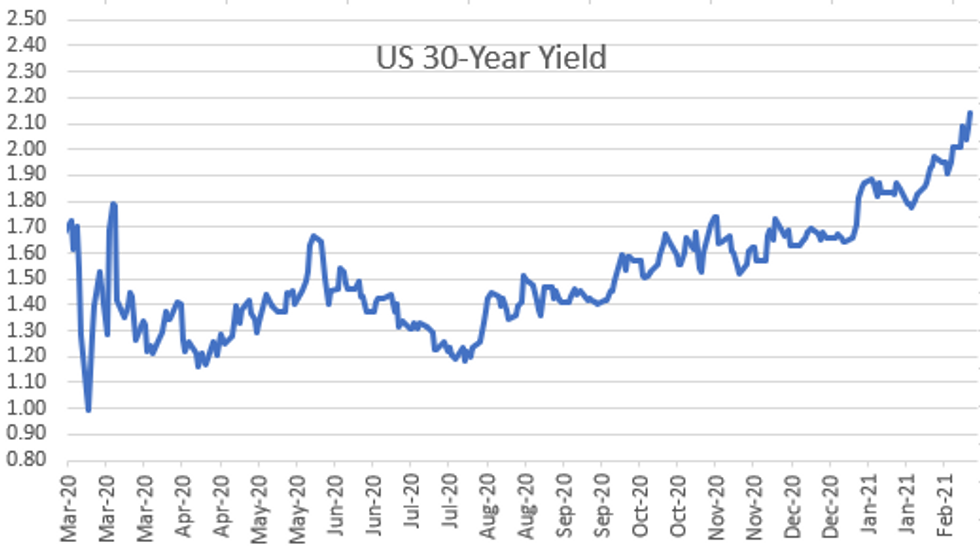

Reflation theme finished strong Friday, at least in Tsys -- selling off to new lows after recent headline from Sen Schumer re: fiscal stimulus bill on track for March 14 passage. Equities lagging as ESH1 pared losses late to 3912.0 vs Tue's high of 3960. New 1Y yield highs: 10YY 1.3601%, 30YY 2.1526%.

- Midmorning sell-off following better than expected existing home sales, bonds extended session lows into noon, curves making new 5Y highs (5s30s 156.326) as hopes improved vaccine inventory/distribution ahead spring spells for improved summer economic outlook.

- About an hour later several stimulus related headlines during second half rounding out the week on a positive note: SCHUMER SAYS SENATE ON TRACK TO PASS STIMULUS BEFORE MARCH 14, Bbg, while House Budget Comm just released text of stimulus bill ahead Monday's markup.

- Heavier futures trade, this time March/June futures rolling did play a part in driving volumes: >755k FVH/FVM by the bell making up just over 40% of total FVH volume on day. March Tsy option expiration contributed to flows as did continued positioning of put positions out and down in strike.

- The 2-Yr yield is up 0.2bps at 0.1068%, 5-Yr is up 2.6bps at 0.5791%, 10-Yr is up 4.9bps at 1.3448%, and 30-Yr is up 6bps at 2.1416%.

US TSY FUTURES CLOSE: Tsy Ylds, Yld Curves Make New Highs

New 1Y yield highs: 10YY 1.3601%, 30YY 2.1526%. Heavier futures trade, this time March/June futures rolling did play a part in driving volumes: >755k FVH/FVM by the bell making up just over 40% of total FVH volume on day. March Tsy option expiration contributed to flows as did continued positioning of put positions out and down in strike.

- 3M10Y +5.43, 131.442 (L: 114.941 / H: 132.97)

- 2Y10Y +4.929, 123.597 (L: 117.351 / H: 125.126)

- 2Y30Y +6.14, 203.417 (L: 195.53 / H: 204.374)

- 5Y30Y +3.68, 156.236 (L: 151.396 / H: 156.383)

- Current futures levels:

- Mar 2Y up 0.125/32 at 110-16.25 (L: 110-16 / H: 110-16.375)

- Mar 5Y down 4.25/32 at 125-11 (L: 125-09.75 / H: 125-16)

- Mar 10Y down 13.5/32 at 135-14 (L: 135-10.5 / H: 135-28.5)

- Mar 30Y down 1-15/32 at 163-1 (L: 162-26 / H: 164-22)

- Mar Ultra 30Y down 2-20/32 at 193-15 (L: 193-02 / H: 196-17)

US EURODOLLAR FUTURES CLOSE: New Record Low Settle 3M LIBOR

Lead quarterly EDH1 back to steady, pared early gains after 3M LIBOR settled to another new record low: -0.00713 to 0.17525% (-0.01850/wk) ** Record Low (prior 0.18138% on 2/17/21).

- Mar 21 steady at 99.843

- Jun 21 steady at 99.855

- Sep 21 -0.005 at 99.835

- Dec 21 -0.005 at 99.790

- Red Pack (Mar 22-Dec 22) -0.015 to steady

- Green Pack (Mar 23-Dec 23) -0.030 to -0.045

- Blue Pack (Mar 24-Dec 24) -0.055 to -0.085

- Gold Pack (Mar 25-Dec 25) -0.085 to -0.08

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00200 at 0.07813% (-0.00150/wk)

- 1 Month +0.00437 to 0.11550% (+0.00812/wk)

- 3 Month -0.00713 to 0.17525% (-0.01850/wk) ** Record Low (prior 0.18138% on 2/17/21)

- 6 Month -0.00188 to 0.19500% (-0.00575/wk)

- 1 Year -0.00450 to 0.28650% (-0.01325/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $215B

- Secured Overnight Financing Rate (SOFR): 0.03%, $872B

- Broad General Collateral Rate (BGCR): 0.02%, $365B

- Tri-Party General Collateral Rate (TGCR): 0.02%, $333B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $22.442B submission

- Next scheduled purchases:

- Mon 2/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 2/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 2/24 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 2/25 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 2/26 1010-1030ET: Tsy 0Y-2.25Y, appr 12.825B

PIPELINE: Global Payments Launched

Friday's sole issuer helps push high-grade issuance to $14.5B for the week

- Date $MM Issuer (Priced *, Launch #)

- 02/19 $1.1B #Global Payments 5Y +63

- $7.25B Priced Thursday

- 02/18 $3B *Charter Comm's $1.5B 20Y +162.5, $1B 30Y +183, $500M 2061 Tap +205

- 02/18 $1.5B *Masco $600M 7Y +60, $600M 10Y +80, $300M 30Y +105

- 02/18 $1.5B *Prov of Ontario 10Y +26

- 02/18 $1.25B *BNP Paribas PerpNC10 4.625%

FOREX: AUD, GBP Hit Multi-Year Highs vs. USD

AUD, NZD outperformed well throughout the Friday session, with AUD/USD topping the early January highs to high the best level since early 2018. A global commodity rally and the upward revision to Westpac's Australian yield forecasts were the primary drivers. This narrowed the gap with next resistance at 0.7885.

- The greenback traded poorly despite an uptick in both US Treasury yields and equity markets in the US and on the continent. This pressured the USD index toward the week's lowest levels printed on Tuesday at 90.12. A break below here opens key support at 90.05. The break of $1.40 in GBP/USD helped pressure the USD index further, with the pair touching new multi-year highs.

- Focus in the coming week turns to German IFO numbers, UK jobs data and personal income/spending & MNI Chicago PMI from the US. Highlight of the central bank speaker schedule will be the delivery of the semi-annual testimony from Fed's Powell.

BONDS:: EGBs-GILTS CASH CLOSE: Real Yields Soar

Core curves ended the week with a bang at the long end, with a risk-on tone boosting real rates (breakevens were flat/down) and leading to sharp bear steepening in Bunds and Gilts.

- Equities rose all session with the EUR and GBP gaining ground on the dollar.

- Flash February PMIs were mixed w manufacturing beating expectations but services not so much. In the eurozone, Germany continues to outperform France.

- UK PMIs were stronger than expected, offsetting disappointing Jan retail sales. GBP hit a 3-yr high vs the USD above 1.40. The 10-Yr Gilt underperformed on the curve.

- BTP spreads and those of peripheries more broadly fell sharply on rising risk appetite.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.7bps at -0.681%, 5-Yr is up 2.1bps at -0.608%, 10-Yr is up 4.1bps at -0.305%, and 30-Yr is up 5.6bps at 0.213%.

- UK: The 2-Yr yield is up 2.7bps at -0.011%, 5-Yr is up 5.9bps at 0.199%, 10-Yr is up 7.6bps at 0.698%, and 30-Yr is up 6.6bps at 1.268%.

- Italian BTP spread down 6.5bps at 92.9bps / Spanish spread down 2.6bps at 66bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.