-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - Massive 2s5s Steepener

EXECUTIVE SUMMARY

- MNI BRIEF: Powell Wants to See Stronger Data Before Any Taper

- MNI POLICY: Fed's Brainard Sees QE Pace For Some Time

- MNI FED: Brainard Reiterates FOMC's Holistic Take On Labor Market Slack

- FED: BRAINARD: U.S. JOBLESS RATE IS CURRENTLY CLOSER TO 10%, Bbg

- MNI POLICY: Fed's Clarida Says Downside Risks Have Declined

- MNI INTERVIEW: Hybrid Securities To Save EU Firms, Boost CMU

- MNI INTERVIEW: BOC's Macklem Says Slack To Hold Down Inflation

US

FED: Federal Reserve Chair Jay Powell on Wednesday said inflation and employment data would need to strengthen before pulling back on asset purchases, while declining to give details on the margin of improvement that would satisfy him.

- "What we've said is that we would be purchasing assets at least at the current pace until we see substantial further progress toward our goals. So that's actual progress, that's not forecast progress," Powell told the House Committee on Financial Services in a semiannual hearing.

- "We've been very specific" on the conditions for liftoff, he said. "We haven't tried to be that specific about the pace of asset purchases."

FED: Federal Reserve Governor Lael Brainard expects it will be "some time" before substantial further progress on inflation and employment is achieved, requiring a push ahead with plans to buy USD120 billion of assets a month.

- The FOMC needs to see "substantial further progress" before dialing back QE and Brainard reiterated that commitment Wednesday. "In assessing substantial further progress, I will be looking for sustained improvements in realized and expected inflation and examining a range of indicators to assess shortfalls from maximum employment," she said in prepared remarks for a Harvard University event. For more, see MNI Policy main wire at 1030ET.

- The speech focused on a variety of metrics well beyond the traditional unemployment rate which could provide an indication of labor market slack. Reiterating what Chair Powell noted in his Congressional testimony yesterday, that the employment-to-population ratio was key to determining "full employment".

- Brainard and Powell (among other Fed officials) are emphasizing that even though the headline unemployment rate may drop rapidly over the coming years, this would not warrant Fed tightening if it were merely reflective of weaker labor force participation.

- Likewise, the traditional Phillips Curve relationship is broken (Brainard: "changes in economic relationships over the past decade have led trend inflation to run persistently somewhat below target and inflation to be relatively insensitive to resource utilization").

- In sum, Brainard is affirming that the Fed will take an increasingly holistic assessment of labor market slack in deciding when to tighten, meaning that the bar to tighten policy is arguably higher than it has been in previous cycles.

- "Prospects for the economy in 2021 and beyond have brightened and the downside risk to the outlook has diminished," Clarida said in prepared remarks ahead of a virtual presentation to the U.S. Chamber of Commerce.

- Clarida did not directly discuss the outlook for monetary policy, but rather reviewed recent changes to the Fed's framework and its new forward guidance. Still, he offered no hints that the central bank might be considering any pullback in its strong monetary support for the economy, which include near-zero interest rates and monthly bond buys of USD120 billion.

Fed Vice Chair Clarida's comments at the US Chamber of Commerce today didn't wade much into current monetary policy, but where it did, he showed little daylight between his outlook and Chair Powell's.

- For instance, Clarida concurred that an increase in demand in 2021 would not generate sustained price pressure, which was almost exactly what Powell said Tuesday on the inflation outlook.

- Clarida took a little more leeway in commenting on fiscal policy (Powell basically would not be drawn out at all on opinions on the current stimulus bill in his 2-day testimony), saying that fiscal support should accelerate the pace of progress toward the Fed's dual mandate goals.

- He also echoed Powell in saying that current market pricing was consistent with strong economic growth expectations.

- All-in-all, the Fed leadership (incl Brainard) has delivered the same consistent message this week: tightening policy is a long way off.

CANADA

BOC: Bank of Canada Governor Tiff Macklem is more concerned by low inflation in an economy with ample slack than by market bets on surging prices, he told MNI, adding that it might be time to adjust the country's three-decade-old inflation-targeting framework.

- Shorter-term debt yields and inflation expectations have been well anchored, in part reflecting forward guidance that the policy interest rate could stay at 0.25% into 2023, Macklem said during a video interview from his office late Tuesday.

- "I'm confident we have the tools to control inflation. We're more worried about inflation being too low than too high," Macklem said. "If you saw inflation expectations starting to go way up well above target, that would be a different story. But that's not what we've seen." For more, see MNI Policy main wire at 0914ET.

- "Over the last couple of quarters, there has been a broad-based depreciation of the U.S. dollar," which was noted in the last economic forecast report, Macklem said. "In this case, the appreciation doesn't reflect strength in Canada, it reflects the weakness of the U.S. dollar." For more, see MNI Policy main wire at 0800ET.

EUROPE

EU: European Union governments have reacted positively to a proposal to create a new bloc-wide class of hybrid securities, incentivised with tax breaks, which would both support firms struggling with the impact of the Covid-19 pandemic and boost impetus towards a European Capital Markets Union, a senior finance industry group official told MNI.

- The Association for Financial Markets in Europe has called on EU governments to grant tax allowances, capital gains tax exemptions and temporary changes to solvency rules for insurers to foster a hybrid financial instrument, which could help prevent a looming wave of corporate insolvencies as public sector support is phased out. For more, see MNI Policy main wire at 1008ET.

OVERNIGHT DATA

U.S. JAN. NEW-HOME SALES AT 923,000 ANN. RATE; EST. 856,000

US MBA: MARKET COMPOSITE -11.4% SA THRU FEB 19 WK

US MBA: REFIS -11% SA; PURCH INDEX -12% SA THRU FEB 19 WK

US MBA: UNADJ PURCHASE INDEX +7% VS YEAR-EARLIER LEVEL

US MBA: 30-YR CONFORMING MORTGAGE RATE 3.08% VS 2.98% PREV

MARKET SNAPSHOT

Key late session market levels- DJIA up 417.03 points (1.32%) at 31953.9

- S&P E-Mini Future up 38.75 points (1%) at 3916.75

- Nasdaq up 82.8 points (0.6%) at 13548.08

- US 10-Yr yield is up 4.1 bps at 1.3824%

- US Mar 10Y are down 7/32 at 135-6.5

- EURUSD up 0.0006 (0.05%) at 1.2155

- USDJPY up 0.65 (0.62%) at 105.9

- Gold is down $7.85 (-0.43%) at $1797.71

European bourses closing levels:

- EuroStoxx 50 up 16.89 points (0.46%) at 3705.99

- FTSE 100 up 33.03 points (0.5%) at 6658.97

- German DAX up 111.19 points (0.8%) at 13976

- French CAC 40 up 18.14 points (0.31%) at 5797.98

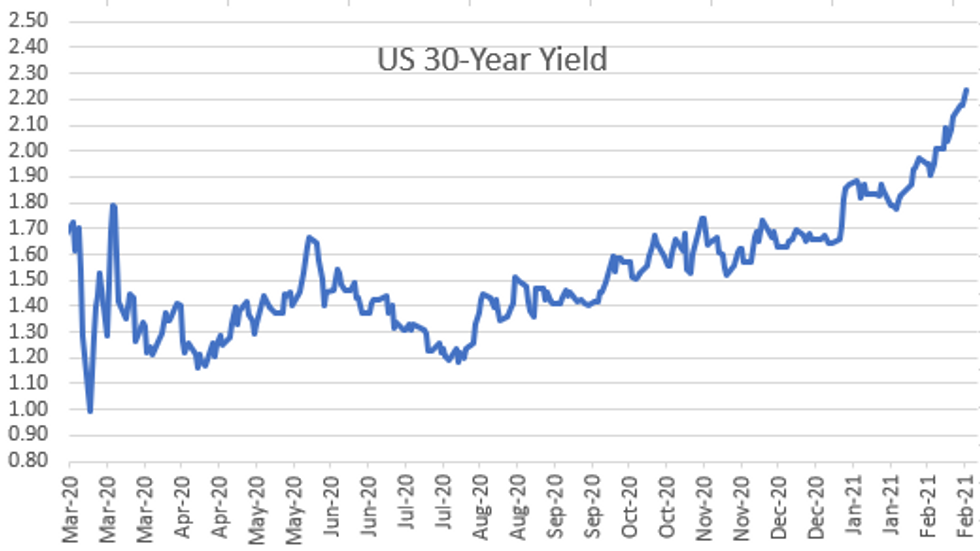

Yields Recede After Making New Highs

Large range for Tsys after Bonds lead a steep sell-off early Wed, talk of negative convexity selling while stops triggered, exacerbating early move that accelerated after NY open. Rates recovered appr half the move by noon after making new high yields before 1000ET (10YY 1.4337%; 30YY 2.2910%) while yld curves extend bear steepening (5s30s 166.984). Fed systems crashed late, gradual recovery.

- Early sell-off not data related, though 1000ET Jan new-home sales better than exp at 923,000 vs. 856,000 est, and Fed Chair Powell repeated his Tue's Senate Banking Comm performance. More likely due to ongoing reflation trade theme the unexpected strength of which caught some off guard (tight stops).

- Other Fed Speak: Gov Brainard largely repeated much of the Fed leadership's recent thinking about QE, inflation and the labor market in a speech at Harvard today; VC Clarida's Comments Echo Powell Dovishness.

- Large Eurodollar Green pack Block 7k -0.045, likely swap related buyer, spds seeing decent tightening across the curve, particularly in 10s-30s, payer unwinds on the sell-off in rates.

- Overall heavy volumes as March/June Tsy futures roll climbed over 80% completion. Tsys dipped briefly after US Tsy $61B 5Y Note auction tailed: high yld of 0.621% (0.424% last month) vs. 0.615% WI; 2.24 bid/cover.

- Massive off ratio 2s5s steepener block: June instead of March (former takes lead Friday)

- +28,815 TUM 110-14.5, buy through 110-14.38 post time offer at 1037:39ET

- -40,569 FVM 124-25, sell through 124-26.75 post-time bid

- The 2-Yr yield is up 1.4bps at 0.125%, 5-Yr is up 4.1bps at 0.6069%, 10-Yr is up 4.1bps at 1.3824%, and 30-Yr is up 5.4bps at 2.234%.

US TSY FUTURES CLOSE: Yields Halve Early Gains

Trading weaker after the bell -- well off midmorning lows after making new high yields before 1000ET (10YY 1.4337%; 30YY 2.2910%), yld curves extend bear steepening (5s30s receded app 4.5 from high of 166.984 last seen Aug 2014). Heavy volumes tied to March/June roll should start to moderate as % completion over 80%.

- 3M10Y +3.066, 133.926 (L: 129.087 / H: 139.824)

- 2Y10Y +2.055, 124.722 (L: 121.674 / H: 130.481)

- 2Y30Y +3.402, 209.918 (L: 205.42 / H: 216.207)

- 5Y30Y +1.166, 162.374 (L: 160.667 / H: 166.984)

- Current futures levels:

- Mar 2Y down 0.5/32 at 110-15.25 (L: 110-14.75 / H: 110-16.125)

- Mar 5Y down 3.25/32 at 125-8 (L: 125-04 / H: 125-15.5)

- Mar 10Y down 5/32 at 135-8.5 (L: 134-27.5 / H: 135-23)

- Mar 30Y down 12/32 at 161-25 (L: 160-16 / H: 162-29)

- Mar Ultra 30Y down 1-0/32 at 190-15 (L: 188-01 / H: 192-23)

US EURODOLLAR FUTURES CLOSE: Short End Pressed

Lead quarterly EDH1 held weaker since 3M LIBOR inched higher: +0.00225 to 0.18975% (+0.01450/wk), Blues-Golds outperformed.

- Mar 21 -0.005 at 99.835

- Jun 21 steady at 99.850

- Sep 21 steady at 99.830

- Dec 21 steady at 99.785

- Red Pack (Mar 22-Dec 22) -0.01 to -0.005

- Green Pack (Mar 23-Dec 23) -0.03 to -0.01

- Blue Pack (Mar 24-Dec 24) -0.01 to +0.015

- Gold Pack (Mar 25-Dec 25) +0.015 to +0.025

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00037 at 0.08013% (+0.00200/wk)

- 1 Month -0.00313 to 0.11450% (-0.00095/wk)

- 3 Month +0.00225 to 0.18975% (+0.01450/wk) ** (Record Low of 0.17525% on 2/19/21)

- 6 Month -0.00437 to 0.19938% (+0.00438/wk)

- 1 Year -0.00663 to 0.27800% (-0.00850/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $212B

- Secured Overnight Financing Rate (SOFR): 0.01%, $917B

- Broad General Collateral Rate (BGCR): 0.01%, $376B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $344B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $8.517B submission

- Next scheduled purchases:

- Thu 2/25 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 2/26 1010-1030ET: Tsy 0Y-2.25Y, appr 12.825B

PIPELINE: $8B NTT Finance 5Pt Jumbo Launched

- Date $MM Issuer (Priced *, Launch #)

- 02/24 $8B #NTT Fin: $1.5B 2Y +25, $1B 3Y +35, $3B 5Y +57, $1.5B 7Y +60, $1B 10Y +70

- 02/24 $5B *KFW 3Y +0

- 02/24 $2B *ADB 10Y +11

- 02/24 $1.8B Post Holdings 10.5NC5.5

- 02/23 $1.25B #Bank of Nova Scotia $950M 5Y +47, $300M 5Y FRN SOFR+54.4

- 02/24 $1B Fortinet WNG 5Y +80a, 10Y +115a

- 02/23 $750M #Bank of New Zealand 5Y +52

- 02/24 $750M #Bharti Airtel 10.25Y +187.5

FOREX: Commodity Surge Fuels NOK, AUD Strength

The reflationary cycle persisted Wednesday, with commodity contracts from copper to crude all registering fresh cycle highs. This helped boost commodity-tied currencies into the Wednesday close, prompting NOK, AUD and CAD to outperform. The longevity of the commodity rally was backed up by the move back above the $50/bbl mark for across the WTI futures curve.

- The reflationary theme bled from commodities in haven FX, with both JPY and CHF trading particularly poorly despite the unimpressive showing from equity markets.

- Early strength in GBP faded into the Wednesday close, as markets heeded the sharp overbought technical conditions. This prompted GBP to eye a middling finish despite hitting new multi-year highs against the EUR and USD early Wednesday.

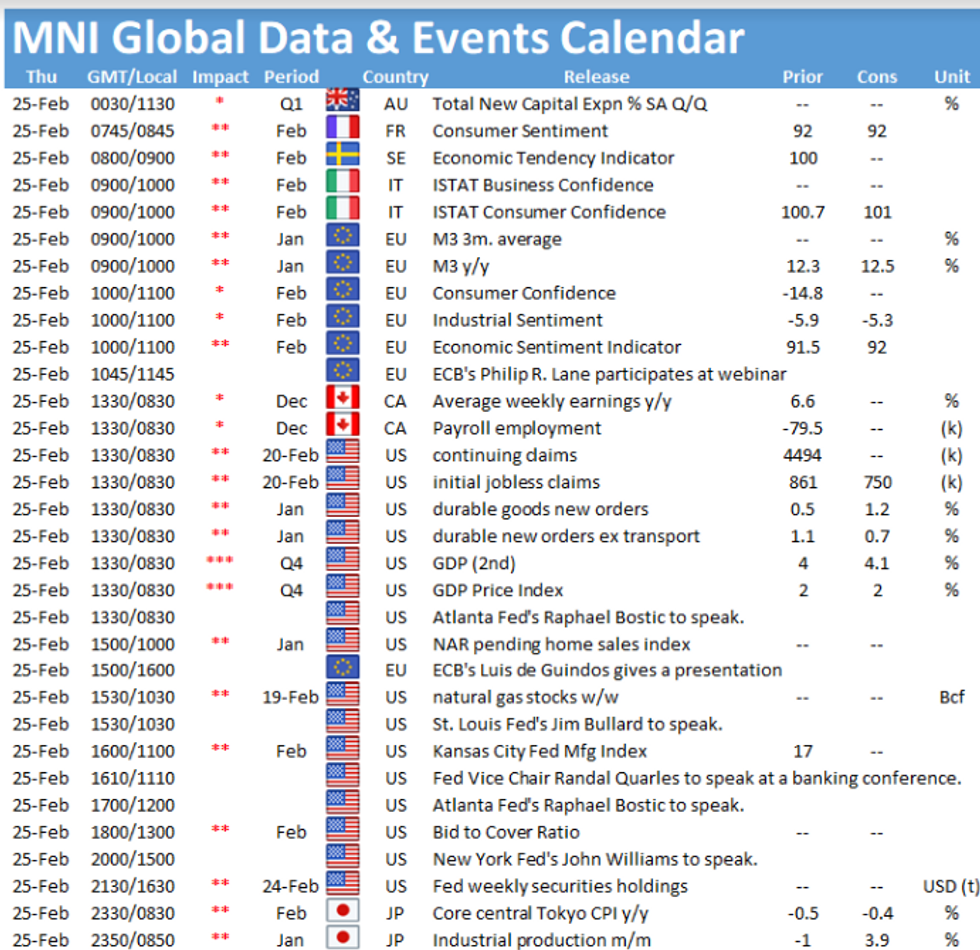

- Focus Thursday turns to weekly US jobless claims numbers, GDP data for Q4, durable goods orders and pending home sales. The speaker schedule includes ECB's Lane, de Cos and de Guindos and Fed's Bostic, Bullard, Quarles and Williams.

BONDS/EGBs-GILTS CASH CLOSE: Gilts Underperform...Again

Gilts underperformed once again, with long-end yields moving higher in both Germany and the UK. 10-Yr UK yields hit widest vs Bunds since Dec 2019. Periphery spreads widened despite a broadly constructive risk-on atmosphere.

- Germany's Merkel appeared to lay the groundwork for longer lockdown restrictions due to virus mutations. In data, French Feb business/manufacturing confidence missed expectations; Q4 German GDP was revised up.

- Today's comments by BOE officials including Bailey (who noted that economic scarring from the pandemic will be limited) and Haskel (who sees downside econ risks, and is open to more stimulus) did little to move markets. Thursday sees ECB's Lane, de Guindos, de Cos speaking.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is unchanged at -0.682%, 5-Yr is up 0.5bps at -0.61%, 10-Yr is up 1.1bps at -0.304%, and 30-Yr is up 1.4bps at 0.209%.

- UK: The 2-Yr yield is down 1bps at 0.032%, 5-Yr is down 0.6bps at 0.278%, 10-Yr is up 1.3bps at 0.732%, and 30-Yr is up 4.9bps at 1.377%.

- Italian BTP spread up 3.2bps at 99.1bps / Spanish spread up 1.6bps at 69.5bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.