-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

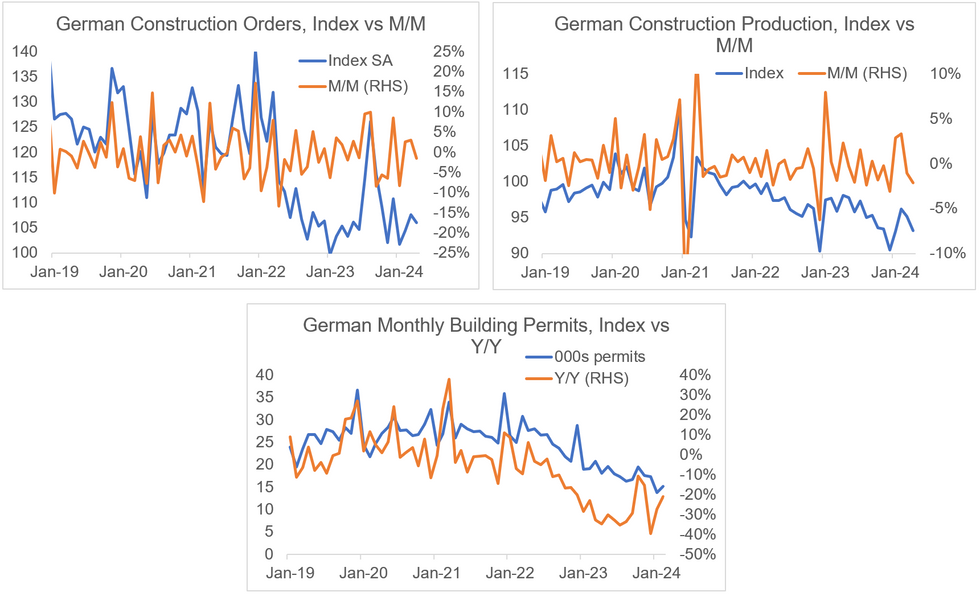

Free AccessConstruction Likely to Contribute Less to Q2 than Q1 GDP Growth

German construction orders decreased by 1.5% M/M in April after two months of expansion. Based on today's print, it appears unlikely that Q2 GDP sees construction repeats the positive 0.3pp positive contribution that was seen in Q1. While volatile, construction has not seen a material shift since last August.

- Construction orders (seasonally-adjusted volumes) have largely moved back to levels seen after the 2022 inflation surge (after a temporary spike last summer) and remained there for the last couple of months.

- Construction production has also decreased again recently after seeing a weather-related bump in January/February this year (-2.1% M/M Apr vs -1.0% Mar).

- Building permits meanwhile have seen some revival in their yearly rate on the back of base effects (-20.8% Y/Y Feb vs -27.2% Jan, -39.4% Dec), leaving the monthly number low by historical standards. The lower number of building permits does, however, partly reflect that the average project has increased in size.

- Sentiment in the industry remains subdued. Although the construction sector IFO Business Climate and construction PMI both have moved away from their lows (IFO -25.0 Jun vs -25.6 May, -36.2 Jan; PMI 38.5 May vs 37.5 Apr, 36.3 Jan), improvement remains limited, leaving both indicators deeply in contractionary territory where they moved around Spring 2022.

- Overall, respective production data started off Q2 on a weaker note, and also incoming orders / permits do not give rise to construction being a notable upside driver to sequential GDP growth again.

MNI, Destatis

MNI, Destatis

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.