-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY177.8 Bln via OMO Wednesday

MNI ASIA OPEN - Late Month-End Rate Bid

EXECUTIVE SUMMARY

- MNI INTERVIEW: US Job Growth Seen Below 2019 Trend for 5-8 Yrs

- MNI POLICY: Canada Apr-Dec Budget Deficit Hits Record CAD248B

- U.S. IS NO LONGER ADVOCATING FOR 'SAFE HARBOR', Reuters

- U.S. to Impose Sweeping Rule Aimed at China Technology Threats, DJ

US

US: The rate of U.S. job creation will take between five and eight years to get back to its 2019 trend, former Bureau of Labor Statistics commissioner Erica Groshen told MNI, pointing to historical precedent from previous recessions and to lasting structural changes accelerated by the Covid-19 pandemic.

- Pandemic disruption has affected both what consumers buy and where products are made, as well as severing ties between workers and employers, making it more difficult for those laid off to find new work, Groshen, who also worked at the New York Fed, said in an interview, echoing comments from Dallas Fed advisor Aysegul Sahin in a recent MNI interview.

- U.S. TREASURY SECRETARY YELLEN TOLD G20 THAT U.S. IS NO LONGER ADVOCATING FOR 'SAFE HARBOR' IMPLEMENTATION IN OECD GLOBAL TAX TALKS -TREASURY OFFICIAL, Rtrs

CANADA

CANADA: Canada's federal budget deficit widened to a record CAD248 billion from April to December, bringing it closer to the government's full fiscal year projection of CAD382 billion.

- Program spending jumped 86% or by CAD198 billion from the year-earlier period, the finance department said Friday, and revenue fell 16%.

- The monthly deficit for December was CAD16 billion compared with a surplus of CAD800 million a year ago. for more, see MNI Policy main wire at 1001ET.

OVERNIGHT DATA

- US ADVANCE JAN GOODS TRADE DEFICIT $83.7B V $83.2 DEC

- US ADVANCE JAN WHOLESALE INVENTORIES +1.3% TO $661.6B

- US ADVANCE JAN RETAIL INVENTORIES -0.6% TO $625.1B

- US JAN PERSONAL INCOME +10.0%; NOM PCE +2.4%

- US JAN PCE PRICE INDEX +0.3%; +1.5% Y/Y

- US JAN CORE PCE PRICE INDEX +0.3%; +1.5% Y/Y

- US JAN UNROUNDED PCE PRICE INDEX +0.340%; CORE +0.252%

- U.S. personal income in January increased 10%, above expectations for a gain of 9.5%.

- That was "more than accounted for by an increase in government social benefits," the Bureau of Economic Analysis said. Unemployment insurance benefits also increased through January.

- January PCE was up 2.4% following a 0.4% decline in December. That reflected a USD277.2 billion increase in spending on goods and a USD63.7 billion increase in spending for services.

- Goods spending was mostly led by recreational goods and vehicles, the BEA said, while spending on food services and accommodations and health care led services spending through the month.

- The PCE price index was up 0.3% following a 0.4% increase in December and was up 1.5% y/y. The core PCE price index was up 0.3% and was up 1.5% from a year earlier.

- MNI CHICAGO BUSINESS BAROMETER 59.5 FEB VS 63.8 JAN

- MNI CHICAGO: NEW ORDERS SHOWED LARGEST M/M DECLINE

- MNI CHICAGO: EMPLOYMENT AT HIGHEST SINCE OCT 2019

- MNI CHICAGO: ORDER BACKLOGS AT 3.5-YEAR HIGH

- The downtick comes after a sharp increase in the previous month, when the index rose to a 2.5-year high.

- Among the main five indicators, New Orders (55.2) saw the largest monthly decline, followed by Production (62.0), while Employment (49.1) recorded the biggest gain.

- Despite the uptick to the highest level since Oct 2019, Employment has been in contraction territory since Jul 2019.

- Order Backlogs increased to a 3.5-year high of 63.0, while Supplier Deliveries ticked up to 71.5, showing the highest level since May.

- Supplier Deliveries remain elevated with firms noting severe logistical issues .

- Inventories declined to 50.4 in Feb, following Jan's sharp increase with anecdotal evidence suggesting that supply chain disruption led to higher inventory levels.

- Prices edged marginally higher to 75.3, showing a 29-month high, with firms continuously noting higher prices for raw materials.

- The majority, at 41.7%, increased their safety stocks, while 22.9% of respondents either implemented new technology or diversified suppliers in order to deal with the disruptions in the past year.

- MICHIGAN FINAL FEB. CONSUMER SENTIMENT AT 76.8; EST. 76.5

- MICHIGAN CURRENT CONDITIONS INDEX AT 86.2, MATCHES PRELIM.

- MICHIGAN FEB. SENTIMENT COMPARES WITH 76.2 PRELIM. READING

- MICHIGAN 1-YR INFLATION EXPECTATIONS AT 3.3%, MATCHING PRELIM.

- MICHIGAN 5-YR INFLATION EXPECTATIONS AT 2.7%, MATCHING PRELIM.

- CANADA CAPEX SPENDING SEEN +7.0% THIS YEAR, 2020 -9.2%

- CANADA JAN INDUSTRIAL PRICES +2.0% MOM; EX-ENERGY +1.5%

- CANADA JAN RAW MATERIALS PRICES +5.7% MOM; EX-ENERGY +3.2%

MARKET SNAPSHOT

Key late session market levels- DJIA down 296.52 points (-0.94%) at 31092.42

- S&P E-Mini Future up 4 points (0.1%) at 3830.25

- Nasdaq up 161.8 points (1.2%) at 13275.26

- US 10-Yr yield is down 7 bps at 1.4495%

- US Jun 10Y are up 10.5/32 at 132-29

- EURUSD down 0.0088 (-0.72%) at 1.2087

- USDJPY up 0.33 (0.31%) at 106.55

- WTI Crude Oil (front-month) down $2.03 (-3.2%) at $61.49

- Gold is down $40 (-2.26%) at $1730.06

European bourses closing levels:

- EuroStoxx 50 down 48.84 points (-1.33%) at 3636.44

- FTSE 100 down 168.53 points (-2.53%) at 6483.43

- German DAX down 93.04 points (-0.67%) at 13786.29

- French CAC 40 down 80.67 points (-1.39%) at 5703.22

US TSY SUMMARY: Strong Month-End Bounce

Tsys rebounded after Thursday's histrionics (post-7Y auction buy-strike or who wants to catch falling knife when Fed not wanting to stand in way of higher yields). Or Is month-end bid an opportunity to Sell? Monday will tell.

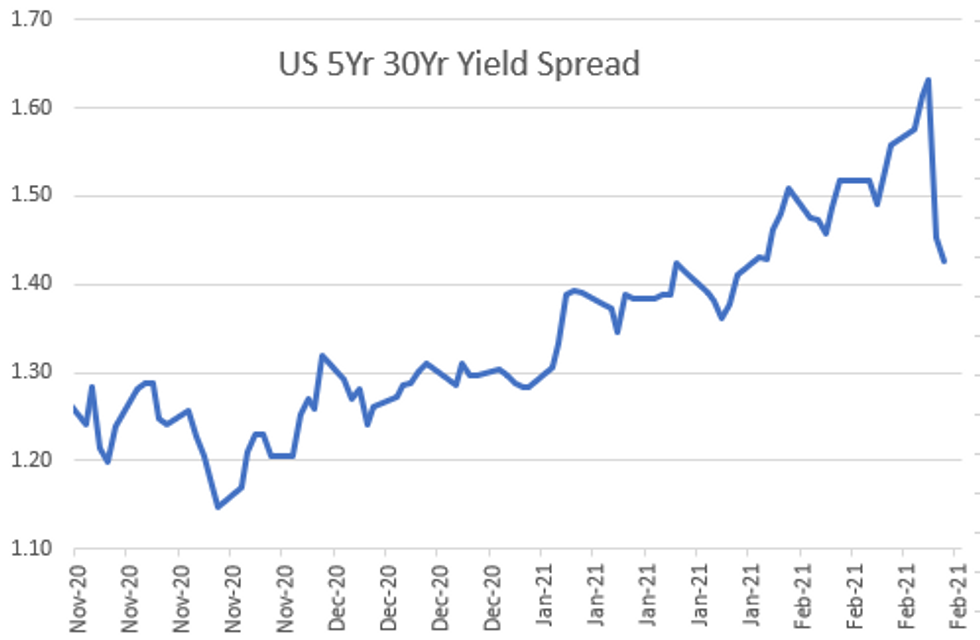

- Yield curves bull flattening (5s30s appr 25bp off Wed's 266.5 high last seen Aug 2014) with long end outperforming heading into month-end. S&P and Nasdaq futures trading firmer (+16.0, +200.0 respe) while DJIA traded weaker: -225.0. Vix receded to around 26.5 after topping 30.80 vs. 31.16 high on Thu, off late Jan highs of 37.51.

- The week's sell-off in rates as well as equities, accelerated sharply Thursday, catching may off guard. Societe Generale strategists take on the the spike in 5Y Tsy yields (0.6113 low to 0.8617 high after the poorly received $62B 7Y note auction tailed 4bp) "seems to be challenging the Fed's 'lower for longer' mantra."

- June futures took lead quarterly while late rolls from March continued to boost volumes. Light deal-tied flow, but decent short end rate paying in 2s-5s as swap spds widened 1.5-3.5bp.

- Another HEAVY option volume session, low delta puts dominating both Eurodollar and Treasury options as accts took advantage of rebound in underlying to buy cheaper rate-hike insurance covering mid-2022 through mid-2024 sector of curve.

- The 2-Yr yield is down 2.9bps at 0.1426%, 5-Yr is down 6bps at 0.7602%, 10-Yr is down 7bps at 1.4495%, and 30-Yr is down 8.4bps at 2.1891%.

US TSY FUTURES CLOSE: New Session Highs After the Bell

Bonds extended session highs on decent month-end buying after the bell, still well off midweek highs, yield curves bull flattening, 5s30s appr 25bp off Wed's Aug 266 high last seen Aug 2014.

- 3M10Y -8.594, 138.834 (L: 138.834 / H: 150.893)

- 2Y10Y -5.179, 129.019 (L: 129.019 / H: 137.468)

- 2Y30Y -7.486, 202.066 (L: 202.066 / H: 214.336)

- 5Y30Y -4.323, 140.884 (L: 139.14 / H: 151.048)

- Current futures levels:

- Jun 2Y up 1.75/32 at 110-13 (L: 110-10.375 / H: 110-13.5)

- Jun 5Y up 6.5/32 at 124-4 (L: 123-22.25 / H: 124-08.5)

- Jun 10Y up 12/32 at 132-30.5 (L: 132-08 / H: 133-05.5)

- Jun 30Y up 1-21/32 at 159-28 (L: 157-14 / H: 159-29)

- Jun Ultra 30Y up 4-17/32 at 190-9 (L: 184-15 / H: 190-10)

US EURODOLLAR FUTURES CLOSE: Month-End Bounce In Rates

Both Treasury and Eurodollar futures continued to inch higher after Friday's close on decent month end duration buying, Whites through Reds paring modest losses. Lead quarterly EDH1 steady/bid after 3M LIBOR set -0.00212 to 0.18838% (+0.01313/wk).

- Mar 21 steady at 99.823

- Jun 21 steady at 99.835

- Sep 21 +0.005 at 99.820

- Dec 21 steady at 99.775

- Red Pack (Mar 22-Dec 22) +0.005 to +0.020

- Green Pack (Mar 23-Dec 23) +0.010 to +0.020

- Blue Pack (Mar 24-Dec 24) +0.010 to +0.015

- Gold Pack (Mar 25-Dec 25) +0.025 to +0.040

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00362 at 0.08400% (+0.00587/wk)

- 1 Month +0.00337 to 0.11850% (+0.00305/wk)

- 3 Month -0.00212 to 0.18838% (+0.01313/wk) ** (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00237 to 0.20300% (+0.00700/wk)

- 1 Year +0.00350 to 0.28375% (-0.00275/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $77B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $243B

- Secured Overnight Financing Rate (SOFR): 0.03.%, $896B

- Broad General Collateral Rate (BGCR): 0.02%, $369B

- Tri-Party General Collateral Rate (TGCR): 0.02%, $332B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.801B accepted vs. $49.547B submission

- Next scheduled purchases:

- Mon 3/1 1100-1120ET: TIPS 1Y-7.5Y, appr $2.425B

- Tue 3/2 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 3/3 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 3/4 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/5 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE: Total $157.865B High-Grade Issuance For February

- Date $MM Issuer (Priced *, Launch #)

- 02/26 $1.7B #Centerpoint Energy $700M 2NC.5 +60, $1B 2NC.5 FRN LIBOR+50

- 02/26 $800M #State Street 10Y +78

- $5.67B Priced Thursday; $42.27B/wk

- 02/25 $3B *Daimler Finance $1.5B 3Y +48, $1B 5Y +70, $500M 10Y +95

- 02/25 $1.25B *Truist Financial 6NC5 fix-FRN +50

- 02/25 $900M *Williams Cos 10Y +115

- 02/25 $520M *Development Bank Japan (DBJ) 3Y +14

FOREX: USD Dominant, Could Revisit Feb Highs

The USD rallied for a second session Friday, boosting the USD index to new weekly highs and narrowing the gap with February's best levels and the 100-dma - both of which remain key levels of resistance. Despite a calmer day for US bond markets (which had been subject to acute volatility earlier in the week), there remained pockets of volatility in currency markets, with AUD selling off aggressively alongside NZD.

- This reversal in growth-proxy and commodity-tied currencies followed a pause in the bull trend for industrial metals and oil, most of which hit new multi-year cycle highs mid-week.

- The pullback in both GBP/USD and AUD/USD this week was particularly eye-catching, with both pairs off as much as 350 pips from the week's best levels. Markets look for confirmation on whether the moves have been corrective, or are the beginning of a trend reversal.

- Focus in the coming week turns to Chinese PMI data, Canadian GDP and the February Nonfarm Payrolls report. The US are expected to have added 150,000 jobs over the month, with the unemployment rate inching 0.1 ppts higher to 6.4%.

- The RBA rate decision is due, in which markets will be watching for any comment on the recent sharp increase in Australian yields.

BONDS/EGBs-GILTS CASH CLOSE: ECB Talk Calms Yields

EGBs recovered some of the substantial ground lost Thursday, helped by multiple ECB officials (Lane and Schnabel in the morning, Stournaras in the afternoon) making soothing remarks on the outlook for Eurozone monetary policy.

- The German curve bull flattened in strong fashion (5s30s at 2-week low).

- Conversely, the UK curve out to 10 years weakened, failing to partake in the the global rally, hurt by comments on upside inflation risks by BOE's Haldane.

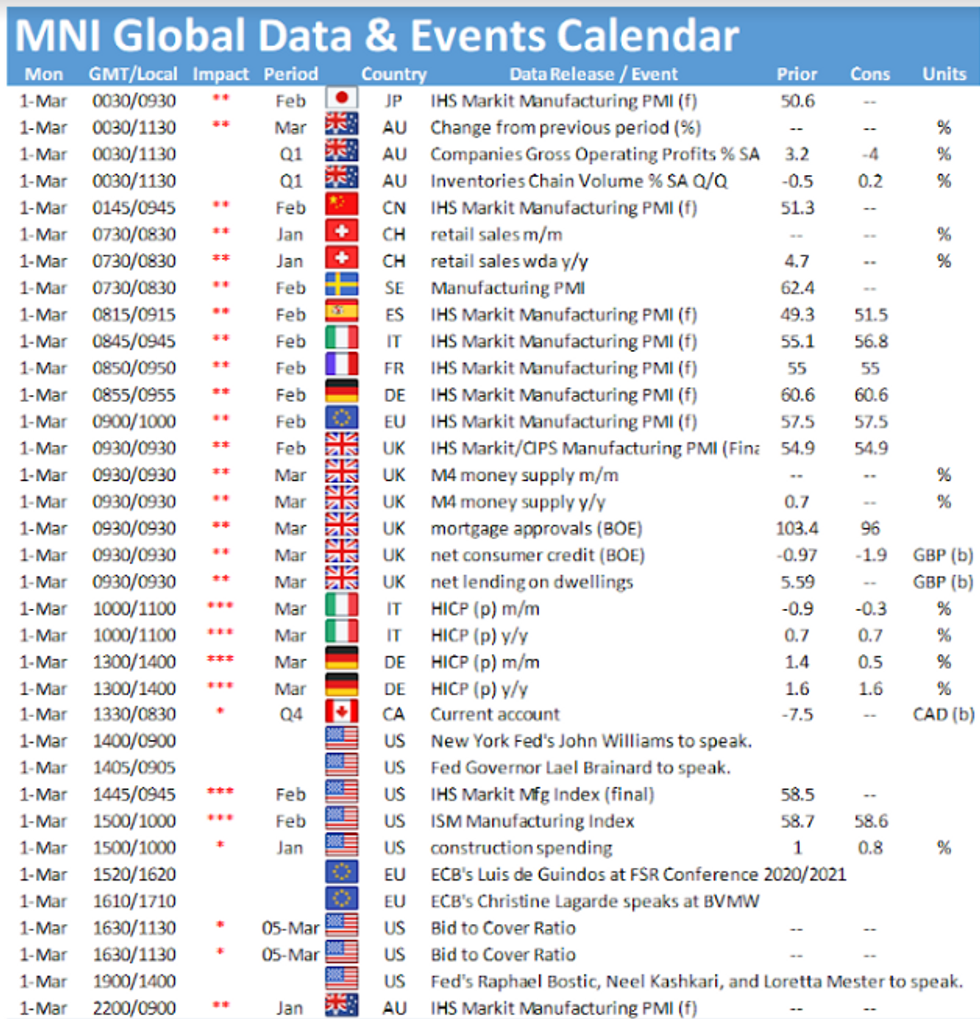

- Some PMI data and inflation figures in focus for next week; Monday's speakers include ECB's de Guindos and Villeroy.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 1.1bps at -0.663%, 5-Yr is down 2.3bps at -0.568%, 10-Yr is down 2.8bps at -0.26%, and 30-Yr is down 5bps at 0.194%.

- UK: The 2-Yr yield is up 2.1bps at 0.128%, 5-Yr is up 3.4bps at 0.4%, 10-Yr is up 3.6bps at 0.82%, and 30-Yr is down 0.3bps at 1.386%.

- Italian BTP spread down 1bps at 102.1bps / Spanish spread down 2.5bps at 68.3bps

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.