-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Huge Jobs Gain, Up-Revisions

EXECUTIVE SUMMARY

MNI BRIEF: US Sees Near 1 Million Jobs Added In March

MNI DATA IMPACT: US March Payrolls Up By Most Since August

"Fully vaccinated Americans can resume domestic and overseas travel as long as they wear masks in public," Politico

US

US: U.S. nonfarm payrolls in March rose 916,000, the most since August and far above forecasts for a gain of 650,000, according to figures released Friday by the Bureau of Labor Statistics. The unemployment rate edged down to 6% from 6.2% in February, in line with market expectations.

- A stronger report than expected by financial markets was thrown up as a strong possibility by MNI's latest Reality Check, published Thursday.

- The employment surge was led mostly by job gains in service-producing industries like leisure and hospitality (+280,000) and education and health services (+101,000). Job growth was also strong in goods-producing industries, with construction payrolls up 110,000. Government payrolls were up 136,000 in March after falling 90,000 in February. Average hourly earnings fell 0.1%, a sign that lower-wage service-sector employees are returning to the labor market. Earnings were up 4.2% from a year earlier.

- Employers added 916,000 jobs: https://www.bls.gov/news.release/pdf/empsit.pdf in March, far above the 650,000 increase forecast by the Bloomberg consensus. February's 379,000 gain was revised up to 468,000.

- Private payrolls were up 780,000, led by a 280,000 increase in leisure and hospitality. Smaller increases came from construction (+110,000), education and health services (+101,000), and professional and business services (+66,000). Government payrolls were up 136,000 after falling 90,000 in February, reflecting increases in local and state government education as more schools transitioned from online to in-person learning.

OVERNIGHT DATA

- US MAR NONFARM PAYROLLS +916K; PRIVATE +780K, GOVT +136K

- US PRIOR MONTHS PAYROLLS REVISED: FEB +468K; JAN +233K

- US MAR AVERAGE HOURLY EARNINGS -0.1% Vs FEB +0.3%; +4.2% YOY

- US MAR AVERAGE WEEKLY HOURS 34.9 HRS

- US MAR UNEMPLOYMENT RATE 6.0%

MARKETS SNAPSHOT

Key market levels after the early session close:- S&P E-Mini Future up 17.25 points (0.43%) at 4027.25

- US 10-Yr yield is up 4.8 bps at 1.7181%

- US Jun 10Y are down 15/32 at 130-30.5

- EURUSD down 0.0019 (-0.16%) at 1.1758

- USDJPY up 0.07 (0.06%) at 110.69

- Gold is down $0.44 (-0.03%) at $1728.87

US TSY SUMMARY: March Employ Surges +916k

Surge in March job gains, +916k vs. +660k est (private, +780k, govt +136k) and up-revisions for prior two helped push Tsy ylds to new one+ year highs while equities posted new all-time highs as well: S&Ps 4038.0.

- Initial chop, Tsys gapped higher after initially better selling, chalk that up to thin market conditions on shortened pre-Easter weekend participation. Much better March employ data finally sunk in a few minutes later as market pulled forward rate hike expectations sooner than later. Yield curves chop, 5s30s that dipped below 138.0 to 137.713 low.

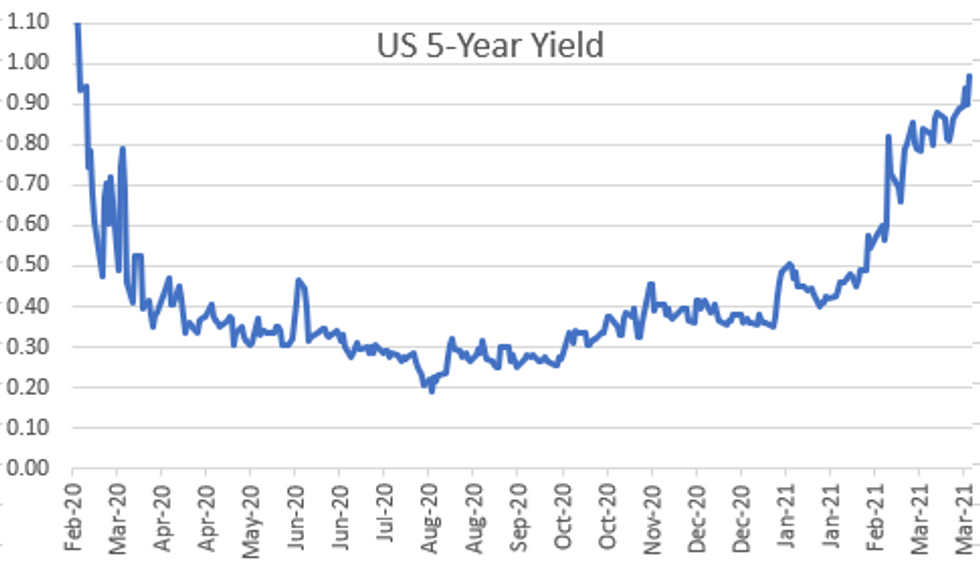

- Focus more on economic recovery not inflation expectations one desk said as 5Y yields climb back to late Feb 2020 levels, 0.9738% highs. Expect further vol

- 3s and 5s back to the assumption of tighter Fed policy starting in April 2022 with a fast increase to 1.25% another desk said.

- CDC left parting message around the early close: green-lighting travel for those fully vaccinated: "fully vaccinated Americans can resume domestic and overseas travel as long as they wear masks in public," Politico reported.

- The 2-Yr yield is up 2.8bps at 0.1862%, 5-Yr is up 7.3bps at 0.9738%, 10-Yr is up 4.8bps at 1.7181%, and 30-Yr is up 3.1bps at 2.3627%.

US TSY FUTURES CLOSE:

- 3M10Y +4.814, 170.031 (L: 164.192 / H: 170.922)

- 2Y10Y +2.439, 152.989 (L: 149.081 / H: 154.116)

- 2Y30Y +0.67, 217.451 (L: 214.517 / H: 218.944)

- 5Y30Y -4.077, 138.891 (L: 138.729 / H: 143.155)

- Current futures levels:

- Jun 2Y down 2/32 at 110-9.5 (L: 110-09.5 / H: 110-11.625)

- Jun 5Y down 11.25/32 at 123-6.5 (L: 123-05.75 / H: 123-19.5)

- Jun 10Y down 15/32 at 130-30.5 (L: 130-29.5 / H: 131-20)

- Jun 30Y down 17/32 at 155-22 (L: 155-16 / H: 156-26)

- Jun Ultra 30Y down 26/32 at 183-19 (L: 183-08 / H: 185-12)

US EURODOLLAR FUTURES CLOSE:

- Jun 21 -0.005 at 99.820

- Sep 21 -0.005 at 99.80

- Dec 21 -0.010 at 99.720

- Mar 22 -0.020 at 99.745

- Red Pack (Jun 22-Mar 23) -0.08 to -0.04

- Green Pack (Jun 23-Mar 24) -0.105 to -0.09

- Blue Pack (Jun 24-Mar 25) -0.105 to -0.09

- Gold Pack (Jun 25-Mar 26) -0.08 to -0.06

Short Term Rates

US DOLLAR LIBOR:No settles across currencies Friday and Monday due to Easter holiday

STIR: FRBNY EFFR for prior session:- Daily Effective Fed Funds Rate: 0.07% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $95B

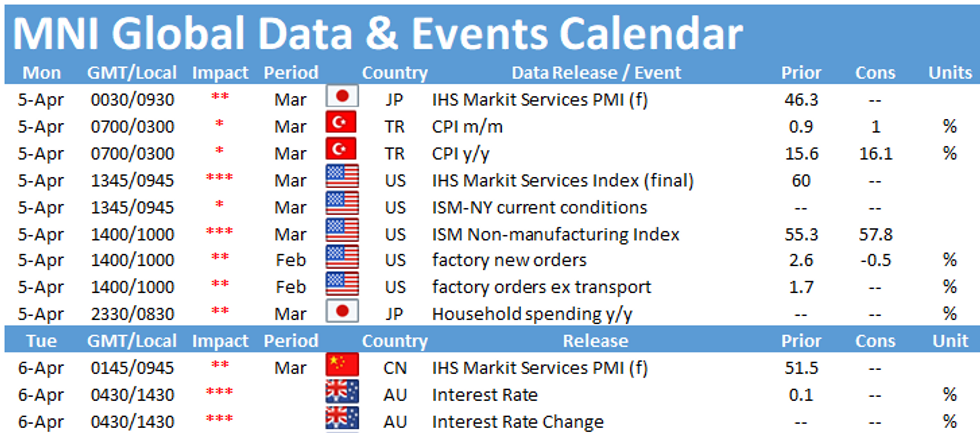

- Scheduled purchases resume next week:

- Mon 4/05 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Tue 4/06 1010-1030ET: Tsys 20Y-30Y, appr $1.750B

- Wed 4/07 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/08 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Fri 4/09 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.