-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: BLS Failure to Launch (PPI on Time)

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed's Gruber Sees 'Messy' Inflation Outlook

- MNI POLICY: Biden Budget Seeks Big Boost To Non-Defense Spend

- MNI: Traders: US Economic Data First Available Outside Of US

- BIDEN SEEKS 8.4% FISCAL YEAR 2022 BUDGET INCREASE TO $1.52T, Bbg

- MICHIGAN PUBLIC HEALTH SYSTEM IS OVERWHELMED: HEALTH OFFICIAL, Bbg

- MICHIGAN GOV CALLS ON HIGH SCHOOLS TO GO REMOTE FOR TWO WEEKS, Bbg

- WHITE HOUSE SAYS U.S. NOT LOOKING FOR CONFRONTATION WITH CHINA, BUT HAS EXPRESSED CONCERN ABOUT ACTIONS RELATED TO TAIWAN, Rtrs

US

US: President Joe Biden set out a 16% increase in non-defense discretionary spending to USD769 billion, or 3.3% of GDP, and a 1.7% boost in defense spending to USD753 billion in his first budget proposal to Congress Friday.

- Biden's preliminary USD1.522 trillion spending request for 2022 is the first step before Congress negotiates the government's budget for October, the start of the fiscal year by when if no budget is passed there will be a government shutdown. The document does not include the USD2.25 trillion infrastructure and jobs plan the president unveiled last week, but officials say the proposals are meant to be complementary.

- Its proposal for non-defense discretionary spending as a percentage of GDP would be roughly equal to the historical average over the last 30 years. For more see MNI Policy mai wire at 1100ET.

- "The fact that major US employment data is available outside of the US first undermines the credibility of the DoL (Department of Labor)" one such US company, which preferred to remain anonymous, stated. It's spokesperson added, "This puts the US investing public at a significant disadvantage, at such a time when gauging the recovery of the US economy has never been so important."

- "I'm not sure what signal to take right now. The inflation picture is very messy," he said in an interview. "There's so much uncertainty in the overall economy right now, it would be premature to expect the inflation picture to become clearer much sooner."

- Gruber said he expects a temporary increase in inflation related to supply constraints and annual comparisons to the depths of the pandemic.

FED: VC Clarida: Wouldn't Characterize Change in SOMA Purchases As Op Twist Fed Vice Chair Clarida says on BBG TT that in steering monetary policy through the pandemic recovery, the Fed will be "be more outcome based and less outlook based", echoing comments by the rest of the Fed leadership in recent weeks.

- Re Fed's "substantial further progress" definition for meeting the conditions required to taper bond purchases: "It's actual progress...hard numbers on the labor market and prices...we're early on in this year...as we go through the year, as the data comes in, as we release our SEP based on incoming data, we will have a sense of where we are on that incoming progress... we will communicate that."

- Notes US twin current account / fiscal deficits "Not a concern now, to me."

- Re NY Fed SOMA chief Lorie Logan's comments Thurs on asset purchase tweaks, including buying more 20-Yr Tsys, Clarida says Logan was "restating essentially what has been our policy for some time now, as we are purchasing Tsys, we are buying on secondary market, and want them to match maturity profile. As Treasury changes issuance patterns, our buying changes. So no change in Fed policy." When asked whether this constituted an Operation Twist]; he said, "I would not characterize this as Operation Twist."

- Notes that there could be temporary imbalances in the economy as the country re-opens, with supply/demand bottlenecks. And that while the 900k+ jobs gained last month was "welcome", there is still a hole in the labor market.

US TSY SUMMARY: Delayed PPI Release Dampens Strong Number

Rates held mildly weaker levels after Friday's closing bell, off early session lows even as equities continued to extend session highs after the bell, ESM1 around 4110.0, no obvious driver. (timing of CNBC interview headlines w/ ECB Pres LaGarde: RECOVERY WILL MOVE FAST IN SECOND HALF OF 2021, coincided with the move, but unlikely the driver).- Friday was an exceedingly disappointing day for data delivery as the Labor Dept's Bureau of Labor Statistics suffered technical difficulties that prevented it from delivering the March PPI data on time. After several minutes equities started to trade weaker, spurring rumors data had been disseminated to some dealers. A few minutes later the BLS annc'd the much stronger than expected data on Twitter: headline +1.0%, core (ex. food and energy) +0.7%. Rates and equities traded weaker, extending session lows around 0900ET.

- Rates and equities both started to bounce after Pres Biden set out a 16% increase in non-defense discretionary spending to $769B (3.3% of GDP), and 1.7% boost in defense spending to $753B in his first budget proposal to Congress Friday.

- The 2-Yr yield is up 0.8bps at 0.1568%, 5-Yr is up 2.9bps at 0.8643%, 10-Yr is up 3.9bps at 1.6585%, and 30-Yr is up 2.8bps at 2.3348%.

OVERNIGHT DATA

- US MAR FINAL DEMAND PPI +1.0% V 0.5% FEB

- US FEB WHOLESALE INV 0.6%; SALES -0.8%

- CANADA MAR EMPLOYMENT +303.1K; JOBLESS RATE +7.5%

- CANADA MAR FULL-TIME JOBS +175.4K; PART-TIME +127.8K

MARKETS SNAPSHOT

Key late session market levels

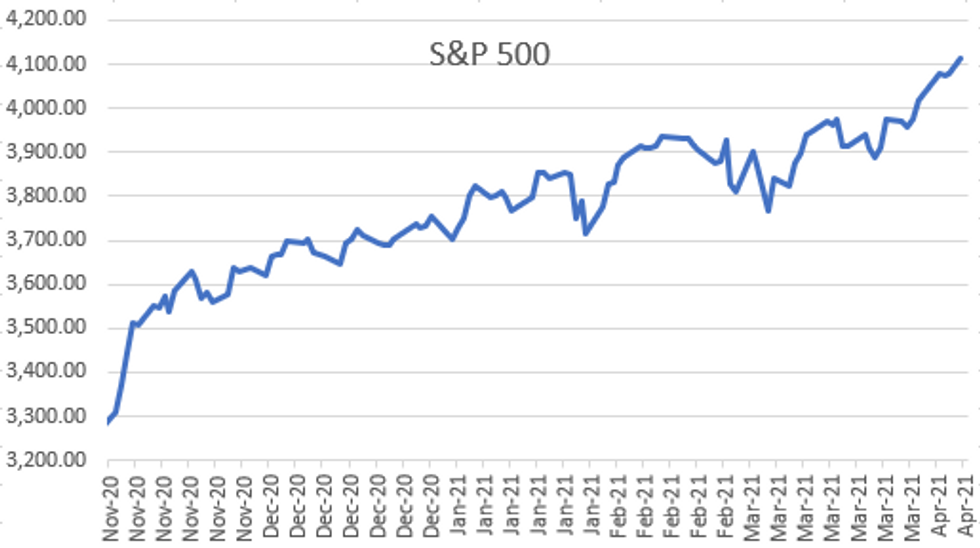

- DJIA up 142.12 points (0.42%) at 33642.75

- S&P E-Mini Future up 12.75 points (0.31%) at 4103.25

- Nasdaq up 8 points (0.1%) at 13849.94

- US 10-Yr yield is up 4.5 bps at 1.6638%

- US Jun 10Y are down 8.5/32 at 131-23.5

- EURUSD down 0.0012 (-0.1%) at 1.1909

- USDJPY up 0.41 (0.38%) at 109.6

- WTI Crude Oil (front-month) down $0.24 (-0.4%) at $59.38

- Gold is down $13.52 (-0.77%) at $1744.16

- EuroStoxx 50 up 1.01 points (0.03%) at 3978.84

- FTSE 100 down 26.47 points (-0.38%) at 6915.75

- German DAX up 31.48 points (0.21%) at 15234.16

- French CAC 40 up 3.69 points (0.06%) at 6169.41

US TSY FUTURES CLOSE

- 3M10Y +4.543, 165.191 (L: 159.888 / H: 167.5)

- 2Y10Y +3.482, 150.322 (L: 146.642 / H: 152.255)

- 2Y30Y +2.379, 217.984 (L: 215.065 / H: 219.814)

- 5Y30Y +0.267, 147.273 (L: 144.815 / H: 147.963)

- Current futures levels:

- Jun 2Y down 0.375/32 at 110-11.875 (L: 110-11.375 / H: 110-12.25)

- Jun 5Y down 4.75/32 at 123-23.5 (L: 123-18 / H: 123-29)

- Jun 10Y down 8/32 at 131-24 (L: 131-15 / H: 132-02.5)

- Jun 30Y down 7/32 at 156-18 (L: 156-01 / H: 157-04)

- Jun Ultra 30Y down 15/32 at 184-25 (L: 184-02 / H: 185-30)

US EURODOLLAR FUTURES CLOSE

- Jun 21 steady at 99.820

- Sep 21 +0.005 at 99.810

- Dec 21 steady at 99.735

- Mar 22 steady at 99.770

- Red Pack (Jun 22-Mar 23) -0.015 to -0.005

- Green Pack (Jun 23-Mar 24) -0.035 to -0.025

- Blue Pack (Jun 24-Mar 25) -0.035 to -0.03

- Gold Pack (Jun 25-Mar 26) -0.035 to -0.03

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00013 at 0.07475% (+0.00000/wk)

- 1 Month +0.00075 to 0.11125% (+0.00087/wk)

- 3 Month -0.00025 to 0.18750% (-0.01225/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00063 to 0.21138% (+0.01013/wk)

- 1 Year -0.00100 to 0.28575% (+0.00525/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $75B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $257B

- Secured Overnight Financing Rate (SOFR): 0.01%, $896B

- Broad General Collateral Rate (BGCR): 0.01%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $350B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, appr $3.601B accepted vs. $9.143B submission

- Next scheduled purchase:

- Mon 4/12 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 4/13 1500ET updated purchase schedule release. The Desk plans to purchase appr $80B over the monthly period from 3/12/21 to 4/13/21.

PIPELINE: Healthy Start for April, $43.37B Total Issuance on Week

- Date $MM Issuer (Priced *, Launch #)

- 04/09 No new names on docket as yet for Friday

- $17.52B Priced Thursday; $43.37B/wk

- 04/08 $5B *KFW 2Y -2

- 04/08 $4.1B *Organon $2.1B 7NC3 4.125%, $2.0B 10NC 5.125%

- 04/08 $4B *Japan Bank of Int Cooperation (JBIC) WNG $1B 3Y +4, $3B 10Y +24

- 04/08 $1B *MassMutual $400M 3Y +32, $600M 3Y FRN SOFR+36

- 04/08 $1B *Canadian Pension Plan (CPPIB) WNG 3.5Y +1

- 04/08 $1B *News Corp 8NC3 3.875%

- 04/08 $920M *Sumitomo Life Insurance 60NC10 3.375%

- 04/08 $500M *AIIB WNG 5Y FRN SOFR+22

FOREX: Stellar Canadian Jobs Report Sees CAD Back on Track

- CAD outperformed all others in G10 Friday, with a stellar jobs report helping fuel gains in the currency. Canada added three times as many jobs as expected in March, with over 300k jobs gained. This pressed the unemployment rate sharply lower and well below forecast, dropping to 7.5% vs. Exp. 8.0%.

- USD/CAD secured a second session of losses, reinforcing the importance of this week's support at the 1.2620 50-dma. 1.2502 undercuts as next support, marking the April 5th low.

- Contrasting with its oil-tied counterpart in CAD, NOK slid throughout the session, falling in tandem with WTI and Brent crude futures, which faded into the Friday close. USD/NOK snapped a multi-week losing streak, rising back above the 50-dma.

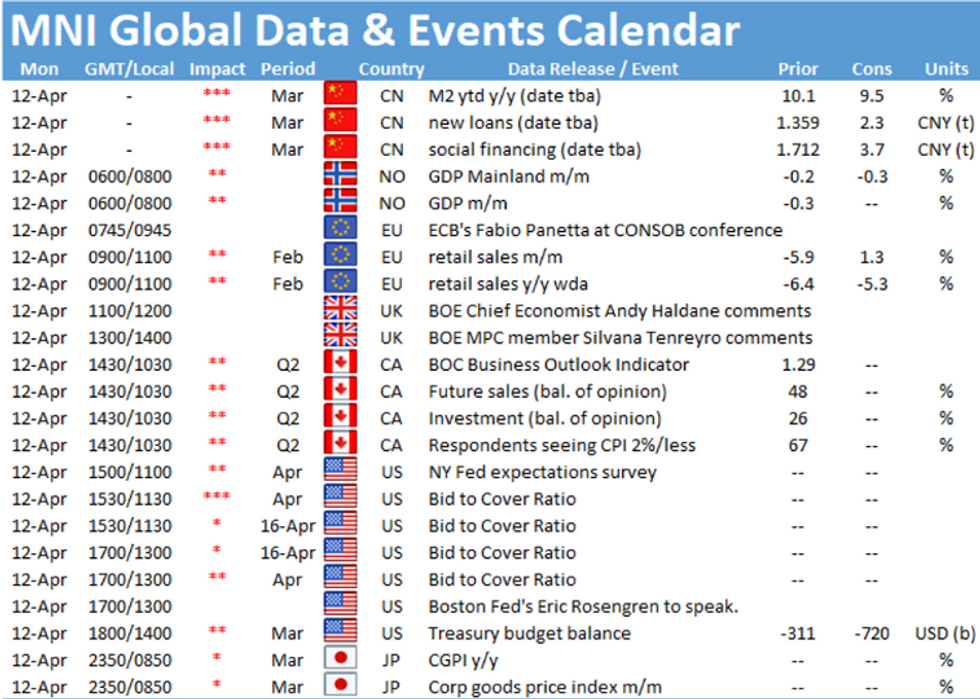

- Focus in the coming week turns to US earnings season, with the biggest name US banks due to report. Markets also watch UK industrial production, German ZEW survey, US CPI & retail sales numbers. Central bank decisions are due from the RBNZ as well as the Turkish and South Korean central banks. Fed speak will be in focus ahead of the pre-decision media blackout, which kicks in at the end of the week.

EGBs-GILTS CASH CLOSE: Bear Steepening Move Falters Late

Gilts and Bunds shifted from a bear steepening move in the morning, to a bear flattening in the afternoon as short-end yields consolidated their rise and yields on 10s through 30s faded lower. Overall though, the initial move proved too much to overcome, with curves steeper on the day.

- Main catalyst for the afternoon move was higher-than-expected US producer price data, which kept pressure on short-/intermediate Tsys, with Europe mirroring.

- Earlier in the session, BTPs sold off on a BBG report that the Draghi gov't will try to bring forward up to E40bn of new borrowing. Spreads wider on the session, w Italy underperforming the periphery.

- Otherwise, data (weak German and French IP) and speakers didn't really have a lasting impact.

- Attention next week is on UK Feb GDP Tuesday, with EGB issuers including EFSF, Netherlands, Italy and Germany (and possibility of Ireland, Finland, or Slovakia also).

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1.2bps at -0.702%, 5-Yr is up 3.5bps at -0.633%, 10-Yr is up 3.3bps at -0.303%, and 30-Yr is up 1.8bps at 0.242%.

- UK: The 2-Yr yield is unchanged at 0.046%, 5-Yr is up 1.3bps at 0.353%, 10-Yr is up 2.5bps at 0.774%, and 30-Yr is up 2.1bps at 1.305%.

- Italian BTP spread up 3.2bps at 103bps/ Spanish up 1bps at 68bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.