-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Commodity Weekly: Oil Markets Assess Trump Impact

MNI Gas Weekly: Winter Weather Takes the Driver's Seat

MNI ASIA OPEN: Tsy Sec Yellen No FX Manipulator Label for China

EXECUTIVE SUMMARY

MNI EXCLUSIVE: Fed's Lack of QE Exit Plan a Looming Challenge

MNI POLICY: US Household Inflation Expectations Hit 7 Yr High

MNI POLICY: Market Reform Needed Amid Strong Rebound-Rosengren

MNI BRIEF: US Treasury Saw March Budget Deficit Of USD660B

FED BULLARD: SEES 6.5% U.S. ECONOMIC GROWTH FOR 2021, Bbg

TSY SEC YELLEN PLANS TO SPARE CHINA FROM CURRENCY MANIPULATOR LABEL, Bbg

US

FED: The Federal Reserve is worried an eventual move to pare back its hefty bond-buying program could disrupt financial markets that are priced for perfection, fueling tighter conditions that hamper the recovery, former staffers tell MNI.

- "No one at the Fed is really sure how, or if, QE works," Rick Roberts, a former long-time staffer at the Federal Reserve banks of New York and Kansas City, told MNI. "I remain very concerned with the implications of our ongoing asset purchases and eventual taper." For more see MNI Policy main wire at 1453ET.

FED: The U.S. economy appears poised for a strong rebound, but a "hot" economy could pose financial stability challenges and policy makers would be well-served to consider options that would avoid the market ructions last March when Covid hit, Boston Federal Reserve President Eric Rosengren said Monday

- The U.S. economy should experience a significant rebound this year, said Rosengren, who is expecting it will take two years to reach pre-pandemic levels, adding there are some continuing concerns with coronavirus variants. For more see MNI Policy main wire at 1200ET.

US: U.S. household inflation expectations ticked up again in March reaching the highest level in almost seven years, a New York Federal Reserve survey showed Monday, with expectations for price increases for homes, rent and gas reaching series highs.

- The median inflation outlook for the next year and three years ahead both increased by 0.1 percentage point to 3.2%, continuing a run of steady increases over the past five months and reaching highs last seen in mid-2014. For more see MNI Policy main wire at 1100ET.

- The Treasury Department said the federal deficit in the first six months of fiscal year 2021 was USD1.706 trillion, USD963 billion more than the deficit recorded during the same period last year. For more see MNI Policy main wire at 1425ET.

US TSY SUMMARY:

OVERNIGHT DATA

No relevant data Monday -- quiet start to a hectic week for Fed speakers ahead of Fed media blackout that started late Friday evening.

MARKETS SNAPSHOT

Key late session market levels

- DJIA down 109.01 points (-0.32%) at 33691.57

- S&P E-Mini Future down 7.25 points (-0.18%) at 4111.75

- Nasdaq down 75 points (-0.5%) at 13826.04

- US 10-Yr yield is up 1.4 bps at 1.6728%

- US Jun 10Y are down 3/32 at 131-20.5

- EURUSD up 0.0007 (0.06%) at 1.1906

- USDJPY down 0.24 (-0.22%) at 109.43

- WTI Crude Oil (front-month) up $0.24 (0.4%) at $59.56

- Gold is down $13.57 (-0.78%) at $1730.32

European bourses closing levels:

- EuroStoxx 50 down 16.94 points (-0.43%) at 3961.9

- FTSE 100 down 26.63 points (-0.39%) at 6889.12

- German DAX down 19.16 points (-0.13%) at 15215

- French CAC 40 down 7.73 points (-0.13%) at 6161.68

US TSY FUTURES CLOSE

- 3M10Y +1.004, 165.586 (L: 161.987 / H: 166.906)

- 2Y10Y -0.142, 150.024 (L: 148.78 / H: 151.489)

- 2Y30Y -0.386, 216.864 (L: 215.358 / H: 218.475)

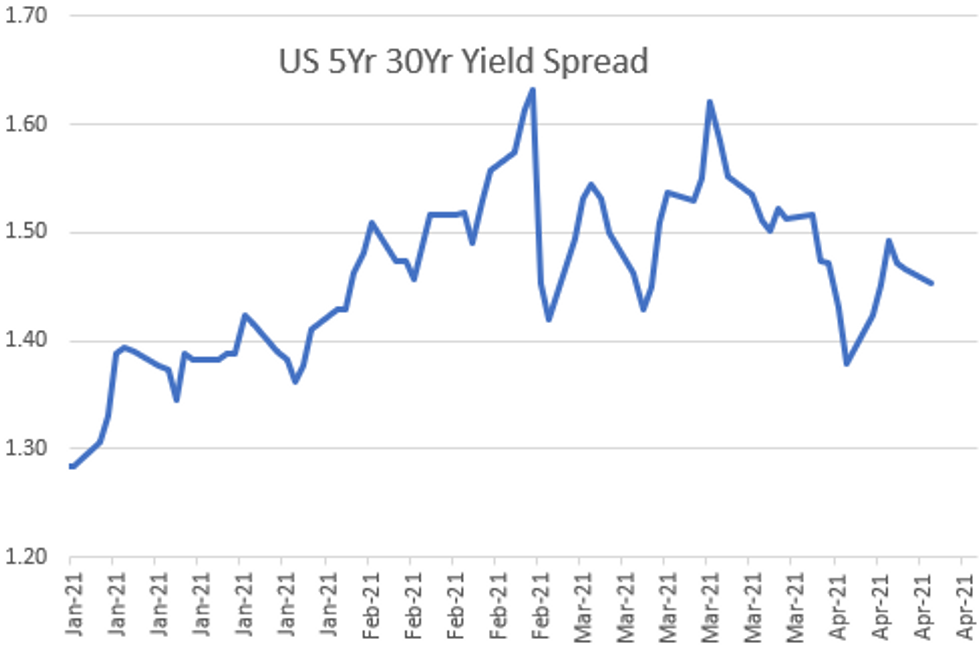

- 5Y30Y -1.256, 145.084 (L: 144.695 / H: 146.266)

- Current futures levels:

- Jun 2Y down 0.875/32 at 110-11 (L: 110-10.875 / H: 110-12.125)

- Jun 5Y down 3.5/32 at 123-20 (L: 123-18.5 / H: 123-25.75)

- Jun 10Y down 3/32 at 131-20.5 (L: 131-17 / H: 131-28.5)

- Jun 30Y down 6/32 at 156-10 (L: 156-05 / H: 156-31)

- Jun Ultra 30Y down 7/32 at 184-19 (L: 184-07 / H: 185-27)

US EURODOLLAR FUTURES CLOSE

- Jun 21 steady at 99.820

- Sep 21 steady at 99.810

- Dec 21 steady at 99.735

- Mar 22 -0.005 at 99.765

- Red Pack (Jun 22-Mar 23) -0.035 to -0.005

- Green Pack (Jun 23-Mar 24) -0.035 to -0.03

- Blue Pack (Jun 24-Mar 25) -0.025 to -0.01

- Gold Pack (Jun 25-Mar 26) -0.01 to -0.005

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00125 at 0.07350% (+0.00000 total last wk)

- 1 Month +0.00100 to 0.11225% (+0.00087 total last wk)

- 3 Month -0.00175 to 0.18575% (-0.01225 total last wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00325 to 0.21463% (+0.01013 total last wk)

- 1 Year -0.00137 to 0.28438% (+0.00525 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $69B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $244B

- Secured Overnight Financing Rate (SOFR): 0.01%, $867B

- Broad General Collateral Rate (BGCR): 0.01%, $366B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $346B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, appr $1.735B accepted vs. $4.710B submission

- Updated purchase schedule release

- Tue 4/13 1500ET: NYFRB: the Desk plans to purchase appr $80B over the monthly period from 3/12/21 to 4/13/21.

PIPELINE: Near $8B To Price Monday

- Date $MM Issuer (Priced *, Launch #)

- 04/12 $2.25B #BNP Paribas 11NC10 +120

- 04/12 $2B #CK Hutchison Hlds $500M 5Y +65, $850M 10Y +95, $650M 20Y +100

- 04/12 $1.25B #Sodexo $500M 5Y +75, $750M 10Y +105

- 04/12 $1B #Genting Malaysia 10Y +220

- 04/12 $750M Transdigm 8NC3 +4.75$a

- 04/12 $700M *Kia Corp 3Y +110a, 5.5Y +125a

- Expected this week:

- 04/13 $Benchmark JFM 5Y +20a

- 04/12 $Benchmark Ontario Teachers Finance Trust 10Y +41a

- 04/15 $5.5B United Airlines $2.75B 5Y, $2.75B 8Y

- 04/?? $Benchmark/Euro Altice France 8NC3

- 04/?? $Benchmark IADB 5Y expected this week

- 04/?? $Benchmark World Bank 2Y, 7Y

- 04/09 No new Issuance Friday; $43.37B total last wk

FOREX: Inside Session as Markets Look Ahead to Busy Week

- Markets generally took profits on the price action seen at the tail-end of last week throughout Monday trade as GBP gained, the greenback softened and recent ranges were generally respected.

- Data releases were few and far between Monday, with more focus paid to the CPI, retail sales prints later in the week as well the beginning of US earnings season. Big name US banks including Goldman Sachs, JP Morgan, Bank of America and others are due to report from Tuesday onwards.

- Early gains in WTI and Brent crude futures faded, leaving the likes of NOK and CAD at the bottom of the G10 pile.

- JPY traded well alongside GBP and CHF, with the upside momentum in equity markets globally petering out as US indices traded in a holding pattern for most of the session.

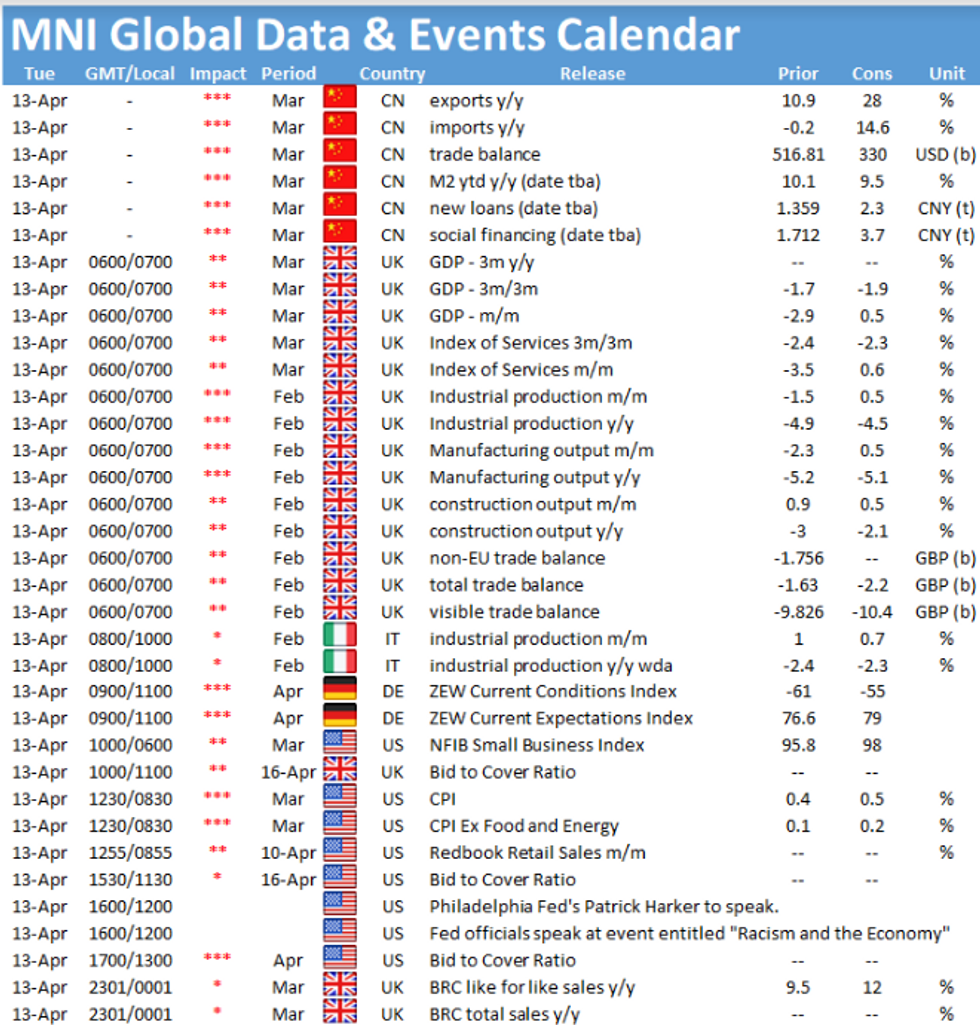

- Focus Tuesday turns to UK industrial production and trade data for February, Germany's ZEW survey and the US CPI report. China trade balance numbers may also be released. Fedspeak picks up, with Harker, Daly, Barkin, Mester, Rosengren and Bostic all due to speak.

EGBs-GILTS CASH CLOSE: Prepping For Big Issuance Tuesday

A fairly quiet session to start the week, with early yield dips (on overnight weakness in equities) reversing over the course of the session.

- More than anything, supply eyed later in the week, with large syndication announcements pushing EGB yields higher. Data showed ECB net asset purchases rebounded sharply last week; in Germany, there was some attention on interrnal party wrangling over who will be the Union parties' candidate for Chancellor in the September elections.

- While today saw "just" E4bn of EFSF syndication, tomorrow sees: syndications from Austria (dual-tranche) and Spain which were announced today, and auctions from the Netherlands, Italy, Germany, and the UK.

- Apart from that, UK Feb GDP and German ZEW figures highlight Tuesday's docket.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.1bps at -0.701%, 5-Yr is up 0.2bps at -0.631%, 10-Yr is up 1bps at -0.293%, and 30-Yr is up 2bps at 0.262%.

- UK: The 2-Yr yield is up 0.8bps at 0.054%, 5-Yr is up 0.8bps at 0.361%, 10-Yr is up 1.5bps at 0.789%, and 30-Yr is up 0.5bps at 1.31%.

- Italian BTP spread down 0.2bps at 102.8bps / Spanish up 0.2bps at 68.2bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.