-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: S&Ps to New Highs; CDC Backs J&J Vaccine

EXECUTIVE SUMMARY

- CDC ADVISERS REAFFIRM BACKING OF J&J VACCINE AUTHORIZATION, Bbg

- INDIA ADDS Record 349,691 CORONAVIRUS CASES IN A DAY, Bbg

- Japan Shuts Tokyo Bars, Bans Sports Fans in New Virus Emergency, Bbg

- HONEYWELL CEO SAYS INFLATION IS `REAL' ON CONFERENCE CALL, Bbg

US TSY SUMMARY:

Mildly weaker Tsy futures trading sideways since noon on light volume Friday, TYM1 just over 1M futures after the bell.

- Largely two-way option related flow keeping the lights on, some moderate pin risk in May 10s, 132.5 strike with 65,527 options coming into the session (41,430 calls, 24,097 puts). Some selling ahead next week's front-ended Tsy auctions (2- and 5Y notes, 13- and 26W bills all on Monday; 2Y FRN and 7Y notes Tuesday) to make way for Wednesday's FOMC.

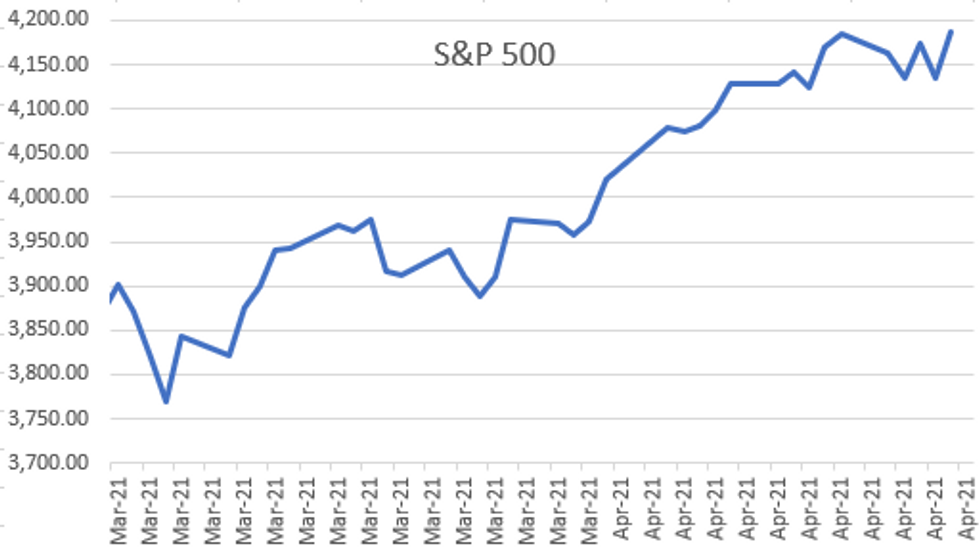

- Stocks marched higher with Jun'21 S&P emini futures making new all-time highs in late trade of 4184.75. Upward trajectory all session after decent beat in US PMIs (Markit Services PMI 63.1 (EXP. 61.5, MAR 60.4); FLASH Composite PMI 62.2; (MAR 59.7)) and New homes sales ( +20.7% TO 1.021M SAAR).

- Otherwise, relative sedate session as markets set sites on next Wednesday's FOMC policy annc.

- The 2-Yr yield is up 1bps at 0.1575%, 5-Yr is up 2.8bps at 0.818%, 10-Yr is up 2.9bps at 1.5666%, and 30-Yr is up 3.1bps at 2.2491%.

OVERNIGHT DATA

- US FLASH APR MFG PMI 60.6; (EXP. 61.0, MAR 59.1)

- US FLASH APR SERVICES PMI 63.1; (EXP. 61.5, MAR 60.4)

- US FLASH APR COMPOSITE PMI 62.2; (MAR 59.7)

- US MAR NEW HOME SALES +20.7% TO 1.021M SAAR

- US FEB NEW HOME SALES REVISED TO 0.846M SAAR

- CANADA FLASH MARCH WHOLESALE SALES +0.9% VS FEB -0.7%

- CANADA FLASH MARCH FACTORY SALES +3.5% VS FEB -1.6%

US

DATA REACT: US PMI: Supply Chain Issues Hit Manufacturing, Boost Inflation The U.S. April flash PMI report showed a slightly disappointing reading for manufacturing vs expectations at 60.6; (survey. 61.0, prior 59.1), but services came in above survey at 63.1 (survey 61.5, prior 60.4).

- The composite accelerated to 62.2 (59.7 prior) - a record high since the start of the series in Oct 2009 - amid what the IHS Markit report cited as "looser COVID-19 restrictions and strong client demand".

- The services sector benefited from reopenings from lockdown, but manufacturing production was "weighed down by difficulties sourcing raw materials and ongoing supplier delivery delays, which were the most extensive on record".

- Private sector firms saw a record upturn in new orders (again, related to easing lockdowns), while new export orders rose at a record pace as export markets reopened.

- Firms reported a 6+ year high in work backlogs, and the sharpest rise in employment since Nov.

- On inflation, input costs rose again due to "unprecedented" supply chain disruptions, but eased vs March as service providers saw "softer increases". Though it was the 2nd fastest rise in input prices on record, and output price inflation for both goods and services hit a series high.

- Optimism remained elevated, though below March levels.

MARKETS SNAPSHOT

Key late session market levels- DJIA up 293.85 points (0.87%) at 34083.87

- S&P E-Mini Future up 54 points (1.31%) at 4179

- Nasdaq up 233.1 points (1.7%) at 14042.32

- US 10-Yr yield is up 2.9 bps at 1.5666%

- US Jun 10Y are down 4.5/32 at 132-13

- EURUSD up 0.0081 (0.67%) at 1.2094

- USDJPY down 0.04 (-0.04%) at 107.93

- Gold is down $8.06 (-0.45%) at $1776.20

- EuroStoxx 50 down 1.46 points (-0.04%) at 4013.34

- FTSE 100 up 0.32 points (0%) at 6938.56

- German DAX down 40.9 points (-0.27%) at 15279.62

- French CAC 40 down 9.34 points (-0.15%) at 6257.94

US TSY FUTURES CLOSE

- 3M10Y +2.145, 153.922 (L: 150.93 / H: 156.04)

- 2Y10Y +1.323, 140.001 (L: 138.024 / H: 142.145)

- 2Y30Y +1.604, 208.274 (L: 206.642 / H: 210.379)

- 5Y30Y +0.312, 142.744 (L: 142.246 / H: 144.437)

- Current futures levels:

- Jun 2Y down 0.5/32 at 110-12.25 (L: 110-12.125 / H: 110-13)

- Jun 5Y down 2.25/32 at 124-1 (L: 123-31.25 / H: 124-06)

- Jun 10Y down 2.5/32 at 132-15 (L: 132-10 / H: 132-23.5)

- Jun 30Y down 1/32 at 158-13 (L: 157-31 / H: 158-30)

- Jun Ultra 30Y down 3/32 at 187-31 (L: 187-08 / H: 188-30)

US EURODOLLAR FUTURES CLOSE

- Jun 21 -0.005 at 99.815

- Sep 21 steady at 99.805

- Dec 21 steady at 99.745

- Mar 22 steady at 99.775

- Red Pack (Jun 22-Mar 23) -0.02 to -0.005

- Green Pack (Jun 23-Mar 24) -0.03 to -0.025

- Blue Pack (Jun 24-Mar 25) -0.025 to -0.02

- Gold Pack (Jun 25-Mar 26) -0.025 to -0.015

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00000 at 0.07338% (+0.00063/wk)

- 1 Month +0.00487 to 0.11100% (-0.00488/wk)

- 3 Month +0.0563 to 0.18138% (-0.00687/wk) ** (New Record Low 0.17288% on 4/22/21)

- 6 Month -0.00650 to 0.20413% (-0.01950/wk)

- 1 Year +0.00013 to 0.28088% (-0.01150/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $70B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $263B

- Secured Overnight Financing Rate (SOFR): 0.01%, $870B

- Broad General Collateral Rate (BGCR): 0.01%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $356B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.401B accepted vs. $5.518B submission

- Next scheduled purchases:

- Mon 4/26 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 4/27-Wed 4/28 Pause for FOMC

- Thu 4/29 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/30 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: $47.63B High-Grade Debt Issued Through Thursday

$7.75B Priced Thursday, $47.63B total for week. No new issuance on tap for Friday as yet- Date $MM Issuer (Priced *, Launch #)

- 04/22 $3B *Petronas $1.25B +10Y +92.5, $1.75B 40Y +115

- 04/22 $2B *Royal Bank of Canada 5Y +45, 5Y FRN SOFR+57

- 04/22 $1B *Santos 10Y +210

- 04/22 $750M *BOC Aviation 3Y +140

- 04/22 $500M *Penn Mutual Life 40Y +155

- 04/22 $500M *EIB 5Y TAP SOFR+17

FOREX SUMMARY

USD took its cue from US yields price action this afternoon.

- The Greenback has been better offered for most of the session as US yields moved lower, after Equity pared some gains.

- But US data spoiled the momentum after a decent beat in US PMIs and New homes sales.

- U.S. Business output expanded the most on record

- Equity spiked on the releases, in turn pushing US yields higher, which helped fade some of the USD weakness.

- Nonetheless, the US Dollar is still trading mostly in the red, against all G10s and EMs, beside the TRY.

- Looking ahead, BoC Macklem speaks to Parliamentary Committee.

- After market, Rating review::

- Fitch on Finland (current rating: AA+, Outlook Stable) & the Netherlands (current rating: AAA; Outlook Stable)

- S&P on {EU} the European Financial Stability Facility (current rating: AA; Outlook Stable), Greece (current rating: Greece BB-; Outlook Stable), Italy (current rating: BBB; Outlook Stable) & the United Kingdom (current rating: AA; Outlook Stable)

- DBRS Morningstar on {FI} Finland (current rating: AA (high), Stable Trend)

EGBs-GILTS CASH CLOSE: Opposing Forces Leave Yields Flat

A back-and-forth final session of the week in the Europe FI space, with price action in both directions leaving yields basically flat, with periphery EGB spreads wider.

- A strong start for Gilts / early Bund strength - in part due to a bigger than expected reduction in the gilt remit for FY21/22 - reversed on strong French flash PMIs. But then another rebound on a German PMI miss, and continued gains as equities fell to session lows.

- Data came to the fore again in the afternoon with EGBs / Gilts moving lower mirroring US Tsys, after a beat in US PMIs and new home sales data.

- Not to mention a sharp drop at midday on a BBG sources piece reporting a "difficult" decision at the June meeting on whether to slow PEPP purchases (echoing Tuesday's MNI Exclusive).

- After hours sees a few ratings reviews, including the UK, Italy and Greece.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.1bps at -0.691%, 5-Yr is down 0.6bps at -0.605%, 10-Yr is down 0.5bps at -0.257%, and 30-Yr is up 0.4bps at 0.29%.

- UK: The 2-Yr yield is down 0.7bps at 0.036%, 5-Yr is down 0.8bps at 0.308%, 10-Yr is up 0.4bps at 0.744%, and 30-Yr is up 0.2bps at 1.277%.

- Italian BTP spread up 3.1bps at 103.8bps / Spanish spread up 1bps at 65.5bp

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.