-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Hawks Have Their Say

EXECUTIVE SUMMARY

MNI INTERVIEW: Fed Could Lift Rates To 4% Or More, Dudley Says

Dallas Fed Dallas' Kaplan: Time To Start Talking About Taper

US DATA: MNI Chicago Business Barometer Surges to Near 38-Year High: 72.1 vs. 66.3 in March

US

FED: Dallas Fed Pres Kaplan (hawk, non-2021/22 voter) at a virtual event this morning expressed his view that the Fed should start talking about tapering bond buying soon, per wires in attendance at the event. He also said he hasn't changed his view (since the March FOMC) that the Fed should start raising rates in 2022.

- This language is possibly a step more hawkish than he expressed earlier this month, for instance with the WSJ when he said "I agree with what we're doing now in terms of asset purchases and stance of policy generally... I also, though... believe that as we're making progress toward meeting our goals, I think it would be much healthier -- the economy would be much healthier if we wean off these extraordinary measures."

- And it's a clear divergence from Chair Powell's blunt comment at the FOMC press conference this week: "No. It is not time yet" to talk about tapering.

- Not a huge surprise from Kaplan though considering his relative hawkishness amid FOMC members, and his view of strong progress in the economy this year (his 6.5% GDP growth forecast in 2021 has risks to the upside, he said today).

- And if he sees rate liftoff in 2022, you'd expect to be tapering well in advance of that, and Fed communications about it would have to start even earlier, with "talking" starting even before that. So it stands to reason.

- "The chances of a soft landing in this regime is virtually nil," Dudley said. "They're going to be late and that's by design. So when they start tightening they're going to have to go relatively quickly."

- When the Fed does eventually begin to raise interest rates it will have to keep doing so for some time Dudley said, much like during the "considerable period" phase under Alan Greenspan from 2004-2006.

- Dudley is surprised markets are only pricing in a rise in the federal funds rate to 2% because "that's lower than what the Fed says is neutral." For more, see MNI Policy main wire at 1136ET.

OVERNIGHT DATA

- MNI CHICAGO BUSINESS BAROMETER 72.1 APR VS 66.3 MAR

- MNI CHICAGO BUSINESS BAROMETER AT HIGHEST SINCE DEC 1983

- MNI CHICAGO: ORDER BACKLOGS SHOWED LARGEST M/M INCREASE IN APR

- MNI CHICAGO: ORDER BACKLOGS AT HIGHEST SINCE DEC 1973

- MNI CHICAGO: PRICES PAID AT HIGHEST SINCE FEB 1980

- US Q1 EMPL COST INDEX 0.9% V Q4 0.9%

- US Q1 EMPL COST INDEX Y/Y 2.6% V Q4 2.5%

- US Q1 BENEFIT PAYMNTS 0.6% V Q4 0.6%;Q1 Y/Y 2.5%(Q4 2.3%)

- US DATA: Personal Income/Spending And PCE Price Data In Line; ECI Higher The raft of 0830ET data came out mostly in line with expectations:

- March personal spending +4.2% M/M (+4.1% expected)

- March personal income +21.1% M/M (+20.3% expected)

- Core PCE prices +1.8% Y/Y (as expected)

- Core PCE prices +0.4% M/M (+0.3% expected)

- Q1 employment cost index +0.9% (+0.7% expected)

- U.S. April Final Michigan Sentiment Rose to 88.3; Est. 87.5

- CANADA FEB GROSS DOMESTIC PRODUCT +0.4% MOM

- CANADA FEB GOODS INDUSTRY GDP -0.2%, SERVICES +0.6%

- CANADA REVISED JAN GROSS DOMESTIC PRODUCT +0.7% MOM

- CANADA FLASH Q1 GDP +1.6% QOQ

- CANADIAN FLASH MARCH GDP +0.9%

- CANADA MAR INDUSTRIAL PRICES +1.6% MOM; EX-ENERGY +1.3%

- CANADA MAR RAW MATERIALS PRICES +2.3% MOM; EX-ENERGY +0.5%

MARKETS SNAPSHOT

Key late session market levels

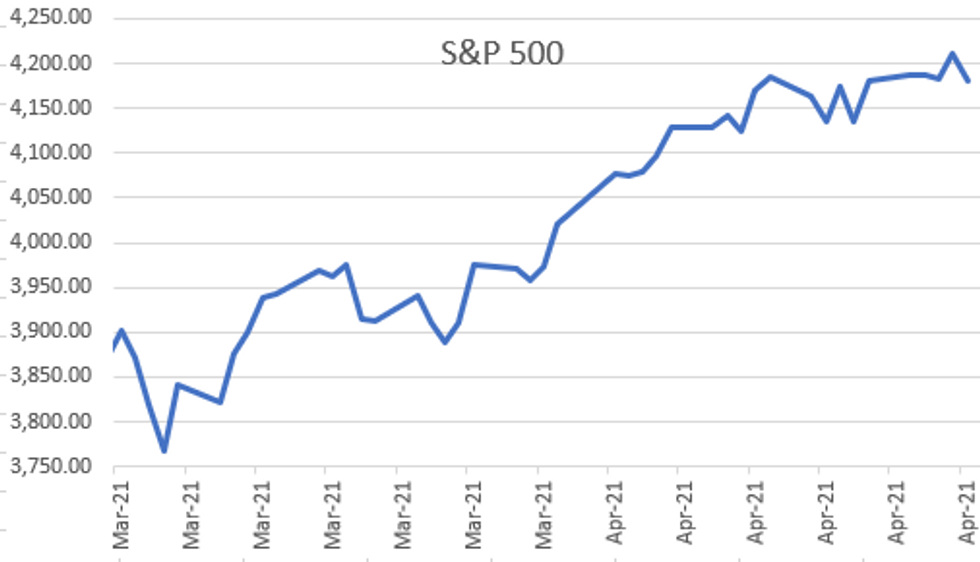

- DJIA down 212.81 points (-0.62%) at 33839.82

- S&P E-Mini Future down 30.75 points (-0.73%) at 4172.25

- Nasdaq down 121.6 points (-0.9%) at 13959.76

- US 10-Yr yield is down 0.5 bps at 1.6294%

- US Jun 10Y are up 1.5/32 at 132-1

- EURUSD down 0.01 (-0.83%) at 1.2021

- USDJPY up 0.38 (0.35%) at 109.31

- WTI Crude Oil (front-month) down $1.41 (-2.17%) at $63.59

- Gold is down $3.63 (-0.2%) at $1768.87

European bourses closing levels:

- EuroStoxx 50 down 22.16 points (-0.55%) at 3974.74

- FTSE 100 up 8.33 points (0.12%) at 6969.81

- German DAX down 18.29 points (-0.12%) at 15135.91

- French CAC 40 down 33.09 points (-0.53%) at 6269.48

US TSY SUMMARY: Ignoring Hawkish Fed Comments, For Now

Mildly choppy session for rates, Tsys posting modest gains after the close, near top end Friday's range. Equities a little weaker but bouncing after the bell, S&P eminis -26.0 at 4177.5 -- vs. Thursday's all-time high of 4208.0.- Apparently taking Dallas Fed Kaplan (hawk, non-voter) comments that the Fed should start talking about tapering bond buying soon in stride. MNI interview w/former NY Fed pres Dudley warned the Fed may need to raise interest rates to at least 3.5% and perhaps even above 4% because its new framework will generate lags in responding to inflation that require more aggressive tightening later.

- Mixed data: MNI Chicago Business Barometer Surges to Near 38-Year High: 72.1 vs. 66.3 in March. Meanwhile, Personal Income/Spending And PCE Price Data In Line. Focus turns to next week Friday's employment data for April, current mean estimate: 975k job gains, +895k for private sector.

- Otherwise, generally quiet two-way month-end trade, broad decline in Govt/Credit and Intermediate credit extensions from year ago levels, while MBS surged (0.05 to 0.25).

- Salient Eurodollar options trade: late blocks pushed session volume buyer of Red June 99.37/99.62 put spds to near 90,000 from 2.5-3.0.

- The 2-Yr yield is down 0.2bps at 0.1604%, 5-Yr is down 1bps at 0.8541%, 10-Yr is down 0.5bps at 1.6294%, and 30-Yr is unchanged at 2.2982%.

MONTH-END EXTENSION ESTS: UPDATED Barclays/Bbg Extension Estimates for US

Updated Forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.16Y; Govt inflation-linked, 0.17. Note broad decline in Govt/Credit and Intermediate credit from year ago levels, while MBS extension est surges.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.08 | 0.13 |

| Agencies | 0.05 | 0.04 | 0.03 |

| Credit | 0.06 | 0.1 | 0.2 |

| Govt/Credit | 0.08 | 0.09 | 0.17 |

| MBS | 0.25 | 0.06 | 0.05 |

| Aggregate | 0.12 | 0.08 | 0.08 |

| Long Gov/Cr | 0.06 | 0.09 | 0.06 |

| Iterm Credit | 0.08 | 0.08 | 0.2 |

| Interm Gov | 0.09 | 0.08 | 0.1 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.15 |

| High Yield | 0.1 | 0.11 | 0.08 |

US TSY FUTURES CLOSE:

- 3M10Y +0.014, 161.928 (L: 161.04 / H: 164.064)

- 2Y10Y +0.061, 146.886 (L: 145.82 / H: 148.96)

- 2Y30Y +0.77, 213.976 (L: 212.898 / H: 215.284)

- 5Y30Y +1.578, 144.797 (L: 142.956 / H: 145.498)

- Current futures levels:

- Jun 2Y up 0.125/32 at 110-12.25 (L: 110-11.75 / H: 110-12.25)

- Jun 5Y up 1.75/32 at 123-30.5 (L: 123-26.5 / H: 123-31)

- Jun 10Y up 2.5/32 at 132-2 (L: 131-26 / H: 132-03.5)

- Jun 30Y steady at at 157-6 (L: 156-27 / H: 157-15)

- Jun Ultra 30Y up 8/32 at 185-27 (L: 185-06 / H: 186-06)

US EURODOLLAR FUTURES CLOSE

- Jun 21 steady at 99.815

- Sep 21 +0.005 at 99.805

- Dec 21 steady at 99.740

- Mar 22 +0.005 at 99.780

- Red Pack (Jun 22-Mar 23) steady to +0.010

- Green Pack (Jun 23-Mar 24) +0.005 to +0.010

- Blue Pack (Jun 24-Mar 25) +0.005 to +0.010

- Gold Pack (Jun 25-Mar 26) +0.005 to +0.010

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00150 at 0.07125% (-0.00212/wk)

- 1 Month -0.00288 to 0.10725% (-0.00375/wk)

- 3 Month +0.00075 to 0.17638% (-0.00500/wk) ** (Record Low 0.17288% on 4/22/21)

- 6 Month -0.00150 to 0.20488% (+0.00075/wk)

- 1 Year -0.00025 to 0.28113% (+0.00025/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $72B

- Daily Overnight Bank Funding Rate: 0.05%, volume: $269B

- Secured Overnight Financing Rate (SOFR): 0.01%, $838B

- Broad General Collateral Rate (BGCR): 0.01%, $373B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $349B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.801B accepted vs. $47.196B submission

- Next scheduled purchases:

- Mon 5/03 1100-1120ET: Tsys 2.25Y-4.5Y, appr $8.825B

- Tue 5/04 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 5/05 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 5/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

PIPELINE: MoM High-Grade Issuance Review

April 2021 comes in third place so far this year with $183.4B -- and well off last year's all-time record of $401.325B. March still leads 2021 with stellar $232.62B high-grade corporate issuance vs. $275.48B for Mar 2020. Q1'21 ahead last years pace $618.03B vs. $548.16B.

| Apr'21 | $183.4B |

| Mar'21 | $232.62B |

| Feb'21 | $157.86B |

| Jan'21 | $227.55B |

| 2020 Recap: | Record $2.196T |

| Dec'20 | $52.24B; $796.54B H2 2020 |

| Nov'20 | $126.83B |

| Oct'20 | $111.65B |

| Sep'20 | $207.82B |

| Aug'20 | $204.50B |

| Jul'20 | $93.50B |

| Jun'20 | $180.50B; Record $1.40T H2 2020 |

| May'20 | $270.90B |

| Apr'20 | $401.32B |

FOREX: USD Bounces Well, Runs Against Month-End Assumption

- Running against most sell-side month-end models, the USD firmed smartly into the Friday close, running against the trend observed across the week.

- This put EUR/USD through first key support, with the pair looking to close back below the 100-dma of 1.2056. The downside pressure Friday makes the formation of a death cross (50-dma < 200-dma) more likely in the coming week, which would be the first since June 2018.

- CAD moved from strength-to-strength, with a market-wide commodity rally helping support oil- and commodity-tied currencies. This puts USD/CAD again at multi-year lows, narrowing the gap with key support at the 2018 low of 1.2251.

- Focus in the coming week turns to the US jobs report. Having added close to a million jobs last month, the US are expected to keep up the pace in April, with 965k jobs added over the month. The unemployment rate is seen edging lower by 0.3 ppts, dropping to a new post-pandemic low of 5.7%.

- Outside of data, central bank decisions are due from Australia, the UK, Brazil and Turkey.

EGBs-GILTS CASH CLOSE: Month Ends With Modest Strength

EGBs and Gilts largely drifted in the afternoon (shrugging off weakness in US Tsys on strong MNI Chicago PMI and hawkish comments by Fed's Kaplan), with Bunds seeing support from large Month End extensions. Periphery spreads ended flat/marginally wider.

- Early focus was on eurozone data: flash 1Q GDP were mixed (France stronger, Italy a bit above consensus, Spain in line, Germany weak in Q/Q terms) - and EZ as a whole contracted for the 2nd consecutive quarter.

- Otherwise, flash Apr inflation data and Spain retail sales had little market impact.

- A few ratings decisions after hours Friday, none expected to have major impact (Germany, Italy among others). Monday sees a UK holiday and thus likely subdued trading volumes; attention will turn quickly to Thursday's BoE decision.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.4bps at -0.682%, 5-Yr is down 1.5bps at -0.577%, 10-Yr is down 0.9bps at -0.202%, and 30-Yr is down 0.3bps at 0.357%.

- UK: The 2-Yr yield is up 0.2bps at 0.08%, 5-Yr is up 0.3bps at 0.39%, 10-Yr is down 0.1bps at 0.842%, and 30-Yr is down 0.5bps at 1.342%.

- Italian BTP spread unchanged at 110.6bps/ Spanish spread up 1bps at 67.8bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.