-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Ample Room For Medium-Term Inflation

EXECUTIVE SUMMARY

- MNI: Fed Has Room to Run on Price Expectations, Advisers Say

- MNI: BOC T-Bill and Repo Holdings Return to Pre-Covid Levels

- DALLAS FED KAPLAN: WORRIED ABOUT EXCESS IMBALANCES, ESPECIALLY HOUSING MKT. Bbg

- DALLAS FED KAPLAN: PREFER TO TALK ABOUT WEANING OFF MORTGAGE BUYS SOONER, Bbg

US TSY SUMMARY: Stocks and Rates Near Session Highs Late

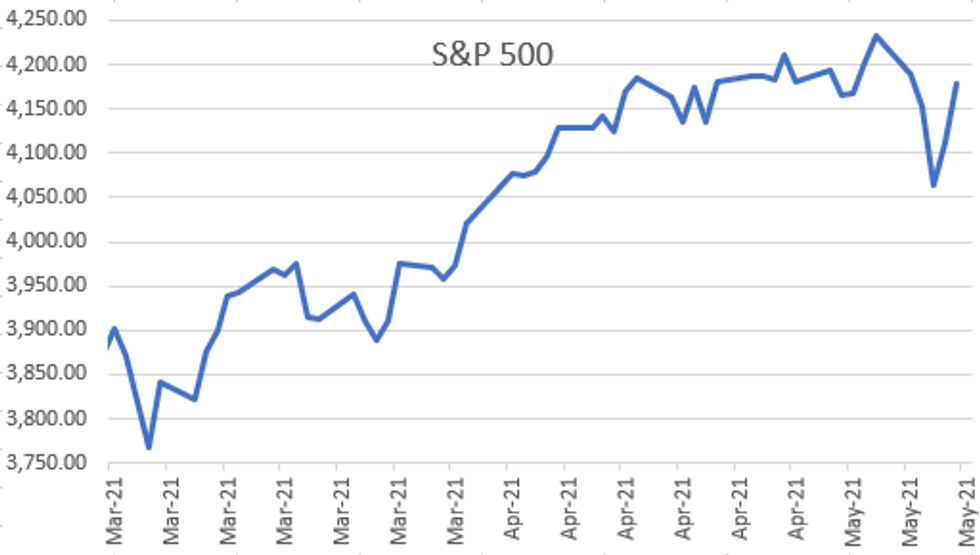

Early post-data chop resolved quickly, rates finishing near session highs while equities remained strong in late trade (ESM1 +65.0 at 4172.0). Bounce in equities said to weigh on US$.- Tsys traded lower on mixed data: retail sales weaker than expected, import prices little higher) but quickly rebounded back to opening levels/top end of range soon after.

- Moderate volumes in Tsy futures by the close (TYM1 1.45M), flow largely two-way positioning from fast$, prop and option acct hedging, no deal tied flow but some light steepener resets after curves bull flattened earlier. Yld curves finished session near lows w/5s30s appr 3.4bp flatter at 153.32.

- After slow start for data next week, focus on Apr FOMC minutes on Wednesday.

- The 2-Yr yield is down 0.4bps at 0.149%, 5-Yr is down 0.8bps at 0.8193%, 10-Yr is down 1.9bps at 1.6386%, and 30-Yr is down 4.2bps at 2.3538%.

US

FED: The Federal Reserve still has an anti-inflationary mindset and could act quickly if necessary after likely looking through price surges this year, current and former Fed advisors told MNI, though they all still saw ample room for medium-term inflation expectations to rise after a decade of downside misses.

- Deeper structural pressures from globalization, new technology, sluggish wage growth and weakened unions mean officials should remain patient, said Laurence Ball, a former visiting scholar at the Fed and a consultant for the IMF, speaking after FOMC members lined up this week to mostly write off a spike in inflation as temporary, despite signs of unease among some current and former staffers.

CANADA

BOC: The Bank of Canada's holdings of treasury bills and repos have unwound to about where they were before markets froze up last year as the pandemic spread worldwide, leaving QE worth CAD3 billion a week as the main driver of the central bank's balance sheet.

- Repo assets declined to CAD34 billion this week, down from CAD153 billion at the beginning of March. Those holdings had swelled to CAD211 billion in June of last year amid a global market dash for cash.

OVERNIGHT DATA

- US APR RETAIL SALES +0.0%; EX-MOTOR VEH -0.8%

- US MAR RETAIL SALES REVISED +10.7%; EX-MV +9.0%

- US APR RET SALES EX GAS & MTR VEH & PARTS DEALERS -0.8% V MAR +8.9%

- US APR RET SALES EX MTR VEH & PARTS DEALERS -0.8% V US APR +9.0%

- US APR RET SALES EX AUTO, BLDG MATL & GAS -1.2% V MAR -29.5%

- US APR IMPORT PRICES +0.7%

- US APR EXPORT PRICES +0.8%; NON-AG +0.9%; AGRICULTURE +0.6%

- US APR INDUSTRIAL PROD +0.7%; CAP UTIL 74.9%

- US MAR IP REV TO +2.4%; CAP UTIL REV 74.4%

- US APR MFG OUTPUT +0.4%

- MICHIGAN PRELIM. MAY CONSUMER SENTIMENT FALLS TO 82.8; EST. 90

- US MAR BUSINESS INVENTORIES +0.3%; SALES +5.7%

- US MAR RETAIL INVENTORIES -1.4%

- CANADA MAR WHOLESALE SALES +2.8%; EX-AUTOS +3.4%

- MAR WHOLESALE INVENTORIES +0.7%: STATISTICS CANADA

- CANADA MAR MANUFACTURING SALES +3.5% MOM

- CANADA MAR FACTORY INVENTORIES -0.4%; INVENTORY-SALES RATIO 1.53

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 409.39 points (1.2%) at 34423.32

- S&P E-Mini Future up 68 points (1.66%) at 4173.75

- Nasdaq up 316.8 points (2.4%) at 13438.09

- US 10-Yr yield is down 1.9 bps at 1.6386%

- US Jun 10Y are up 6/32 at 132-12

- EURUSD up 0.0061 (0.5%) at 1.2142

- USDJPY down 0.1 (-0.09%) at 109.35

- WTI Crude Oil (front-month) up $1.53 (2.4%) at $65.35

- Gold is up $15.44 (0.85%) at $1842.22

- EuroStoxx 50 up 64.99 points (1.64%) at 4017.44

- FTSE 100 up 80.28 points (1.15%) at 7043.61

- German DAX up 216.96 points (1.43%) at 15416.64

- French CAC 40 up 96.81 points (1.54%) at 6385.14

US TSY FUTURES CLOSE:

- 3M10Y -1.875, 162.593 (L: 161.062 / H: 164.39)

- 2Y10Y -1.286, 148.757 (L: 147.025 / H: 150.526)

- 2Y30Y -3.573, 220.281 (L: 219.427 / H: 224.368)

- 5Y30Y -3.366, 153.291 (L: 153.218 / H: 157.053)

- Current futures levels:

- Jun 2Y up 0.5/32 at 110-13 (L: 110-12.5 / H: 110-13.125)

- Jun 5Y up 2.25/32 at 124-5.75 (L: 124-03.75 / H: 124-08.75)

- Jun 10Y up 7/32 at 132-13 (L: 132-06 / H: 132-17)

- Jun 30Y up 20/32 at 156-26 (L: 156-03 / H: 156-30)

- Jun Ultra 30Y up 1-5/32 at 184-0 (L: 182-16 / H: 184-04)

US EURODOLLAR FUTURES CLOSE

Jun 21 steady at 99.84

Sep 21 +0.005 at 99.835

Dec 21 +0.005 at 99.790

Mar 22 +0.005 at 99.805

Red Pack (Jun 22-Mar 23) steady

Green Pack (Jun 23-Mar 24) -0.005 to steady

Blue Pack (Jun 24-Mar 25) steady to +0.015

Gold Pack (Jun 25-Mar 26) +0.020 to +0.035

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00025 at 0.06200% (-0.00212/wk)

- 1 Month -0.00338 to 0.09750% (-0.00388/wk)

- 3 Month -0.00075 to 0.15513% (-0.00475/wk) ** (vs. Record Low 0.15413% on 5/12)

- 6 Month -0.00500 to 0.18763% (-0.00512/wk)

- 1 Year +0.00125 to 0.26588% (-0.00512/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $63B

- Daily Overnight Bank Funding Rate: 0.05% volume: $253B

- Secured Overnight Financing Rate (SOFR): 0.01%, $860B

- Broad General Collateral Rate (BGCR): 0.01%, $372B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $349B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.401B accepted vs. $42.745B submission

- Next week's purchases:

- Mon 5/17 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 5/18 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 5/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 5/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/21 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

PIPELINE: Nearly $60B Priced on Week

05/14 No new issuance Friday after $55.95B priced first 4 days of week, Monday's $18.5B Amazon 8pt jumbo the lion's share. $5.55B Priced Thursday:- Date $MM Issuer (Priced *, Launch #)

- 05/13 $1.85B *JP Morgan PerpNC5 $25par pfd, 4.625%

- 05/13 $1.5B *Arthur J Gallagher $650M 10Y +90, $850M 30Y +115

- 05/13 $1.45B *Goodyear $850M 8Y 5%, $600M 10Y 5.25%

- 05/13 $750M *Vornado Realty 00M $5Y +135, $350M 10Y +180

EGBs-GILTS CASH CLOSE: Gilts Outperform In Broad Relief Rally

Gilts strongly outperformed Bunds Friday amid a broader reprieve for core global FI, following Wednesday's US inflation data. Periphery spreads widened, led by Italy.

- With no bond supply, or key data or speakers, the broader risk tone (less fearful of an inflation surge) set the stage for a retracement lower in yields vs the past couple of sessions.

- Equities rose sharply and the euro and pound strengthened.

- MNI published an Exclusive talking to ECB sources on an upcoming Strategy Review meeting.

- After hours Friday sees ratings reviews: Fitch on Portugal, S&P on Netherlands.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.2bps at -0.656%, 5-Yr is down 0.8bps at -0.52%, 10-Yr is down 0.9bps at -0.129%, and 30-Yr is down 0.3bps at 0.434%.

- UK: The 2-Yr yield is down 2.3bps at 0.08%, 5-Yr is down 2.9bps at 0.38%, 10-Yr is down 4.1bps at 0.857%, and 30-Yr is down 4.1bps at 1.397%.

- Italian BTP spread up 2.3bps at 120bps /Spanish spread up 0.8bps at 71.4bps

FOREX: Strong Recovery In Risk Weighs On US Dollar

- A strong bounce in US equity indices and oil prices prompted the dollar to lose ground on Friday. Broad dollar indices retreated around 0.4% to levels closely matching the prior week's close.

- The clear outperformer was NZD, squeezing just shy of 1% back to 0.7250. The improved global sentiment also boosted the Aussie (+0.65%) to 0.7777.

- Unchanged on the session and lagging the move against the greenback was the Japanese Yen as cross/JPY was a beneficiary, consistently supported throughout the day.

- EUR, GBP and CAD all roughly 0.4% higher in a very gradual, orderly manner, with little notable price action to report throughout the session.

- GBPUSD outlook remains bullish despite the post-CPI weight in the pair. Cable looks almost certain to post the highest weekly close since mid-February. The rate has cleared a number of resistance levels, reinforcing a positive theme with sights set on the key resistance at 1.4237, Feb 24 high.

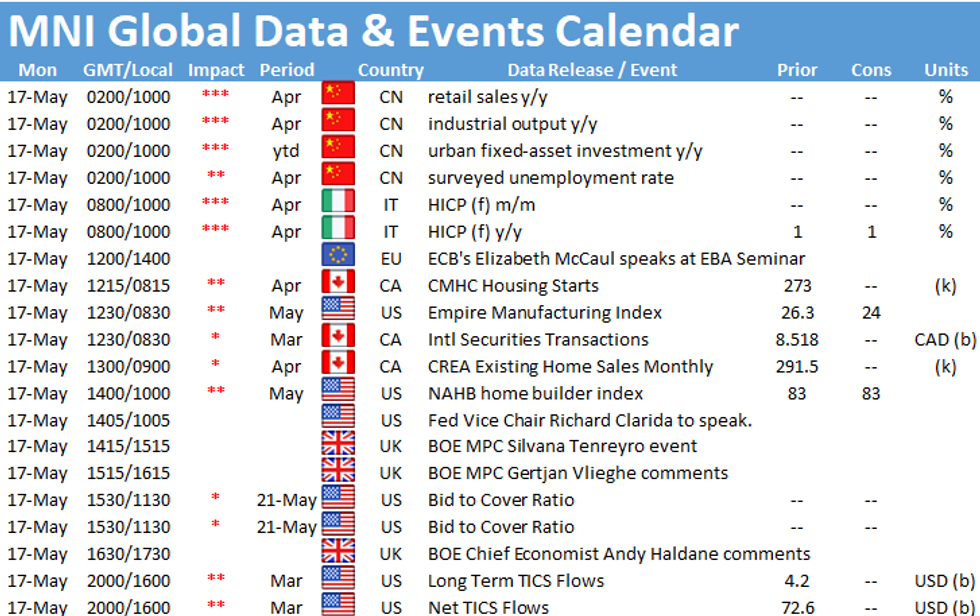

- Data highlights next week include, Australian Employment, Eurozone Flash PMIs as well as Inflation data from the UK and Canada. The week kicks off with multiple Fed Speakers on Monday, as they participate in an online conference hosted by the Federal Reserve Bank of Atlanta.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.