-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: NFP Miss, G-7 Tax Talk

EXECUTIVE SUMMARY

- MNI: Fed, PBOC, ECB - Climate Risks To Influence Future Policy

- TSY YELLEN: Praised an agreement to pursue a global minimum tax of at least 15% on corps, Bbg

- TSY YELLEN: G-7 AGREED TO REALLOCATE TAX RIGHTS ON BIG TECH, Bbg

- TSY YELLEN: GLOBAL MINIMUM TAX TALKS STILL `FAR FROM OVER', Bbg

- TSY YELLEN: GLOBAL MINIMUM TAX ALLEVIATES RACE-TO-BOTTOM, Bbg

US

DATA: U.S. employers added 559,000 jobs in May, the Bureau of Labor Statistics reported Friday, nearly 100,000 jobs short of the 655,000 gain financial markets had been expecting. The unemployment rate fell 0.3 percentage points to 5.8%, better than expected, as the participation rate fell a tenth of a percent to 61.6%.

- Notable gains came from leisure and hospitality (+292,000), health care and social assistance (+45,800), state and local government education (+103,000), and private education (+41,000). Government payrolls were up 67,000.

- Gains in other industries were subdued, and job growth declined in construction (-20,000), transportation and warehousing (-5,800), and financial activities (-1,000), as pointed to by the latest MNI Reality Check.

- Central bankers would be "failing in our mandate" by not accounting for climate change, ECB chief Christine Lagarde said at a BIS panel discussion. Rising temperatures can make the economy and inflation more volatile, alter the value of assets that central banks hold and raise issues in banking supervision so "we are squarely in our mandate" to tackle such risks, she said.

- Yi Gang of the People's Bank of China said the issue requires "urgency" in shifting production and consumer spending. Inflation pressures may shift in the move from treating pollution as free to something that must be paid for and there are financial risks around the transition from coal to green energy, he said. Fed Chair Jerome Powell said most climate work is for governments and isn't directly considered in current monetary policy. Climate risks fall under the Fed's banking supervision and "there's no question that climate change has the potential to affect the structure of the economy over time."

NFP Miss: Stim Prospects Underpins Rates & Equities, USD Wanes

Large May employment gain of +559k jobs for May was still well below expectation of +680k (+800k whisper) spurred choppy two-way trade immediately after the release. Took a few minutes before a rally in rates gained momentum followed by equities soon after amid prospects of further stimulus.- Eminis climbed to within $10.0 of May 9 all-time high of 4236.25 to session high of 4229.25. After making strong gains in the prior session, USD slid on the headline jobs miss, the unexpected tick lower in the labor force participation adding some weight, which slipped to 61.6% vs. Exp 61.8%.

- With decent action and one-way bearish option put buying early -- trade evaporated by noon. Rates drifting near session highs through the second half. TYU breached near-term resistance of 132-05.5 earlier to 132-07 high but have receded back to -05.5 to -06.

- Fed enters blackout at midnight tonight through June 17.

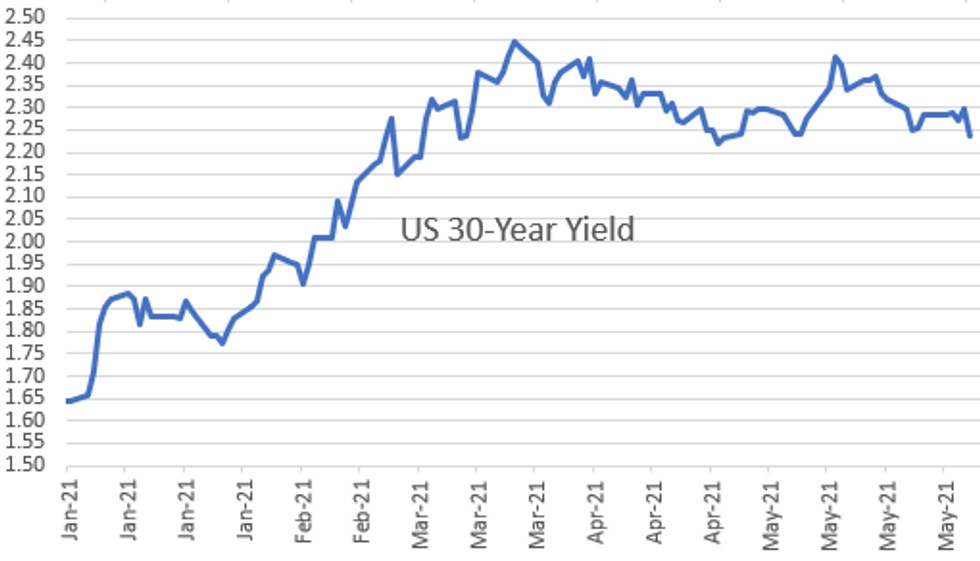

- The 2-Yr yield is down 0.6bps at 0.1487%, 5-Yr is down 5.6bps at 0.7836%, 10-Yr is down 6.5bps at 1.5602%, and 30-Yr is down 5.8bps at 2.2384%.

OVERNIGHT DATA

- US MAY NONFARM PAYROLLS +559K; PRIVATE +492K, GOVT +67K

- US PRIOR MONTHS PAYROLLS REVISED: APR +278K; MAR +785K

- US MAY UNEMPLOYMENT RATE 5.8%

- US MAY AVERAGE HOURLY EARNINGS +0.5% Vs APR +0.7%; +2.0% YOY

- US MAY AVERAGE WEEKLY HOURS 34.9 HRS

- The USD trades softer following the miss on headline change in nonfarm payrolls, prompting a decent bounce in EUR/USD of around 45 pips. The unexpected tick lower in the labor force participation may also be adding some weight, which slipped to 61.6% vs. Exp 61.8%.

- Net result for equities has been positive, helping the e-mini S&P add initially around 15 points before much of the move fades.

- The 10y Treasury yield fell to 1.5942% in the knee-jerk reaction, before bouncing and stabilizing at pre-data levels.

- CANADA MAY EMPLOYMENT -68.0K; JOBLESS RATE 8.2%

- CANADA MAY FULL-TIME JOBS -13.8K; PART-TIME -54.2K

- CANADA Q1 LABOR PRODUCTIVITY -1.7% QOQ

FED: Tentative 2022 FOMC Schedule

Mark your calendar, next yr's Federal Open Market Committee schedule just out:

- January 25-26 (Tuesday-Wednesday)

- March 15-16 (Tuesday-Wednesday)

- May 3-4 (Tuesday-Wednesday)

- June 14-15 (Tuesday-Wednesday)

- July 26-27 (Tuesday-Wednesday)

- September 20-21 (Tuesday-Wednesday)

- November 1-2 (Tuesday-Wednesday)

- December 13-14 (Tuesday-Wednesday)

- January 31-February 1, 2023 (Tuesday-Wednesday)

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 164.32 points (0.48%) at 34741.11

- S&P E-Mini Future up 35.5 points (0.85%) at 4226.75

- Nasdaq up 194.4 points (1.4%) at 13809.19

- US 10-Yr yield is down 6.5 bps at 1.5602%

- US Sep 10Y are up 18.5/32 at 132-5.5

- EURUSD up 0.004 (0.33%) at 1.2167

- USDJPY down 0.75 (-0.68%) at 109.54

- WTI Crude Oil (front-month) up $0.69 (1%) at $69.51

- Gold is up $21.38 (1.14%) at $1892.25

- EuroStoxx 50 up 10.14 points (0.25%) at 4089.38

- FTSE 100 up 4.69 points (0.07%) at 7069.04

- German DAX up 60.23 points (0.39%) at 15692.9

- French CAC 40 up 7.74 points (0.12%) at 6515.66

US TSY FUTURES CLOSE:

- 3M10Y -6.473, 153.742 (L: 153.486 / H: 161.323)

- 2Y10Y -5.5, 140.955 (L: 140.643 / H: 147.519)

- 2Y30Y -4.792, 208.838 (L: 208.697 / H: 216.095)

- 5Y30Y +0.003, 145.382 (L: 144.002 / H: 148.704)

- Current futures levels:

- Sep 2Y up 0.75/32 at 110-11.125 (L: 110-10.25 / H: 110-11.625)

- Sep 5Y up 9.75/32 at 123-29.5 (L: 123-19.25 / H: 123-30.25)

- Sep 10Y up 18.5/32 at 132-5.5 (L: 131-18 / H: 132-07)

- Sep 30Y up 1-10/32 at 157-12 (L: 155-26 / H: 157-15)

- Sep Ultra 30Y up 2-0/32 at 186-21 (L: 183-27 / H: 186-24)

US EURODOLLAR FUTURES CLOSE

- Jun 21 +0.0025 at 99.880

- Sep 21 +0.005 at 99.885

- Dec 21 steady at 99.825

- Mar 22 +0.010 at 99.845

- Red Pack (Jun 22-Mar 23) +0.015 to +0.035

- Green Pack (Jun 23-Mar 24) +0.045 to +0.075

- Blue Pack (Jun 24-Mar 25) +0.080 to +0.10

- Gold Pack (Jun 25-Mar 26) +0.10 to +0.105

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N +0.00050 at 0.05513% (-0.00600/wk)

- 1 Month +0.00125 to 0.08125% (-0.00463/wk)

- 3 Month -0.00250 to 0.12825% (-0.00312/wk) ** (New Record Low 0.12825% on 06/04)

- 6 Month +0.00013 to 0.16488% (-0.00613/wk)

- 1 Year +0.00037 to 0.24600% (-0.00213/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $69B

- Daily Overnight Bank Funding Rate: 0.04% volume: $272B

- Secured Overnight Financing Rate (SOFR): 0.01%, $903B

- Broad General Collateral Rate (BGCR): 0.01%, $391B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $360B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.201B accepted vs. $11.664B submission

- Next scheduled purchases:

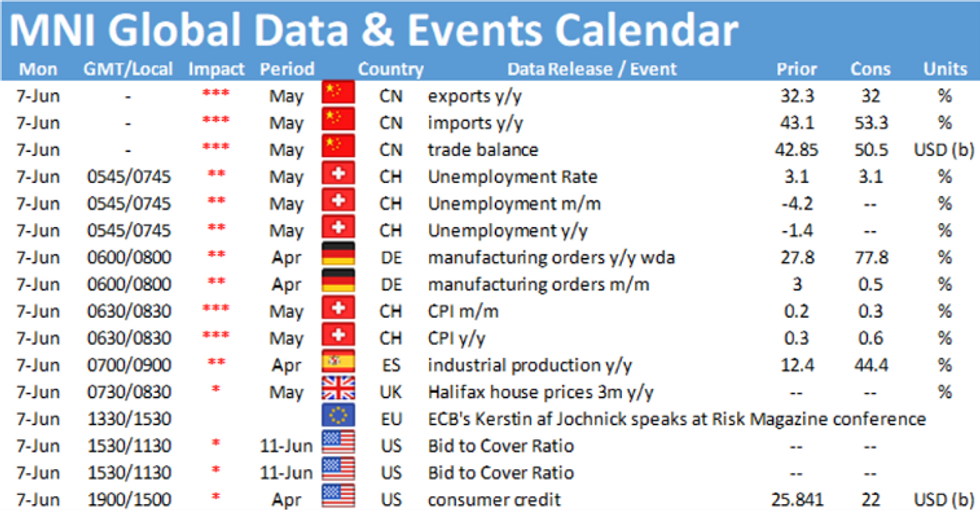

- Mon 6/07 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 6/08 1010-1030ET: TIPS 1-7.5Y, appr $2.425B

- Wed 6/09 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Thu 6/10 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 6/11 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 6/11 1500ET Update NY Fed Operational Purchase Schedule

PIPELINE: Issuers Sidelined Ahead May Employ

$5.3B Priced Thursday, $30.45B total for week- Date $MM Issuer (Priced *, Launch #)

- 06/03 $1.5B *Consolidated Edison $750M each: 10Y +80, 40Y +130

- 06/03 $850M *Ares Capital 7Y +165

- 06/03 $750M *Travelers 30Y +75

- 06/03 $700M *Blue Owl Fnc 10Y +165

- 06/03 $500M *Puget Energy 7Y +108

- 06/03 $500M *IADB 10Y FRN SOFR+36

- 06/03 $500M *Council of Europe Development Bank (CoE) 3Y -4

EGBs-GILTS CASH CLOSE: U.S. Jobs Disappointment Sets Bullish Tone

The event of the day Friday was inevitably going to be U.S. nonfarm payrolls, and it indeed proved the session's biggest catalyst as a weaker-than-expected report led to a bull flattening rally in Bunds and Gilts.

- Periphery spreads closed a little wider, with Greece and Portugal underperforming (the latter on 6-/10-Yr supply announcement).

- There was no key data or bond supply, and the only central bank speakers (ECB's Lagarde and Villeroy) spoke on climate change.

- The key ratings review this evening is Fitch on Italy, but no change in outlook/rating is expected, and Italian spreads were little changed today.

- Attention swiftly turns to next Thursday's ECB decision.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is down 0.3bps at -0.671%, 5-Yr is down 1.9bps at -0.598%, 10-Yr is down 3bps at -0.213%, and 30-Yr is down 2.8bps at 0.351%.

- UK: The 2-Yr yield is down 1.8bps at 0.069%, 5-Yr is down 3.5bps at 0.336%, 10-Yr is down 5.1bps at 0.79%, and 30-Yr is down 4.5bps at 1.326%.

- Italian BTP spread up 0.5bps at 108.6bps / Spanish spread up 1.2bps at 66.5bps

FOREX: Dollar Slippage Post-Payrolls as Markets Judge Fed Taper as a Way Off

- Having held steady for much of the Friday morning, the greenback reversed sharply on the back of the weaker than expected nonfarm payrolls report, in which both headline change in jobs and the participation rate fell below expectations. Markets took the data to mean the Fed were further off their taper pivot than previously seen, putting the USD under pressure while equities and Treasury markets made solid gains.

- At the other end of the table, AUD outperformed all others in G10, reversing much of the recent underperformance and garnering some support from more buoyant commodities prices. AUD/USD bounced back above the 50-dma ahead of the close, completing a solid bounce off multi-month lows at the $0.7646 lows.

- Focus in the coming week turns to rate decisions from both the ECB and BoC. Both banks are seen keeping policy unchanged, but markets remain on watch for any signals of policy tightening in the near future.

- The Fed enter their pre-decision blackout period, keeping focus on the key data releases including the German ZEW survey, CPI from both China and the US and the prelim Uni of Michigan sentiment index.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.