-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Dots Up, Inflation Still Transitory

EXECUTIVE SUMMARY

- MNI: FED KEEPS RATES ON HOLD, QE PROGRAM UNCHANGED

- FED DOT PLOT MEDIAN SHOWS 2023 RATE INCREASE TO 0.6%

- FED'S DOT PLOT SHOWS 7 FAVOR 2022 HIKE VS 4 IN MARCH

- FED'S RATE, QE GUIDANCE UNCHANGED; FOMC STATEMENT HAS NO DISSENTS

- FED SAYS INFLATION RISE LARGELY REFLECTED TRANSITORY FACTORS

- MNI BRIEF: NGEU Pre-Finance Funds Set For July Payment: Offc'l

- MNI BRIEF: Atl Fed: Firms' Inflation Expectations Spike to 3%

- TSY SEC YELLEN: WE SEE INFLATION EXPECTATIONS BY MOST MEASURES AS BEING WELL ANCHORED, Bbg

- (Yellen added current signs of inflation are transitory and will decline over time)

US TSY SUMMARY: Hawkish Take on Steady FOMC, IOER Adjust, Rising DOTS

Futures broadly weaker across the strip as markets take measure of tone from latest FOMC policy annc as hawkish to one degree or another with an eye toward late 2023.- "FOMC forecasts for economic growth have been revised up since our March summary economic projections, even so the recovery is incomplete and risks to the economic outlook remain."

- Aside from a technical adjustment in IOER to 0.15%, Powell said the Fed is "continuing to increase our holdings of treasury securities by at least 80 billion per month, and of agency mortgage backed securities by at least 40 billion per month, until substantial further progress has been made toward our maximum employment and price stability goals."

- Several waves of selling saw Eurodollar and Tsy futures ratchet lower through the initial statement, then the Fed chair's press-conference. Futures did bounce off lows as Chairman Powell reiterated effects of inflation in near term remain uncertain, but likely transitory, will fade over time and any liftoff will be well telegraphed.

- Powell did downplay the DOTS as "not a great forecaster of future rate moves" and need to be taken with a "big grain of salt". Any future lift-off will remain "outcome based and not time based."

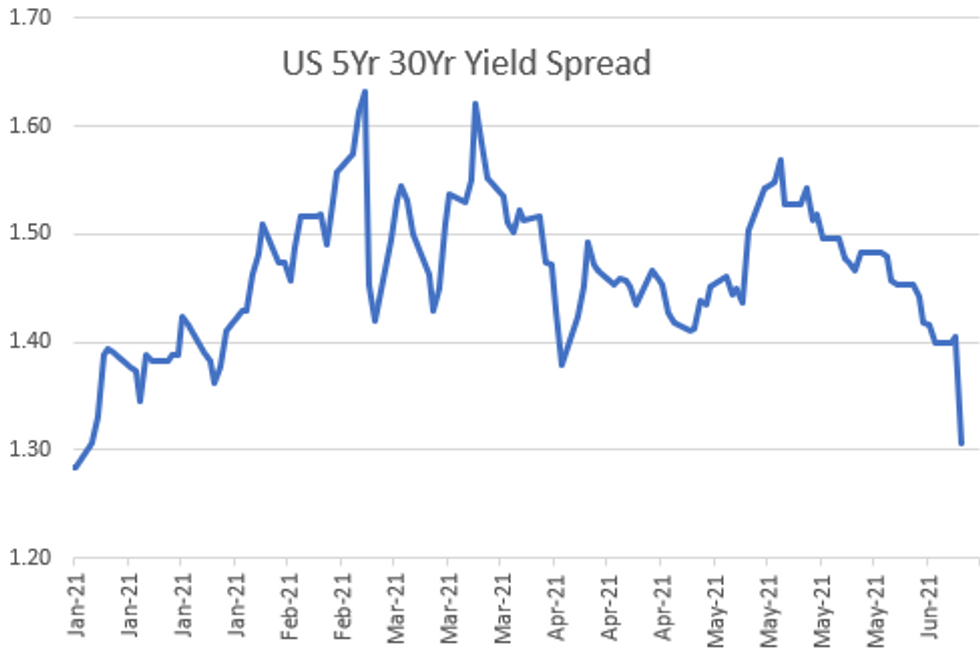

- Large sell-blocks noted in 5Y futures, -15k from 123-19.5 to -17.75 before trading down to 123-07.5 low. Yield curves mixed with longer pares flatter after the bell.

- The 2-Yr yield is up 4.2bps at 0.2052%, 5-Yr is up 11.3bps at 0.8938%, 10-Yr is up 8.3bps at 1.5754%, and 30-Yr is up 1bps at 2.1968%.

US

FED: Firms in the Atlanta Fed district now expect inflation to be a record 3.0% in the coming year, increasing "significantly" from a month earlier, according to the bank's latest survey. Business' year-ahead inflation expectations have shot up since the pandemic low of 1.4% -- and they were at 2.8% in May.

- Firms' long-term inflation expectations also rose significantly to 3.0%, the Fed bank said. The data series started in October 2011.

- Simmering price pressures could force Federal Reserve officials to speed up their QE exit liftoff timeline as they reassess how hot the economy can run, MNI has reported. However, the FOMC is expected to signal patience at Wednesday's meeting and press conference.

EUROPE

EU: Brussels is confident that pre-financing funds from the NextGenerationEU programme can be paid over to member states in July, an EU official said Wednesday. The official made the comments as the Commission approves the Portuguese and Spanish Recovery Plans.

- "Given that the Commission has already raised money on the markets, the first pre-financing payments can start in July," the official said.

- Once the Commission has approved the national recovery plans, the Council (national ministers) has four weeks to vet and approve them. Around 13% of the Recovery and Resilience Fund money to member states can be disbursed to states on a pre-financed basis this year.

OVERNIGHT DATA

- US MAY HOUSING STARTS 1.572M; PERMITS 1.681M

- US APR STARTS REVISED TO 1.517M; PERMITS 1.733M

- US MAY HOUSING COMPLETIONS 1.368M; APR 1.426M (REV)

- US MAY IMPORT PRICES +1.1%

- US MAY EXPORT PRICES +2.2%; NON-AG +1.7%; AGRICULTURE +6.1%

- CANADA APR WHOLESALE SALES +0.4%; EX-AUTOS +1.2%

- CANADA APR WHOLESALE INVENTORIES +0.0%

- CANADIAN MAY CONSUMER PRICE INDEX INFLATION +3.6% YOY

- CANADA MOM CPI INFLATION WAS +0.5% IN MAY

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 266.4 points (-0.78%) at 34039.12

- S&P E-Mini Future down 23.5 points (-0.55%) at 4214.5

- Nasdaq down 35.1 points (-0.2%) at 14040.18

- US 10-Yr yield is up 8.5 bps at 1.5771%

- US Sep 10Y are down 29/32 at 131-20

- EURUSD down 0.0122 (-1.01%) at 1.2005

- USDJPY up 0.56 (0.51%) at 110.64

- WTI Crude Oil (front-month) down $0.21 (-0.29%) at $71.92

- Gold is down $31.41 (-1.69%) at $1829.58

European bourses closing levels:

- EuroStoxx 50 up 8.24 points (0.2%) at 4151.76

- FTSE 100 up 12.47 points (0.17%) at 7184.95

- German DAX down 18.95 points (-0.12%) at 15710.57

- French CAC 40 up 13.13 points (0.2%) at 6652.65

US TSY FUTURES CLOSE: Weaker, Off Post-FOMC Lows

Rate futures extended session lows after the FOMC but bounced as Fed Chairman Powell discussed the policy annc and took media questions. Powell did downplay the DOTS as "not a great forecaster of future rate moves" and need to be taken with a "big grain of salt". Any future lift-off will remain "outcome based and not time based." Large sell-blocks noted in 5Y futures, -15k from 123-19.5 to -17.75 before trading down to 123-07.5 low. Yield curves mixed with longer pares flatter after the bell:

- 3M10Y +6.79, 153.732 (L: 145.249 / H: 154.34)

- 2Y10Y +3.787, 136.509 (L: 131.499 / H: 137.783)

- 2Y30Y -2.692, 199.442 (L: 198.944 / H: 203.329)

- 5Y30Y -9.187, 131.23 (L: 130.452 / H: 141.487)

- Current futures levels:

- Sep 2Y down 2.625/32 at 110-7.375 (L: 110-06.75 / H: 110-10.5)

- Sep 5Y down 17.75/32 at 123-12.25 (L: 123-07.5 / H: 124-00)

- Sep 10Y down 27.5/32 at 131-21.5 (L: 131-17.5 / H: 132-20.5)

- Sep 30Y down 20/32 at 157-29 (L: 157-12 / H: 158-31)

- Sep Ultra 30Y down 3/32 at 188-3 (L: 187-12 / H: 189-07)

US EURODOLLAR FUTURES CLOSE: Broadly Weaker in Reaction to FOMC

Broadly weaker across the strip but off session lows as Fed chair conference somewhat cooled the initial hawkish react to FOMC annc. Greens-Blues underperformed:

- Sep 21 -0.015 at 99.855

- Dec 21 -0.015 at 99.800

- Mar 22 -0.015 at 99.815

- Jun 22 -0.030 at 99.760

- Red Pack (Sep 22-Jun 23) -0.08 to -0.03

- Green Pack (Sep 23-Jun 24) -0.14 to -0.10

- Blue Pack (Sep 24-Jun 25) -0.145 to -0.14

- Gold Pack (Sep 25-Jun 26) -0.13 to -0.095

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00063 at 0.05550% (+0.00012/wk)

- 1 Month +0.00075 to 0.08250% (+0.00963/wk)

- 3 Month -0.00025 to 0.12450% (+0.00562/wk) ** (New Record Low: 0.11800% on 6/14)

- 6 Month -0.00075 to 0.15188% (-0.00063/wk)

- 1 Year +0.00125 to 0.23450% (-0.00488/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $60B

- Daily Overnight Bank Funding Rate: 0.04% volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.01%, $905B

- Broad General Collateral Rate (BGCR): 0.01%, $381B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $355B

- (rate, volume levels reflect prior session)

- Wed 6/16 ---- Buy-op paused for FOMC rate annc

- Next scheduled purchases:

- Thu 6/17 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 6/18 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

PIPELINE: FOMC Sidelines Issuers

- Date $MM Issuer (Priced *, Launch #)

- 06/16 $2B #Lundin Energy Finance $1B each: 5Y +115, 10Y +155

- 06/16 $750M #Wipro 5Y +80

EGBs-GILTS CASH CLOSE: UK Breakevens Shrug Off High Inflation Data

The UK and German curves bull flattened Wednesday with periphery spreads slightly wider, ahead of the US Federal Reserve decision after hours.

- UK inflation data came out on the high side (2.1% Y/Y in May vs 1.8% consensus), but breakevens actually headed lower over the day after the initial jump (in a move similar to the US inflation data shockers in Apr and May).

- Bond supply came from the UK (Gilts, GBP2.5bn) and Germany (Bunds, EUR4.085bn allotted). Italy also conducted a tap issuance for specialists (E1.5B total).

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is down 0.5bps at -0.677%, 5-Yr is down 1.6bps at -0.619%, 10-Yr is down 1.8bps at -0.25%, and 30-Yr is down 1.7bps at 0.305%.

- UK: The 2-Yr yield is down 0.3bps at 0.077%, 5-Yr is down 0.6bps at 0.325%, 10-Yr is down 1.9bps at 0.739%, and 30-Yr is down 1.9bps at 1.257%.

- Italian BTP spread up 0.8bps at 102.8bps/ Spanish spread up 0.6bps at 64.7bps

FOREX: Dollar On The Charge

- The greenback rallied sharply on the back of FOMC decision, with markets immediately focusing on the median dot pointing to two hikes by the end of 2023. This was more hawkish than expected, with traders also eyeing the hike to the RRP rates and IOER, as well as 7 dots now favouring rate liftoff by end-2022, up from 4 previously.

- The greenback surge unsurprisingly put most major pairs under pressure, with the likes of EUR/USD, GBP/USD and USD/JPY all breaking out of their recent ranges.

- The USD Index rallied to touch new June highs, showing above the 100-dma in the process.

- NOK was the G10 laggard, with the currency slipping ahead of Thursday's Norges Bank rate decision. The bank are expected to bring forward their projections for the first NB hike to September.

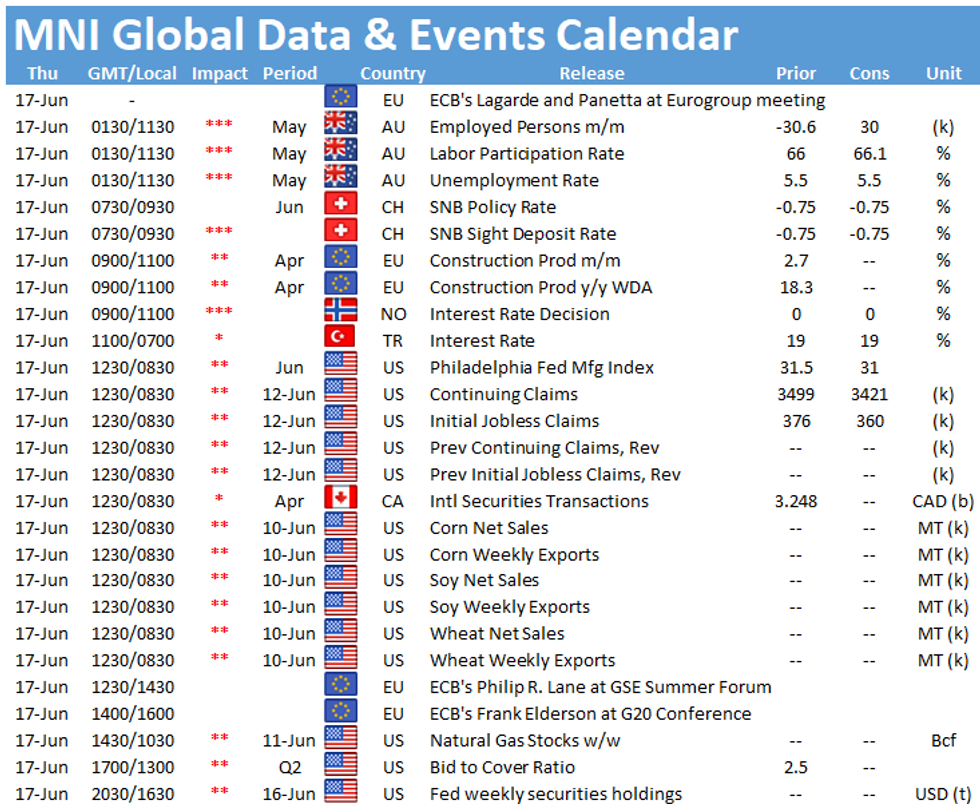

- Focus Thursday turns to Australian jobs report, final Eurozone CPI data, weekly jobless claims data and the latest Philly Fed release. Rate decisions are due from the Swiss, Norwegian, Indonesian and Turkish central banks, all of which are expected to keep rates unchanged.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.