-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI ASIA OPEN: Covid Angst Resumes

EXECUTIVE SUMMARY

- MNI STATE OF PLAY: ECB Pledges Low Rates To Meet New Target

- COVID 7-DAY AVERAGE OF COVID CASES RISES 53% TO 37,700: WALENSKY, Bbg

- CDC'S WALENSKY SAYS SOME HOSPITALS ARE REACHING THEIR CAPACITY IN SOME AREAS OF THE U.S. AMID SURGE IN COROANVIRUS CASES, Rtrs

- WHITE HOUSE'S ZIENTS SAYS 1 IN 5 OF ALL U.S. CORONAVIRUS CASES OCCURRED IN FLORIDA ALONE FOR THE SECOND WEEK, Rtrs

- ECB LAGARDE: RISKS TO EURO-AREA OUTLOOK BROADLY BALANCED, Bbg

US TSY SUMMARY: Yld Bounce Stalls

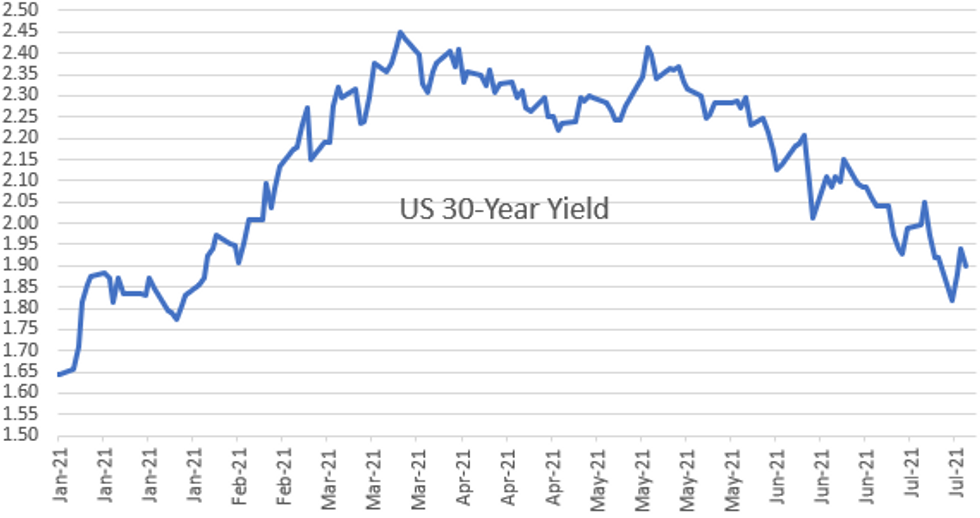

The strong bounce in Tsy ylds from Mon-Tue sharp decline ran out of gas Thursday, finishing day off session lows (10YY 1.2599% vs. 1.2316%L; 30YY 1.8957% vs. 1.8783%L).

- Tsy futures traded higher after weekly claims (weekly claims 419k vs. 350k est; continuing claims 3.236M vs. 3.1M est; July rev to 368k), after bouncing off session lows a few minutes after ECB steady policy annc -- deposit and key refi rates unch'd but revised forward guidance, perhaps not as dovish as anticipated as Bunds trade lower as well.

- Covid case count headlines (7-day avg case count +53%; 20% of all US cases coming from FL) pushed Tsys to new session highs, though equities managed to trade higher into the FI close (ESU1 +9.0).

- Tsys holding off midday highs after 10Y TIPS auction draws -1.016% high yield vs. -0.997% WI. Bid-to-cover steady with prior auction at 2.50. Indirect take-up climbs to 70.14% vs. 68.59% in May (68.68% 5M avg) Primary dealer take-up slips to 14.31% vs. 14.88% 5M avg. Direct take-up 15.55% vs. 14.88% 5M avg.

- The 2-Yr yield is down 1bps at 0.1978%, 5-Yr is down 2.6bps at 0.7105%, 10-Yr is down 2.5bps at 1.2632%, and 30-Yr is down 3.7bps at 1.9022%.

EUROPE

- ECB: Temporary factors driving rising eurozone prices are expected fade early next year, European Central Bank president Christine Lagarde said Thursday, noting that headline inflation will need to consistently hit 2% by the mid-point of the ECB's projection horizon before the Governing Council will consider raising rates.

OVERNIGHT DATA

- US JOBLESS CLAIMS +51K TO 419K IN JUL 17 WK

- US PREV JOBLESS CLAIMS REVISED TO 368K IN JUL 10 WK

- US CONTINUING CLAIMS -0.029M to 3.236M IN JUL 10 WK

- US June Existing Home Sales Bounce Back to 5.86M Pace (+1.4%)

- June Leading Economic Indictors +0.7%

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 80.96 points (0.23%) at 34798

- S&P E-Mini Future up 10 points (0.23%) at 4355.75

- Nasdaq up 54.9 points (0.4%) at 14631.95

- US 10-Yr yield is down 2.5 bps at 1.2632%

- US Sep 10Y are up 4.5/32 at 134-8

- EURUSD down 0.0025 (-0.21%) at 1.1789

- USDJPY down 0.09 (-0.08%) at 110.26

- Gold is up $3.37 (0.19%) at $1796.97

- EuroStoxx 50 up 32.37 points (0.8%) at 4073.37

- FTSE 100 down 29.98 points (-0.43%) at 7000.44

- German DAX up 92.04 points (0.6%) at 15556.3

- French CAC 40 up 17.11 points (0.26%) at 6514.31

US TSY FUTURES CLOSE

- 3M10Y -2.84, 120.674 (L: 118.344 / H: 126.269)

- 2Y10Y -2.145, 105.715 (L: 103.183 / H: 110.148)

- 2Y30Y -3.284, 169.605 (L: 167.856 / H: 175.165)

- 5Y30Y -1.105, 118.977 (L: 118.233 / H: 121.16)

- Current futures levels:

- Sep 2Y up 0.625/32 at 110-9 (L: 110-07.375 / H: 110-09)

- Sep 5Y up 4.5/32 at 124-11.25 (L: 124-02.5 / H: 124-12.5)

- Sep 10Y up 6.5/32 at 134-10 (L: 133-27.5 / H: 134-15)

- Sep 30Y up 20/32 at 164-21 (L: 163-09 / H: 165-00)

- Sep Ultra 30Y up 1-12/32 at 199-17 (L: 196-27 / H: 200-02)

US EURODOLLAR FUTURES CLOSE

- Sep 21 +0.005 at 99.865

- Dec 21 +0.005 at 99.810

- Mar 22 +0.005 at 99.825

- Jun 22 +0.005 at 99.775

- Red Pack (Sep 22-Jun 23) +0.010 to +0.030

- Green Pack (Sep 23-Jun 24) +0.030 to +0.035

- Blue Pack (Sep 24-Jun 25) +0.025 to +0.030

- Gold Pack (Sep 25-Jun 26) +0.020 to +0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00050 at 0.08338% (-0.00238/wk)

- 1 Month +0.00262 to 0.08925% (+0.00562/wk)

- 3 Month -0.01263 to 0.12525% (-0.00900/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00412 to 0.15725% (+0.00512/wk)

- 1 Year +0.00100 to 0.24400% (+0.00188/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $71B

- Daily Overnight Bank Funding Rate: 0.08% volume: $258B

- Secured Overnight Financing Rate (SOFR): 0.05%, $913B

- Broad General Collateral Rate (BGCR): 0.05%, $383B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $352B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $4.660B submission

- Next scheduled purchases

- Fri 7/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED: Reverse Repo Operation

NY Fed reverse repo usage climbs to $898.197B from 73 counterparties vs. $886.206B on Wednesday (compares to June 30 record high of $991.939B).

PIPELINE: DirecTV Priced, Chile Still Expected to Launch

- Date $MM Issuer (Priced *, Launch #)

- 07/22 $2.3B *DirecTV 6NC2 5.875%

- 07/22 $2B #JP Morgan PerpNC5 4.2%

- 07/22 $900M #World Bank 2031 tap FRN/SOFR +34

- 07/22 $500M *Ukraine 6.876% 2029 Tap 6.3%

- 07/22 $Benchmark Republic of Chile 12Y +155a, Tap 20Y +160a, 40Y +170a

EGBs-GILTS CASH CLOSE: ECB Day Resolves In Dovish Direction

Markets ultimately took the ECB decision and press conference as dovish, though price action was very much two-way for most of the European afternoon Thursday.

- After an initial knee-jerk move lower on the ECB statement (a move whose cause was not totally clear, perhaps the newly-communicated statement not as dovish as some hoped), Bund yields moved quickly to session lows - only to retrace to where they began the afternoon. Periphery spreads ended marginally lower.

- With minimal data and no supply, the only highlight apart from the ECB was a speech by BoE's Broadbent but that didn't provide major revelations - this may have taken a bit of impetus out of the potential for action at the August MPC meeting though - Gilts outperformed.

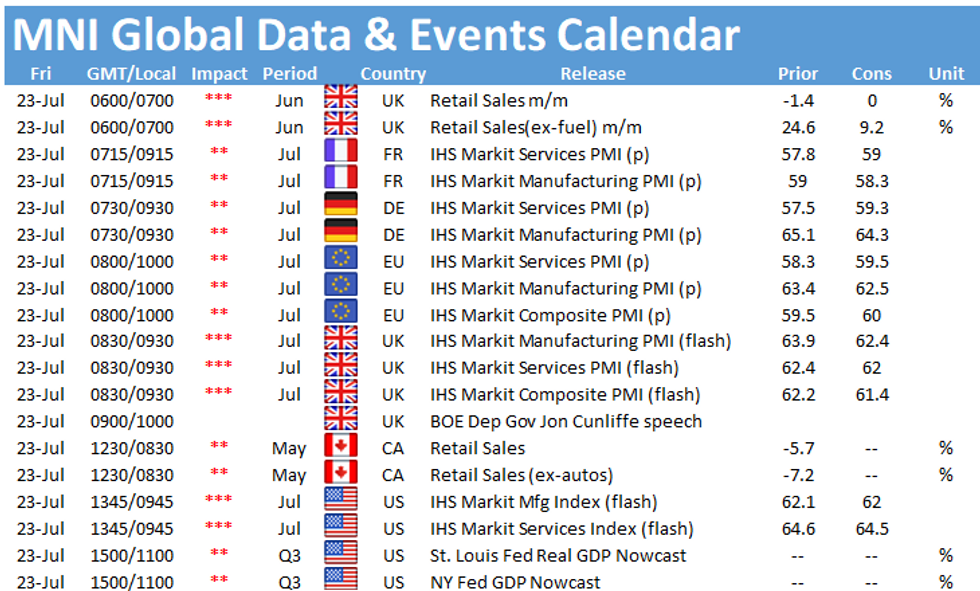

- UK retail sales and flash PMIs highlight Friday's calendar.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.5bps at -0.72%, 5-Yr is down 2bps at -0.702%, 10-Yr is down 2.9bps at -0.424%, and 30-Yr is down 3bps at 0.058%.

- UK: The 2-Yr yield is down 3.2bps at 0.07%, 5-Yr is down 3.4bps at 0.267%, 10-Yr is down 3.6bps at 0.567%, and 30-Yr is down 5.3bps at 1.003%.

- Italian BTP spread down 1.7bps at 106.6bps

FOREX: Euro Ends Lower Following ECB, GBP Advances

- Two-way price action for the single currency following the first ECB monetary policy statement and press conference since the ECB strategy review.

- Despite an alteration to the forward guidance, the majority of analysts appear convinced the changes offer little new significance for markets at this stage.

- With some potentially expecting a more dovish scenario, EURUSD popped above 1.18 to print a fresh weekly high at 1.1831.

- Some cited marginal dovish tweaks, highlighting the central bank's stance "may also imply a transitory period in which inflation is moderately above target". This could point to why EURUSD eventually headed lower, however, short-term positioning and dollar dynamics may be equally attributable. The pair resides 0.2% lower for Thursday, just above the week's lows at 1.1770 with a more notable 0.65% move south in EURGBP.

- Despite the technical outlook turning favourable, EURGBP has had a sharp reversal and key support is seen roughly 0.5% from current spot at 0.8504, the July 14 low. Similarly, 1.3817 resistance in cable, the 20-day EMA, will need to hold for GBP bears. The most recent Covid data showed another daily decline in cases, potentially bolstering recent signs that UK COVID case growth could have topped out.

- AUD and NOK extended on gains made yesterday, both gaining roughly 0.4% against the greenback.

- UK Retail Sales and Eurozone Flash PMI's headline the European data schedule, before Canadian Retail Sales and US PMI's close out the weekly calendar.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.