-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Late Selling Meets Little Resistance

EXECUTIVE SUMMARY

- MNI Fed Preview - Jul 2021: A Little Closer To Tapering

- MNI BRIEF: BOE Vlieghe Says Keep Stimulus In Place

- CBO TO RELEASE SOME BIDEN BUDGET PROPOSAL ESTIMATES ON JULY 30, Bbg

- CHINA WANG: URGES U.S. TO REMOVE ALL SANCTIONS AGAINST CHINA: MOFA, Bbg

- CHINA WANG: ASKS U.S. TO REMOVE 'HIGH' TARIFFS, TECHNOLOGY BLOCK, Bbg

- CHINA WANG: ASKS U.S. TO STOP DESTROYING CHINA'S TERRITORIAL INTEGRITY, Bbg

US

FED: The FOMC will use the July meeting to debate its strategy to taper asset purchases (including timing, pace, and composition). The December FOMC looks like the most likely meeting for a formal announcement.

- The risks to the July Statement lean hawkish, but the mood could swiftly change with Powell delivering a relatively dovish press conference.

- Moves in yields since the June FOMC suggest increasing market concerns over the growth outlook, but it's unlikely this will persuade the Fed to change course at this stage.

- SAYS U.S TARIFFS ON CHINA 'BLATANT VIOLATION' OF WTO RULES, Bbg

- U.S. SANCTIONS AGAINST CHINA VIOLATE INTERNATIONAL RULES, Bbg

UK

BOE: Bank of England Monetary Policy Committee member Gertjan Vlieghe still sees the rise in inflation as temporary, arguing Monday against near-term tightening, noting in a speech to the London School of Economics that the long-term factors keeping rates low are still in place.

- "It will remain appropriate to keep the current monetary stimulus in place for several quarters at least, and probably longer," he said, adding that when tightening comes not much will need to be done. Vlieghe's term as an independent MPC member is almost at an end, with the August meeting his final one in this role, and his comments making crystal clear that he has no intention of backing tightening next week.

OVERNIGHT DATA

- U.S. JUNE NEW-HOME SALES AT 676,000 ANN. RATE; EST. 796,250

- U.S. JUNE NEW-HOME SALES FALL 6.6% FROM PREVIOUS MONTH

MARKETS SNAPSHOT

Key late session market levels

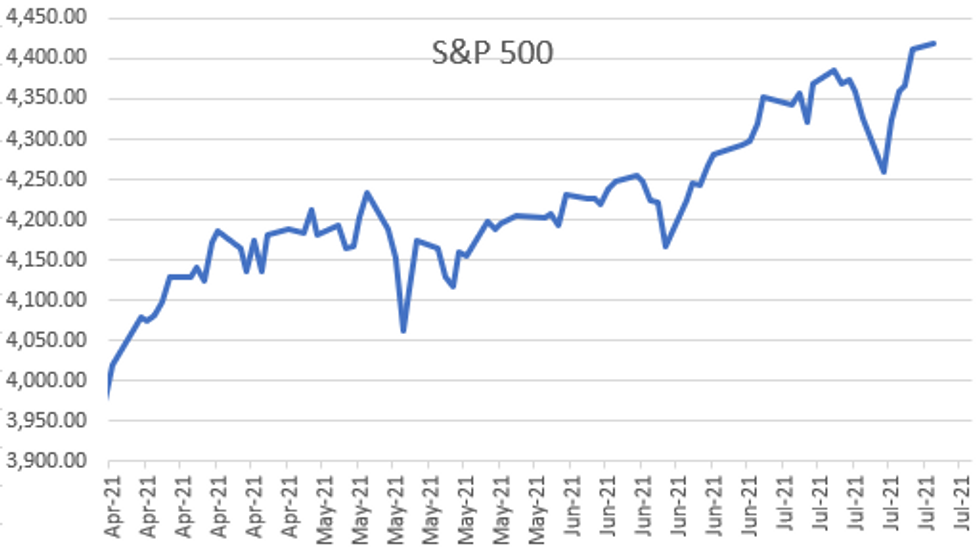

- DJIA up 63.34 points (0.18%) at 35125.78

- S&P E-Mini Future up 8 points (0.18%) at 4410.5

- Nasdaq up 1.8 points (0%) at 14837.62

- US 10-Yr yield is down 0.2 bps at 1.2746%

- US Sep 10Y are up 2.5/32 at 134-7

- EURUSD up 0.003 (0.25%) at 1.1801

- USDJPY down 0.17 (-0.15%) at 110.38

- WTI Crude Oil (front-month) up $0.11 (0.15%) at $72.17

- Gold is down $5 (-0.28%) at $1797.24

European bourses closing levels:

- EuroStoxx 50 down 6.51 points (-0.16%) at 4102.59

- FTSE 100 down 2.15 points (-0.03%) at 7025.43

- German DAX down 50.31 points (-0.32%) at 15618.98

- French CAC 40 up 9.78 points (0.15%) at 6578.6

US TSY SUMMARY: Reversing Overnight Risk-Off Tone

Well off early London highs to below early Asia session lows by midmorning, some desks pointed to a rebound in equities after China stocks fell appr -3%. Generally muted week opener with sites on Wednesday's FOMC policy announcement.

- Decent early volumes (TYU >600k) petered out soon after, TYU trading an additional 325k to 975k by the closing bell as rates held to a narrow range. Current 10YY 1.2846% vs. 1.2196% low; 30YY 1.9346% vs. 1.8545% low.

- Tsy futures bounce slightly off lows, still holding narrow overall range after the $60B 2Y (91282CCN9) note draws 0.213% vs. 0.215% WI. Bid-to-cover was 2.47x, shy of the 5 month average of 2.52x. Indirect take-up climbs to 52.76% from 50.63% in June (51.85% 5M avg); direct bidder take-up of 21.26% continues to outpace the 5M avg of 16.92%; primary dealer take-up recedes to 25.98% vs. 5-month average of 31.23%.

- Usually muted around earnings cycles let alone the FOMC, markets say a decent pick-up in swappable corporate issuance noted: $2.5B #Temasek ($750M 10Y +40, $750M 20Y +65, $1B 40Y +85) and $1.5B Royal Bank of Canada ($850M 3Y +30, $650M 3Y FRN/SOFR+36).

- The 2-Yr yield is down 0.4bps at 0.1941%, 5-Yr is down 0bps at 0.7117%, 10-Yr is down 0.2bps at 1.2746%, and 30-Yr is up 1bps at 1.9248%.

MONTH-END EXTENSIONS: Preliminary Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.16Y; US Gov infl-linked 0.23Y.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.06 | 0.04 | 0.05 |

| Credit | 0.06 | 0.12 | 0.08 |

| Govt/Credit | 0.07 | 0.1 | 0.08 |

| MBS | 0.08 | 0.07 | 0.06 |

| Aggregate | 0.07 | 0.09 | 0.08 |

| Long Gov/Cr | 0.05 | 0.09 | 0.07 |

| Iterm Credit | 0.06 | 0.1 | 0.08 |

| Interm Gov | 0.08 | 0.08 | 0.08 |

| Interm Gov/Cr | 0.07 | 0.09 | 0.08 |

| High Yield | 0.06 | 0.11 | 0.1 |

US TSY FUTURES CLOSE

Yld curves moving steeper as mild sell volume meeting little resistance last few minutes, futures extending session lows. Don't read too much into the move -- Sep 10Y futures slip to 134-02.5 lows on appr 16k after the bell, no obvious drivers.

Late curve levels:

- 3M10Y +1.917, 124.733 (L: 116.886 / H: 124.733)

- 2Y10Y +2.263, 109.683 (L: 102.546 / H: 109.683)

- 2Y30Y +3.466, 174.763 (L: 166.026 / H: 174.894)

- 5Y30Y +1.587, 121.756 (L: 117.685 / H: 121.917)

Late futures levels:

- Sep 2Y up 0.125/32 at 110-9 (L: 110-08.625 / H: 110-09.625)

- Sep 5Y down 0.75/32 at 124-8.5 (L: 124-08.25 / H: 124-15.75)

- Sep 10Y down 1.5/32 at 134-3 (L: 134-02 / H: 134-19)

- Sep 30Y down 6/32 at 163-27 (L: 163-24 / H: 165-12)

- Sep Ultra 30Y down 18/32 at 197-25 (L: 197-17 / H: 200-30)

US EURODOLLAR FUTURES CLOSE

- Sep 21 -0.005 at 99.865

- Dec 21 steady at 99.815

- Mar 22 +0.005 at 99.830

- Jun 22 +0.005 at 99.780

- Red Pack (Sep 22-Jun 23) -0.01 to steady

- Green Pack (Sep 23-Jun 24) -0.01 to -0.005

- Blue Pack (Sep 24-Jun 25) steady to +0.010

- Gold Pack (Sep 25-Jun 26) +0.010 to +0.015

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00087 at 0.08100% (-0.00562 total last wk)

- 1 Month +0.00112 to 0.08725% (+0.00250 total last wk)

- 3 Month +0.00275 to 0.13163% (-0.00537 total last wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00125 to 0.15725% (+0.00637 total last wk)

- 1 Year -0.00275 to 0.23863% (-0.00075 total last wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $68B

- Daily Overnight Bank Funding Rate: 0.08% volume: $245B

- Secured Overnight Financing Rate (SOFR): 0.05%, $861B

- Broad General Collateral Rate (BGCR): 0.05%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $345B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $1.999B accepted vs. $3.403B submission

- Next scheduled purchases

- Tue 7/27 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 7/28 No buy-operation scheduled due to FOMC

- Thu 7/29 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 7/30 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Reverse Repo Operation

NY Fed reverse repo usage bounces to $891.203B from 70 counterparties vs. $877.251B on Friday (compares to June 30 record high of $991.939B).

PIPELINE: $2.5B Temasek, $1.5B Royal Bank of Canada Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/26 $2.5B #Temasek $750M 10Y +40, $750M 20Y +65, $1B 40Y +85

- 07/26 $1.5B #Royal Bank of Canada $850M 3Y +30, $650M 3Y FRN/SOFR+36

- 07/26 $1.5B Novelis Corp 5NC2 3.5%a, 10NC5 4.125%a, later today

- 07/26 $Benchmark Adani Ports 10.5Y +255a, 20Y 5.0%a

- 07/26 $Benchmark AutoNation 7Y +100a, 10Y +120a

- 07/26 $1B Jefferies Finance 7NC3 investor call

- Later in week:

- 07/28 $2.75B Air Canada 5NC, 8NC4.5, investor calls Monday

- 07/?? $1.5B Venture Global 8NC, 10NC

EGBs-GILTS CASH CLOSE: Yields Drift Higher After Morning Rally

Gilts strengthened with bull flattening though finished well off best levels, with Bunds ending relatively flat, in a fairly directionless session to start the week.

- Weak equities (led by Asia) overnight and disappointing German IFO numbers set a bullish tone early in the session, though this reversed as equities found a footing and yields drifted toward Friday's highs.

- In the end bonds were rangebound, with Gilts outperforming, and periphery spreads modestly wider.

- Today, Belgium sold E3.1bln of OLOs. Tuesday, Italy sells up to E3.75bln of short-term BTP; UK sells GBP3bln of Oct-26 Gilt.

- The only scheduled central bank speaker Tuesday is ECB's de Cos.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 0.7bps at -0.733%, 5-Yr is up 0.1bps at -0.703%, 10-Yr is up 0.2bps at -0.418%, and 30-Yr is up 0.3bps at 0.064%.

- UK: The 2-Yr yield is up 0.1bps at 0.08%, 5-Yr is down 0.1bps at 0.278%, 10-Yr is down 1.3bps at 0.571%, and 30-Yr is down 1.4bps at 0.991%.

- Italian BTP spread up 0.9bps at 104.7bps / Spanish up 0.7bps at 69.8bps

FOREX: Softer Greenback Extends GBP Bounce

- The US dollar lost ground on Monday with the DXY 0.36% worse off. Initial two-way price action was trumped by a bout of greenback supply following the US cash equity open, where US indices breached Friday's highs, largely ignoring the sharp drawdown in Chinese equities overnight.

- Factoring in the lack of cross-region follow through and the strong performance of commodity indices, AUD and NZD reversed early losses, to trade in the green. Additionally, a buoyant EURUSD broke back above 1.18, honing in on the ECB highs at 1.1830.

- The weaker dollar aided further GBP strength in the latter half of Monday, with GBPUSD (+0.55%) taking out initial resistance at 1.3790 and trading to highs of 1.3833. Local press have highlighted the recent downtick in case growth despite economic re-opening. Showing the effectiveness of vaccines, case growth has slowed before any catch-up in hospitalisation or fatality statistics, bolstering the sterling recovery. The next level of note is the 50-day EMA at 1.3887.

- The market's attention is starting to focus on the July Fed statement and press conference, due on Wednesday. The FOMC will use the July meeting to debate its strategy to taper asset purchases (including timing, pace, and composition).

- Bank of Japan's Governor Kuroda is due to speak overnight at an online event hosted by the Japan National Press Club. RBA's Debelle will then speak at the FX Markets USA online conference with a Q&A expected.

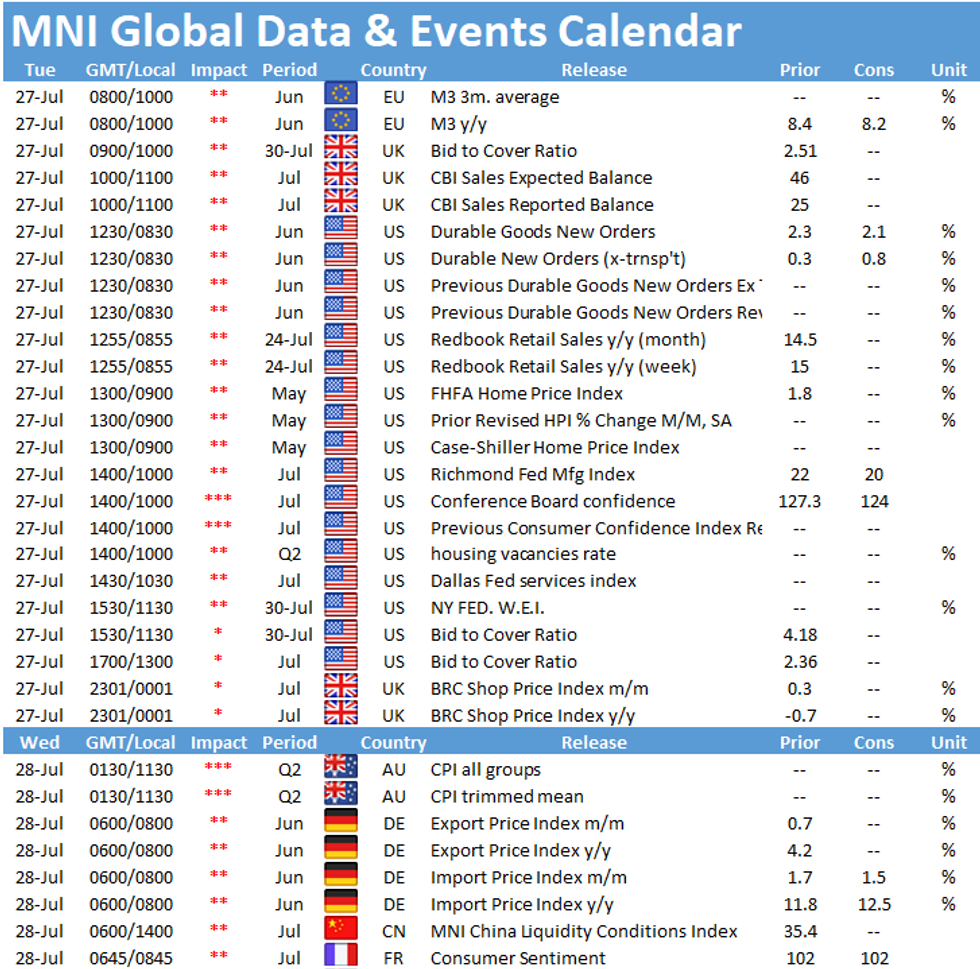

- In terms of data, US durable goods orders and consumer confidence headline a light Tuesday docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.