-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Forget ADP Miss, Fed Clarida Talks Taper Timing

EXECUTIVE SUMMARY

- MNI: Clarida - Fed Liftoff Conditions Could Be Met End of 2022

- MNI BRIEF: Fed's Clarida Stresses Taper, Rate Hikes Separate

- MNI INTERVIEW: Shortages More Worrisome Than Delta -ISM Svcs

- MNI SOURCES: ECB Bracing For September Debate On PEPP Future

- US TSYS: US Treasury Set To Sell USD 126Bln in Q3 Refunding

- US DATA: ISM Services PMI At Record High in July of 64.1

US

FED: Federal Reserve Vice Chair Richard Clarida said Wednesday that the necessary conditions for raising benchmark interest rates are likely to be met by the end of next year and officials will continue to assess pulling back asset purchases in coming meetings.

- If the economy performs about as expected, "necessary conditions for raising the target range for the federal funds rate will have been met by year-end 2022," he said in the text of a speech.

- "My inflation projections for 2022 and 2023, which forecast somewhat higher inflation than do the SEP medians, would also, to me, satisfy the 'on track to moderately exceed 2 percent for some time' threshold specified in the statement," he wrote, adding that Fed staff's common inflation expectations index will likely continue to show inflation expectations are well anchored near 2%.

- While the rapid spread of the Delta variant among the still considerable fraction of the population that is unvaccinated is clearly a downside risk for the outlook, he said, "I believe that the risks to my outlook for inflation are to the upside." For more see MNI Policy main wire at 1000ET.

- "If my baseline outlook does materialize, then I can certainly see supporting announcing a reduction in the pace of our purchases later this year," he said. "They're completely separate decisions, and I think the Committee deserves credit because we laid out specific conditions for lift off, and those are different. There's a different metric for lift off than there is a metric for reducing the pace of asset purchases."

- High demand for in-person services is driving business activity, spending and prices, and businesses have yet to feel any slowdown as infections rise, Nieves said.

- "With all the pent up demand that we've had, it just seems like the economy is really pushing forward hard," he said in an interview. The ISM Services PMI rose 6.6 points in July, hitting an all-time high of 64.1.

- There's likely to be "some pullback" in activity as Delta spreads, he said, but businesses are confident that another nationwide lockdown isn't in the cards, even if new infections and hospitalizations increase in the coming months. For more see MNI Policy main wire at 1256ET.

- Officials say they plan to sell USD58 billion in 3-year notes on August 10,

- USD41 billion in 10-year notes on August 11,

- and USD27 billion in 30-year bonds on August 12.

- Officials however did announce TIPS auction sizes will again be increased by USD1 billion in the August 30-year reopening compared to last year, the September 10-year reopening compared to May, and in the October 5-year new issue compared to April. "While flexibility will be maintained to adjust TIPS issuance at each refunding quarter, we expect total gross issuance of TIPS to increase by $15 billion to $20 billion in CY 2021," Treasury said.

- The U.S. Treasury said Wednesday in its regular refunding announcement it anticipates gradual reductions in bills as a percent of Treasury debt outstanding and leaving longer-dated issuances steady in the next quarter, while signaling cutting coupon auctions as soon as November.

EUROPE

ECB: The European Central Bank is likely to start considering at next month's Governing Council meeting an extension to its Pandemic Emergency Purchase Programme (PEPP) beyond March as fears grow over the spread of the Covid delta variant - with early suggestions that a further EUR 500 billion may be appropriate - sources told MNI.

- But decisions on any extension are not expected until later in the autumn or even into next year in a bid to narrow substantial differences among policymakers over PEPP's duration and scale. Political uncertainty, in particular the looming German federal election, is also cited as a key factor while the UK's July reopening 'experiment' is also being closely watched.

OVERNIGHT DATA

- JUL ADP NATL EMPLOYMENT +330K (+683K EXP, +680K PRIOR REV)

- JUN ADP REV TO +680K FROM +692K

- US JUL FINAL SERVICES PMI 59.9 (VS 59.8 FLASH, 64.6 JUN)

- US JUL FINAL COMPOSITE PMI 59.9 (VS 59.7 FLASH, 63.7 JUN)

- US JUL ISM SERVICES PMI 64.1 VS 60.1 JUN

- US ISM SERVICES BUSINESS INDEX 67.0 JUL VS 60.4 JUN

- US ISM SERVICES EMPLOYMENT INDEX 53.8 JUL VS 49.3 JUN

- US ISM SERVICES NEW ORDERS 63.7 JUL VS 62.1 JUN

- US ISM SERVICES SUPPLIER DELIVERIES 72.0 JUL VS 68.5 JUN (NSA)

- The ISM Services PMI surged to a record high of 64.1 in Jul, edging above May's previous record reading and stronger than markets expected (BBG: 60.5).

- Jul's increase was broad-based with every major category posting a gain, led by Business Activity which rose 6.6pt to 67.0, the highest reading since Mar.

- Employment increased 4.5pt in Jul, while Supplier Deliveries and New Orders rose 3.5pt and 1.6pt, respectively.

- Among the other categories, Exports showed the largest increase, up 15.1pt to 65.8, its highest level since May 2007.

- While Inventory Sentiment ticked up 3.1pt to 40.3, Prices rose 2.8pt to 82.3, its highest reading since Sep 2005.

- Imports posted the largest decline in Jul, down 6.6pt to 51.6, while Order Backlogs eased 2.8pt to 63.5 and Inventories slipped 0.7pt to 49.2, remaining in contraction for the second successive month.

- US MBA: REFIS -2% SA; PURCH INDEX -2% SA THRU JUL 30 WK

- US MBA: UNADJ PURCHASE INDEX -18% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 2.97% VS 3.01% PREV

- US MBA: MARKET COMPOSITE -1.7% SA THRU JUL 30 WK

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 293.29 points (-0.84%) at 34817.63

- S&P E-Mini Future down 14.5 points (-0.33%) at 4400.75

- Nasdaq up 29 points (0.2%) at 14792.57

- US 10-Yr yield is up 1.2 bps at 1.1837%

- US Sep 10Y are down 5.5/32 at 134-26.5

- EURUSD down 0.0026 (-0.22%) at 1.1837

- USDJPY up 0.46 (0.42%) at 109.5

- WTI Crude Oil (front-month) down $2.56 (-3.63%) at $68.10

- Gold is up $0.64 (0.04%) at $1810.93

- EuroStoxx 50 up 26.95 points (0.65%) at 4144.9

- FTSE 100 up 18.14 points (0.26%) at 7123.86

- German DAX up 137.05 points (0.88%) at 15692.13

- French CAC 40 up 22.42 points (0.33%) at 6746.23

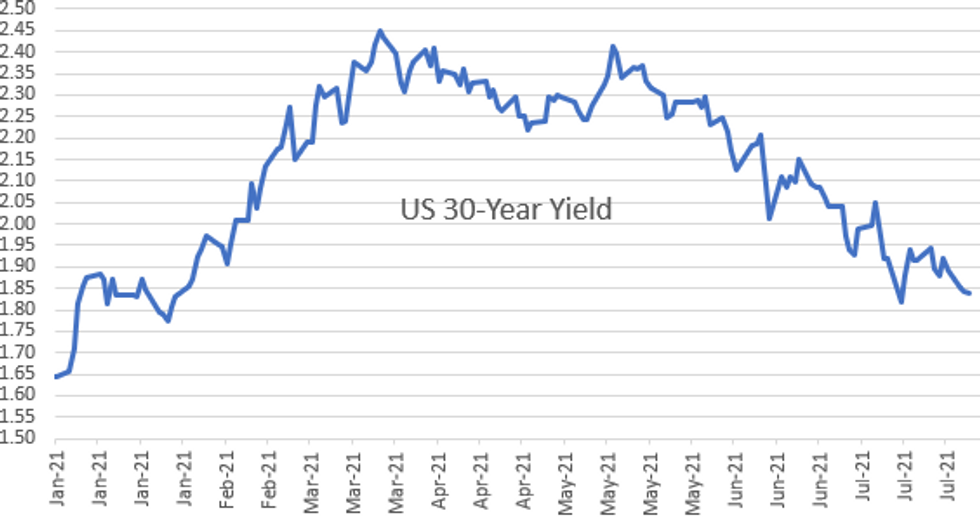

US TSY SUMMARY: Hawks Sharpen Liftoff Framework

Tsys drift not far above the narrow range that held through muted overnight trade, mixed levels after the bell with the long end outperforming on decent overnight volumes (TYU1>1.6M).- Sharply weaker than expected July ADP private employ data (+330K vs. +683K est) helped kick off a rally that held into midmorning.

- Market support evaporated quickly on one-two punch of data and Fed speak: surge in July ISM Services PMI to record high of 64.1 followed by comments from Fed VC Clarida virtual event where he sees see upside risk to his inflation projection, says "2023 rate liftoff consistent with framework."

- Additional comments from Fed Vice Chair Clarida on taper / hike timing:

- If my baseline materializes, could see myself supporting announcement of a taper later this year.

- Decisions to taper and to hike rates are completely separate. Not thinking about hiking rates. Rate hikes not on my (and I don't think Committee's) radar screen.

- Tsys sold off/extended session lows over the next hour (incidentally, so did German Bunds, equities and WTI crude). Discounting the data and mon-pol comments, rates drew short cover support back to mildly mixed range through the NY close, focus on Friday's July NFP (+870k est vs. +850k in June).

- The 2-Yr yield is up 1.2bps at 0.1822%, 5-Yr is up 2.9bps at 0.6761%, 10-Yr is up 1.3bps at 1.1854%, and 30-Yr is up 0.1bps at 1.842%.

US TSY FUTURES CLOSE

- 3M10Y +0.398, 112.801 (L: 107.505 / H: 116.292)

- 2Y10Y -0.538, 99.458 (L: 96.07 / H: 102.616)

- 2Y30Y -1.703, 165.154 (L: 164.257 / H: 169.186)

- 5Y30Y -2.91, 116.12 (L: 115.929 / H: 121.26)

- Current futures levels:

- Sep 2Y down 0.5/32 at 110-10.875 (L: 110-10 / H: 110-12.375)

- Sep 5Y down 4.25/32 at 124-18.5 (L: 124-14.75 / H: 124-30.25)

- Sep 10Y down 5/32 at 134-27 (L: 134-20 / H: 135-14)

- Sep 30Y up 8/32 at 166-8 (L: 165-12 / H: 167-00)

- Sep Ultra 30Y up 16/32 at 201-24 (L: 200-05 / H: 202-29)

US EURODOLLAR FUTURES CLOSE

- Sep 21 +0.005 at 99.880

- Dec 21 +0.005 at 99.835

- Mar 22 steady at 99.855

- Jun 22 -0.005 at 99.815

- Red Pack (Sep 22-Jun 23) -0.045 to -0.015

- Green Pack (Sep 23-Jun 24) -0.055 to -0.050

- Blue Pack (Sep 24-Jun 25) -0.050 to -0.035

- Gold Pack (Sep 25-Jun 26) -0.03 to -0.020

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00012 at 0.08150% (+0.00462/wk)

- 1 Month -0.00113 to 0.08925% (-0.00125/wk)

- 3 Month +0.00037 to 0.12175% (+0.00400/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00013 to 0.15500% (+0.00188/wk)

- 1 Year -0.00225 to 0.22988% (-0.00525/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $69B

- Daily Overnight Bank Funding Rate: 0.08% volume: $245B

- Secured Overnight Financing Rate (SOFR): 0.05%, $974B

- Broad General Collateral Rate (BGCR): 0.05%, $382B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $352B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.201B accepted vs. $8.120B submission

- Next scheduled purchases

- Thu 8/05 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 8/06 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

FED: Reverse Repo Operations

NY Fed reverse repo usage climbs to $931.755B from 69 counterparties vs. $909.442B on Tuesday. Compares to last Friday's new record high of $1.039.394B

PIPELINE: Raytheon Launched

- Date $MM Issuer (Priced *, Launch #)

- 08/04 $2B #Raytheon Tech 10Y +75a, 30Y +100a

- 08/04 $1.5B #Barclays Plc 7Y 4.375%

- 08/04 $1B #Brunswick 3NC1 +60a, 10Y +130a

- 08/04 $500M #Summit Digital 10Y +187.5

- 08/04 $650M Chemours 8.25NC3.25

EGBs-GILTS CASH CLOSE: USTs Drag Bunds And Gilts Off Highs

Early gains in the European space reversed sharply in the afternoon on US factors: US ISM Services hit a record high in July, and Fed's Clarida said he saw conditions in place for a 2023 Fed hike.

- Early in the session, European FI rallied as ECB's Kazaks said a decision on PEPP's future in September would be "premature". Later in the session, MNI published a sources story noting that a decision is not expected until later in the autumn at the earliest.

- This led German 10Y yields to lowest levels since early Feb (through -0.50%), but this reversed on the US headlines. Bunds ended up outperforming though, with yields edging lower into the close.

- Spanish and Italian Services PMIs both disappointed. Eurozone final PMI was revised lower from flash but UK's was revised higher.

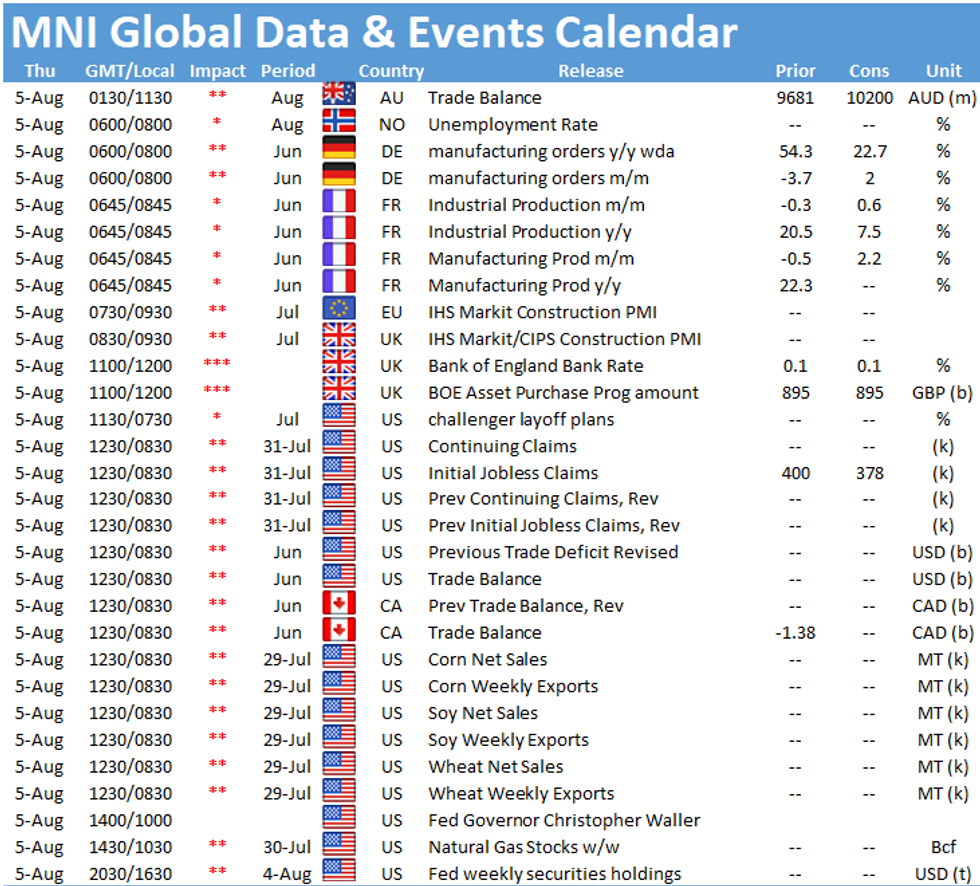

- Thursday's focus is the BoE decision - our preview went out earlier today.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1bps at -0.781%, 5-Yr is down 2bps at -0.768%, 10-Yr is down 1.9bps at -0.501%, and 30-Yr is down 2.9bps at -0.04%.

- UK: The 2-Yr yield is up 0.6bps at 0.063%, 5-Yr is down 0.6bps at 0.224%, 10-Yr is down 0.8bps at 0.512%, and 30-Yr is down 1.3bps at 0.933%.

- Italian BTP spread up 0.6bps at 105.4bps / Spanish up 1.6bps at 73.1bps

FOREX: ISM Services/Fed's Clarida Spark Dollar Squeeze

- Following a miss in US ADP employment, the USD had been underperforming with broad dollar indices roughly 0.3% softer, following the data.

- Comments from Federal Reserve's Richard Clarida, perceived as marginally hawkish, coupled with the strong beat in US ISM Services data (particularly the inflation component) sparked a sharp greenback recovery, which then extended through the best levels of the day.

- The Vice Chair said the central bank could begin to raise interest rates in early 2023 if employment and inflation continue to progress as expected. Stating the inflation outlook risks remain to the upside, the US dollar continued its upward trajectory.

- The most significant squeeze was seen in USDJPY. Hovering just off the 108.72 lows, the pair spiked back above 109 as fresh shorts were covered and the rally extended to fresh highs of 109.67, erasing much of the week's selloff.

- EURUSD fell short of resistance at 1.0910 and slipped rapidly to the worst levels in 5 days sub-1.1850. The dollar index remains up 0.2%.

- Similar moves were seen in the greenback against, GBP, AUD and CHF, however CAD and NZD held more narrow ranges throughout US hours.

- Kiwi remains top of the G10 pile as overnight gains were consolidated following New Zealand's labour market data beating expectations across the board and another round of hawkish RBNZ repricing.

- Headline event risk on Thursday includes the Bank of England MPC meeting where the sequencing review will require particular attention. Smaller items on the calendar include Aussie trade balance, German factory orders and US initial jobless claims.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.